I just discovered about Carbonite, one of the companies in The 17 Most Important IPOs To Watch For In 2011. Storage and backup are clearly hot fields in 2011 (just have a look at Fusion-io for example). In the 1st link I just mentioned above, Carbonite is described this way:

Carbonite, the online storage backup for consumers and businesses, has raised roughly $67 million in various venture rounds, while its sales have doubled each year since its launch in 2006. The company claims to have backed up some 80 billion files, with more than 150 million new files backed up daily. It also claims to have restored more than 7.2 billion files that would have been otherwise lost forever. Inc. Magazine placed it as #9 on its Inc. 500 list for 2010 of the 500 fastest growing private companies. With “the cloud” remaining a hot topic and with its annual basic plan starting at less than $55.00 a year, Carbonite should have a solid reception when it comes to market.

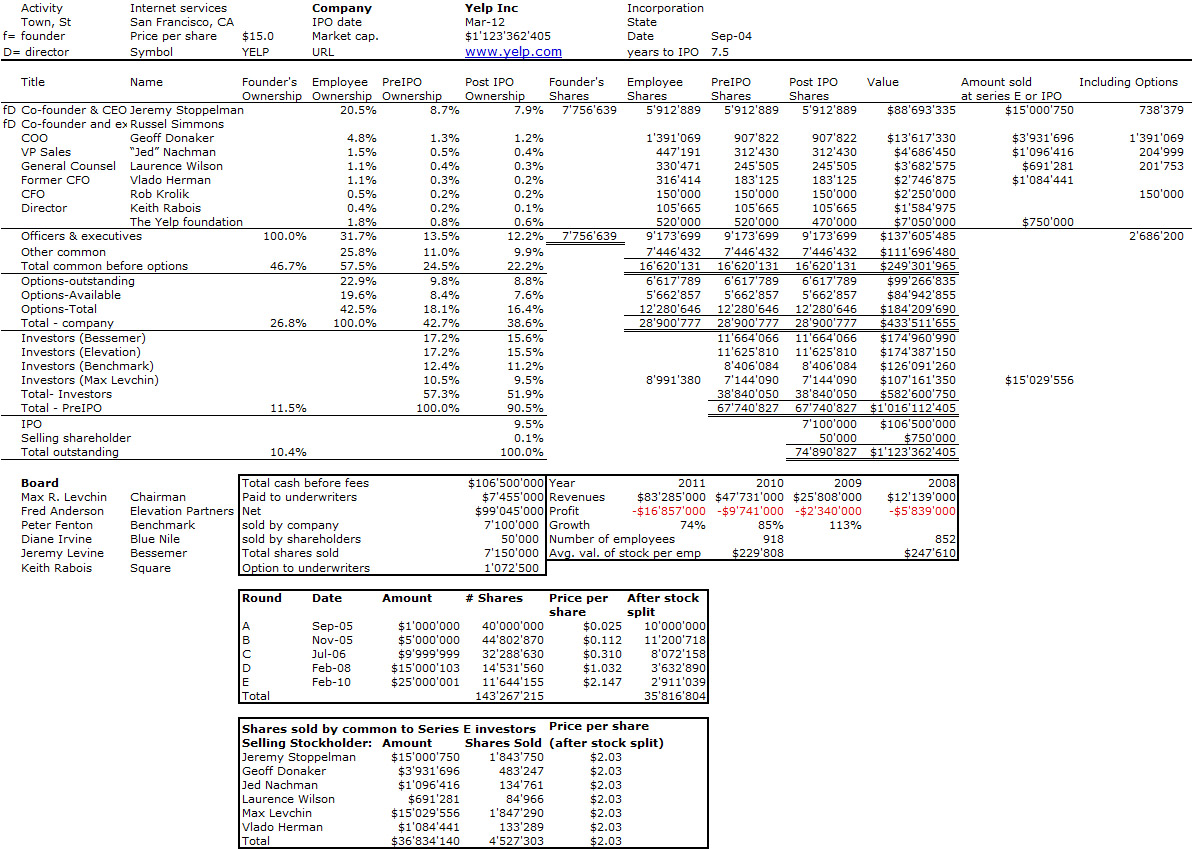

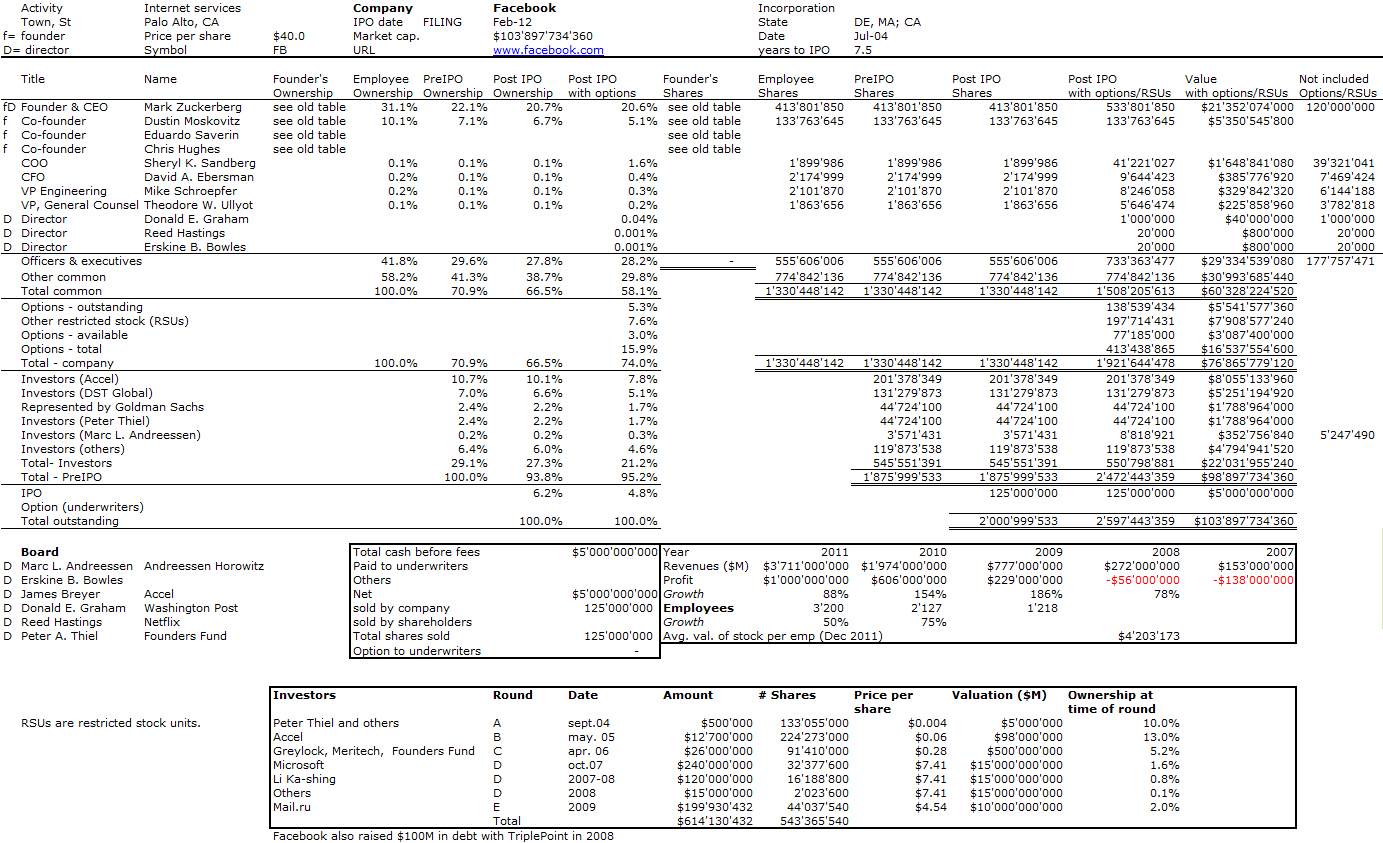

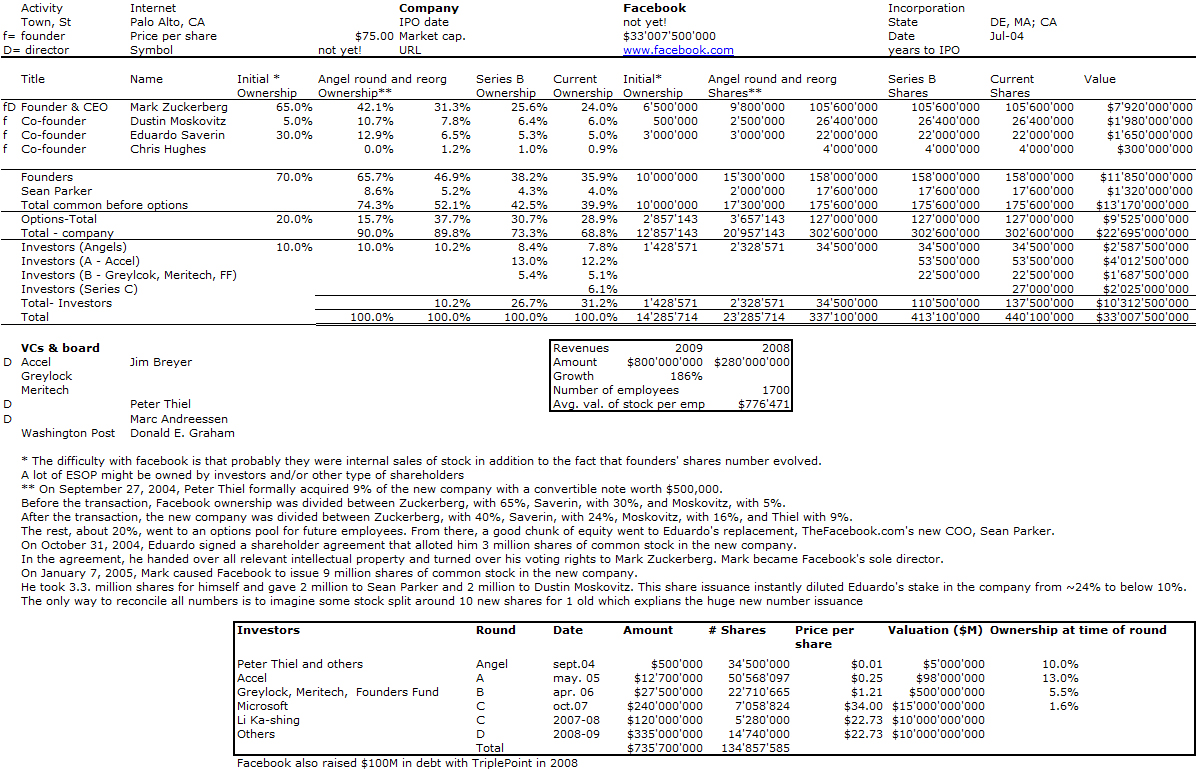

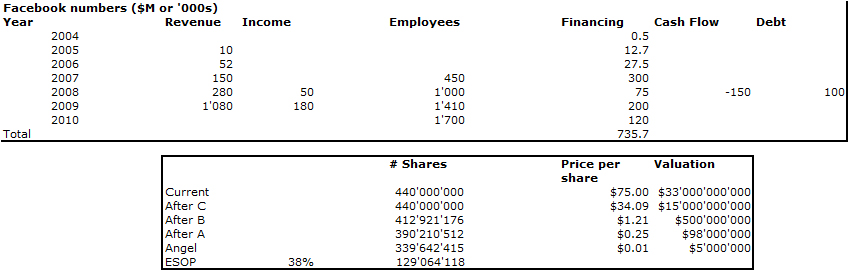

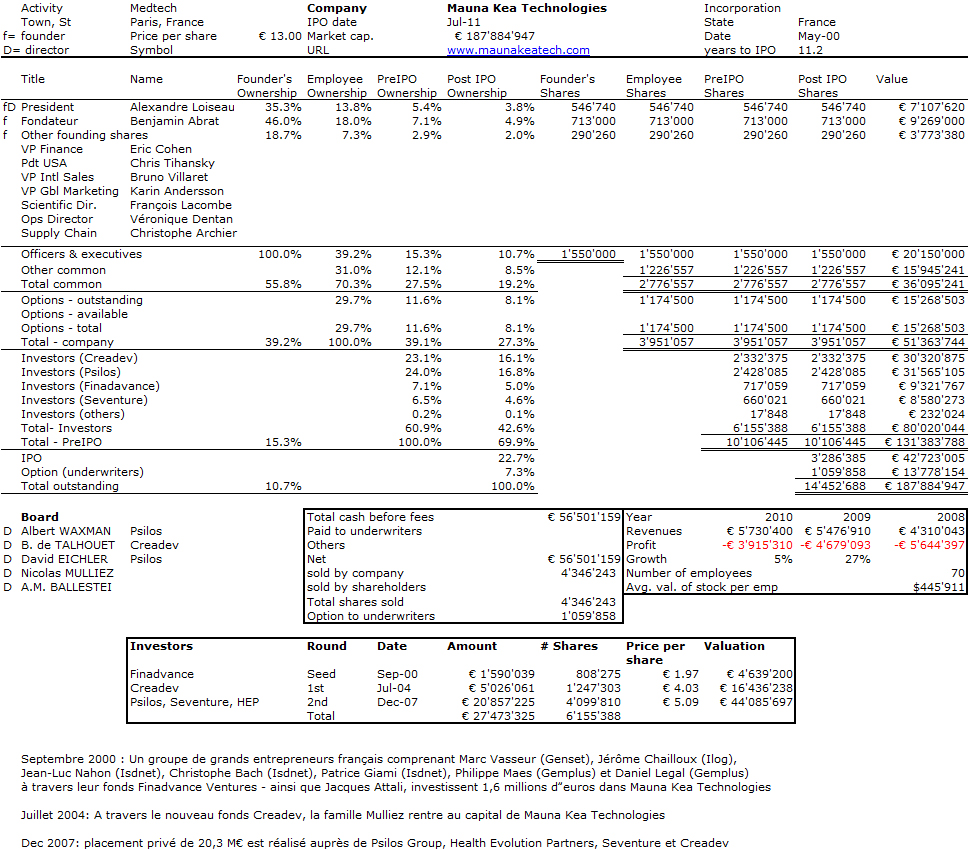

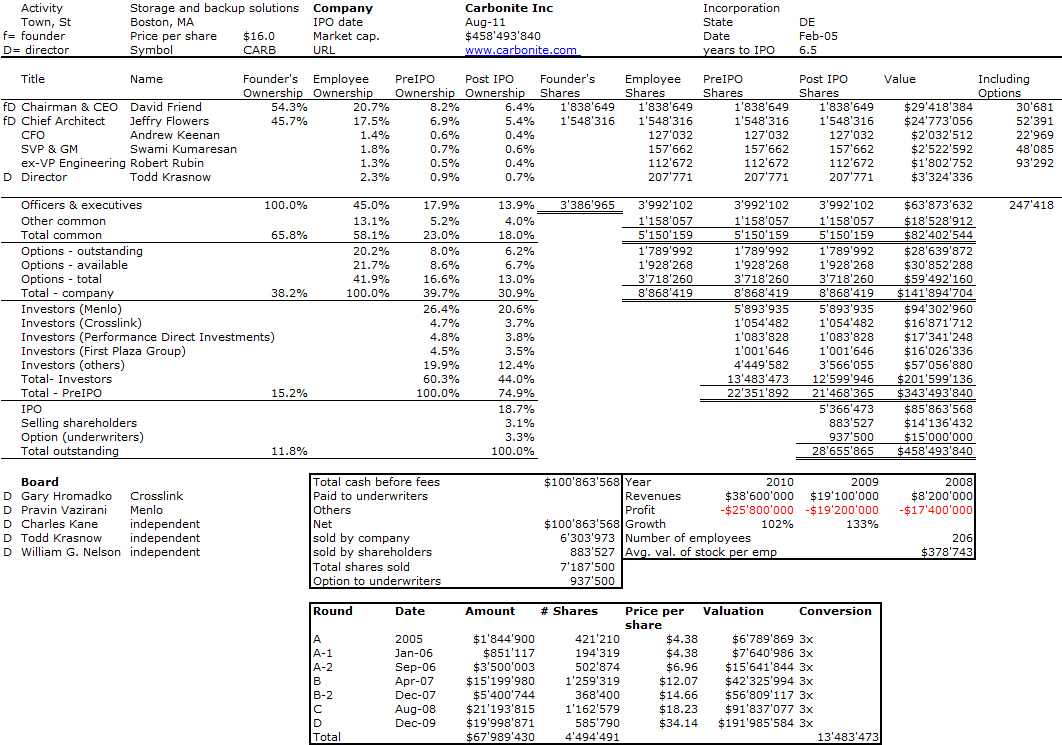

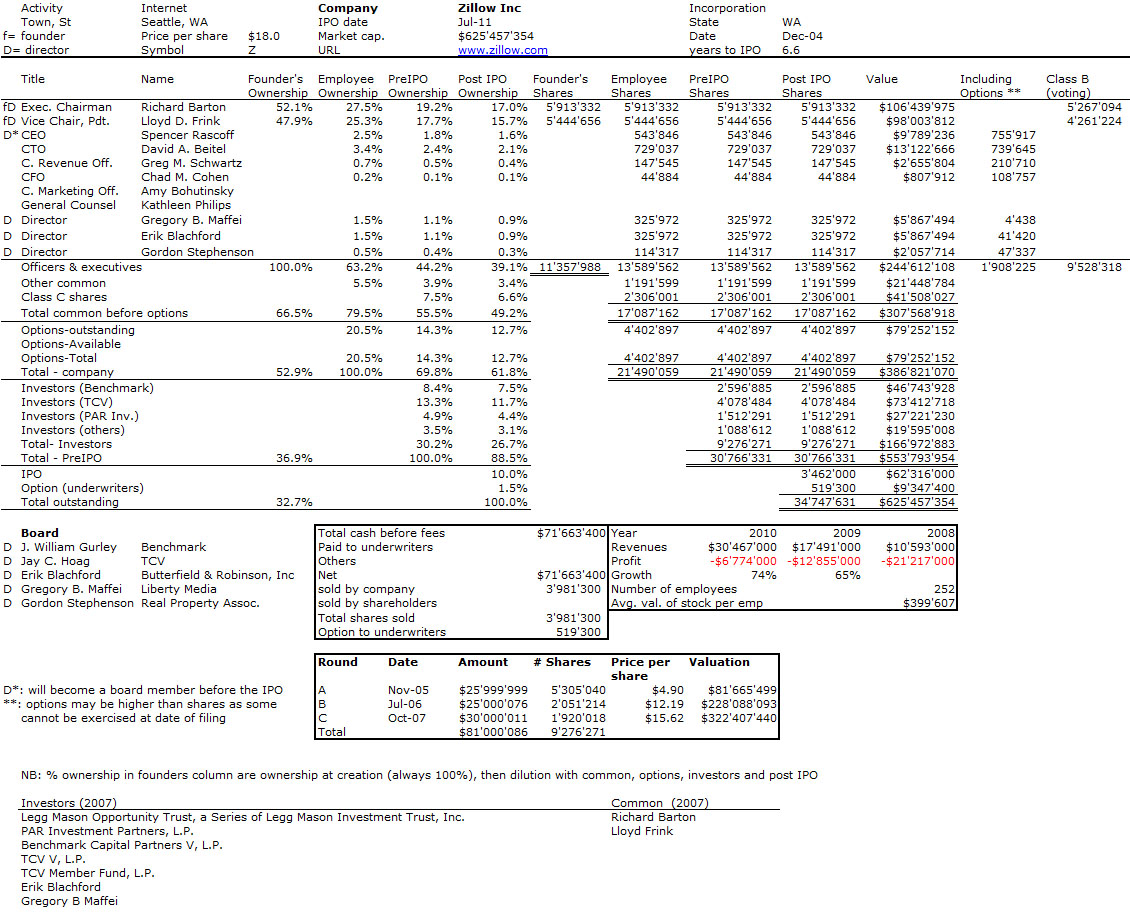

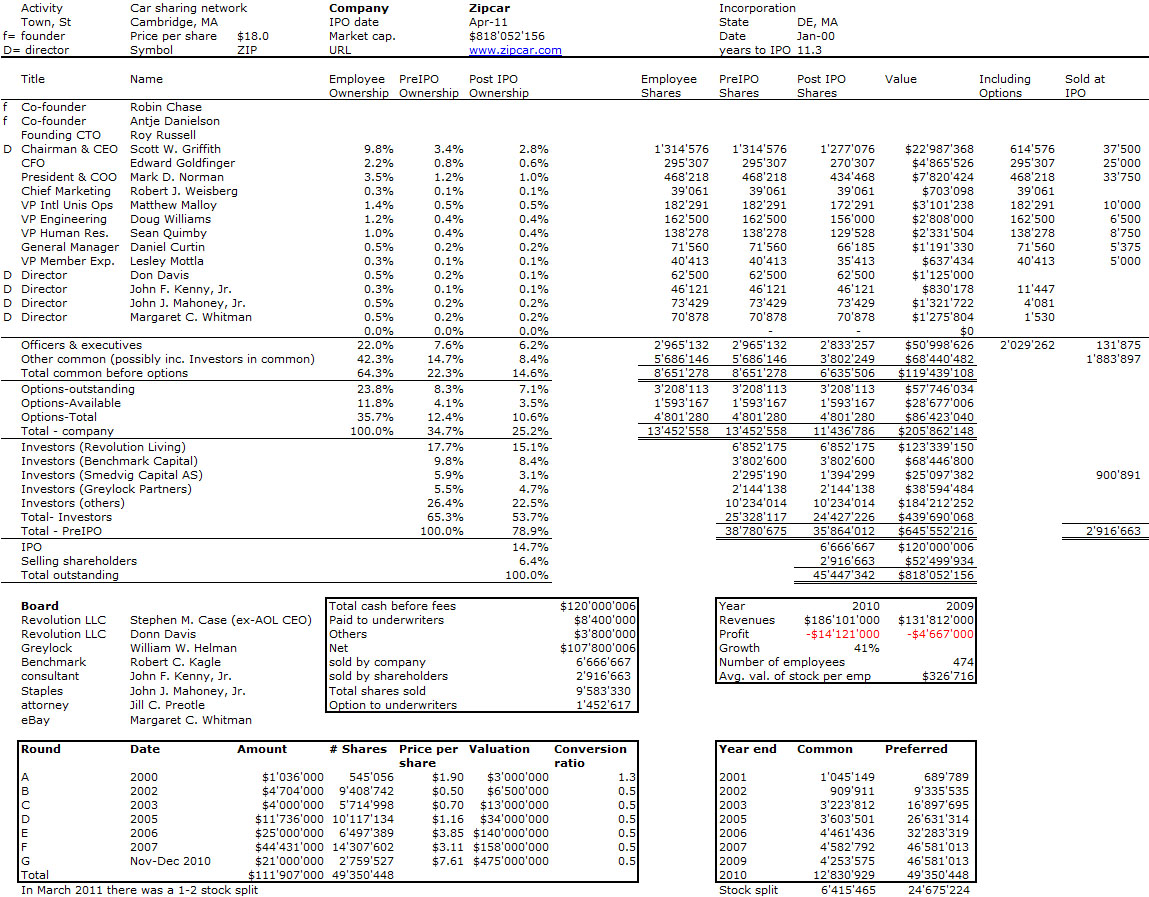

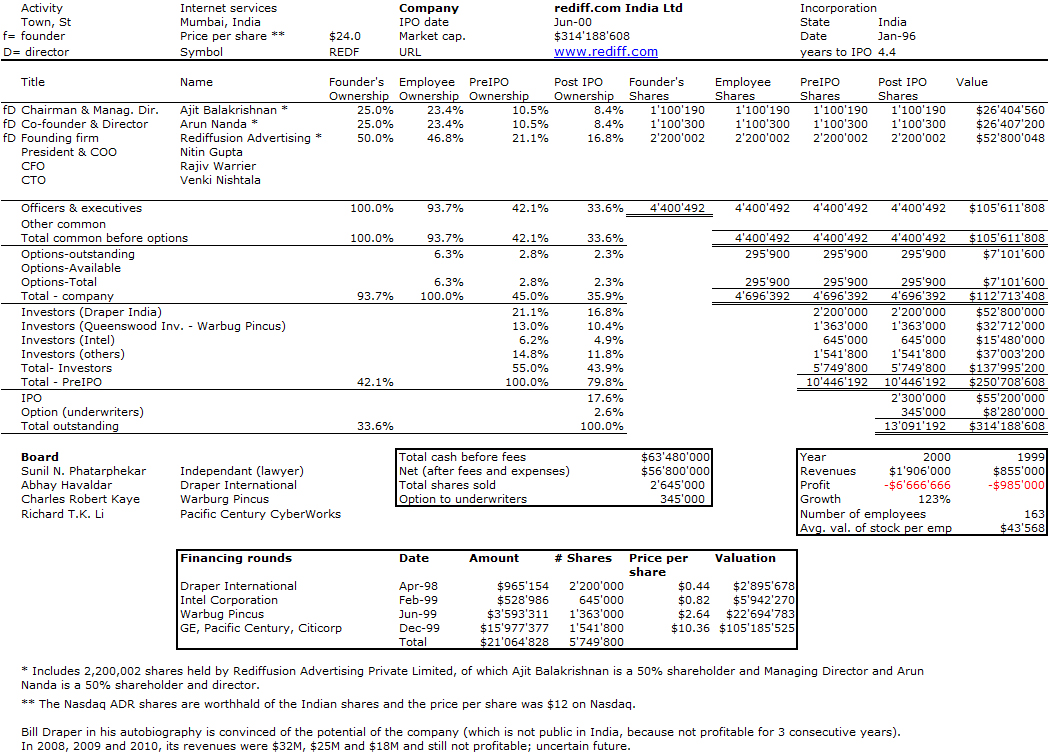

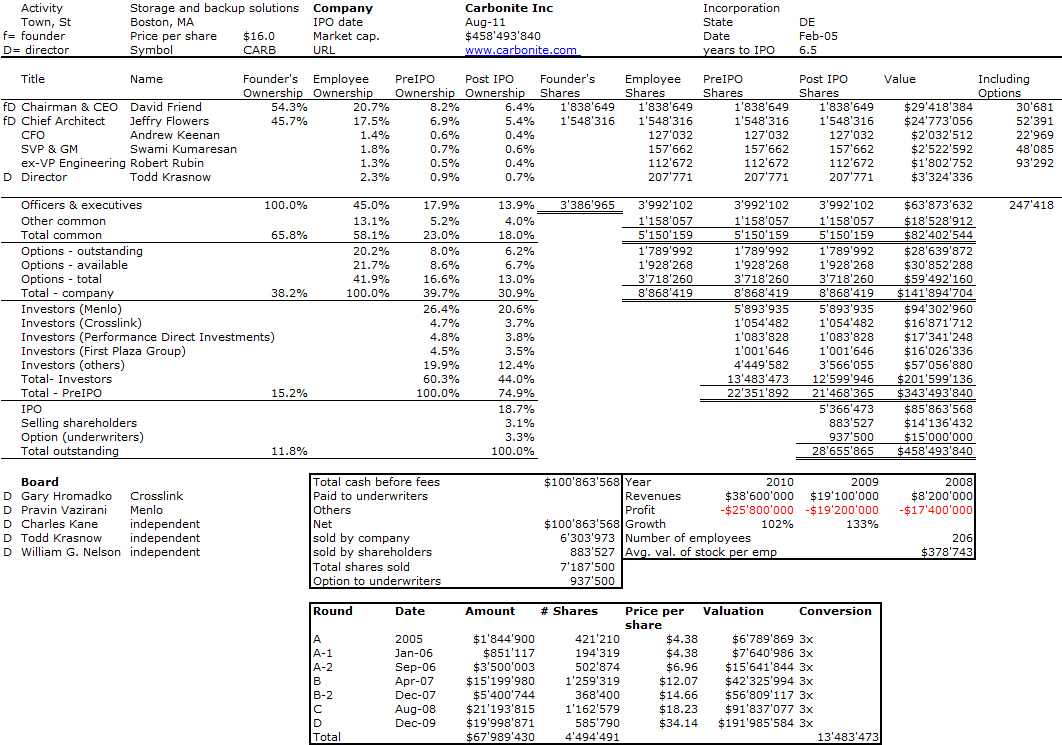

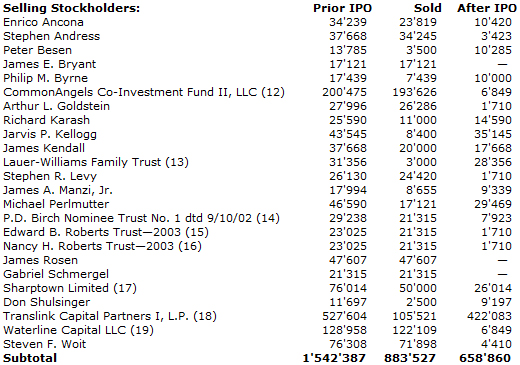

So I digged the IPO S-1 document and looked at the company with my usual interest. Cap. table. founders, investors, ESOP. The 2 foudners has 7-8% each pre-IPO, investors 60% and employess the remaining 25%. What might be a little scary though is the lack of profitability. Here it is.

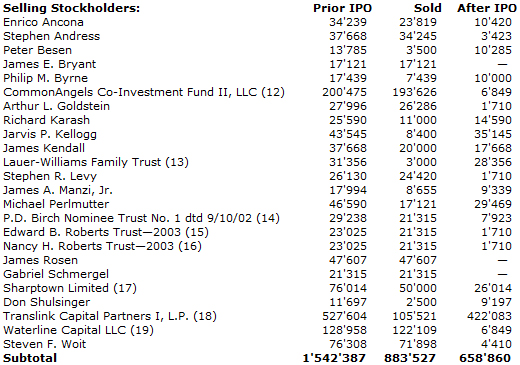

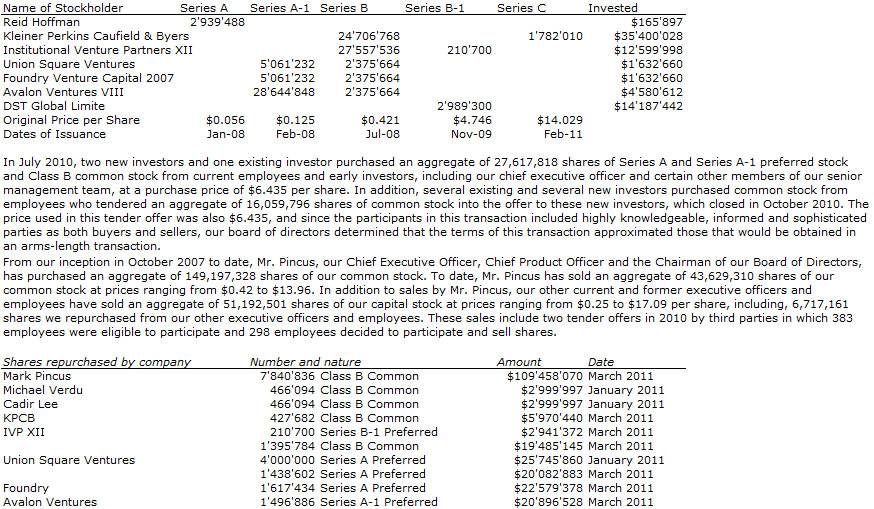

The S-1 also gives the list of selling shareholders.

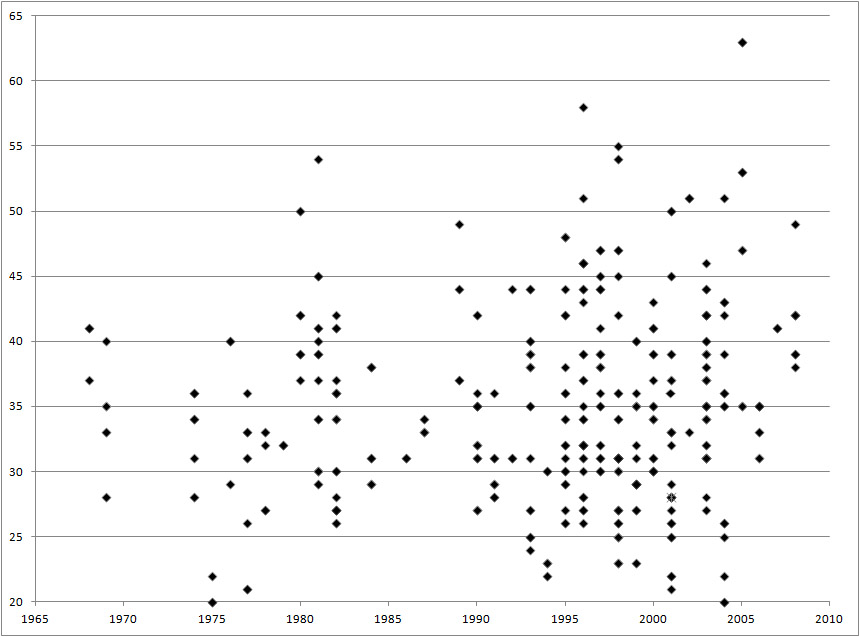

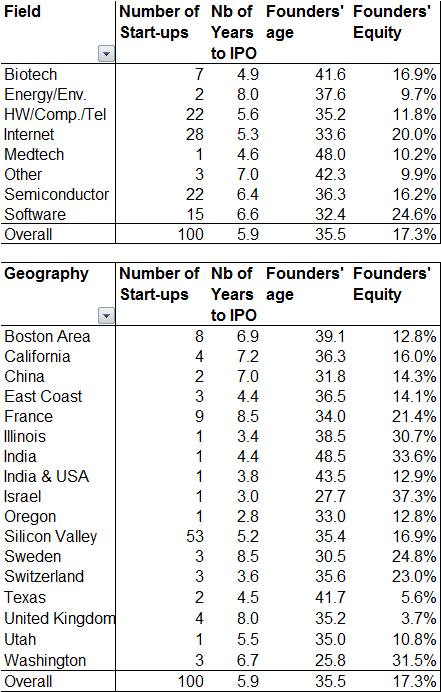

But following a few exchanges of comments on a recent post, Is There A Peak Age for Entrepreneurship?, I looked at something else, the founders and their age. Here is what the prospectus gives:

David Friend (63) has served as our chief executive officer and as a member of our board of directors since he co-founded our company with Mr. Flowers in February 2005. Mr. Friend also served as our president from February 2005 to September 2007 and again since August 2010. Prior to starting our company, Mr. Friend co-founded with Mr. Flowers and served as chief executive officer and president of Sonexis, Inc., a software company providing audio-conferencing services, from March 1999 through March 2002 and served as a director of Sonexis from March 1999 through August 2004. From June 1995 through December 1999, Mr. Friend co-founded with Mr. Flowers and served as chief executive officer and as a director of FaxNet Corporation, a supplier of messaging services to the telecommunications industry. Prior to that time, Mr. Friend co-founded Pilot Software, Inc., a software company, with Mr. Flowers. Previously, Mr. Friend founded Computer Pictures Corporation, a software company whose products applied computer graphics to business data, and served as president of ARP Instruments, Inc., an audio hardware manufacturer. Mr. Friend served as a director of GEAC Computer Corporation Ltd., a publicly-traded enterprise software company, from October 2001 to October 2006, and currently serves as a director of CyraCom International, Inc., Marketplace Technologies, Inc. and DealDash Oy. Mr. Friend holds a B.S. in Engineering from Yale University. We believe that Mr. Friend is qualified to serve on our board of directors based on his historic knowledge of our company as one of its founders, the continuity he provides on our board of directors, his strategic vision for our company and his background in internet and software companies.

Jeffry Flowers (57) has served as our chief architect since April 2011, as a member of our board of directors since he co-founded our company with Mr. Friend in February 2005, and as our chief technology officer from February 2005 to March 2011. Mr. Flowers co-founded with Mr. Friend and served as chief technical officer of Sonexis, Inc., a software company providing audio-conferencing services, from March 1999 through March 2002 and served as a director of Sonexis from March 1999 through August 2004. Prior to that time, Mr. Flowers co-founded with Mr. Friend and served as chief technology officer and as a director of FaxNet Corporation, a supplier of messaging services to the telecommunications industry, and co-founded Pilot Software, Inc., a software company, with Mr. Friend. Mr. Flowers served as VP of Development at ON Technology Corporation, a publicly-traded software vendor, from June 1994 through February 1996. Mr. Flowers holds an M.S. and a B.S. in Information and Computer Science from Georgia Institute of Technology. We believe that Mr. Flowers is qualified to serve on our board of directors based on his historic knowledge of our company as one of its founders, the continuity he provides on our board of directors, his strategic vision for our technology, and his background in internet and software companies.

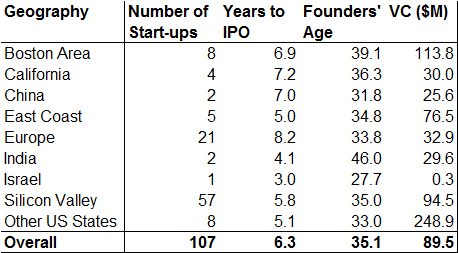

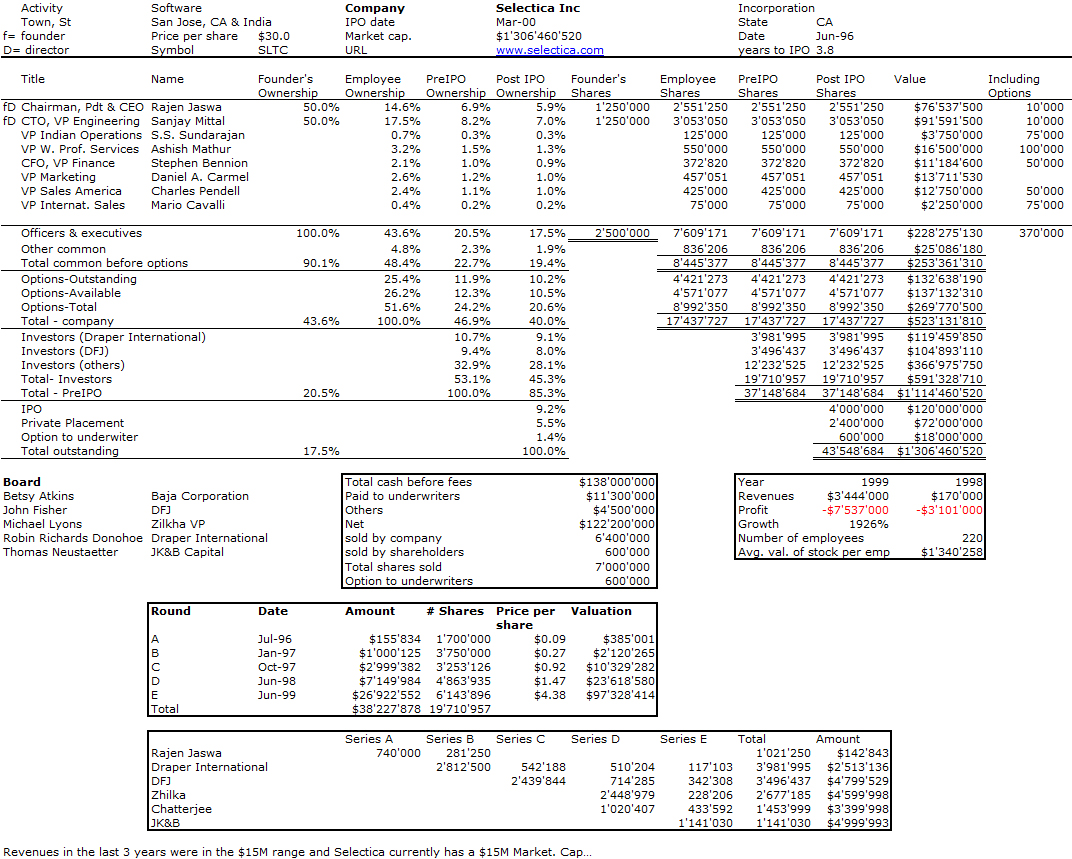

Doing simple math (so maybe not very accurate, this would give the following table)

| Founder |

Friend |

Flowers |

| Born in |

1948 |

1954 |

| Company |

Founded at age |

Founded at age |

| Sonexis in 1998 |

50 |

44 |

| Faxnet in 1994 |

46 |

40 |

| Computer Pict. in 1982 |

34 |

|

So it shows that the founders are not young, not even middle-age. They are serial entrepreneurs and probably close friends given the facts they have co-founded 3 companies together and were definitely not in their twenties when they did it. In my next post today, I will come back on the topic.