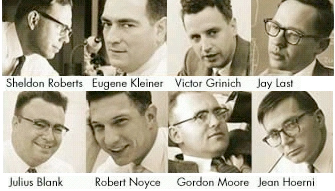

A short quiz: who are the people on the picture?

The answer can be found here. I also tried to do the exercise and you just have to scroll down.

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

A short quiz: who are the people on the picture?

The answer can be found here. I also tried to do the exercise and you just have to scroll down.

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

…

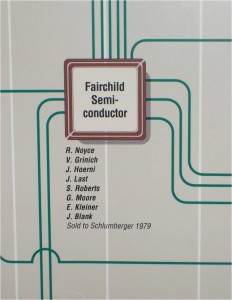

Thanks to a conversation with an EPFL colleague, I was recently reminded the early history of Silicon Valley. I knew about Shockley, Fairchild and the Traitorous Eight. I did not know Shockley had been funded by Beckman (thanks Andrea :-)), that was the point of the recent conversation.

What is interesting is to have a look at the Traitorous 8 also. Their history (cf Wikipédia) is well-known, what may be less known is their background.

The next table gives the origin, education and age of the 8 traitors, the 8 engineers who left Shockley labs to found Fairchild Semiconductor in 1957 (click on it to enlarge).

They can be considered as the real fathers of Silicon Valley. The famous poster entitled Silicon Valley Genealogy is certainly a convincing illustration of it as well as their Post-Fairchild activities.

The next image is extracted from the one above (left, mid-height level, corresponding to 1957).

A few comments:

– 5 were educated on the East Coast, 2 on the West Coast and 1 in Europe.

– Indeed, three were from Europe.

– 6 had a PhD (3 from MIT), all had a bachelor.

– They were between 28 and 34-year old in 1957.

It’s one of Silicon Valley strongest assets: entrepreneurs do not stay for long in established companies and create new ones. And it is accepted as a fact. Let us just me quote again Richard Newton: “The Bay Area is the Corporation. […When people change jobs here in the Bay Area], they’re actually just moving among the various divisions of the Bay Area Corporation.”

And what about the famous Wagon Wheel bar: “During the 1970s and 1980s, many of the top engineers from Fairchild, National and other companies would meet there to drink and talk about the problems they faced in manufacturing and selling semiconductors. It was an important meeting place where even the fiercest competitors gathered and exchanged ideas.”

The story goes on. I read today (thanks to Burton Lee) 15 Interesting Startups From Ex-Googlers from Jay Yarow. He found that since 2004, 49 spin-offs were created by former “Googlers”. Because it was a work in progress, apparently the number has increased to more than 70. See slide 2 of the pdf.

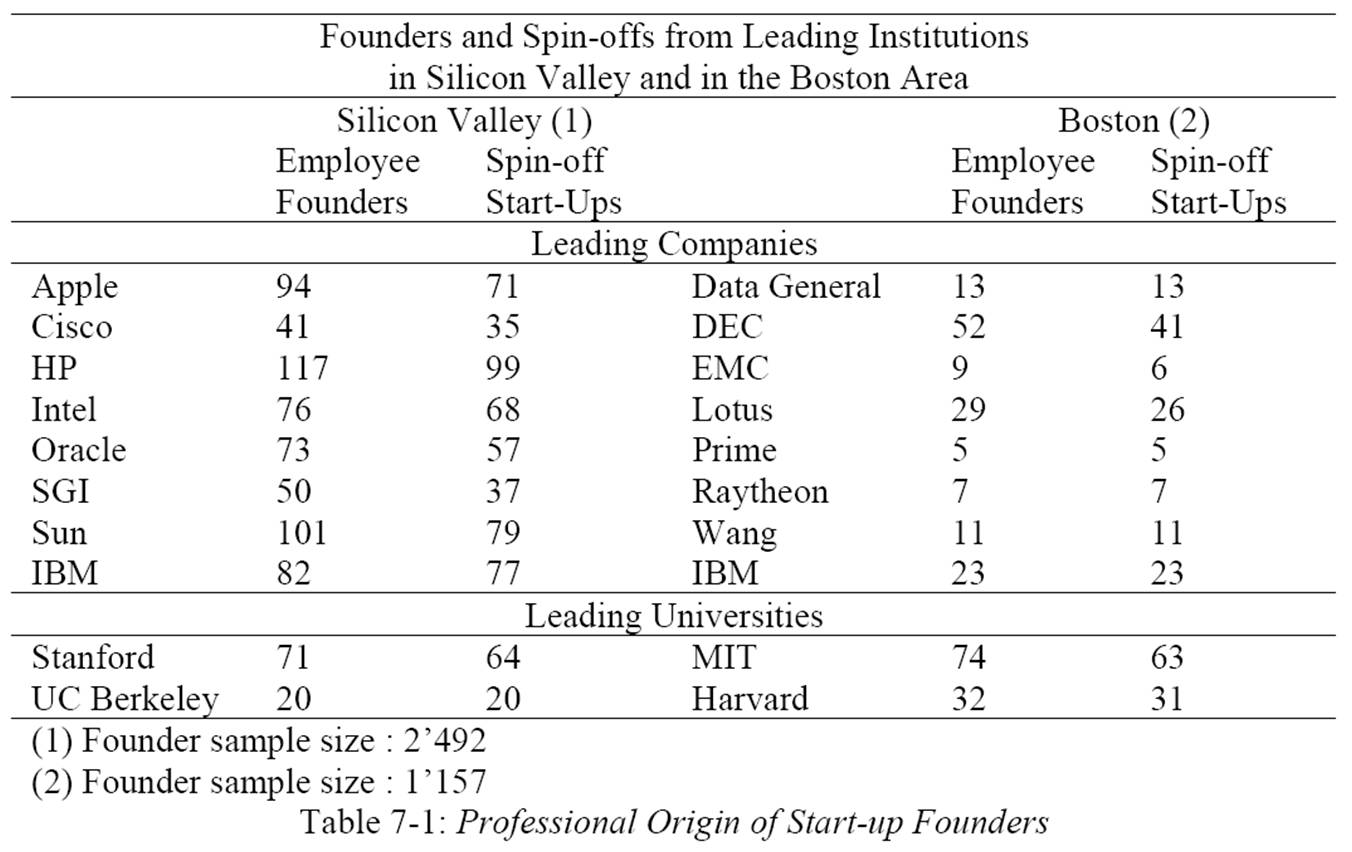

As a conclusion, let me add a study by Junfu Zhang who compared Silicon Valley to the Boston Cluster, in terms of how many entrepreneurs left their big company. He showed the big difference there was between the two regions that both Newton and the Wagon Wheel bar explain in terms of culture.

Source: High-Tech Start-Ups and Industry Dynamics in Silicon Valley – Junfu Zhang – Public Policy Institute of California – 2003

I have a short memory for things but when I focus on one point, I stick to it for a few days. After finding a few things on Valentine, I digged a little more and found again the interview I used in my book when he compares Steve Jobs to Ho Chi Min (“We financed Steve in 1977 at Apple. Steve was twenty, un-degreed, some people said unwashed, and he looked like Ho Chi Min. But he was a bright person then, and is a brighter man now”).

There he also explains why Silicon Valley can not be replicated. Here it is:

“There is no question. It’s very difficult. And over the years we’ve been visited by hundreds of people from every country in the world, almost all of the states in the country. They all want to figure out and clone what causes Silicon Valley to exist and thrive. Many or most of the visitors are interested in the underlying employment creation. But if you look at venture capital, it only works two places in the world. It doesn’t work outside the U.S., and it only works in Boston, or the greater Boston area, and in Silicon Valley. Basically, almost no other major financial center in the world has ever generated companies of consequence and providence that is so large and visibly successful.

And you can blame it on the weather. You can give credit to the great universities. You can explain that the venture community here is stronger and more experienced than other parts of the world. But the mystique of why it works is still very hard to narrow down to six or seven simple declarative sentences. And it – it is a local bit of magic that – works at this particular point and time. The duration of the venture industry is probably only from something like 1960 through the present, so you talk about not even half a century. [The interview is dated 2004…] It – it’s still a new and – and sort of closet-like form of financial engineering. We don’t think of it as investing at all. We think of it as building companies, often times building industries. And it’s an entirely different mentality and attitude than in the traditional idea of buying and selling things. And this is not a place where you buy things; this is a place where you build things. And you participate in the founding team that creates an entirely new company and sometimes a new industry. And now there are far more practitioners.

But if you go around the world, the Research Triangle in North Carolina was going to be another magic spot. Well, you can’t name a great company, it’s never been started there. You can look at other centers. Seattle – well, there is a great company there. Maybe there are two great companies there – they include Nike. And – has anything happened in the last twenty-five years in that community other than Microsoft and Nike? And the answer is not a lot. [Well he forgets Amazon!] Lot’s of companies have started. Lots of things going on, but not a lot of monumental success. I mean it’s unbelievable the number of companies that have gained prominence, have revenues of a billion dollars in this tiny, little valley. So it is a bit of enigma what all the ingredients are that everybody would like to clone and take away.

I once tried to explain to the Deputy Prime Minister of Singapore who was here trying to take back the magic, and I said it’s a state of mind. You can’t take it back. Somehow or other you’d have to move your people here and they would have to have their DNA changed so that when they went back to Singapore, there was a DNA adjustment in the way they thought, the way they were willing to take risks. I mean in a place like Japan, if you start a company and it fails you’re disgraced. Some people would commit suicide – if that happened.”

“And here – you – you start a company and you fail, some of the best people are better after their failure than before their failure. So you don’t have the stigma of failure. In Ireland, I can’t imagine with jobs so hard to come by, somebody would leave a good job in a country like Ireland to – to run the risk of their company failing. And a place like Germany, it’s so rigid you’d be socially ostracized, I suspect, if you started a company and – and it didn’t work.

Environmentally here – the other ingredient I forgot to mention and it’s more true now than it ever was, the – the community is built up of emigrants and immigrants. So almost all of the people who have started or participated in starting these great companies have come from some other state. Noyce was from Iowa. Went to Grinnell College. And there’s a – Gordon Moore might be an exception of somebody who was born in California. So we have a whole history of emigrants coming from all over the country, and in the last ten years more than ever, we have a huge population coming from Southeast Asia. It – a month doesn’t go by where Sequoia doesn’t start a new company populated by Indians. Fabulously educated, brilliant entrepreneurs, they come from an economic system that is so different from ours it’s hard for me to understand it, although about once every two months I get a lecture from some entrepreneur who says that you don’t even understand your own system.

You don’t understand how unique it is and – and then the fact that it doesn’t exist anywhere else in the world. So there is something here that is – that is different as perceived by the people who purposely immigrate here.”

Those who follow my blog know I am interested in the history of Silicon Valley, start-ups and venture capital. I had published a while ago data about Kleiner Perkins’ first fund. I’ve been trying ( and I still do) to find data on Sequoia’s first fund (Atari, Apple, Tandem, Altos) without much success [anyone with data on Sequoia I is welcome to contact me!) but today I found an interview fo Sequoia’s founder, Don Valentine, given to Inc. magazine in May 1985. What he told about start-ups, entrepreneurs, investors and big corporations could be said again today. I put in bold characters what stroke me. Enjoy, even if the interview is rather long.

Now I just found a recent interview of Valentine (dated October 2010). Though given 25 years later at Stanford Graduate School of Business, it does not seem valentine has changed much his values and beliefs.

Peaks And Valleys

Venture capitalist Don Valentine scaled the entrepreneurial heights as a key investor in Apple Computer, Altos Computer Systems, and Tandem. Now, amidst uncertainty in Silicon Valley, he talks of opportunity, company building, investor madness, and the failings of the business press.

He speaks like the New York street kid he used to be, but Don Valentine understands the challenges facing California‘s high-technology entrepreneurs better than most Californians. At 47, the feisty venture capitalist ranks high among the deans of Silicon Valley‘s much ballyhood investment community.

Not that this reputation has made him universally beloved. Gruff sometimes to the point of rudeness, he can be a formidable for of foolishness. As the marketing manager of the then fledgling National Semiconductor Co., Valentine is to have scolded a subordinate so severely on one occasion that the poor fellow fainted dead away. Other victims have also felt the lash of his wit: entrepreneurs and journalists, to name a few.

Despite his prickly manner, Valentine is widely admired among those entrepreneurs who have taken his money, and, more importantly, benefited from his intimate knowledge of building companies in emerging growth industries. The son of a New York City Teamster official and a graduate of Fordham University, Valentine won his spurs in the infant integrated circuit business — at Fairchild Camera and Instrument Corp.‘s semiconductor division from 1960 to 1967, then at National Semiconductor Corp. until 1971.

He then formed his own venture capital firm, Capital Management Services Inc. (now called Sequoia Capital), which was a key early investor in more than 100 California high-technology companies, including Atari, Apple Computer, Tandem, Altos Computer Systems, LSI Logic, and Cypress Semiconductor. With these and other successes, Sequoia Capital over the past 10 years has earned its limited partners returns in excess of 60%.

For all his triumphs, Valentine insists that he doesn’t back in the media’s glorification of his trade. Indeed, he deplores it. And now that the press has decided to deflate the industry’s once-buoyant image, he professes to be relieved. He knew failure, too, in the midst of his successes: Pizza Time Theatre was a Capital Management-launched company.

At the same time, Valentine has not lost faith in the future of U.S. entrepreneurism. Looking out of his office window at the rolling hills above Stanford University, sipping a mug of tea, he reflects that entrepreneurs need only remember the key qualities that have made for their success in the past — the courage to be different, to create markets where none existed before, and to invent radically new ways of doing business. With such weapons, he argues, entrepreneurs can continue to enjoy surprising triumphs against their larger, more entrenched competitors.

INC.: What’s going on in the venture capital business these days? Do you still have people pounding on your doors with new Apple Computers, or new add-ons for the IBM?

VALENTINE: Amazingly to me, yes.

INC.: What do you say?

VALENTINE: Well, the first thing I ask is, “Why, in 1985, do you want to do this? What do you see happening in the world that leads you to believe that you can make a real company, achieve whatever you want to do as an entrepreneur, and at the same time allow us to make a consequential return on the risk we take?”

INC.: And what do they reply?

VALENTINE: Unfortunately, many of them start talking about the installed base, how many are being produced — that sort of thing. They often don’t seem to have any sense that the race has been run, that there’s no longer an opportunity for the modest technical contribution to the evolving family of Apple or IBM boxes.

INC.: Does that mean there’s no more room for anybody in the microcomputer industry, apart from those two?

VALENTINE: Oh, I think Radio Shack is probably a well-entrenched company. They have their own distribution channel, which kind of helps them. And Commodore has staked out a very strong position in Europe and at the very low end. But I wonder if that’s not it.

INC.: What about the IBM-compatibles, the Coronas or the Compaqs?

VALENTINE: I have never believed it was possible to invest and make substantial returns by being compatible with IBM — anywhere, at any time. Not in mainframes, not in disk drives, and certainly not in personal computers.

INC.: The conventional wisdom says you have to be compatible with IBM.

VALENTINE: I think the conventional wisdom must be comprised of what goes on in people’s heads who have no sense of history. There are no historical examples where IBM compatibility has produced anything except annihilation.

INC.: OK. But if computers are not, where do you see any new fields of opportunity?

VALENTINE: Right where they have always been. One of our theories is to seek out opportunities where there is major change going on, a major dislocation in the way things are done. Wherever there’s turmoil, there’s indecision; and wherever there’s indecision, there’s opportunity.When it becomes obvious to anybody who reads Time magazine that it’s useful to have a disk drive on a computer, then it’s already way too late in the cycle to invest in disk drives. So we look for the confusion phase, when the big companies are confused, when other venture groups are confused. That’s the time to start companies. The opportunities are there, if you’re early and have good ideas.

INC.: Can you be more specific?

VALENTINE: Sure, the telecommunications industry is a good example. The regulations are unclear, the interpretations are unclear. So the big companies don’t know what they’re allowed to do and what they’re not allowed to do; and neither do the regional companies. They don’t know what they can sell and what they can’t sell. The venture business has never been a business of taking the big companies head-on; in fact, it is always a business of avoiding taking them head-on.

INC.: So the success of venture capital depends to some extent on there being a lot of confusion in the market-place, or at least in the minds of big companies. Is that right?

VALENTINE: Well, I don’t want to leave you with the impression that we’re so much more clever than the people who run big companies — that only we, the venture people, can see through the murkiness. On the other hand, big companies do suffer from certain disadvantages — implementation, for instance. Oftentimes, a big company will develop something, but then it will languish around and never get into production, or get into production too late. Take everyone’s favorite example, the personal computer. Long ago it was too late to be in that business. So what did the big computer companies do? They launched their own personal computers: Wang, NCR, HP, and I don’t mean to leave out Data General and DEC. Now some of those companies might be buying the product from someone; they might get it on an OEM basis, or a license basis, or coventuring it. But it’s all an example of a time when we should be moving in another direction.

INC.: Still, we’re hearing a lot about big corporate types beginning to see the value of “intrapreneurship,” small niche marketing, and so forth.

VALENTINE: I don’t know about all that. Big corporations flap their lips a lot about all the great things they’re going to do, but basically they’re obedient people. When you run a big company, it’s like running anything else that’s big, a church or an army: The key ingredient is obedience. Anything big requires people performing and acting in conventional, predictable ways — within the rules. Entrepreneurism is by comparison the role of the nonconventional person who’s going to do it differently. And in the big corporation, he’s just a flat-out pain in the ass. He doesn’t get through the industrial relations department, because that’s why you have an industrial relations department: to make sure the oddballs don’t get in and create confusion in the obedient world.

What you’re hearing is a fashionable reaction to a currently overreported event. Entrepreneurism is “in”; therefore corporate cultures have to embrace it in order to appear contemporary. I think that after the fad has passed, the big corporations will discontinue it, like affirmative action and the employment of women and all the other bullshit things they do for public appeal. This, too, will pass; and in another two years they’ll be on to something else.

INC.: Yes, but affirmative action accomplished something. Women and blacks were hired. They’re still working. Won’t this intrapreneur faddism, as you call it, leave some of its spirit behind, even after it has passed?

VALENTINE: I would be surprised. The progress of minority groups, the progress of women, is because fundamentally, as individuals, they are contributors, of sex and color. There’s no fundamental reason why intrapreneurship is going to be useful to a multibillion-dollar company.

INC.: You think it’s all public relations, nothing that’s deeply felt?

VALENTINE: Yes. Big corporations are made up of several ingredients. One part is public relations. But another part is accounting. Big companies are run by accountants, whose mentality is to control things, to homogenize things. That’s what control is: sameness, predictability. Look at what happens to an entrepreneurial company when it’s acquired by a giant. The giant comes in and says: “We have to change a few of the rules. Don’t worry; we’re not going to change the company. We just want you to think about a few things. You’ve got to have a compatible health plan. Ours is better than yours, so we’ll fix that. And this accounting firm is really better than your accounting firm, so we’ll fix that, too.” It’s death by a thousand cuts. A little nick here, a little cut there, a little change here — nothing significant. But at the end of a short period of time the people are so driven by controlling and accounting that the environment of nonconventional solutions is lost.

INC.: So you’re saying that big companies are doomed in their efforts to coopt the entrepreneurial spirit.

VALENTINE: Yes, but not the entre-preneurial product. The bioengineering world may be a good example. The bioengineering product is a technique, more a manufacturing process than a freestanding product. And the logical people to be in the biolengineering business are the pharmaceutical and drug companies, right? So why, then, do you have all there bioengineering firms starting up since 1978 or so? I think what happened was that the big pharmaceutical companies had other fish to fry. They had their scientists grinding away on other products. But meanwhile they saw all these little companies getting venture financing, and what they did, cleverly, was to point some money at this one, then at that one, knowing that later they would catch up with them. They knew that the venture companies couldn’t walk the new interferon drug, or whatever, through the Federal Drug Administration cycle, into production, and into the marketplace. That’s a very expensive process and requires a lot of know-how. They knew that the little companies didn’t have that kind of wherewithal. But the big companies did; so that when the time came they knew that they could come in and pick up the marketing rights from the little companies.

INC.: You seem to have a lot of ideas about big companies. Have you ever worked at one?

VALENTINE: That depends on what you mean by “big.” I worked at Fairchild, where I joined an already existing sales force and sales concept, and I managed it up to $150 million from the mid-20s. Then, at National Semiconductor, I got the opportunity to design a sales concept and sales force from scratch. They were losing about $2 million when I got there, and by the time I left they were earning about $40 million. I enjoyed that. I like taking the proverbial blank piece of paper and designing another approach to doing things. It matched my personal goals. But then I found myself no longer challenged. More important, I found that I didn’t like companies when they got to $40 million or $150 million. I hated them.

INC.: What was it you couldn’t stand?

VALENTINE: Success, I think, is what I couldn’t stand. When a company succeeds, the founders no longer have a personal impact on strategy, no longer have a direct contact with the customers. They become managers and superiors, while all the other guys who work with them have the fun. And if you don’t let them have the fun, you can’t keep them. I like doing things personally. I like seeing the customers, the applications of a product. I don’t like seeing them through a sales force. By the same token, I like planning products and strategies, personally, not through three layers of people. So I opted for venture capital, where I could act personally and permanently in a small-company, fast-track, growth environment — somewhat as a dilettante rather than a full-time manager. Managing a company that was growing at 10% or 20% a year wasn’t even an option for me. I wanted an environment where I could invest in small companies and enjoy their success, modestly contributing at the strategic level. Venture capital is where I can do that, and in a multitude of companies at the same time.

INC.: Let’s talk about how that works. When an entrepreneur walks into this room, looking for money presumably, how do you size him up?

VALENTINE: The characteristic we’re concerned with every time is whether the person knows what he doesn’t know — whether he’s mature enough to recognize it, talk about it, and do something about it. That’s one of our critical tests. Many entrepreneurs have incredible blind spots. For instance, they are often, correctly, said to be insensitive to the importance of sales, or manufacturing, or how to get good gross margins. They’re not deliberately blind; they just haven’t thought about those things.

INC.: How do you test for blind spots?

VALENTINE: We discuss it. We ask them about their products, their approach, and what skills they think are crucial to the company’s growth. Then we want to know whether those skills are resident in the team; and if so, who has them; and if not, why not, and where they’re going to come from. Our world is one of constant Socratic questioning. We spend a small part of our time trying to find out which questions are relevant, and the rest of it we spend listening.

INC.: How important to you is the business plan?

VALENTINE: Most important, but for a not very obvious reason. We must have something that will tell us how people think. We get one or two of these plans every day and we can’t possibly understand the nuances of every business. So the business plan to us is where we begin to learn about the people. We can’t tell whether the numbers are right, therefore we concentrate on how they reached the numbers, the thought processes that led them to conclude that their project was possible.

INC.: Where do most entrepreneurs fail in their thinking?

VALENTINE: Well, that’s one of the great ironies of my career. It’s the computer. The prevalence of the computer and the spreadsheet has caused entrepreneurs in the last two or three years to develop pro forma projections of their businesses. They’re no longer written out by hand and really thought about, with the result that many people have no personal understanding of the numbers they’re projecting. Sometimes you find incredible market shares being achieved in just four years, simply because the numbers suggest it; or sometimes you find sales expenses projected at numbers far below what you’ll probably need to get the orders. Things like that fall out because the numbers are generated impersonally, and nobody thinks about the relationship between them and the structures that have to be in place before the numbers start coming in.

So for us the business plan is a bridge to communication. We’ve never invested in a company that achieved more than 70% of its plan. But that’s not such a great failing, in our view. We’re dealing with people who are supreme optimists. If they weren’t, they wouldn’t be starting companies, they’d be working in some nice, comfortable haven. They would not be doing the hardest thing in the world. So we’ve become less concerned about the completeness of the plan than we are about how the founders reached their conclusions — what factors they considered relevant, what assumptions they made, how realistically they viewed the competition, and so forth. These are things which, from our point of view, you can learn only by listening, not by reading.

INC.: What do you look for in terms of growth — the company that gets up and running at $25 million to $50 million a year, or one that goes to $200 million?

VALENTINE: I wish your question had more alternatives. But if I have to choose, my interest is always in people who can get the company from zero to $25 million or $50 million as quickly as possible.

INC.: Why is that?

VALENTINE: Well, the thing you have to keep in mind is that we invest in partnerships that last from 8 to 10 years, at the end of which time they terminate. This means that the real time frame of our growth expectations is about 5 years. How much can you legitimately expect a company to grow in 5 years? Not to $200 million or $300 million. Of course there are exceptions — Apple, for one — but their principal effect has been to confuse people about the real history of venture capital. Historically, the probability of a venture investor having even one Apple to his credit in 7 or 8 years is very low. If he were really good, out of 30 or 40 investments, he might make 2 or 3 Apples, but never 10. It’s absolutely unrealistic, in my opinion, to expect $200 million to $300 million in 5 years. On the other hand, it is perfectly reasonable to expect $25 million, $35 million, $50 million in that time, and that’s what we look for.

INC.: That certainly seems a lot more modest than what you were saying not long ago. It sounds as though you’ve radically scaled down your expectations from what they were a few years ago.

VALENTINE: Let me suggest that it’s you, the press, who have had to scale down your expectations, and you want to impute your disappointments to me. The fact that a company goes from zero to $50 million counts for a lot to me. Now it is true that during much of 1982 and all of 1983 there was a real pricing insanity in the venture field. Investment bankers, pension fund managers, a good many new players were racing around frantically to get their money employed in start-ups or mezzanine financing. This drastically shortened the amount of time available to study investment opportunities. We saw companies being funded very rapidly, so rapidly that we didn’t get a chance to participate. We were too slow. Recently, as a matter of fact, we were talking about one such company, wondering why we hadn’t made an investment in it. Well, the other investors were more agile. They moved before we could, in our iceberg fashion. As it happened, this company didn’t succeed. We had dodged the bullet. But the point is that the reason we were able to dodge the bullet is that we didn’t adjust our approach during that period of insanity. You know the old saw — keeping your head while all around you people are losing theirs. Well, I don’t want to suggest that all the companies we ducked in that period of frenzy were properly ducked. I suspect some were successful. But I don’t believe the venture investment community was ever conceptualized or designed to produce a dozen $500-million companies per year. History, at any rate, shows that it works best at delivering lots of small-niche companies, employing hundreds of people, doing brilliantly on $25 million to $50 million a year in revenues.

INC.: But isn’t there a danger in that sort of thinking? Aren’t you doing these companies a disservice by focusing on relatively short-term growth? Don’t you have some responsibility to make sure they have management capable of taking them past the $50-million mark?

VALENTINE: If you’re going to talk about responsibility, the real question is, to whom and to what constituency am I primarily responsible? I would say that our first responsibility is to our limited partners, who are mainly members of various pension plans in the United States. They’re the ones who own our companies, and when I think of responsibility, I think about those people, and the returns that they have signed up for and expect to be delivered.

INC.: Yes, but even so, we’ve seen loads of companies go to $30 million or $40 million in sales and then collapse, sometimes before going public. Don’t you at least have a responsibility to get managers who can keep companies solid over the 5-to-10-year period of your involvement?

VALENTINE: Of course. And after having made investments in perhaps 150 companies, we are inclined to believe that there is one set of management skills needed to start a company and another set needed to manage a bigger company. They are rarely resident in the same person.

INC.: So, even within a 5- or 10-year time frame, it’s almost inevitable that you’re going to have to make significant management changes.

VALENTINE: I’d say “management additions.” Sometimes the man who starts as president of a company is replaced by another member of the team when the company reaches a later stage of development. But with the exception of someone like [Tandem Computers Inc. president] Jim Treybig, it’s rare that a successful, driving entrepreneur becomes a successful executive capable of managing the assets and people of a $100-million or $500-million company. A great many entrepreneurs just cannot make that transition.

INC.: Of course, to listen to the entrepreneurs these days, the problem they’re having is getting people to invest at all. They refer to the venture capital community as “the valley of the maybes.” That certainly wasn’t the situation a year or two ago. Have you changed with the times, too?

VALENTINE: I don’t know. We don’t keep data; we don’t want our investment process dictated by the numbers. But looking back over the past 15 years, I would guess we’ve made substantially the same number of investments every year, with only a small range of differences. It’s not that we planned it that way; it just turned out that way. But the other key point is that we almost always invest in the early stages. We reconsider this virtually every time we meet to discuss strategy, but we’ve always found that for our purposes it made sense to continue to invest in the early phases of a company.

INC.: Why is that?

VALENTINE: Because in the company-building business, which is the business we perceive ourselves to be in, it’s easier to have an impact on the concept and personality of the company. This is difficult to do after the first financing. By then other people are influencing the company; its personality has been determined. We’ve seen companies that have been very badly influenced: for example, encouraged or tolerated in habits of irresponsible spending. We just find it easier — as in child-care — to form company attitudes toward spending and growth early on.

INC.: What’s your “letting go” point? When does it seem you can no longer impose your will on them?

VALENTINE: May I quibble with the question?

INC.: Quibble all you want.

VALENTINE: Thank you. We don’t view ourselves as “imposing our will” on a team starting a company. We don’t see ourselves as relating to companies in an adversarial way. We see ourselves as encouraging them, as a stimulator. The important thing we have to maintain in perspective is that other people are running the company. It is their company. On the tactical level we are at best a partner, but mostly a cheerleader. For example, during the wooing process — when the decisions are made whether to invest or not — we try to avoid having any of our ideas taken up as part of the concept of the company, lest we distort the entrepreneur’s or management’s view of what’s supposed to happen. We don’t make an investment decision based on our ability to enforce our will. That’s a repugnant concept. We want to make sure that the company is one where the entrepreneurs are having their ideas financed, and that they are passionately committed to those ideas.

INC.: So what exactly do you bring to the table — besides capital, I mean?

VALENTINE: I would say the main thing is what we call “intelligence equity” — experience the companies don’t have, contacts they don’t have, perspectives they don’t have. Basically, we give them the opportunity to move from the entrepreneurial stage to that of a larger, more stable company. Altos, for example, is now a company with around $103 million in annual sales. When we invested in it, it was comfortably successful, doing something like $12 million to $15 million a year. Altos was profitable, had money in the bank, had no debt, and was developing a fair amount of momentum. They really didn’t need our money, but they realized that they were entering a risky period, with a lot of unanswered questions — the more so because they didn’t know what the relevant questions were. So they were clever enough to want to associate with other people who could help them identify the questions as well as the answers — not just us, but lawyers, accounting firms, and so on.

INC.: All right, but let’s face it. Your experiences are heavily oriented toward the computer industry. How valuable are they in, say, a restaurant chain, not to mention any names?

VALENTINE: Well, it’s true that most of our expertise is in the computer area, and we probably have less to offer to companies outside the wide embrace of technology, especially companies in slower-growing industries. There are leverage skills we don’t have. We are probably better off staying out of those businesses.

INC.: But doesn’t the same reasoning apply in a technology-based industry like biotech? Don’t you think that microbiology demands profoundly different skills and perspectives than micro-electronics?

VALENTINE: A lot of fundamentally different skills and a lot of fundamentally similar skills.

INC.: For instance?

VALENTINE: Well, it’s true that many of us understand the world of bits and bytes, and relatively few have much experience in the world of microbiology, partly because this hasn’t been a business before. So, from one perspective, we’re operating at a disadvantage.

But it’s also true that microbiology is basically a tool for solving problems, just as a computer is a tool for solving problems. The challenge in both cases is to identify the problem and the best tool with which to solve it. From that perspective, we still have something to contribute to these companies, not so different from what we’ve contributed to computer companies. After all, we’ve seldom contributed anything to, say, the electronic architecture of a computer, or the kind of circuitry needed, or the speed or packaging. It’s rare for investors to get involved in that kind of detail.

INC.: Can you give us an example of the kind of “intelligence equity” you might provide to a biotech company, or a telecommunications company, for that matter?

VALENTINE: Sure. One thing about both those industries is that they tend to be very capital-intensive, so you have to find creative ways to raise money. We try to help companies do just that.

One example is a company called Equatorial Communications, which had to acquire $16 million worth of transponders on satellites in order to be operative as a communications company. That’s a lot of money, and the situation required a solution that would not be an equity disaster to the founders and early investors. I mean, if the company went to the market and tried to raise the money, they would have no equity left. They needed a way to finance assets that had never been financed before — the worth of which were therefore unknown — and they had to do this before the satellite was launched.

Well, through a combination of leasing and guarantees, modest amounts of equity were sold in order to control two transponders on Westar 4.The solution involved corporations, insurance companies, and banks — nontraditional financiers for a company like Equatorial. Frankly, nothing like it had ever been tried before because nothing like it had ever been needed. Since then, this kind of solution has also been used in many of the modestly successful bioengineering companies.

INC.: I suppose another solution would be to form one of these so called alliances, or corporate partnerships, with a larger company.

VALENTINE: Absolutely. That’s something we’ve done in the semiconductor industry — so that, for example, a company like LSI Logic can go into business and, through Johnson Controls, have the ability to purchase equipment worth $20 million for very little in the way of equity.

INC.: Do you think that this sort of alliance will become more common in the future, that people will be looking less to the equity market?

VALENTINE: I think corporate investors are a necessity in a capital-intensive business, where the equity leverage in a model venture deal can be easily lost. Obviously, straightforward debt doesn’t work. These companies don’t have the underlying equity from which to borrow from traditional sources. So corporate America has been one of the solutions. Insurance companies have been interested participants in these things, and some of the pharmaceutical companies as well.

INC.: Does this mean that small companies and large companies have more in common now than before?

VALENTINE: I view the small company as a vehicle for the individuals involved, but large companies can also benefit from their activities. Entrepreneurial companies are a stir to get big companies moving. What’s more, the people who work in big companies often own the small companies through their pension plans. One of our largest partners is General Electric, so the employees of GE benefit from our companies’ successes.

INC.: Let me change the subject and ask how all this affects you personally. You’ve had a string of spectacular successes as an investor, beginning with Apple. You’ve noted how unusual that is. Isn’t there a risk that they might go to your head? Don’t you ever get a slight Deity Complex?

VALENTINE: I suppose the correct way to answer that, in a magazine interview, is to say yes. It makes one appear humble. But the answer is no. I think I always understood why Apple worked, and that there was a great amount of luck involved, both for Apple and for our being investors in it. The publicity, if anything, reinforced this sense of perspective. Also, I have a teenage daughter whose role in life seems to be keeping my ego in check. At every opportunity she reminds me of my mortality.

INC.: Speaking of mortality, I take it that you don’t think we’re coming to the end of the Age of the Entrepreneur — despite all these stories of “Doom in Silicon Valley.”

VALENTINE: I think the thing that’s coming to an end is the reporting of it. Newspapers and magazines — and let’s throw in TV — are usually interested in short-term fads and “trends,” and since there are many more media than there are fads, the latter tend to get overreported. The fact that the media are now writing about “Doom in Silicon Valley” means to me only that they are getting tired of writing about “Boom in Silicon Valley.” For the public, maybe things will come back into some sort of historical perspective. Entrepreneurism is not the solution to all the economic problems of the country or the world. No one ever conceived it to be — except the press.

INC.: So in a way the doom-talk might be good.

VALENTINE: It might be good if fewer company presidents and venture capitalists have to talk with reporters. More time will be spent in creating new companies.

The new movie about Facebook’s founder, Mark Zuckerberg, is a great movie. It does not matter so much if it is a description of reality. You may watch it as a piece of fiction, and it would remain a great movie thanks to the actors and screenplay.

It is also great because it describes the start-up world in a very accurate manner. It is not a movie about start-ups really, but there are details which reminds me a lot of real-life stories.

The first lesson is that money and friendship seldom work together. The stories of Eduardo Saverin, the founder soon to be diluted, Sean Parker, the exhuberant founder of Napster and Plaxo and mentor of Zuckenberg and the short appearance of Peter Thiel are such examples.

It also shows the old world of Boston where people think ideas are crucial and the new world of Silicon Valley where what matters is implementation. It’s why Silicon Valley is the Triumph of the Nerds. It shows how right Paul Graham is when he says Silicon Valley is about nerds and money. You see the crazy, sad, exciting, depressing life of these hard-working people. You may like it or not, but it is mostly what start-ups are about.

I just looked for what some key people thought of the movie. So, for example, Eduardo Saverin said here: “The Social Network” was bigger and more important than whether the scenes and details included in the script were accurate. After all, the movie was clearly intended to be entertainment and not a fact-based documentary. What struck me most was not what happened – and what did not – and who said what to whom and why. The true takeaway for me was that entrepreneurship and creativity, however complicated, difficult or tortured to execute, are perhaps the most important drivers of business today and the growth of our economy.”

And Dustin Moskovitz said there: It is interesting to see my past rewritten in a way that emphasizes things that didn’t matter (like the Winklevosses, who I’ve still never even met and had no part in the work we did to create the site over the past 6 years) and leaves out things that really did (like the many other people in our lives at the time, who supported us in innumerable ways). Other than that, it’s just cool to see a dramatization of history. A lot of exciting things happened in 2004, but mostly we just worked a lot and stressed out about things; the version in the trailer seems a lot more exciting, so I’m just going to choose to remember that we drank ourselves silly and had a lot of sex with coeds. […] I’m very curious to see how Mark turns out in the end – the plot of the book/script unabashedly attack him, but I actually felt like a lot of his positive qualities come out truthfully in the trailer (soundtrack aside). At the end of the day, they cannot help but portray him as the driven, forward-thinking genius that he is. And the Ad Board *does* owe him some recognition, dammit.

And Zuckerberg himself!

Watch live video from c3oorg on Justin.tv

This is from Garham’s start-up school and here is part 2

Watch live video from c3oorg on Justin.tv

Of course, this looks like corporate language, we should remember these guys have FaceBook shares! Talking about shares, there was another thing I did not like recently, the fact that according to Forbes, Zuckerberg would be richer than Steve Jobs. I had a discussion with a friend over the week end and he agreed with the statement whereas I disagreed. It may be a detail: but as long as Facebook is not quoted, Zuckerberg’s wealth is mostly paper value he can not really trade. I am sure he is already rich, he probably has already monetized some of his shares but not all of them whereas Jobs owns shares which are liquid. It may not be a big difference given the success of Facebook, but I have seen to many stories of start-ups where people thought the paper value of the stock was real wealth and the next day worth nothing…

When my daughter told me yesterday, she might at least explain her friends what her dad was doing. i.e. working in the world of start-ups, I thought the movie had at least reached that goal of reaching a large audience towards this important topic!

Final point, a recurrent topic in my blog: Facebook cap. table and shareholder structure. As Facebook is private, it is a challenge to know what’s true and what’s myth. I have still tried the exercice from what the Internet gives. One interesting feature is Saverin’s dilution from 30% to 5% whereas Zuckerberg went from 65% to 24%, not really pro-rata! We shall see when Facebook goes public, who wrong I was!

A colleague of mine (thanks Jean-Jacques) recently mentioned to me this book by Josh Lerner, which full title is Boulevard of Broken Dreams: Why Public Efforts to Boost Entrepreneurship and Venture Capital Have Failed–and What to Do About It. I was all the more interested that Lerner is the author of many academic papers on high-tech entrepreneurship, and particularly of one about serial entrepreneurs: “Performance Persistence in Entrepreneurship” [pdf format here] with Paul Gompers, Anna Kovner, and David Scharfstein, Journal of Financial Economics, 62 (2007), 731-764. I will come back in the future on this topic which I am currently studying.

So what should we do about the public efforts is what Lerner is trying to help us with and his answer shows how challenging the topic is. What is beautiful about the author (my personal point of view) is that he likes history (just like me). Just like Steve Jobs! Just read again what I posted about Jobs on mentors; “You can’t really understand what is going on now unless you understand what came before”.

Lerner’s initial chapter is “A Look Backwards” He shows how entrepreneurs and investors benefited and suffered from each other in the 70s and 80s, including the excess of speculative bubbles, the PC burst of the 80s for example. He also shows how important public support was in the very early days through the funding of research (mostly the cold war militaries) and the legal actions to ease venture capital (SBIRs, Erisa Acts) so that he does not really agree with Rodgers (founder of Cypress) who wanted government out of Silicon Valley (page 32) so that he claims that “The Public sector did play a key role in shaping the evolution of Silicon Valley” (page 35).

Then, in the following chapters he shows how complex it is to find facts: “consistent information on venture-backed firms that were acquired or went out of business doesn’t exist” (page 59) which means that quantitative analysis is rare. And remember he is a respected academic, so he knows! What he tried to do then, is to show some of the obvious mistakes: incompetence in allocating public resources (page 73), capture, that is use of subsidies by the wrong groups (page 80), by “organizations that are mandated to help entrepreneurs” (page 83). “Seven of the incubators gave less than 50% of funding in cash to incubated firms” (just one example from Australia, page 84) or the SBIR program which has exhausted its usefulness (page 85).

So his advice is:

– enhancing the entrepreneurial culture (page 90) [through the right laws, the access to technologies, tax incentives and training],

– increasing the venture market’s attractiveness (page 100) [through allowing partnerships, creating local markets, accessing human capital abroad],

– avoiding common mistakes: timing [be patient], sizing [not too small, not too large], flexibility [learn by doing], create the right incentives [and here it is a complex situation as perverse effects from good ideas often occur] and evaluate [which does not happen often enough].

Indeed, his introduction (pages 12 and following ones) summarized it all: you need rules, experience, time, incentives and assessment. But with all his experience and knowledge about high-tech entrepreneurship, Lerner is very humble with the lessons: the topic is really complicated, all these advice have to be implemented together and it is really their careful interconnections which will make an ecosystem lively or not. Then it is my personal conclusion that such favorable conditions will be useful if entrepreneurs use them intelligently. So the reason why all this fails has many roots…

I cannot finish this post without comparing it to my book. It is indeed very similar in its conclusions with slightly different facts and figures. So you would learn complementary and consistent things by reading both! My thesis is we need an entrepreneurial culture and access to people from Silicon Valley who have the experience. Everything else is necessary but not sufficient.

Well who am I to predict the future? In fact I do not know but I really doubt it. Famous bloggers have mentioned the topic again recently. In Techcrunch it was Can Russia Build A Silicon Valley? by Vivek Wadhwa. And in the Equity Kicker, it was Building an ecosystem to rival Silicon Valley by Nic Brisbourne. I reacted to both in the following way:

What a topic! Clearly something which has been around for… at least 35 years (I mean how to replicate SV). The fact that we still discuss it shows how complex it is. It has been my main concern in the last years and for the beauty of the debate (that’s what blogs are about, right?) let me play the devil’s advocate fully. At an extreme, I do not think there will ever be another Silicon Valley. For example, Kenney claims in his book on SV it requires 5 basic ingredients: universities of high caliber (Stanford and Berkeley in SV), a strong investor base, service providers, high-tech professionals (who accept to leave their big companies for start-ups so from Intel, Cisco, Apple, MSFT, even Google now to the next wave) and last but not least an entrepreneurial culture. All this is not easy to gather. But even worse, SV was probably an accident, a monster which was never successfully replicated. Saxenian showed in Regional Advantage how even the Boston area failed and the fact that Paul Graham moved ycombinator fully out of Boston to SV is just another sign. In Europe, Sophia Antipolis was a first experience … in 1972 so? So you need a rare combination of ingredients in the recipe and hope the oven is at the right temperature for a long, long time. Now I am playing devil’s advocate so things are not so bad. As a positive reaction, let me add my own analysis: I am not sure governments are good at innovation, they are good at stimulating research. The US federal govt has put billions through DARPA, NIH, DOE, etc, and this obviously helped Stanford, Berkeley to be the best universities worldwide (see the rankings) and the Internet to be created. Long term investment in infrastructure is what gvts are good at (education, research, transport…) Then, yes, bridges with SV are critical. It is exactly how Israel, Taiwan, then India and China have been successful with their diasporas. Countries should invite back the experienced migrants. When he has time, Brin should help Russia or Levchin Ukraine, or even Grove Hungary etc… I am less sure tax credits, admin, legal tools have been so useful in the 50’s, 60’s and 70’s when SV was its in early days. As a conclusion, it is and will remain for a while a great topic.

Of course, my reaction was not as important as the source of the posts: Russia wants to be more innovative and commissioned a report to assess experiments of innovation ecosystems. The result is the following report: Yaroslavl Roadmap 10-15-20 (pdf format.)

There isn’t anything really new in this report, at least for innovation experts. But it is a very good synthesis of what the USA, Israel, Finland, India, and Taiwan have tried, be successful in, but also in what they failed. The historical summaries are great and full of good lessons. I had the feeling the authors put too much emphasis on infrastructure vs. culture. It is my own bias again! They mention culture a lot, but they may be aware also that it’s the most difficult thing to create… If you like the topic, you should certainly download and read the pdf, and build your own opinion.

Listen to Loic Lemeur’s views on why “Why Silicon Valley kicks Europe’s butt”. Nothing special if you read regularly my blog but said by someone who has visibility, credibility and experience on both sides of the ocean.

Check his arguments:

– the main reason is how much time we take for lunch in Silicon Valley (i.e. feeling of urgency)

– all in one place (i.e. critical mass)

– like a campus (i.e. easy connections, young, sunny)

– business happens 24/7 even when you don’t expect it (i.e. obsession)

– seed funding and VCs (i.e. money)

– flexible (i.e. changes happen fast)

– “how can I help” attitude (i.e. open and pragmatic)

– easy to get an appointemnet (i.e. open again)

– people trust by default (i.e. open mindedness)

– diversity (i.e. yes diversity works in the US)

– press and bloggers (i.e. tech friendly culture)

– Europeans begin locally (i.e. not globally)

– too much copy / paste in Europe (i.e. no real innovations?)

– Europeans hire local (i.e. challenging to go global)

– Think in English (i.e. another challenge)

– you guys can fix it (i.e. self-confidence and confidence in others – empowerment, remember class A people hire class A+ people)

– aim at being a world leader (i.e. ambition)

– focus on execution, ideas do not matter (i.e. action oriented)

– gather a community and iterate (i.e. learn by doing, by trials and errors)

– believe in yourself (i.e. …)

Well even if this may be obvious for some of you, I still had to fight against people who disagree about this (check my previous post!)

yYou can compare all this to my summary slide when I talk about Silicon Valley. No frustration in all this as we all have to say these things endlessly, but sometimes, still too often!

Two pieces of news caught recently my attention. One is entitled Frank Quattrone, Star Banker of Technology Ventures, Talks Wistfully of the Good Old Days—Before Netscape’s IPO.

The other one is less nostalgic because of the web site name, which I quite like: You’re in Deep Chip Now.

Here is the full text captured from the site:

I will not comment this but let me come back on Quattrone. Quattrone was a star of the IPO world as you may read from this Xconomy blog. What is striking is that in the last 8 years, following the Internet bubble, there has been less venture capital, fewer IPOs. The reasons are many. But the key question remains: are we facing a major innovation crisis? After the transistor in the 60’s, the computer in the 70’s and the PC in the 80’s, the Internet and mobile communications in the 90’s, what have the 00’s given us? And what about the 10’s… I do not have any answer. What about you?