You will find on the French part of the blog an article entitled Prix d’exercice des BSPCE, BSA et autres stock options that describes (in French) the mechanisms of fixing the price of stock options, with some very specific habits and rules of French law. If you read French, this may be useful…

Tag Archives: ESOP

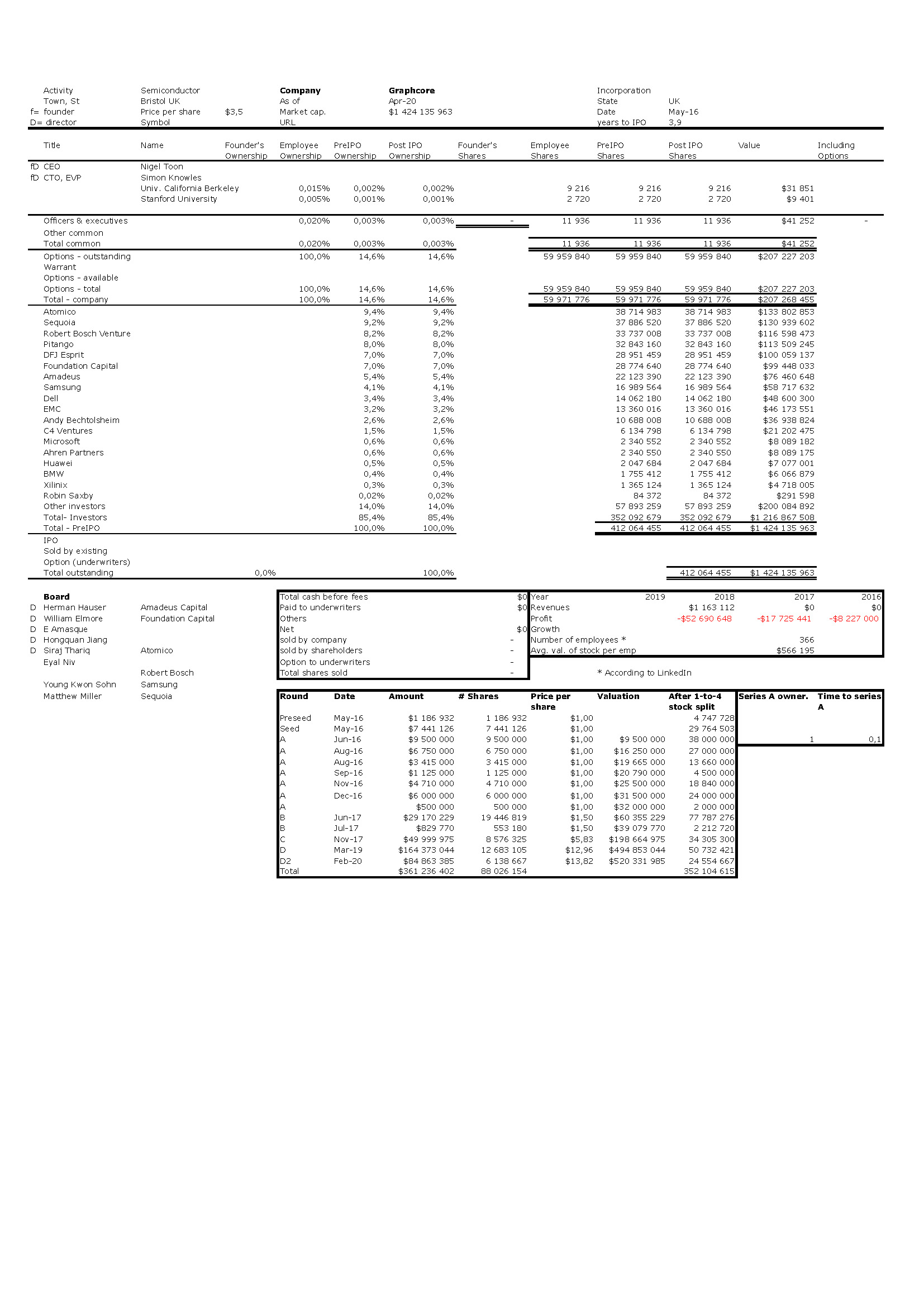

Graphcore shareholding is really strange!

Graphcore gave me concerns. How is it possible that the two founders, Simon Knowles (58) and Nigel Toon (56), two serial entrepreneurs, who founded Icera Semiconductor in the past (sold to Nvidia in 2011 for $435 million or $367 million depending the sources – after having raised $258 million) and Element14 (a 1999 spin-off of Acorn – or its new name – sold to Broadcom in 2000 for $640 million), each owns only 4 shares of the startup? Are they so rich that they don’t need more? !!

All this follows my recent discovery that the UK gave open access to all company and in particular startup data. I began with Revolut a few days ago and now Graphcore. There had to be something wrong. The startup could not have only investors as shareholders. And then of course, I had forgotten the ESOP, the employee stock-options. So my only explanation is that the founders are part of this too and have a minimal number of shares. Still intriguing!

Data about equity of 600 startups – comments (4)

Fourth post of comments on the 600 startup data. Today, it’s about how equity is shared following my post yesterday which focused on founders’ equity.

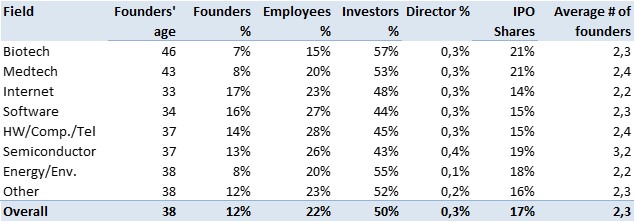

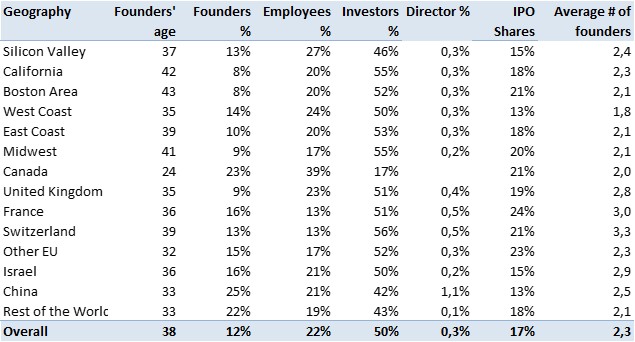

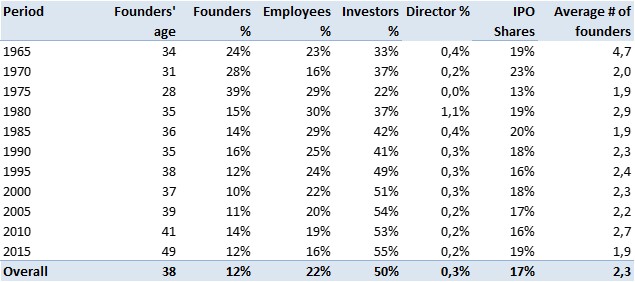

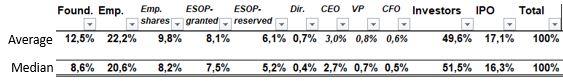

A quick extract from the data gives the following average and median values:

So as a simple model, it is 10% for (2-3) founders, 20% for employees, 50% for private investors (VCs and BAs – business angels) and about 20% for public investors at IPO.

In addition the 20% for employees are made of 8% of common shares, 7% of granted options and 5% of available options.

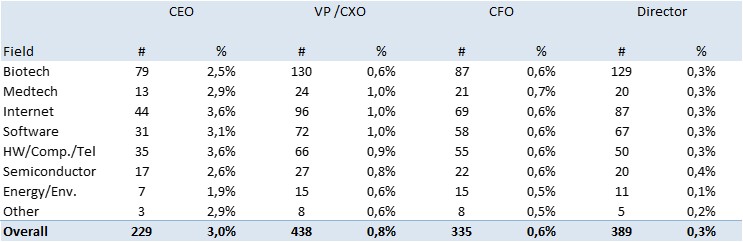

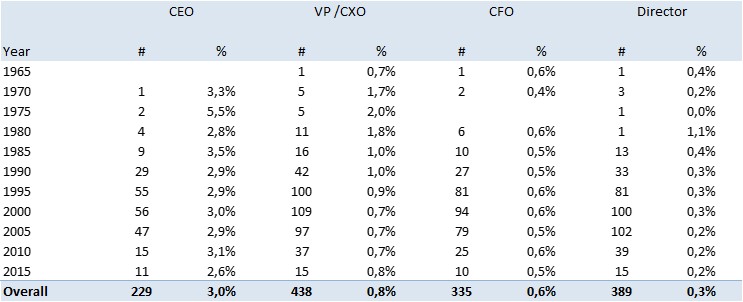

Finally non-founding CEOs have 3%, VPs 0.8% and CFOs 0.6%.

Independant board members have as a group 0.4%, they are in general 2 to 3, so it is about 0.2% per director.

If you want to dig in the topic, you may be interested in the following slides:

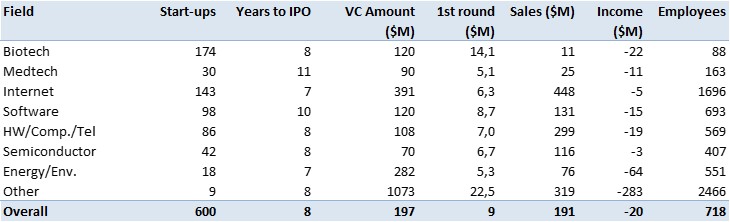

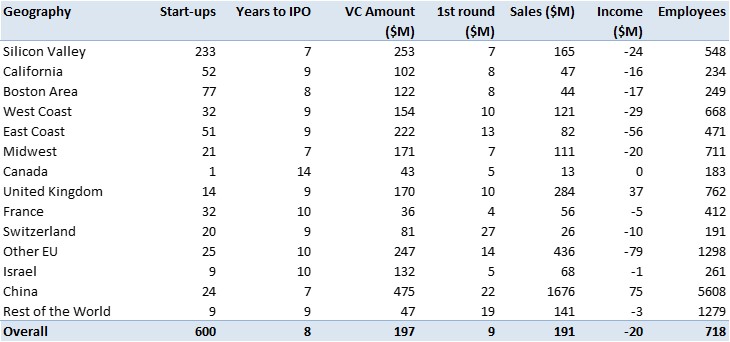

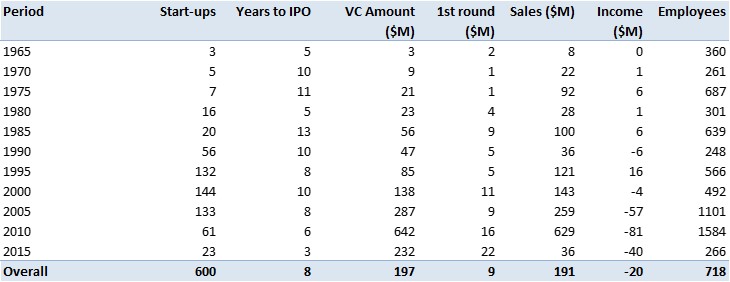

Updated data in equity of 600 (former) startups

The Covid19 virus has an indirect effect, we have more time at home and in front of computers. So I updated my data in startup equity from 600 companies for which information was available, mostly because they had filed to go public. Here is the full list of individual data.

If you cannot visualize the document on scribd, here is a direct link to the pdf entitled Equity_in_600_Startups-Lebret-April2020.

At the end of this 600+-page document, you’ll find some statistics, here they are again. I will probably come back to some results I find interesting not to say intriguing. Enjoy an react!

Some addtional comments in later posts:

1- About venture capital: on April 7 comments 1.

2- About the age of founders: on April 8 comments 2.

3- About the equity of founders: on April 9 comments 3.

4- How is equity shared: on April 10, comments 4.

5- About the equity of non-founding CEOS: on April 11, comments 5.

6- About valuation of startups: on April 12, comments 6.

7- What have they become: on April 16, comments 7.

Basic data about startups (funding, sales, profits, employees at IPO and years to IPO) by fields, geographies and periods of time.

Data about founders (age, ownership and nb. by startups) and other stakeholders by fields, geographies and periods of time.

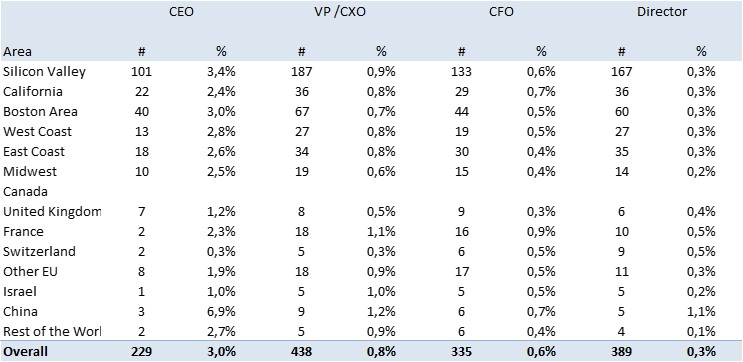

Data about ownership of non-founding CEOs, VPs, CXOs, board members by fields, geographies and periods of time.

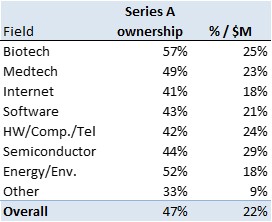

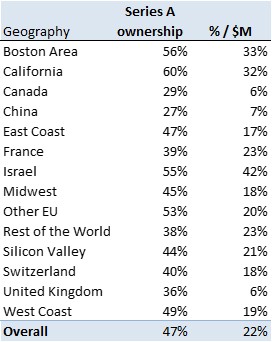

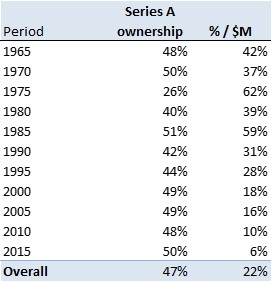

New data about ownership of series A investors by fields, geographies and periods of time.

Rewarding Talent – A guide to stock options for European entrepreneurs by Index Ventures

I recently read an article mentioning a new report by Index Ventures Rémunération du risque : la France s’en sort bien ! and a few days later a student of mine mentioned a new app by Index to help entrepreneurs allocate stock options: Index Ventures Option Plan beta. Thanks Javier! I had a look, tweeted about it and then thought it was worth a blog article…

I advise you to read the full (143-page) report – link here. It includes great information at the macro (national policy) and micro (startup) level. There are minor differences with my past analyses such Equity in Startups published in Sept. 2017 or my recurrent class about Equity Split in Startups which you can find here:

What is particularly interesting, I think, is their summary:

1 European employees own less of the companies they work for than US employees. For late-stage startups, they own around 10%, versus 20% in the US.

2 Ownership levels vary much more in Europe than the US. In Europe, employee ownership in late-stage startups ranges from 4% to 20%. In the US, ownership is more consistent, as stock option allocation is driven by market forces.

3 Employee ownership correlates to how deeply technical a startup is. An AI or enterprise software startup requires more technical know-how than a straightforward e-commerce startup. These employees are more likely to seek stock options.

4 Ownership policy details adopted by startups vary between the US and Europe. For example, provisions for leavers, and accelerated vesting following a change in control.

5 In Europe, stock options are executive-biased. Two-thirds of stock options are allocated to executives, and one third to employees below executive level. In the US, it’s the reverse.

6 European employees still don’t expect stock options much of the time. US employees joining a tech startup with fewer than 100 staff would typically expect stock options straight away. This is much less true in Europe, although expectations are steadily rising.

7 European option holders are often disadvantaged. In much of Europe, employees will be paying a high strike price, and they will be taxed heavily upon exercise as well as sale. Leavers often get nothing.

8 There is wide variation in national policy across Europe, with the UK most supportive of employee ownership. Regulations and tax frameworks are radically different across Europe. The UK’s EMI scheme is most favourable, better than what is available in the US, and France is also good. Other countries, including Germany, lag behind in our opinion.