As a follow-up of my post Safe choices aren’t always good choices, here is my full account of I’M Feeling Lucky – Falling On My Feet in Silicon Valley by Douglas Edwards. As I said then, I thought it might be just another book about Google. It is not. The lessons are amazing. And here are examples.

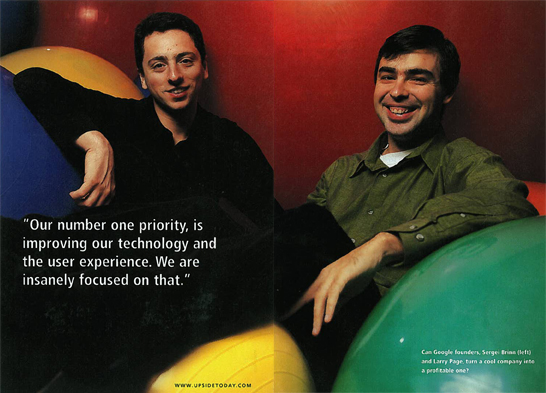

A first illustration comes from a conversation between Douglas and Larry Page: “I realize that more often than not you’ve been right about things. I feel like I’m learning a lot and I appreciate your patience as I go through that process.” […] “More often than not?” [Larry] asked me. “When were we ever wrong?” he didn’t smile as he asked his question or arch an eyebrow to signify annoyance. He simply wanted to know when he had been wrong so he could feed that information into the algorithm that ran his model of the universe. [Pages ix-x]

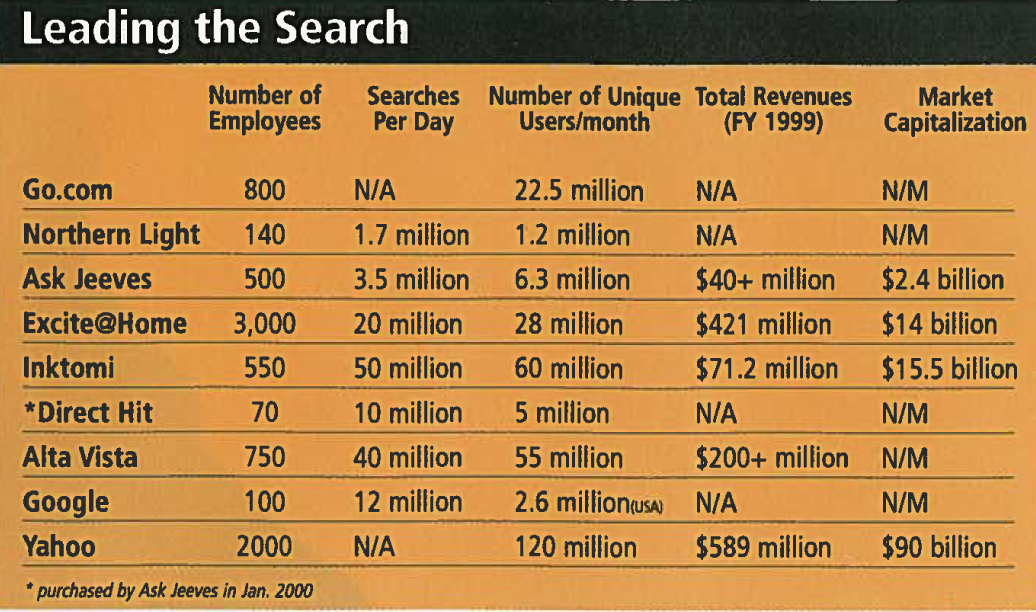

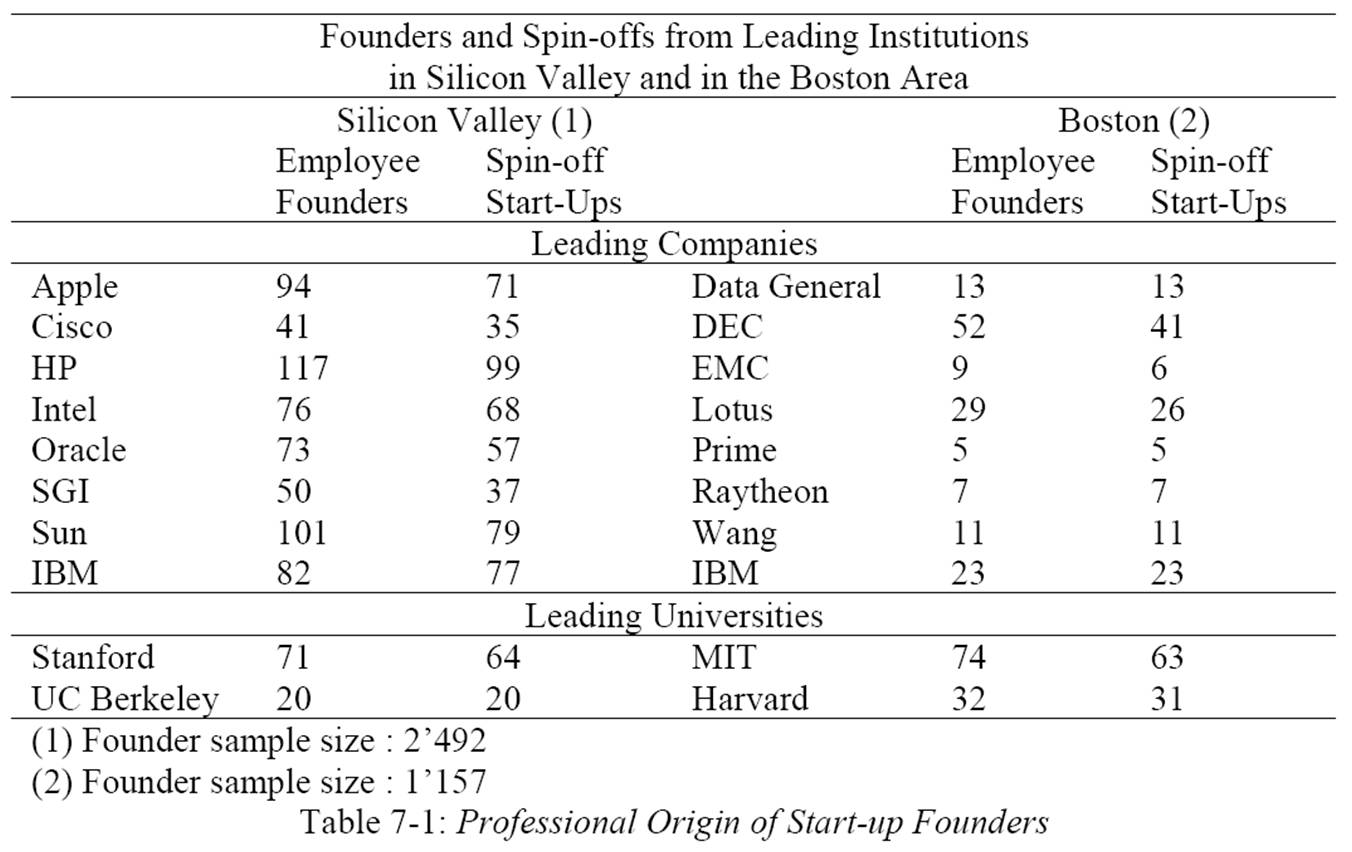

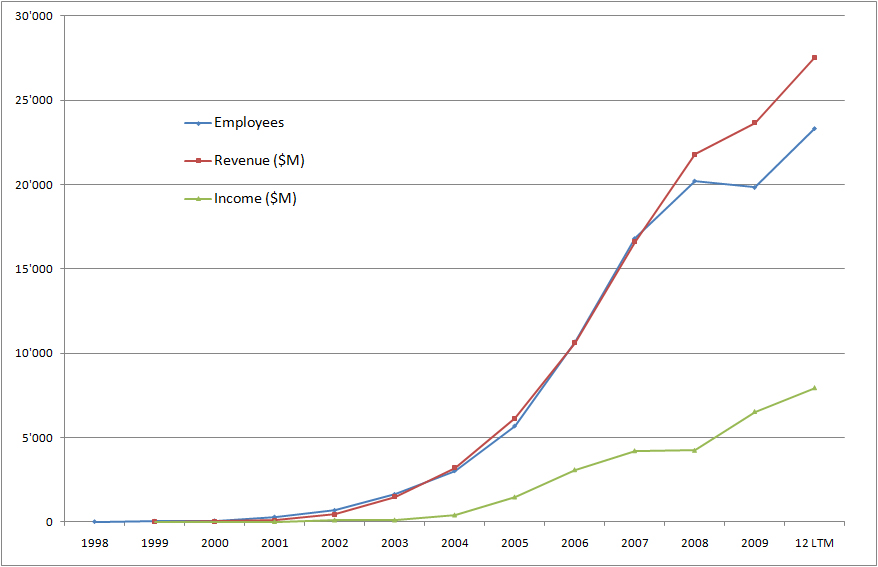

Douglas was employee number 59 [Page xv]. He left in 2005, so his account of the Google story is extremely rich and shows how exceptional it was. “Other signs pointed to something out of the ordinary. Sequoia Capital and Kleiner Perkins were the Montagues and Capulets of Silicon Valley venture capital firms. An intense rivalry usually kept them from investing in the same startup”. [Page 7] [This is not so true as you may see from When Kleiner Perkins and Sequoia co-invest(ed).]

As a marketing person, he also has an interesting vision of engineers. “Neither Larry nor Sergey had been to business school or run a large corporation, but Larry had studied more than two hundred business books to prepare for his role running Google as a competitive entity”. [Page 141]

“Impulsive and opinionated, Ray [employee #6] will always personify for me Google engineering id, a lone cowboy patrolling the electronic frontier in shocking-pink shorts, facing down the black hats and making them blink, then riding off into a sunset that was only as colorful as he was”. [Page 152]

“The ideal success rate was seventy percent, which showed we were stretching ourselves. Missing targets would not factor in performance reviews, because if they did we would take too few risks”. [Page 55] … “Starting with something that’s more ambitious will get you something that’s reasonable. But if you don’t put the goal post way out there, people are already taking fewer risks and are less ambitious about how big the idea should be. It was another reason Google valued intelligence over experience.” [Page 105] “Think big. Stay flexible. Embrace data. Be efficient and economical in the extreme. [Page 113]”

There is a funny account of MentalPlex, an April Fool that upset some people but which was apparently quite creative, an “Ante-temporal search that anticipated user requests”. [Page 97-103] At the end of the post, you can have a look at how it looked like.

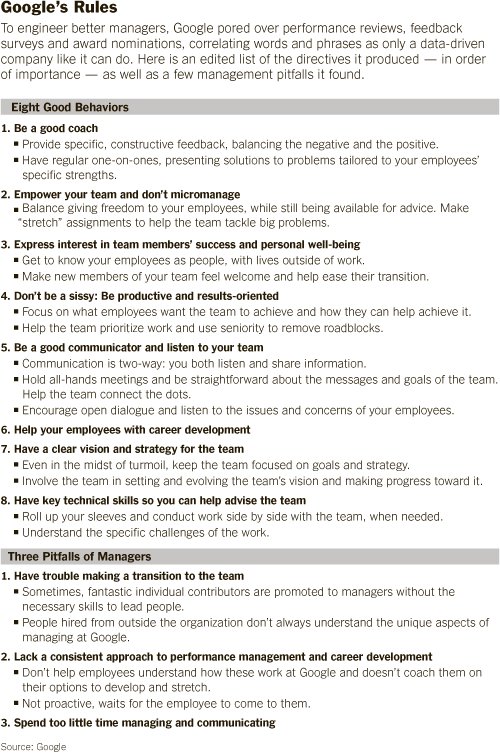

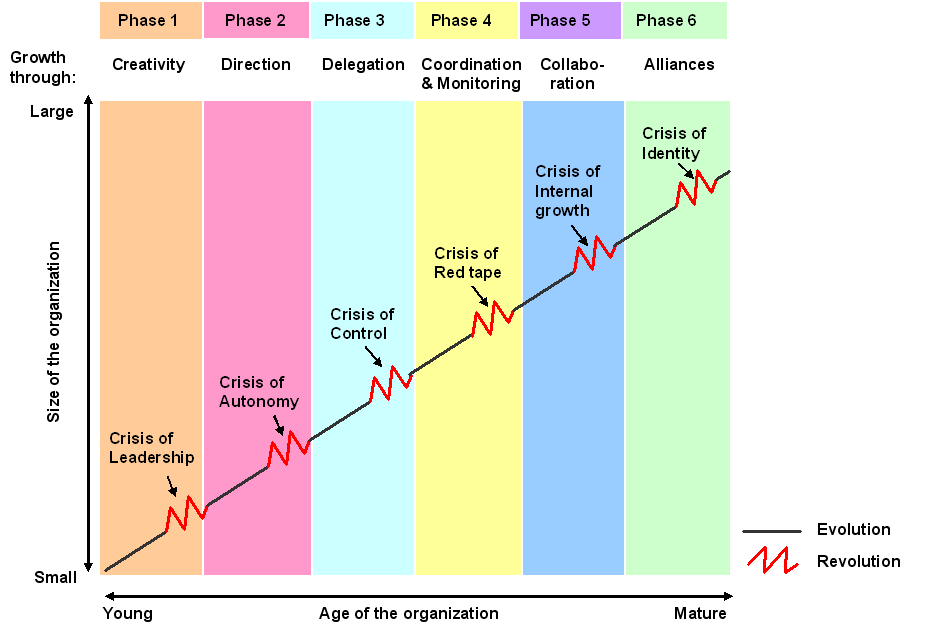

Part II is about growth and it is a change from the chaotic experimental company Google was. Not a dramatic change, but a change. The main lesson I keep from part I is that Google did many things in the opposite way that business books or experienced managers would tell you. Always doubtful, always skeptical with obvious truths. In particular anything which is not engineering or which cannot be backed by data.

“Larry’s decision to let user-created ads go live on our site without review convinced me he occupied some alternative and severely distorted reality”. [Page 185]

“There were people my age at Google when I joined and people older than me within a few months. Hardware engineer Will Whitted had been fifty-four when he started, and he saw no gap between his thought process and that of his younger colleagues. “I think that I think younger, which probably means more irresponsibly than most people do” he confessed. “There were people at Google who had the opposite problem – who were a little younger than me, but perceived by people who mattered as old-thinking. To be slow and overly-conservative, and it got them in trouble.” Those who succeeded, as I was trying to do, needed to be open to new ideas regardless of their source or seeming defiance of logic.” [Page 187]

“Would Google never tire of succeeding with big ideas that I found patently ludicrous? It was starting to make me feel like a crotchety geezer yelling at kids to get off his lawn.” [Page 190]

“What matters is whether we are doing the right thing, and if people don’t understand it now, they will eventually come to understand it.” It was a lesson that would shape Google’s attitude towards the public from that point on. Sure we had upset people with MentalPlex, but at least some us conceded their kvetching might have had cause. With Deja, we were clearly on the side of the angels. The public just did not get it. Even when we worked our asses off, spent our own cash, and tried to do something good for them, they bellowed and ranted, bitched and moaned. Since users were being so unreasonable, we could safely ignore their complaints. That suited our founders just fine – they always get with their guts anyway.

I’ve been asked if Larry and Sergey were truly brilliant. I can’t speak to their IQs but I saw with my own eyes that their vision burned so brightly it scorched anything that stands in their way. The truth was so obvious that they felt no need for the niceties of polite society when bringing their ideas to life. Why slow down to explain when the value of what they were doing was so self-evident that people would eventually see it for themselves?

That attitude was both Google strength and Achilles’ heel. From launching a better search engine in an overcrowded field to running unscreened text in Adwords, the success of controversial ideas gave momentum to the conviction that initial public opinion was often irrelevant. [Page 212]

You might remember how shocking Sept 11 was for Americans. But Google’s reaction to Sept 11 was moderate with Alon Cohen’s looped ribbon. Doug is showing how Google has been at the same time extreme with experimentation and much cautious about users than paranoid people might think…

You can skip this section if you have already read “Safe choices are not always good choices“.

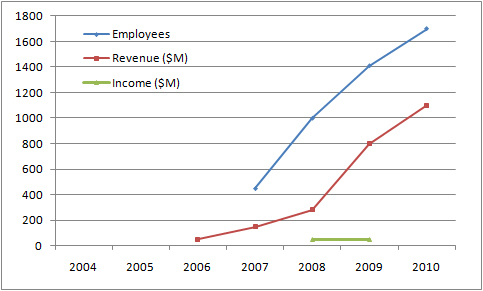

[Pages 256-258] “When Google finally recognized its failure in implementing a CRM software to manage customer emails, “composing a list of CRM vendors didn’t take long. Fewer than half a dozen major players offered stable, well-tested systems. […] Larry has a college friend, David, who would advise us on desirable features and then added, by the way, he and a buddy were building a CRM product called Trakken. […] Interested? Interested in an untested CRM product still in development with one tiny client? Sure that’s just what I was looking for – another risky technology with no support and no track record behind it. I thanked David for his help and, because he was a friend of Larry, assured him we’d be happy to send him our request for proposal. [Meanwhile they analyzed established players.] I felt confident I could convince Larry and Sergey to loosen the purse strings and do it right this time: spend money for a high-quality, stable system from a respected vendor. I hoped Larry’s friend had taken the hint and forgotten about us. [He had not] I didn’t want him to complain to Larry when his hopes were dashed. I decided to head him off at the pass by talking to Larry myself. “Actually,” Larry recommended “you should hire these guys. They’re really smart. They’ll work hard to build the product and we can invest in their company. […] They’ll be very responsive.” I could say I was stunned, outraged, incredulous, but that would be an understatement. I couldn’t believe Larry was going cheap again instead of buying reliability. When I informed the other vendors, they thought I was either corrupt or an idiot. […] “If you can believe you can build an email tool like resembling ours in thirty days, you are mistaken. It has taken us four years and twelve hundred customers.” […] I’d still be cursing Larry’s decision today if not for one small thing: Larry was absolutely right. […] Within a couple of months we had the CRM system we wanted built to our specs, fully stable and intuitive to use. […] So what did I learn from all this? I learned that obvious solutions are not the only ones and “safe” choices aren’t always good choices. I had thought that due diligence meant finding the product most people relied on, then putting pressure on the vendor to cut the price. It never occurred to me to talk to Larry not to do that. We had different tolerances for risk and different ideas about what two smart people working alone could accomplish in a complex technical area – and that is why I spent seven years working in mainstream media while Larry found a partner and founded his own company. Two smart guys working on complex technical problems, it turns out, can accomplish a hell of a lot”.

“Yet, once again, risk reaped rewards. The willingness to suffer a few quickly eradicated indignities opened up enormous gates to international audience growth. The world tolerated awkward translations and the occasional insult in order to access Google’s search technology. It was a reminder that perfecting the polish was not as important as giving people access to the product behind it. The results we returned and the speed with which we returned them were ultimately all that mattered. They were the essence of Google’s brand”. [Page 263]

[Pages 290-92] “The hour I spent with (Larry) and Sergey probing their vision for Google gave me my best look at their motivations and aspirations for the company. Larry wanted Google to be a force for good, which meant we would never conduct marketing stunts like sweepstakes, coupons and contests, which only worked because people were stupid. Preying on people’s stupidity, Larry declared, was evil.

We need to do good. We need to do things that matter on a large scale. When I asked for examples, he mentioned microcredit in Bangladesh (…) and talked about changing business systems to make them environmentally friendly while saving money. He also talked about distributed computing, drug discovery and making the Internet faster. And that wasn’t all.

We should be known for making stuff that people can use, he said, not just for providing information. Information is too restrictive. In fact, we shouldn’t be defined by a category but by the fact that our products work – the way you know an Apple product will look nice and a Sony product will work better but cost more. We’re a technology company. A Google product will work better.

(Then they talk about personal information, sensors, storage, cameras, and user-generated data.)

Not once did the subject of making money come up. I was probably a naïve-middle-aged dreamer, because looking back at it now, I see there was nothing truly extraordinary about what Larry described. But when I walked out of his office I believed that for the first time in my life, I had been in the presence of a true visionary. It wasn’t just the specifics of what he saw, but the passion and conviction he conveyed that made you believe Larry would actually achieve what he described. … My respect for our two capricious, obstinate, provocative and occasionally juvenile founders increased tenfold that day”.

[Page 324] “The experience confirmed the power of prototyping to give definitive answers far more quickly than theoretical discussions. Google learnt a lesson: the prototype had been put together not for a specific project but just because it was found interesting. The real value is that people will do things that everyone thinks are a waste of time. That’s where the big opportunities are. It’s an opportunity because other people don’t see it. Google itself was a canonical example. No other company had thought search was important. If they had, Microsoft or Yahoo would have invested more heavily in technology and Google would never gained such a big head start”.

[Pages 387-389. Finally…] “There was no longer a role at Google for what I did. I would wind things down. I picked March 4, 2005 as my last day: “Three, Four, Five.” I liked the architectural purity of it. […] I had started at a small company as a big-company guy. Now I was leaving a big company as a small-startup guy. And I like to think that, in some small way, I helped advance the human condition. Or at least that I did more good than harm.”

************ GOOGLE MENTALPLEX – APRIL FOOL 2000 ************

|

|

|

New! Search smarter and faster with Google’s MentalPlexTM |

|

|

Instructions:

|

See our FAQ and illustrations for correct usage.

Note: This page posted for April Fool’s Day – 2000.

© Google Inc.