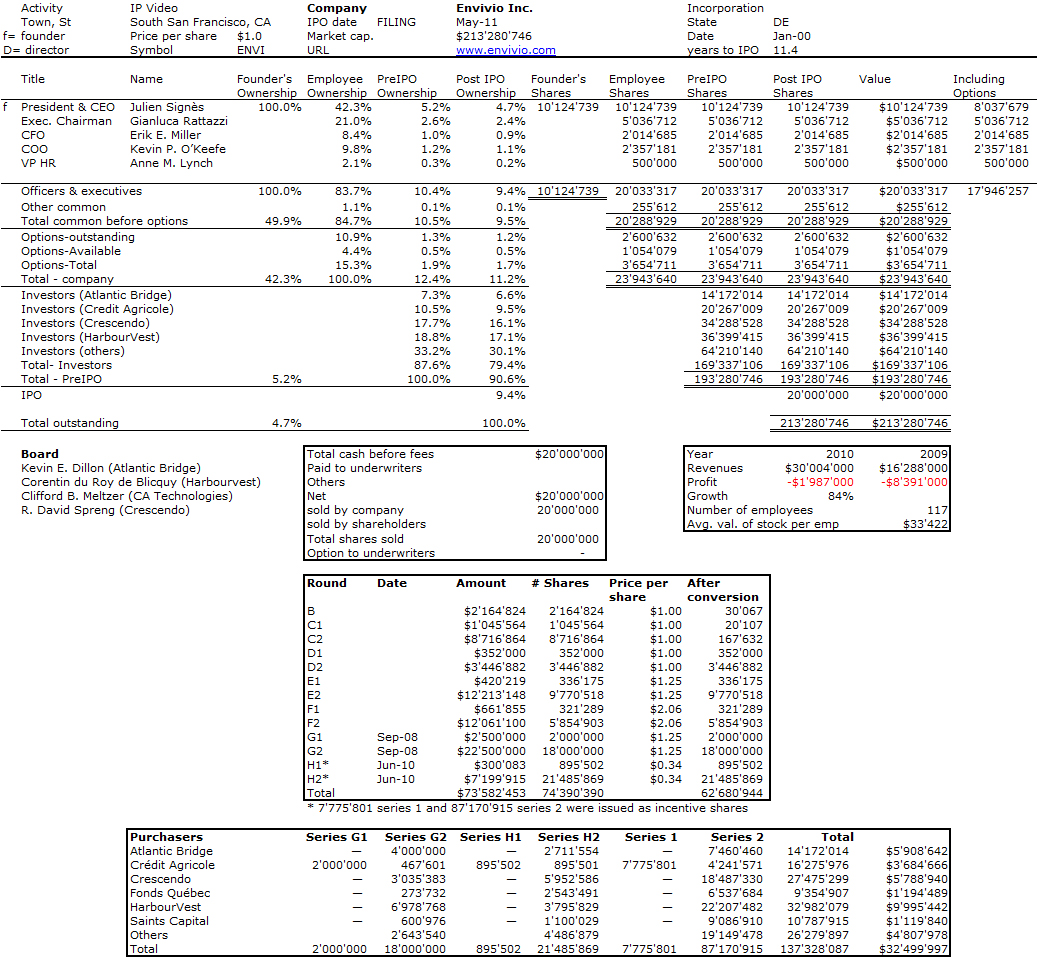

Envivio follows my recent post on another start-up with European roots, Transmode. Envivio has similarities and differences. Both have roots in the Telecom industry, Transmode with Ericsson and Envivio with France Telecom. Both were founded in 2000, 11 years before the IPO or filing.

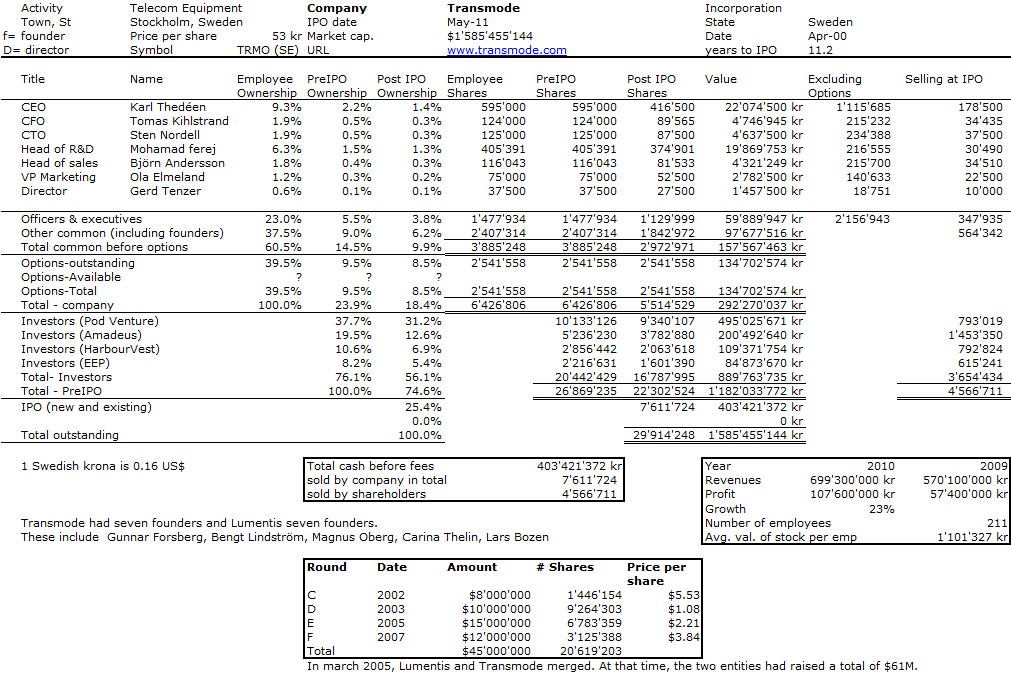

Both had complex financing rounds, including “down rounds”. You can see that in the Transmode case, the price per share went from $5.5 in the B round to $1 in the C round. These down rounds are usually terrible for founding teams. And indeed, there is not much info about Transmode founders.

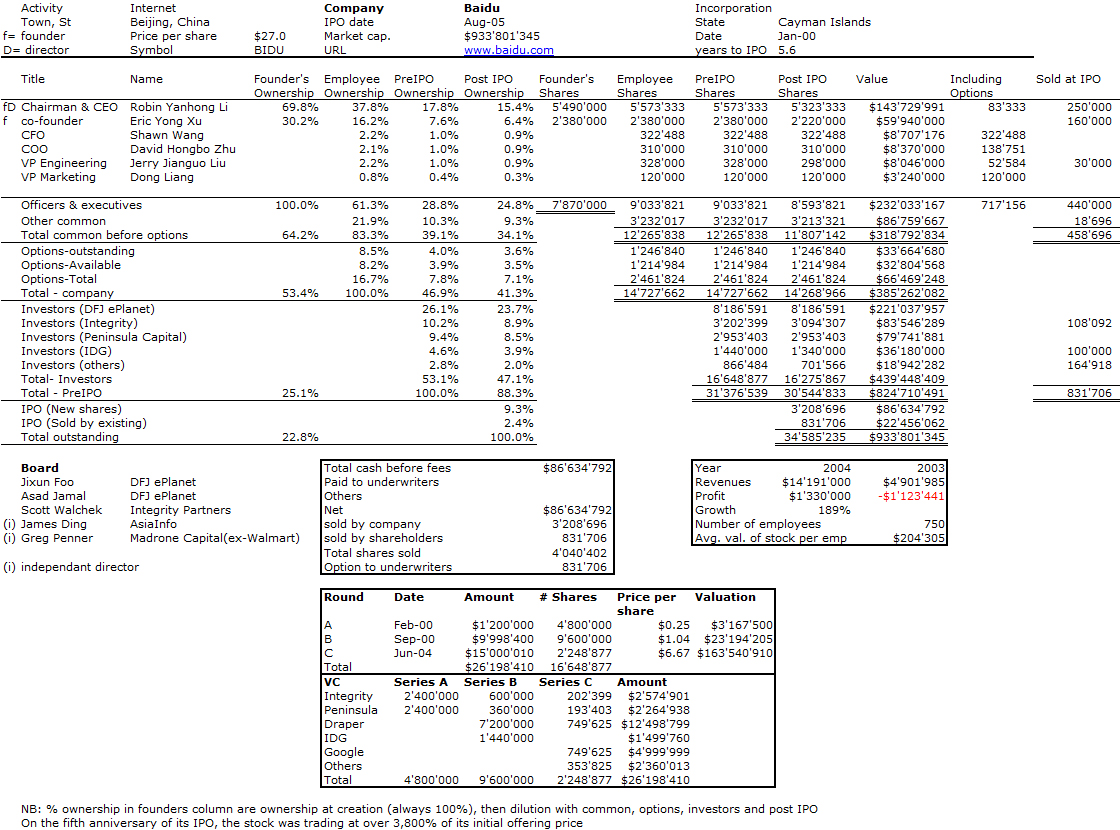

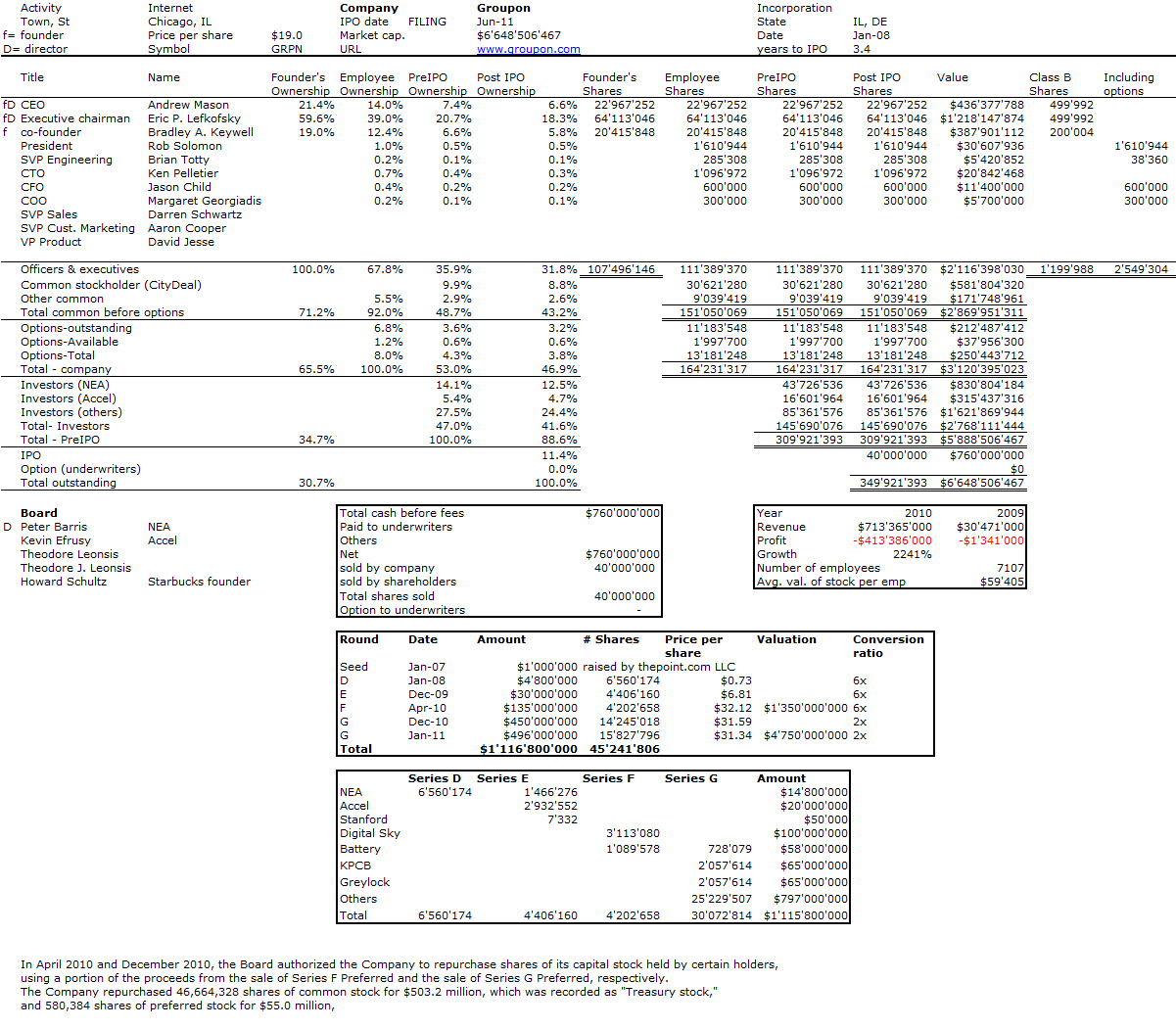

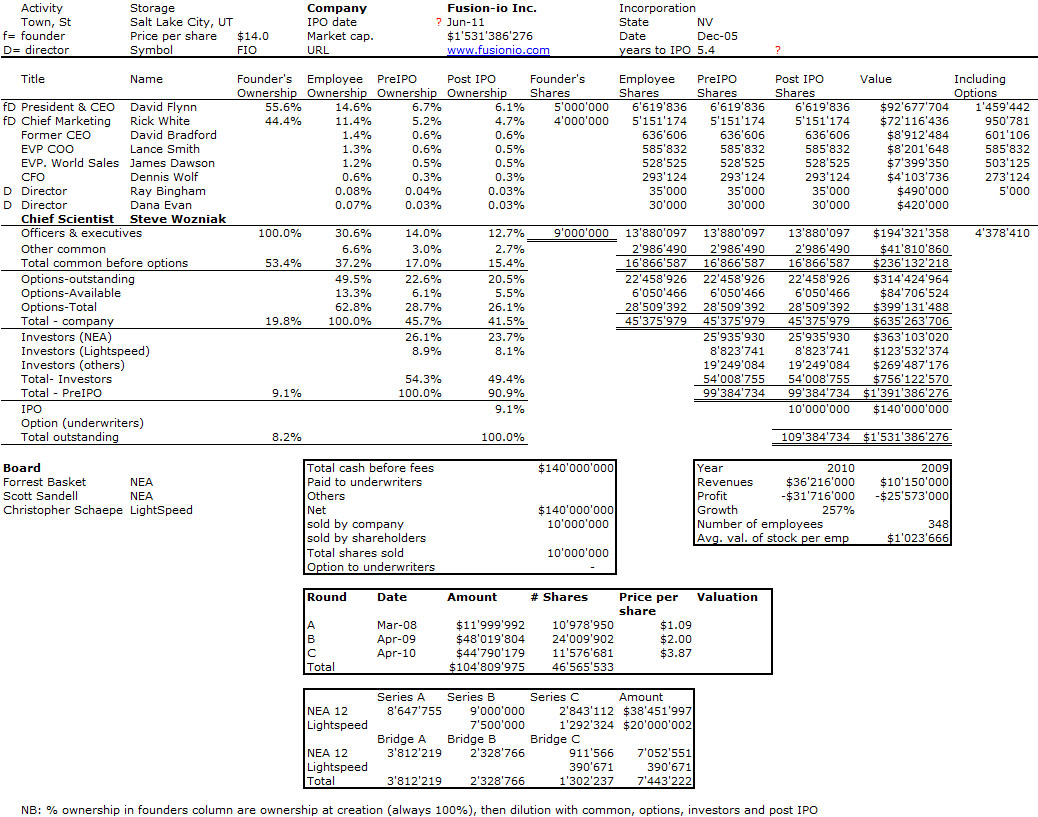

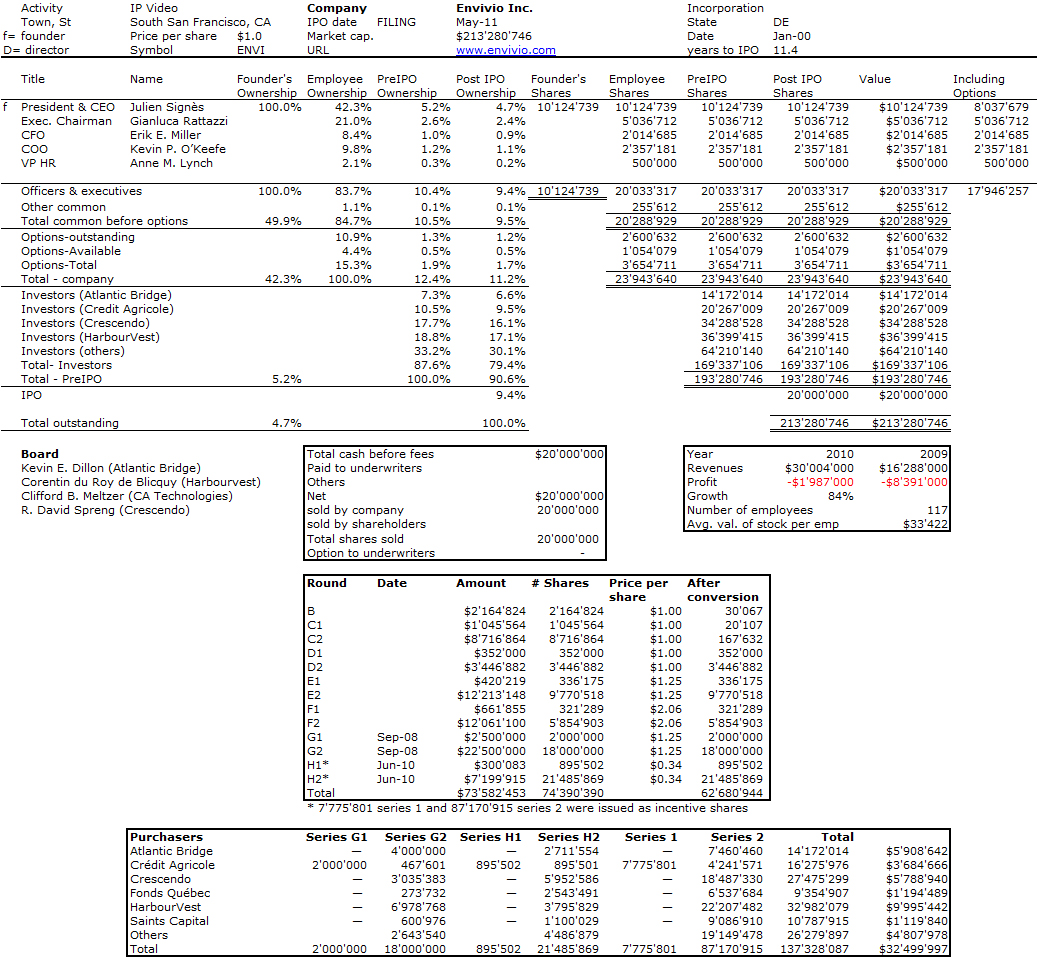

Envivio had raised $41M until 2008 and the price per share increased steadily to $2 per share. Difficult to give precise dates for the rounds, but the investors were a combination of corporate investors (France Telecom, Intel, Bertelsman, Philips), and financial (Global Accelerator, Crédit Lyonnais – now Crédit Agricole). Then the G round in 2008 was a down round at $1.25 and the H round, less than 2 years later, even lower at $0.34. With such events, it is not surprising to discover that the investors own 87% of the company before the IPO. Obviously, this would have been very dilutive to the founder, Julien Signes, without the possibility of granting new (stock option) shares that you discover in the right column.

There is another interesting difference with Transmode: Envivio is filing to go public in the USA, it is indeed an American start-up, and not much shows its French roots (the R&D is based in Rennes, Britanny though). Even if Julien Signes studied and worked in France initially, he worked also for France Telecom in San Francisco and I would be curious to know if this had an impact in his entrepreneurial path. I asked him and am waiting for an answer, but it is possible that Envivio is not allowed to communicate in the pre-IPO period.

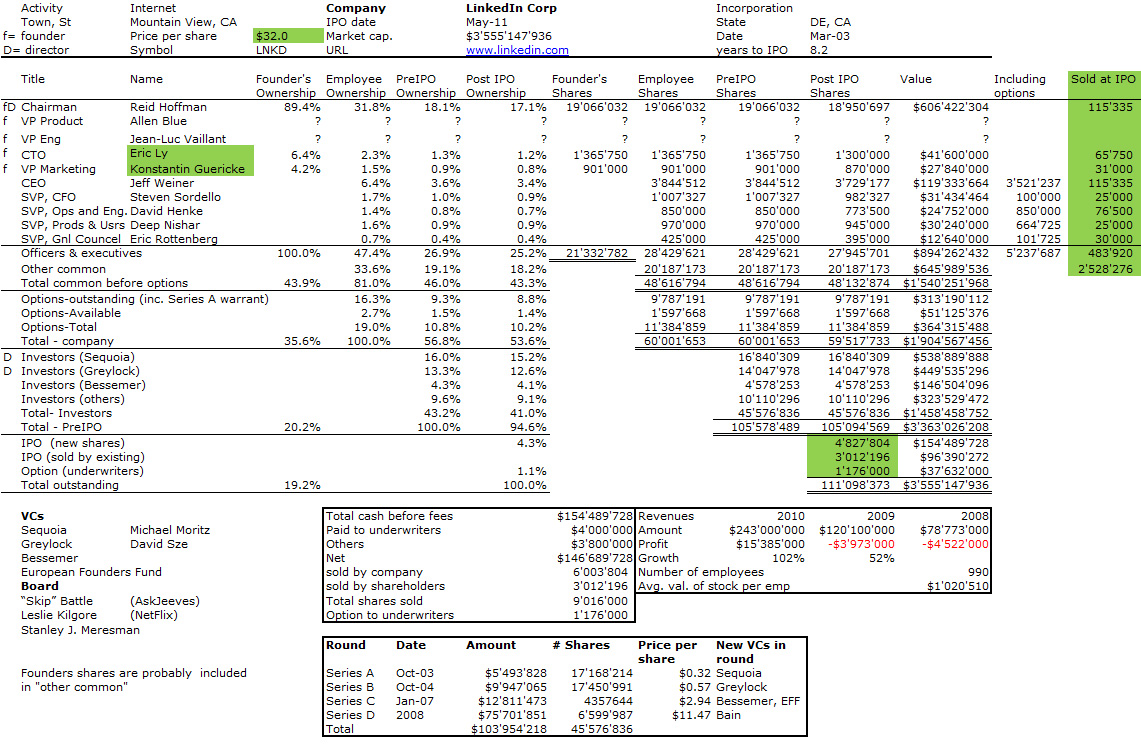

It is one my thesis that Europeans who had a US experience have digested better the start-up dynamics (whether they moved to the USA and became entrepreneurs there – De Geus, Bechtolsheim, Brin – or they became entrepreneurs in Europe but had lived in the USA – Liautaud, Borel, Haren). This does not prevent European high-tech start-ups to exist and succeed, but I have to admit, the numbers are not exactly the same.

Again, because the company is not public yet, I had to guess what the price per share might be at IPO. I have put a small price, using multiples of market cap. to revenues of 7x. I will make an update when I know more…

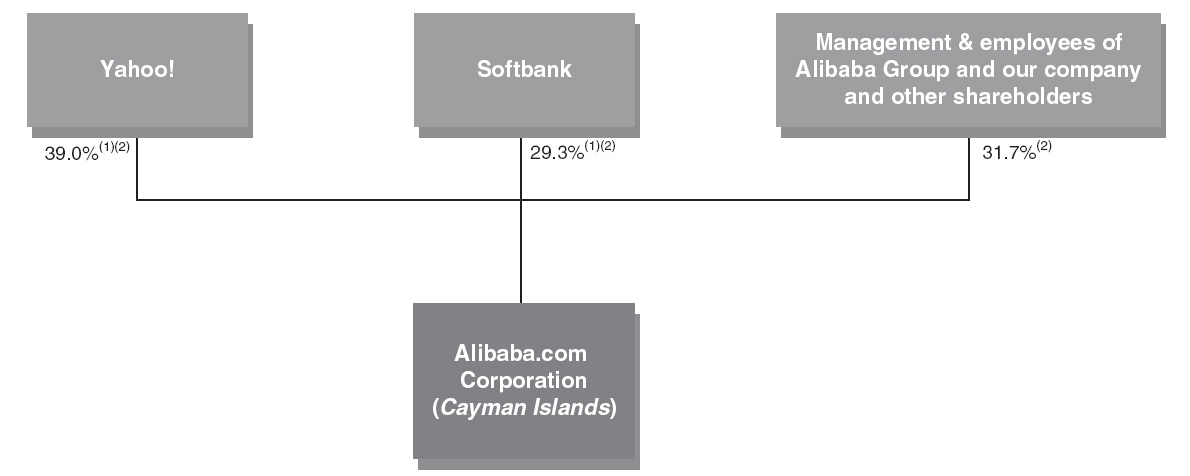

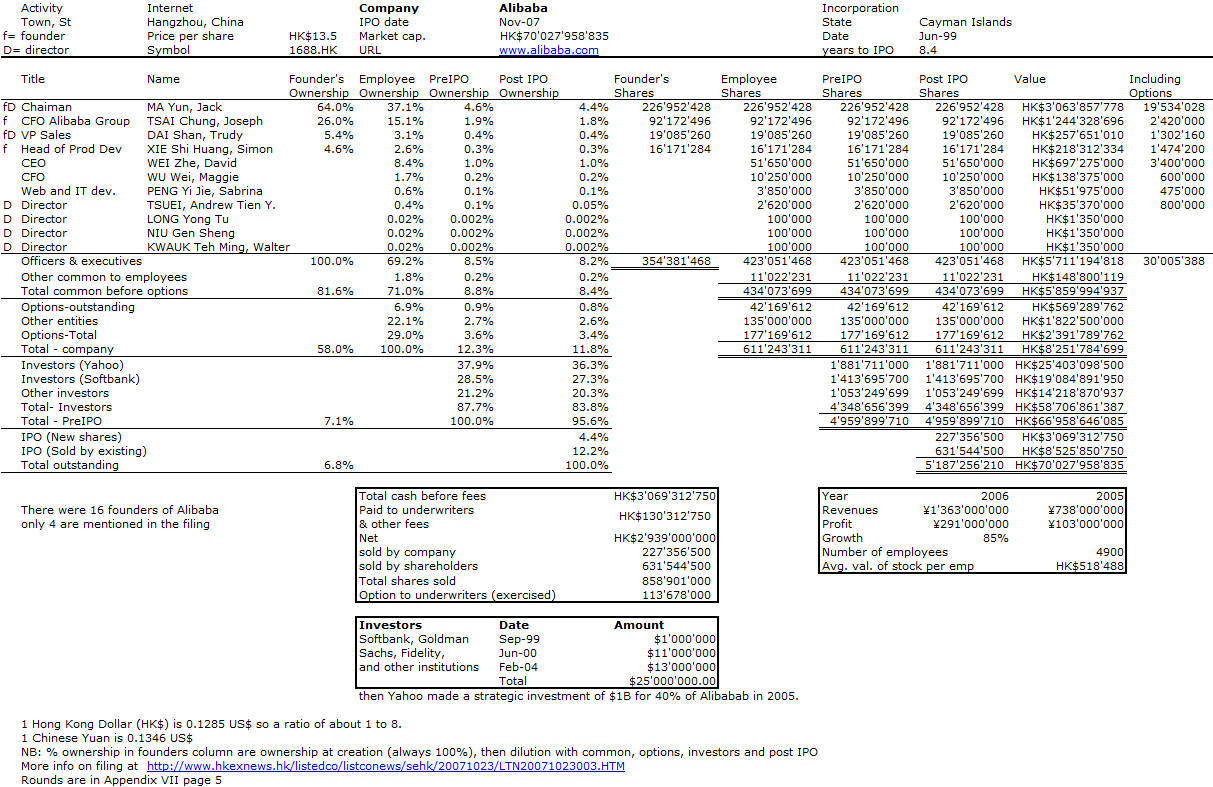

Next: Alibaba

NB: an explanation from the filing on the issuance of incentive shares: “In September 2008, we sold 1,532,372 shares of Series G1 convertible preferred stock and 13,359,323 shares of Series G2 convertible preferred stock for $1.25 per share and received total consideration of an aggregate of $15.9 million. Also in September 2008, we converted the outstanding principal balance of our outstanding convertible promissory notes in the amount of approximately $8.9 million plus accrued interest in the amount of approximately $0.2 million into 467,628 shares of Series G1 convertible preferred stock and 6,829,154 shares of Series G2 convertible preferred stock simultaneously with our Series G financing. In June 2010, we sold 895,502 shares of Series H1 convertible preferred stock, 18,487,298 shares of Series H2 convertible preferred stock, 7,775,801 shares of incentive Series 1 common stock and 87,170,915 shares of incentive Series 2 common stock for $0.3351 per unit and received total consideration of approximately $6.5 million. In connection with this Series H financing, all outstanding shares of Series B, C, D, E and F convertible preferred stock converted into shares of common stock. Also in June 2010, we converted the outstanding principal balance of our outstanding convertible promissory notes in the amount of $1.0 million plus accrued interest in the amount of approximately $4,800 into 2,998,571 shares of Series H2 convertible preferred stock simultaneously with our Series H financing. The number of Incentive Shares to be issued was based on the series of the outstanding convertible preferred stock held by each Series H participant as follows: at a rate of 107.430618 shares of common for each share of the Series B, 77.588779 shares of common for each share of Series C, 1.492092 shares of common for each share of Series D, 1.865115 shares of common for each share of Series E, and 3.073709 shares of common for each share of Series F. As a result, the Company issued 94,946,716 Incentive Shares with the shares of Series H convertible preferred stock issued during the Series H financing.”