Pemo Theodore is doing great interviews of people in high-tech, and she has a specific focus on women & entrepreneurship, on venture capital too, her blog is ezebis. She was interested in my views on the topic, I am not sure why as I am neither an entrepreneur, nor a VC anymore. If you are not afraid of French accents… here it is and the text is on Hervé Lebret, EPFL Swiss Tech Institute, Difference in European & US Venture Capitalists. Thanks, Pemo!

Tag Archives: Venture Capital

Boulevard of Broken Dreams

A colleague of mine (thanks Jean-Jacques) recently mentioned to me this book by Josh Lerner, which full title is Boulevard of Broken Dreams: Why Public Efforts to Boost Entrepreneurship and Venture Capital Have Failed–and What to Do About It. I was all the more interested that Lerner is the author of many academic papers on high-tech entrepreneurship, and particularly of one about serial entrepreneurs: “Performance Persistence in Entrepreneurship” [pdf format here] with Paul Gompers, Anna Kovner, and David Scharfstein, Journal of Financial Economics, 62 (2007), 731-764. I will come back in the future on this topic which I am currently studying.

So what should we do about the public efforts is what Lerner is trying to help us with and his answer shows how challenging the topic is. What is beautiful about the author (my personal point of view) is that he likes history (just like me). Just like Steve Jobs! Just read again what I posted about Jobs on mentors; “You can’t really understand what is going on now unless you understand what came before”.

Lerner’s initial chapter is “A Look Backwards” He shows how entrepreneurs and investors benefited and suffered from each other in the 70s and 80s, including the excess of speculative bubbles, the PC burst of the 80s for example. He also shows how important public support was in the very early days through the funding of research (mostly the cold war militaries) and the legal actions to ease venture capital (SBIRs, Erisa Acts) so that he does not really agree with Rodgers (founder of Cypress) who wanted government out of Silicon Valley (page 32) so that he claims that “The Public sector did play a key role in shaping the evolution of Silicon Valley” (page 35).

Then, in the following chapters he shows how complex it is to find facts: “consistent information on venture-backed firms that were acquired or went out of business doesn’t exist” (page 59) which means that quantitative analysis is rare. And remember he is a respected academic, so he knows! What he tried to do then, is to show some of the obvious mistakes: incompetence in allocating public resources (page 73), capture, that is use of subsidies by the wrong groups (page 80), by “organizations that are mandated to help entrepreneurs” (page 83). “Seven of the incubators gave less than 50% of funding in cash to incubated firms” (just one example from Australia, page 84) or the SBIR program which has exhausted its usefulness (page 85).

So his advice is:

– enhancing the entrepreneurial culture (page 90) [through the right laws, the access to technologies, tax incentives and training],

– increasing the venture market’s attractiveness (page 100) [through allowing partnerships, creating local markets, accessing human capital abroad],

– avoiding common mistakes: timing [be patient], sizing [not too small, not too large], flexibility [learn by doing], create the right incentives [and here it is a complex situation as perverse effects from good ideas often occur] and evaluate [which does not happen often enough].

Indeed, his introduction (pages 12 and following ones) summarized it all: you need rules, experience, time, incentives and assessment. But with all his experience and knowledge about high-tech entrepreneurship, Lerner is very humble with the lessons: the topic is really complicated, all these advice have to be implemented together and it is really their careful interconnections which will make an ecosystem lively or not. Then it is my personal conclusion that such favorable conditions will be useful if entrepreneurs use them intelligently. So the reason why all this fails has many roots…

I cannot finish this post without comparing it to my book. It is indeed very similar in its conclusions with slightly different facts and figures. So you would learn complementary and consistent things by reading both! My thesis is we need an entrepreneurial culture and access to people from Silicon Valley who have the experience. Everything else is necessary but not sufficient.

Super Angels

I just come back from vacation and all of a sudden I discover that the world has changed! Before my break you had the business angels investing in the early rounds (up to $1M) and the VCs who would seldom invest in rounds smaller than $1-2M. Now the frontier is blurred: you have the seed VCs (Index seed being a recent one) and the Super Angels fighting for the same deals.

If you want to know more, you will find plenty of posts and news such as:

VCs And Super Angels: The War For The Entrepreneur from Techcrunch.

Why Micro-VCs Are So Damn Friendly from Xconomy.

‘Super Angels’ Alight from the WSJ.

Micro VCs Are all BFFs… Forever? by David Beisel.

All this is not so new as Business Week mentioned the phenomenon in May 2009: ‘Super Angels’ Shake Up Venture Capital.

And I should not forget Fred Destin’s blog where i first read about all this: Super Angels, Lean VCs, Proto-Incubators, whatever. Focus on social contract. He also published an article about European SuperAngels.

So what is new here? Well I am not sure, I may just be so much remote that I have missed a big trend. Or is it just that the VC and high-tech world is such in a crisis that it is looking for new models. They were always big angels. Arthur Rock for Intel and Apple, Andy Bechtolsheim for Google or Magma, and Sequoia did the seed round for Yahoo, so what?

Well the VCs have really big funds up to a billion so investing in small rounds is tough but they have understood and move back to seed. Entrepreneurs think angels are nicer, but check again my posts on the Tesla story and Elon Musk.

Finally there is a strong argument that Internet and software companies may not need as much capital as start-ups in the past and another argument that entrepreneurs just look to sell their company to Google for $25M which is not so bad, so they might not need VCs anymore. But then, Silicon Valley faces the risk of not creating new Apples or Googles… So it is probably just “back to the future”…

How to pitch VCs

An interesting presentation, both content and format, on how to pitch VCs was given by Fred Destin at LIFT. Fred is a VC with Atlas whom I met a few months ago and I like his style. You can check his post directly or look at his documents below.

On the format, I was seduced by the Prezi tool.

A123, Boston and Atlas

I just met this morning Fred Destin in the beautiful Rolex Learning Center at EPFL. We both have a passion for entrepreneurs and architecture!

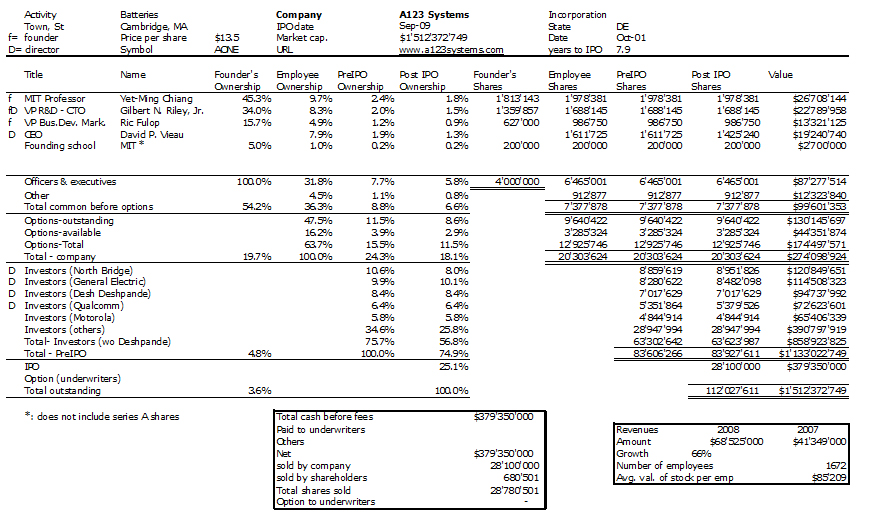

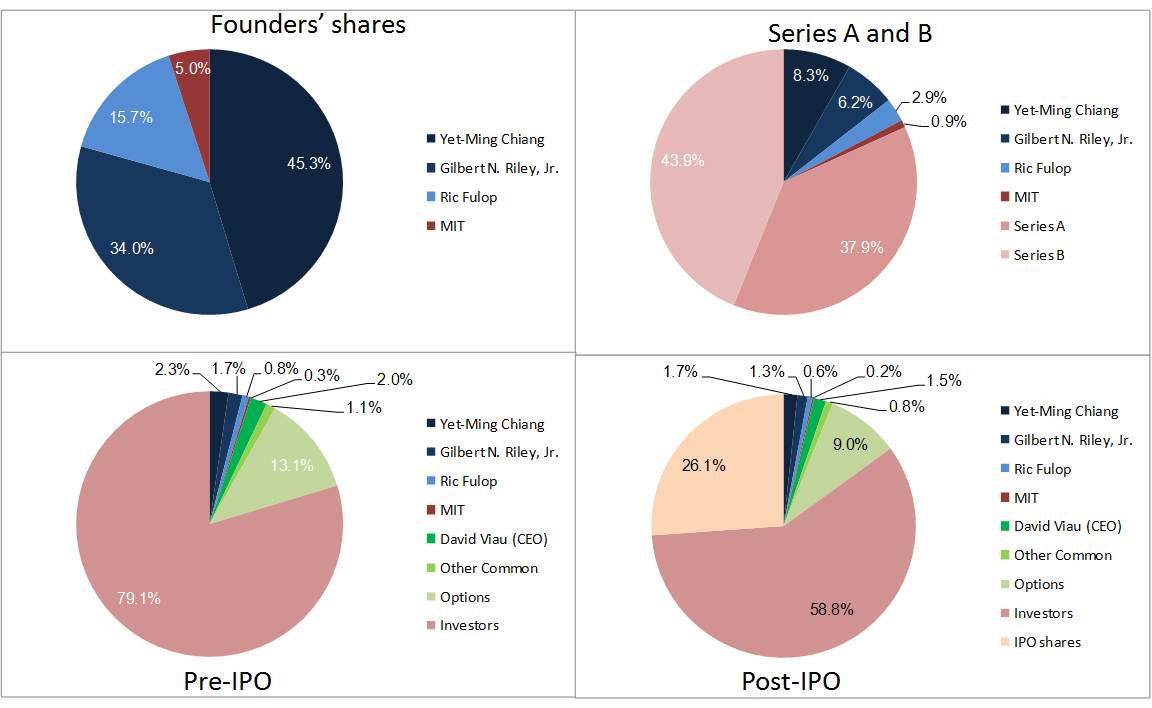

Fred told me he liked my equity tables and pies (check skype, mysql, Kelkoo, Synopsys, Genentech, Adobe, or the general one.

So as a small gift to Fred who is moving to the Atlas office in Boston this summer, here is the equity case of A123 Systems, an MIT spin-off which went public last September.

I am aware the pictures are not very nice but you can enlarge them and ask me for the excel file…

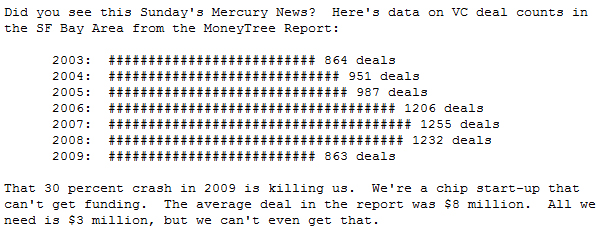

The Good Old Days

Two pieces of news caught recently my attention. One is entitled Frank Quattrone, Star Banker of Technology Ventures, Talks Wistfully of the Good Old Days—Before Netscape’s IPO.

The other one is less nostalgic because of the web site name, which I quite like: You’re in Deep Chip Now.

Here is the full text captured from the site:

I will not comment this but let me come back on Quattrone. Quattrone was a star of the IPO world as you may read from this Xconomy blog. What is striking is that in the last 8 years, following the Internet bubble, there has been less venture capital, fewer IPOs. The reasons are many. But the key question remains: are we facing a major innovation crisis? After the transistor in the 60’s, the computer in the 70’s and the PC in the 80’s, the Internet and mobile communications in the 90’s, what have the 00’s given us? And what about the 10’s… I do not have any answer. What about you?

Are VCs arrogant?

This was the question asked by Fred Destin in his blog post last December: The Arrogant VC: A View From the Trenches

I am interested in the topic because I see more and more entrepreneurs who just do not want to face VCs. I think it is a mistake as you may not find adequate resources for your ventures, but it is a real debate.

Destin puts in bold the following arguments:

– behaved in a rude and disrespectful manner

– absence of feedback loop

– lack of empathy

– VCs tend to string along entrepreneurs forever

– vague on their decision and engagement process

– the entrepreneur comes away feeling like he was played

– seeing everything through the lens of money

– out of touch with the reality of entrepreneurs

– VCs really don’t take any personal risk but expect everyone else to…

– dubious practices

and as a conclusion Choose your VC’s with care. Good ones transform your business, bad ones wreck it

I have read this many times, seen it sometimes but not so often. So let me add my piece, taken from my readings. You will find on this blog accounts of books I really recommend, such as Founders at Work, Betting it All, In the Company of Giants. I just extracted comments on investors from these books. I think they are more balanced and as Destin wrote, choose your VCs with care. Here they are:

– Great as long as all goes well.

– Learn about them and their lack of transparency

– Best motivation is not to need investors

– Know people and speak their language

– You can’t live with them, you can’t live without them

– Avoid it if you can

– VCs are politer than others, they rarely say no…

– Bad behaviors on all sides, “We’re interested in you guys because of your management team; we think you’re fantastic … Two weeks later they pull me into the office—before even the first board meeting—and say, “We want to replace you as CEO.”

– When company became popular, VCs knocked at the door

– Move from the ego, “me” to the company, “we”, the shareholders

– Met 43… and a lengthy process; Then once you’ve received a term sheet, then the VCs get interested, and then acquirers get interested. They all told me $18 million wasn’t interesting. And I’d say, “But most people will tell you $50 million, and you know they’re lying. I’m already discounting it because I’m a venture guy just like you are.” And they’d say, “Yeah, but $18 million just isn’t interesting.” So I changed my spreadsheet to say $50 million. And they said, “OK, that’s pretty interesting.”

– We’re also overly paranoid because the first thing we did when we started the company was talk to a bunch of entrepreneurs who told us, “Don’t tell anyone what you are doing. VCs are sharks.” Meanwhile, you hear from the VCs, “You’re too paranoid.” So it’s hard to find the right balance and be human, because you don’t know who’s genuine and who’s not.

– Within venture capital, you don’t want to manage what they call the “living dead.” Their rules of thumb were: typically one out of ten companies is a really big hit; roughly three out of ten go belly up pretty quickly, and you get rid of them. The other five to six are what they call the “living dead.” They grow nicely, organically, but don’t generate spectacular returns, and they take management time and energy.

– The venture capitalists at least in those days, had a terrible track record of bringing people in and then throwing the entrepreneur out.

– We didn’t take any salaries. but we held off on the VCs. We wanted the discipline. Not being paid and having uncertainty of having no safety net is a great motivator.

– It serves an enormous service in the business, in financing companies, in providing leadership, and connections. But we did not need their money or the leadership.

– I learnt something about raising money. They need us as much as we need them.

– I tried to get venture capital money, to no avail. What people don’t understand is that innovation is the hardest thing in the world to fund. I was 28 years old and this was before it was good to be a 28-year-old entrepreneur.

– In the old days, venture capitalists helped a company a lot. They were mentors. Many just bring money today.

– [To raise money,] go with the best venture capitalists and give them more equity. I’ll take a worse deal from Kleiner. They have people like John Doerr. You can’t put into words what that makes.

– We did a lot of market research, studied the customer, understood the problems. We couldn’t even get second meetings [with venture capitalists]. We had no industry experience and at the time VCs did not invest in consumer products.

– I did not have any venture capitalist which was good news and bad news. I could make every mistake, it was my neck, and probably no VC would have given me money: I was a woman, it was software at the time software had no value.

– In 83, I used the board to get some experienced business people. We got Dave Marquardt, a venture capitalist who bought 5% of the company for $1M.

– The downside to venture guys is that they sometimes think they know more than they do about what’s best for your company. They don’t want to admit when they make mistakes

Business angels and venture capitalists

The question often arises about the difference between the two groups, business angels and venture capitalists. The simple answer, which claims that angels come at the seed and early stages whereas VCs only come later, is misleading. For example, Google got $1M from Business Angels initially whereas Yahoo got its 1st million from Sequoia. In fact the differences are elsewhere. A recent academic article theorizes some of these differences and I describe them below.

I have a tendency to say that venture capital was the institutionalization of angels. In the 60s, there was not much venture capital and the first funds were built by the syndication of angel and institutional money. Even today, some groups of angels syndicate their money and look like venture capital. So they are indeed quite similar.

The recent academic paper I just mentioned is “Prediction and control under uncertainty: outcomes in angel investing” written by Wiltbalm, Read, Dew and Sarasvathy and published in the Journal of Business Venturing. Because of copyright issues, I am not sure you can access the paper but you can try and click the picture below.

The authors define angel investor as “a wealthy individual who acts as an informal venture capitalist”. Informal venture capitalist and institutional business angel look very similar so we do not disagree. One manages his money directly; the other manages others’ money. But there is much more than this. Forget about conditions in term sheets. They have become very similar even if some claims business angels are easier to work with. You will find good and bad people in both groups. The paper I mention above is very interesting at another level. It categorizes investors in two groups. I am certainly simplifying as these academic papers are often too detailed for a blog!

On one side, the authors claim you have investors who focus on prediction, on the other side, those who emphasize control. Prediction means here that you see a long-term business opportunity and you deploy the resources adequate for this ambition. Control means you do not know about long term so you plan short term and you act as you learn. No real need for a business plan. Let me describe this further using the terms of the authors.

“Predictive strategies include market research using formal tools such as surveys, detailed financial models leading to careful calculations of risk-adjusted expected return, etc., and are very familiar to virtually anyone involved in writing business plans… However, high uncertainty may reduce the accuracy and usefulness of prediction… One concept suggests that to the extent you can control the future you do not need to predict. Such actors begin with who they are, what they know and whom they know, rather than with a predetermined vision or externally validated “opportunity.” This means that they do not evaluate opportunities based on expected return. Instead they work with any and all interested. In other words, those who commit something valuable to come on board help determine what the venture will do next. People are working on things within their control, working to expand the zone of things they can materially control, obviating the need to predict the future.”

What are the implications of the two strategies?

The authors claim the following: “Findings show that emphasizing control strategies is significantly related to experiencing fewer negative exits and those investors who emphasize prediction make significantly larger investments, but do not experience more homeruns. We found that angel investors who performed more due diligence experienced significantly more homeruns, and significantly more negative exits (thus fewer moderate exits). Also, angel investors who participated more with their ventures, post-investment, experienced fewer negative exits. Surprisingly, we found that investors who concentrated on very early stage opportunities experienced fewer negative exits. These results raise important considerations about the use of prediction and control as decision tools in highly uncertain settings. Understanding the differential use of these strategic approaches may be relevant not only to angel investors but also to venture capitalists, corporate entrepreneurs, and managers making decisions in very uncertain situations.”

These are quite interesting and also surprising. If I fully understand the advantages of the control strategy, it seems strange that a homerun may come with a conservative strategy. But control does not mean conservative, it means more pragmatic. This is my understanding of the thing.

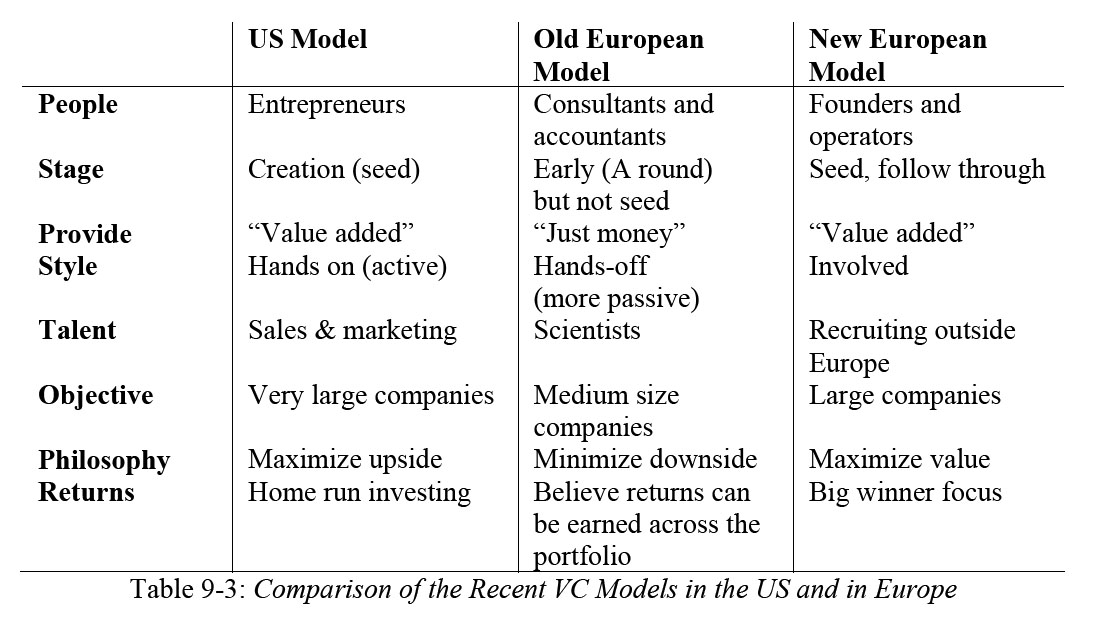

For those who read my book, you may remember the analysis of venture capital that I had taken from Tim Cruttenden. I see some similarities between his description and the two categories of the paper with the major exception that Cruttenden expects more homeruns (and more failures) with aggressive strategies. What do you think?

Is there too much venture capital ?

This is an open-ended debate between those who think there is not enough capital for start-ups and entrepreneurs and those who believe too much money kills the ideas (lack of discipline, too many me-too companies being some arguments).

I have a tendency to believe there is too much money these days and let me illustrate the argument.

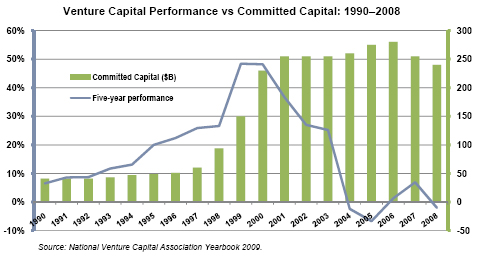

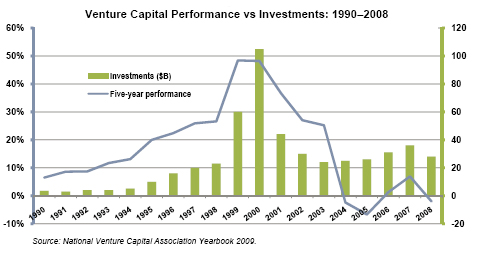

A recent analysis showed how much money was committed and invested over the past two decades. Here are the numbers.

Despite the Internet bubble, we have not come back to the level of the early nineties.

Now there is a second argument, marvelously explained in the post VC’s Mathematical Challenge by Matt McCall. If the money invested by VCs ($35B) is at the same level of the combined value of M&A and IPOs, the VC industry is just in trouble. Just have a look at his post.

So yes, it is tough to raise money. You may have heard of the Sequoia R.I.P. document. However Sequoia just annouced they have done more early stage investments in the last 12 months than in the two previous years.

And apparently, yes, there is finally less fund raising.

Here are two illustrations:

– I was in Washington a few days ago and read the following article:

– you may read the post of Xconomy entitled Is Venture Up or Down?

In conclusion, I think there was too much money and the recent news may indicate we are finally going back to the right levels… any thought?

What Have VCs Really Done for Innovation?

“What Have VCs Really Done for Innovation?” This is the title of a post by Vivek Wadhwa dated September 20. You can find the full account on Techcrunch. I have to admit I was not happy with the content. Instead of saying immediatly why, I will let you read comments made by others as I shared their point of view. You can also read the post and all the comments, but they are numerous!

So, for example, I agreed with the following three comments:

by Ashok

It is true that the claims made by VCs are not realistic and vastly exaggerated. But, at the same time, we cannot forget that they have played key role in many innovative fields. By its very nature, a Venture Capitalist will invest only in a new promising project where he can hope to earn a handsome profit. There is nothing wrong in a VC selectively investing in projects. After all, we have to appreciate that for every one grand success, a VC may have seen 9 failures losing his money invested in projects which could not lead to big money. So, you have to judge the role of VCs also by their failed projects. Who would like to invest in a project which is likely to fail? Yet, it is a fact that a big percentage of projected financed by VCs fail. Does it not show the high risk involved in what VCs do? This being the position, what is wrong if they are selective in financing the projects? Therefore, the author’s observations “The fact is that VC’s follow innovation, they don’t lead. They go where they smell blood.” are not fully justified.

What about their failed projects? Did they not smell blood? Then why did they invest? Why did they fail then?

Unfortunately, the author has tried to present one-sided story without taking into consideration the problems which VCs might be facing.

Of course, at the cost of repetition, I would say that the tall claims made by the VCs are also not correct. To conclude, it is neither black nor white; it is some shade of grey. Truth lies somewhere in between the two extremes

then by Chris Yeh

This is one of the most dangerous and wrong-headed posts that I have read all year. And I’m flabbergasted by the lack of critical thinking displayed in the comments section.

There is definite truth to some of what Vivek has to say. The NVCA’s estimates are bogus, because they equate investing in a company with being responsible for its success. This is an egregiously egotistical assumption.

It may very well be true that the venture industry as a whole trails index investing. It’s hard to pick winners. But so does the entire actively managed mutual fund industry.

But the statement that “VCs at best have little to no impact on these companies and at worst have a negative impact” is absurd.

First, there is a major survivorship bias problem with the data. By interviewing successful companies, the study fails to prove whether VC makes success more or less likely. All it says is that the majority of successful new businesses in the US do not rely on VC.

A number of commentators seem to be of the impression that VCs make easy money by investing in companies after all the risk has been removed by the entrepreneur. This is talking out of both sides of one’s mouth. If the VCs aren’t taking risks, then how can they be delivering sub-par returns? By definition, they must be taking risks.

Venture capital plays an important role in the startup ecosystem. It provides high-risk equity capital to startup companies. Not every company can be a bootstrapped consumer Internet company. Many important businesses (semiconductors, hardware, biotech) require significant up-front capital. If VCs went away, would there be enough funding for these business? Do you seriously think banks would start lending to these companies?

I also wager that most of the commentators pooh-poohing VC would be glad to accept funding for their startups.

finally by ethanboss

… Of course there are VCs that don’t add value. As there are entrepreneurs who fail.: most of them. How ridiculous to claim that Sergey and Brin had already succeeded when KP and Sequoia invested. That shows a total lack of understanding of what it takes to build companies.

Also, I suppose capital would also grow on the trees for these “innovative” companies to go and harvest, so there is no need for VCs…

In the old days, when capital was hard to access there were some great entrepreneurs (few) that could get to profits without much help and capital. Some still do it but are the exception. The real world is a little different. You need capital and help with networks and other things to build a LARGE innovative company. Those things don’t grow on trees.

so here is the comment I made on September 25.

Vivek

I agree with many other people that you are too single-minded. I do not fully disagree with some elements of your analysis, which explains why you have so much support, BUT…

I was once a venture capitalist and I have neither an MBA nor a law degree but engineering degrees including a PhD and more importantly two years spent in Silicon Valley where I developed a passion for innovation and start-ups which I translated in becoming a VC.

One more fact in addition to the other contributions:

Surprisingly, Bill Gates had venture capitalists: this is taken from Microsoft IPO prospectus: “Mr. Marquardt has been a director of the Company since 1981. Since 1980, Mr. Marquardt has been a general partner of TVI Management. He has been with TVI Management since 1980. He is also a director of Archive Corporation and Sun Microsystems, Inc.” TVI had about 6% of Microsoft shares before the IPO.

Now what have VCs really done for innovation? You would have been more credible by saying what are they doing. But if you use the past, let me put some historical perspective:

– If investors (VC was not developed yet) had not funded Fairchild in 1957, Intel in 1968, Silicon Valley may not exist as it is. Your friend Vinod is maybe an exception, but there were many others. Arthur Rock helped in funding or funded directly Fairchild, Intel, Apple Computers.

– The story of Genentech is well-known (go on my blog for more if you wish): when Bob Swanson, a former VC at KP became convinced biotech had a future, he first convinced Boyer, the researcher, then his former colleague Tom Perkins to try. Both were skeptical, so you are right Entrepreneurs are in the driving seat, but without the inventor and the investor, Genentech and then the biotech industry may not have existed. The innovation did not exist yet and the VCs contributed a lot.

– Who do you think were the first VCs such as Gene Kleiner and Don Valentine and many others? They were former entrepreneurs who had the vision that funding the next generation would fuel innovation.

I am also doing an analysis of startups created with Stanford technology or by Stanford Alumini. The surprising fact is that so far about 30% of the companies (I have a total of 2’700) were funded by VCs. It does not mean VCs were responsible for their success, but they had their contribution (in the group are companies such as Cisco, Yahoo, eBay, Google, Rambus, Atheros and so many others)

Paul Graham says that for innovation, you just need nerds and rich people. I agree with him. The nerd is the brain and the investor is the blood. And then both will need a team, managers, employees which will constitute the full body. VCs do not contribute to inventions, but they help in their commercialization, which is I think the definition of innovation.

You are not only singled minded but I think you are hurting the innovation ecosystem. I see too many entrepreneurs and future entrepreneurs scared with investors because they focus on your point of view. Of course, there have been terrible stories. But do not forget entrepreneurs need resources to succeed. Repeat entrepreneurs may bypass investors, business angels may help when resources are not too huge (maybe like in software though this is not even always true). But what about young people who develop semiconductors, biotechnologies, green technologies and have no money.

Money is never cheap or fun. But you need it. Let me finish with two quotes which show that I support some of your views but I still disagree with your overall vision.

In the book Founders at Work, one entrepreneur says about investors: “You can’t live with them, you can’t live without them” and even better Robert Noyce, Intel’s founders: “Look around who the heroes are. They aren’t lawyers, nor are they even so much the financiers. They’re the guys who start companies”

cheers

Herve