Now that business is for real, the level of stress increases…

to this level

It’s also time to move…

to new serious offices

or is it?

You will also check that Silicon Valley is not about software and web or mobile apps only…

though I am not sure it is good news, if not for us…

at least for our heroes

Tag Archives: Silicon Valley

HBO’s Silicon Valley – episode 12 : Building a Company

Now that they have money, our heroes need to spend it. Will they follow the “team” structure of Episode 1 when hiring: “There is always a tall skinny white guy, a short skinny asian guy, a fat guy with a ponny tail, some guy with crazy facial hair, and then an east indian guy.” Unclear from who they interviewed…

While PiedPiper hires, Hooli strategizes and everyone knows in Silicon Valley that merit comes 1st…

You will also learn about the 3-comma club! And the importance of solving team tensions.

HBO’s Silicon Valley – episode 11: should you sell or should you die – or neither?

I have to admit episode 10 was full of s…- I have never seen a VC stealing ideas neither a major corporation suing a start-up. Whatever SV is fun. So when you have the choice between sell or die, should you choose?

– “You should pursue your dream, not for profit, not for valuation or material wealth but for the good of humanity”.

– “Easy to say when you are a billionaire”

– “Billionaires are people too.”

Here SV uses the strange real episode from Tom Perkins.

“Do not do what you should do. Do what you want!”

(But our hero is not very gifted with Japanese food, or is he stressed?).

Let us listen (in fact read here!) Monica: “Every successful company can look back at a defining moment early on where they would have died, had it not been for the courage and the tenacity and maybe the insanity of one visionary person who put it all on the line, even though it seemed like a huge mistake at the time, a moment where all the metrics and the numbers did not mean anything; it was all about the emotion, it was about belief, rational or irrational and I think, I hope, that I was just like that.”

HBO’s Silicon Valley – episode 10: don’t spend the money when you do not have it (yet)

There is something well-known and little known at the same time in the start-up world: a deal is never guaranteed until the money is on your bank account. Our heroes will learn it the hard way. Now they are less arrogrant with the VCs…

but then what about being stolen ideas during due diligence…

and what about the cost of IP litigation. I will let you discover it…

When Samwer was not Samwer yet but was writing a book – way before Rocket Internet and its clones

I did not know much of the background of the Samwer brothers beyond the names associated with them: Alando, Jamba, the European Founders Fund, Zalando and Rocket Internet. So I was surprised to be mentioned (thanks Kevin!) a book by Oliver, one of three brothers, America’s Most Successful Startups.

America's Most Successful Startups: a thesis by Oliver Samwer and Max Finger (1998)

Even if now more than 15 years old, it is a good book at least from the first 30 pages I have read so far. It reminds me the advice from Steve Blank. Just one example about founders: “The first thing you have to make sure when you put tagether a team of founders is that all founders share the same vision and the same values. The group can be heterogeneous, but the founders cannot have a different vision or a different set of values, because they will probably be partners for many, many years. You absolutely need to make sure that the goals of the founders are all aligned. Each of the founder has to be very sensitive what each of the other founders’ objectives are. You have to recognize these and try to incorporate them, because otherwise you will have people from day one heading in fundamentally different directions. Only if you get a team of really great people together, who share the same vision, and work together well as a team, you will create a very strong foundation for the company. Because everything in the company originates from the founding team and will grow out of that”. [Page 30]

Additionnally, concerning their roles: “Fourthly, depending on the business model, a high-tech company should typically have at least three key people: It should have a market visionary, someone who understands the market, the customer and the problem the customer has. It also has to have a product or technology visionary, who understands the product and technology and how it might be applied, but does not necessarily understand all the problems that the market has. And it needs a business execution person, because the idea itself if worth zero. It is the execution of the idea.” [Page 31]

Another interesting comment about Equity sharing: “Last but not least, the founders should hold equal stakes in the company so that they are in every respect equal partners. No matter who the idea bad and who contributed what in the founding process, the founders should split the company equally among them. Otherwise some founders will feellike second-rate founders, which produces a flaw from the very beginning and which might have a strong negative effect on the way.” [Page 31]

Marc, Oliver and Alexander Samwer

Finally, I also liked their point of view on what you should do when at school: “Also, you need to try actively to get an educational background and experience that supports the venture. This really has to be an active approach. You have to put yourself in a position where you get involved in startups, you have to go to the places where entrepreneurs are, you have to go to places where you can get inspired, you have to meet people of similar spirits and build a network. In school you might participate in the business plan competition, take the classes where you will write a business plan, and take the entrepreneurial track at business school. That is where the people who want to do it are. […] Through such activities you will be meeting partners and ideas incidentally.”

HBO’s Silicon Valley – episode 9: The Term Sheet

Time to see our old friends

and the team fighting to be “Chiefs”

Of course Silicon Valley is what it is… just have a look

or read this: “I don’t want to live in a world where someone else makes the world a better place better than we do.“

But reality is taking money can be dangerous: “You take money from the wrong dudes, you’ll get smoked as bad as I did.” But also never think you have the money until you have it in your bank account…

America’s movie industry have always adapted the story when an actor disappears… then the fun begins. Negotiating with VCs can be hard. “There is a linear correlation between how intolerable I was and a higher valuation…”

But then listen to Monica’s advice… A high valuation can be a very bad deal. Believe her…

And the final minute is great…

HBO’s Silicon Valley is back!

HBO’s Silicon Valley is back and hopefully this second season will be as interesting as the previous season…

What has Silicon Valley to do with Capitalism?

(this is a quick and dirty translation of a French post as it is linked to a French radio broadcast – sorry for the bad english if any)

I was a guest yesterday of French radio Culturesmonde France Culture in a series about capitalsim entitled Des capitalismes (1/4) – Silicon valley: l’émancipation par l’argent. I had to give my views abotu SV and capitalism. Is it unique or extreme? Does the area care, does it have an ideology or is it indifferent to capitalism?

The topic is rich and complex because with 7 million people, opinions in SV are also diverse and were built over 50 years. Each decade brough a new generation of entrepreneurs and investors. You can listen to the broadcast (in French) who also involved Yann Moulier-Boutang, who talked about « cognitive capitalism » and Sébastien Caré, a spécialist of libertarian thinking.

A big thank you to Clémence Allezard who prepared the series, pushing me to think about the region in a manner I was not used to. 🙂 So I thought about it as follows. Is SV an extreme form or a unique form of capitalism? or as I have a tendency to think a region quite indifferent to capitalism? On the one hand you have large powerful firms who do not really pay taxes, you have a fast Schumpterian creative destruction, the government is not active as it is in Europe (health, schools, transportation) so that firms (at the anecdote level or not?) do the work (Google buses, Apple And FB recent initiative about freezing women eggs, Peter Thile encouraging school dropouts) and even induce the SF authorities in changing housing laws. One the other hand, it is not just extreme, it is unique, SV created venture capital, systematized stock options, and has active co-opetition. Richard Newton was saying SV is the firm and all the companies are its divisions. People move from one to the other easily with market dynamics.

Finally, it is the “revenge of the nerds”. They are problem solvers, and do not care about society (hence the libertarians) and even about capitalism (making money is a by-product and if an objective, far from being the only one). I read a great New Yorker article where George Packer explains that these nerds hate the friction created by negotiation and compromises politics and society necessarily induce. So they avoid it as long as they can. And do more when they feel limited by the government but are quite neutral about it. They are selfish. But i doubt “changing the world to make it a better place” is totally convincing at the same time. It is more selfish than generous. These people are mild versions of Asperger and are obsessed by solving their problems. If it solves others’, good, not critical. (Of course SV is 7 million people and is a diverse region, I am focusing on what is visible). I was saying to the journalist when we prepared the talk, that I see more indifference than real strategy, I see some lobbying in SF or Washington, but rather limited compared to general lobbying in the USA.

Another way to summarize is: is there a particular ideology of capitalism in Silicon Valley? I would say that rather than a strategy, there has been a practice that was put in place over decades, by iteration, by trial and error. Ultimately, Silicon Valley is the meeting of ideas (entrepreneurs, and academics sometimes) and money (investors). But unlike the rest of the world where investors are bankers who lend money, in SV they are often former entrepreneurs who “give” money (in the sense that they take the risk of not finding it back), in fact they take shares in the company (often around 50%). They literally invented venture capital, which has found its final form in the 80’s. In addition, the “stock options” decried in Europe are recognized in the SV as a motivation. Secretaries at Apple or Microsoft did sometimes become millionaires, something unthinkable at home in Europe. I have also said, there is an optimism that encourages risk-taking. Moreover, there is no real risk because the skill allows you to find a new job quickly. The risk lies in the possible error in the choice of the project and nobody is ever ruined normally, except one’s health. And as the model works, it is enriched in new areas beyond which the electronics is the root, through the electric car (Tesla Motors), aeronautics (SpaceX) and even the food 2.0 movement (for synthetic food). And the last frontier, aging, death, trans-humanism … which seems to me personally crazy, but …

As a post-scriptum, some comments I got… very interesting! i think SV is more diverse these days. there are the really old school types, like intel, cisco, even apple. then there are places like google and Facebook, that actually do something valuable. and then there are the startups with a hand full of 20 year olds that do not much, but have valuations measured in billions. i think the question should be answered differently for the different groups. and it’s important to not lump cisco in with, say, whatsapp or snapchat.

i’d say for many of them, it’s indifferent to mildly positive feeling abotu politics, as you say. for some (many of the VCs) it’s definitely capitalism on steroids. (or at least, they like to think of themselves that way; they blabber all the time about “wealth creation”, making sure that much of that new wealth goes to them.) more than capitalism, i think what’s concentrated in SV is talent, especially, technical talent. creative destruction resonates *very strongly* with people here; the whole idea of SV is that a handful of kids can change an entire industry, or even create a new one. they usually fail, and sometimes they succeed. imagine how steve jobs or the google guys would have done in europe. the google guys would have gone to the librarians and asked, how can we help you find information? steve jobs would have run long, extensive marketing tests to determine what people want. or maybe he’d go to siemens to try to convince some high level manager that a smart phone was a good idea. of course what happened is way cooler. steve jobs had better taste than everyone else, so he made stuff he liked, period. and the google guys just forged a new path, without seeking the endorsement or buy in of the librarians. in europe, a startup would try to get some giant company to use their product/technology, a long, boring, and tedious process.

typically, a handful of EPFL students would not imagine/believe that they can change the world. stanford students (who are not more talented) do. so, i think it’s mostly a cultural difference, and not something that has to do with capitalism.

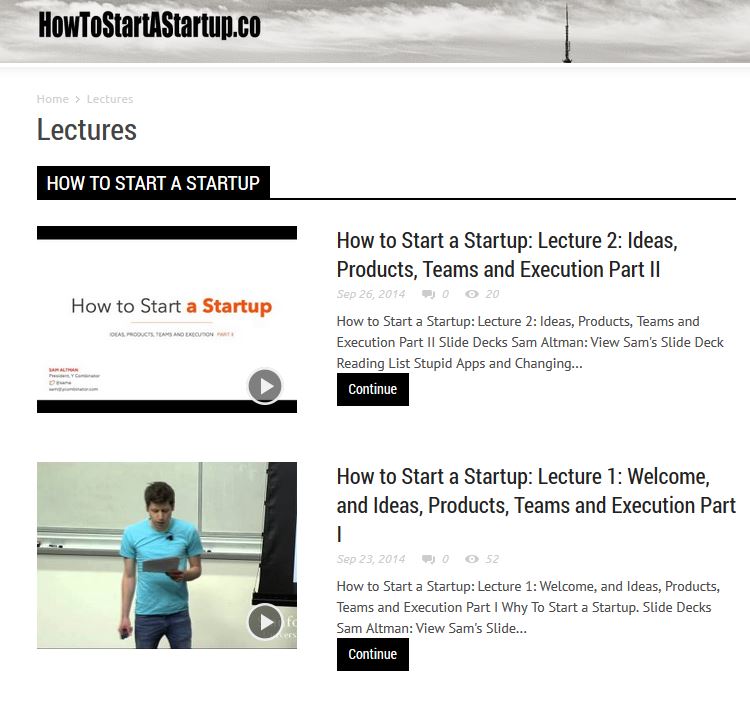

How to Start a Startup by Sam Altman

There are tons and tons of courses and videos about high-tech entrepreneurship. In 2013, the star was probably Peter Thiel. In 2014, it seems to be Sam Altman, President of Ycombintor with his How to Start a Startup The first 2 lectures have been very good with a focus on the ingredients a start-up requires:

1- an idea,

2- a product,

3- a team,

4- an execution.

Altman added in a typical American manner that hopefully you do not execute the team in step 4. You can find the videos on the web site How to Start a Startup, and also the full text of the lectures here:

Lecture 1: How to Start a Startup by Sam Altman – Ft: Dustin Moskovitz. The slides anc content can be found on another nice web site: howtostartastartup.co

Altman’s slides: here.

Dustin Moskovitz ‘s slides: here.

Lecture 2: Ideas, Products, Teams and Execution Part II by Sam Altman

Slides: here.

More also here: howtostartastartup.co

Enjoy!

The First Trillion-Dollar Start-up

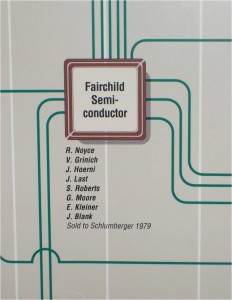

Thanks to my friend Jean-Jacques for pointing to a nice historical article about the beginnings of Silicon Valley. According to The First Trillion-Dollar Startup, “measured in today’s dollars, we believe the firm [ Fairchild ] would qualify as the first trillion dollar startup in the world.” I will let you read the other findings and will not relate again a story I mentioned in The fathers of Silicon Valley: the Traitorous Eight.

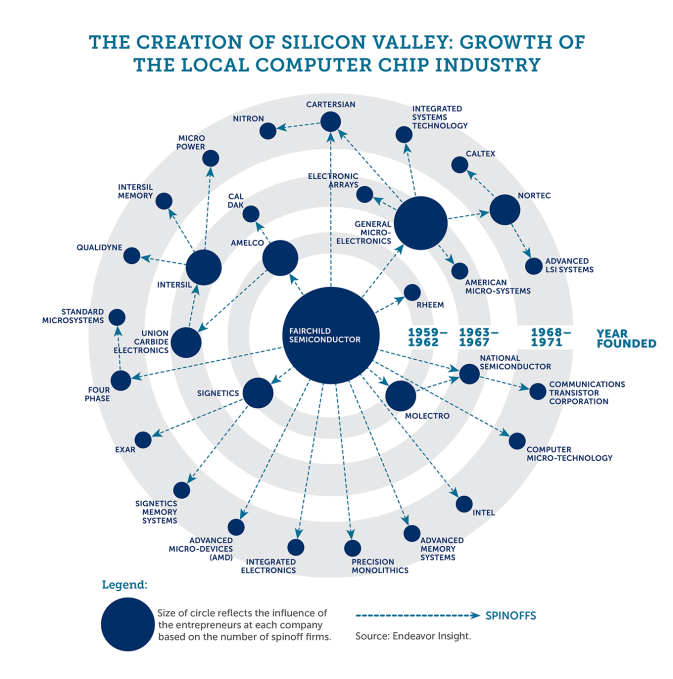

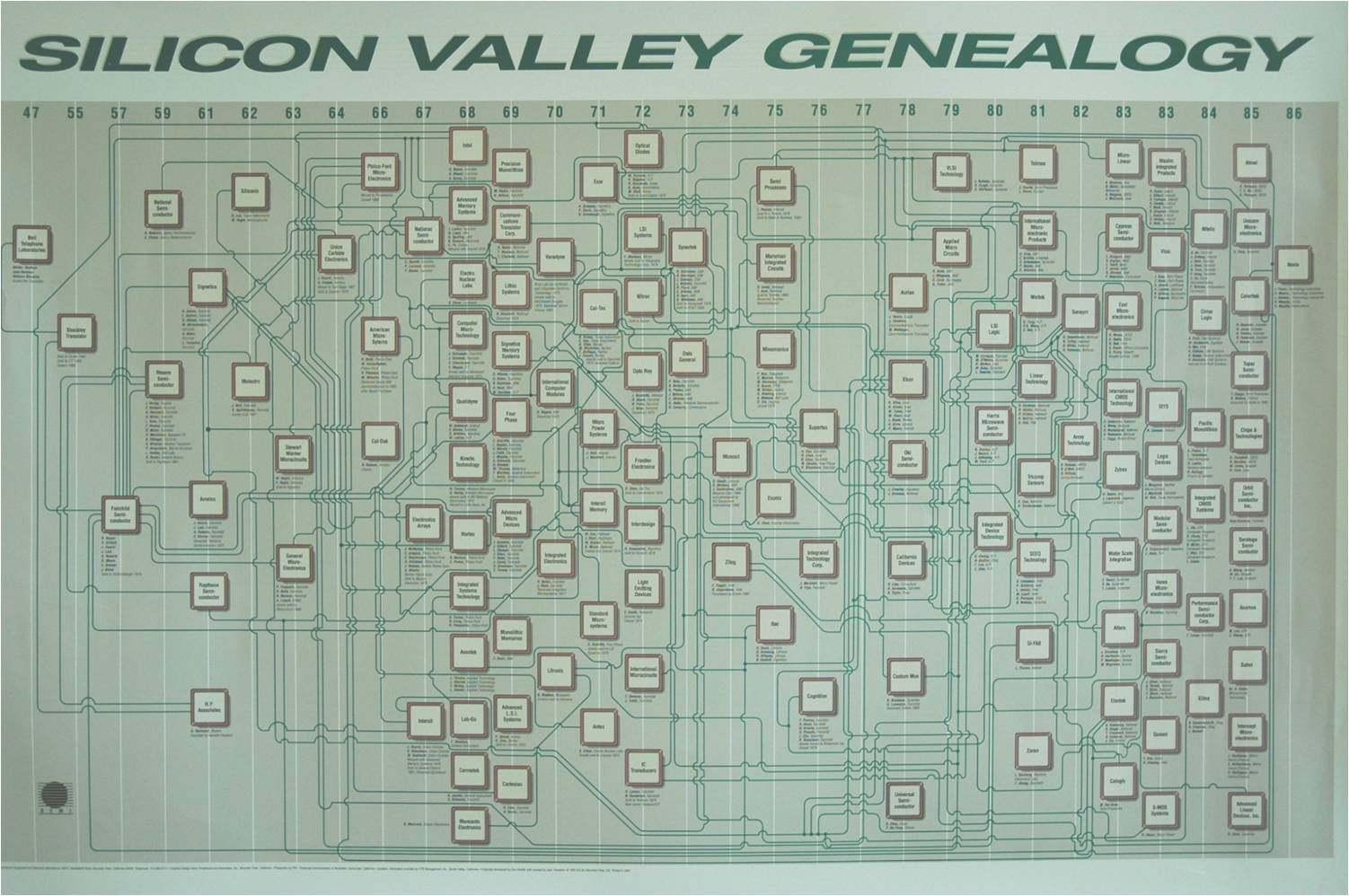

The authors show that Silicon Valley did not exist in 1957. No company active in semiconductor was based there as the East Coast was still the center of high-tech. But the founders of Fairchild are directly or indirectly responsible for 92 companies in Silicon Valley, today listed on Nasdaq or NYSE, worth over $2’000 billion and employing more than 800,000 people.

Here is a nice illustration of their study,

but I still love this one, a famous poster created by the author of the term Silicon Valley; I scanned it a few years ago,

the image below is taken from the previous (left and halfway up – corresponding to 1957)

The full report can be downloaded in pdf format and I find interesting their 3 lessons:

1. Great companies can develop in unlikely and challenging places.

2. A few entrepreneurs can make a large impact.

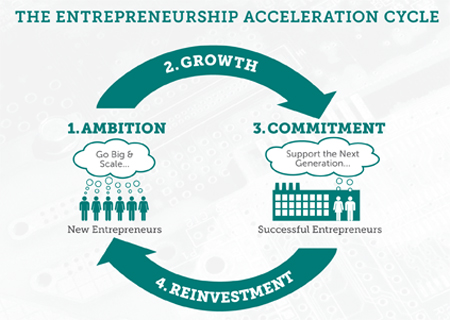

3. There is a framework for success that leaders can accelerate: ambition, growth, commitment, reinvestment.