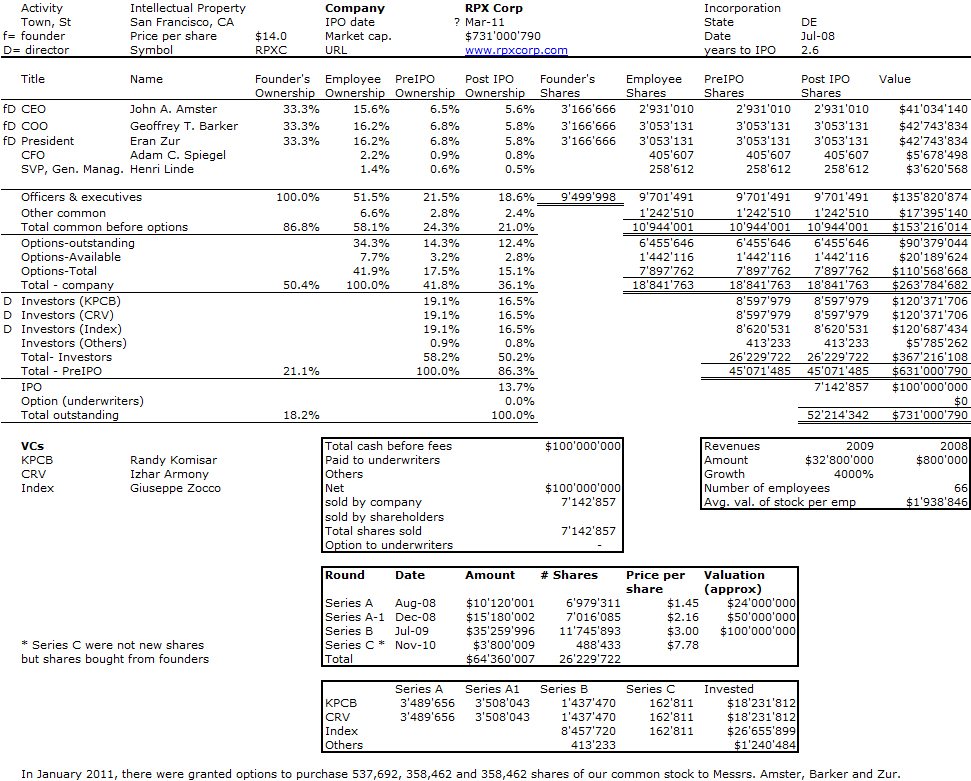

Following my recent post, Is there something rotten in the state of IP, I could not avoid to add this provocative statement despite all my respect for venture capital. When Kleiner Perkins, one of the best West Coast VC (not to say one of the best VC ever), Charles River, one of the best East Coast VC and Index, one of the best European VC co-invest in an IP company (a “Patent Risk Manager”) such as RPX, I thought there had been a major event. And Randy Komisar who is mentioned in my latest post is on the board… Now RPX is filing to go public so as I do usually, here is the cap. table. All these data remain subject to the IPO date and share price which I just had to imagine… You may also be interested to know that the founders of RPX come from Intellectual Ventures…

Tag Archives: Intellectual Property

Is there something rotten in the state of IP?

I have been surprised not to read more about Intellectual Ventures’ recent legal actions. You can read more about the companies they are suing for infringing IV’s IP.

If you do not know about Intellectual Ventures, you should know they have filed or bought about 30’000 patents or patent applications and raised billions of dollars. Until now, nobody really knew why, but their recent actions show IV is just another patent troll.

Around the same period, Paul Allen has been dismissed by a judge about the complaint he had filed for another patent infringment. More here. I should add I read about both pieces of news thanks to the Xconomy web site.

This is an opportunity to say that I have never been a big fan of IP, intellectual property, patent applications and copyrights. I do not have good alternatives to propose, but innovation is often more a matter of speed and being more advanced that being protected by IP. I am aware it is not so simple though. I have worked in the field for a while and I still give general courses on the topic. Those interested may click on the picture below or on this link.

Intellectual Ventures was founded by Nathan Myhrvold, who was formerly CTO at Microsoft. Not need to add which role Paul Allen had at Microsoft. All this could be funny when you think about the fact Microsoft success was not based on patents (and Microsoft did not suffer that much from all the people who copied all their software…)

University licensing to start-ups – part 2

As an addition to the post, dated May 4, 2010, I’d like to add a few slides which describe visually the balance between royalties and equity (with some possible antidilution). If you did not have the previous pdf slides, you should check my previous post first. What these new slides show are linear variations of the equity-royalty (possible) balance.

It may not be universally accepted, but in a way more royalty induces less equity and more equity induces less royalty. Also there may be an anti-dilution mechanism:

– many universities state the equity level will stay the same up to a given amount of money invested or up to the 1st round of funding. Given the habit of investors of taking 30-50% of the company after the 1st round, you can compute back how much equity it would have been at incorporation.

– one university, UNC, and I mentioned that in the comment to my post, asks for antidilution until exit at the 0.75% level. Interesting!

What is also interesting is that globally, Stanford, Caltech, Carnegie Mellon and UNC are very similar (small royalties) and MIT may appear as similar for equity but higher for royalties. All this should be handled with care but is probably not too far from a good summary…

So my visuals are not perfect, neither my comments above, but if I am not clear, just contact me! You can download the pdf slides or click on the picture that follows.

University licensing to start-ups

There’s been a long standing and passionate debate about what universities “deserve” when they license technologies to start-ups. There is the famous Google vs. Yahoo comparison where Google is an official Stanford spin-off which brought $336M in revenue from the equity the university owned in the start-up whereas Yahoo was considered as a hobby of the founders and no intellectual property was owned by the university. However one Yahoo founder gave some $75M to Stanford.

So what is a typical license between a university and start-up? Well there is no clear answer but the attached pdf file may be of help. I have done some search and found some info, mostly from US universities. I have also tried to find the rationals for or against such deals. The debate remains open and I do not expect a general agreement any time soon. But I hope this is contributing to the topic.