I’m regularly asked how to share or distribute equity in start-ups. One related question is how much equity should be given to board members. I am not discussing here investors’ seats on the board as they represent the equity owned by the funds, but only the independent board members, those who have a specific expertise to help the company (industry expert, scientific expert, business expert). There is an implicit assumption: board members do not receive cash (except the reimbursement of out of pocket expenses).

As a general rule, I heard many times that the independent board members as a group should not represent more than 2% of the company, and individual board member not more than 0.5-1%. (As a comparison, I had mentioned in documents in the past (including Equity Split in Start-ups) that a CEO is about 5-10%, a VP between 0.5 and 2% and a technical director about 0.2%. The rule of thumb is dividing by 5 at each level, CEO 5, VP, 1, director 0.2).

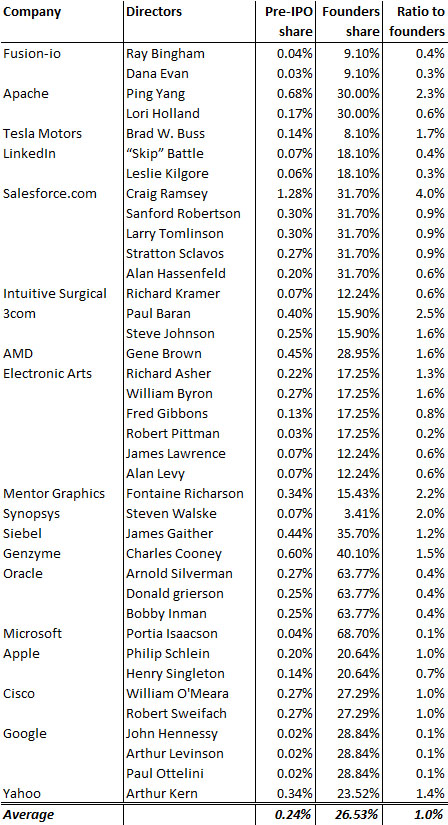

I just had a look at my past cap. tables and S1 documents and listed below examples of independent board members. The table gives the company and board members’ names and then how much the director had just before the IPO, which is related to the founders’s specific shares. On average, they have 0.24% of the company and about 1% of what founders own. This is consistent with what I had been saying for years. 🙂