Following my previous post about the book The Power Law and Venture Capital, I can only confirm it is a fascinating book about the history of Venture Capital. I have now read chapters 2 & 3 which covers the sixties mainly through Arthur Rock and his funding of Fairchild and the Traitorous Eight.

About Fairchild

Coyle pulled out crisp dollar bills and proposed that every man present should sign each one. The bills would be “their contracts with each other,” Coyle said. It was a premonition of the trust-based contracts – seemingly informal, yet founded, literally, on money – that were to mark the Valley in the years to come. [Page 35]

Source : https://www.sfgate.com/business/article/Tracing-Silicon-Valley-s-roots-2520298.php

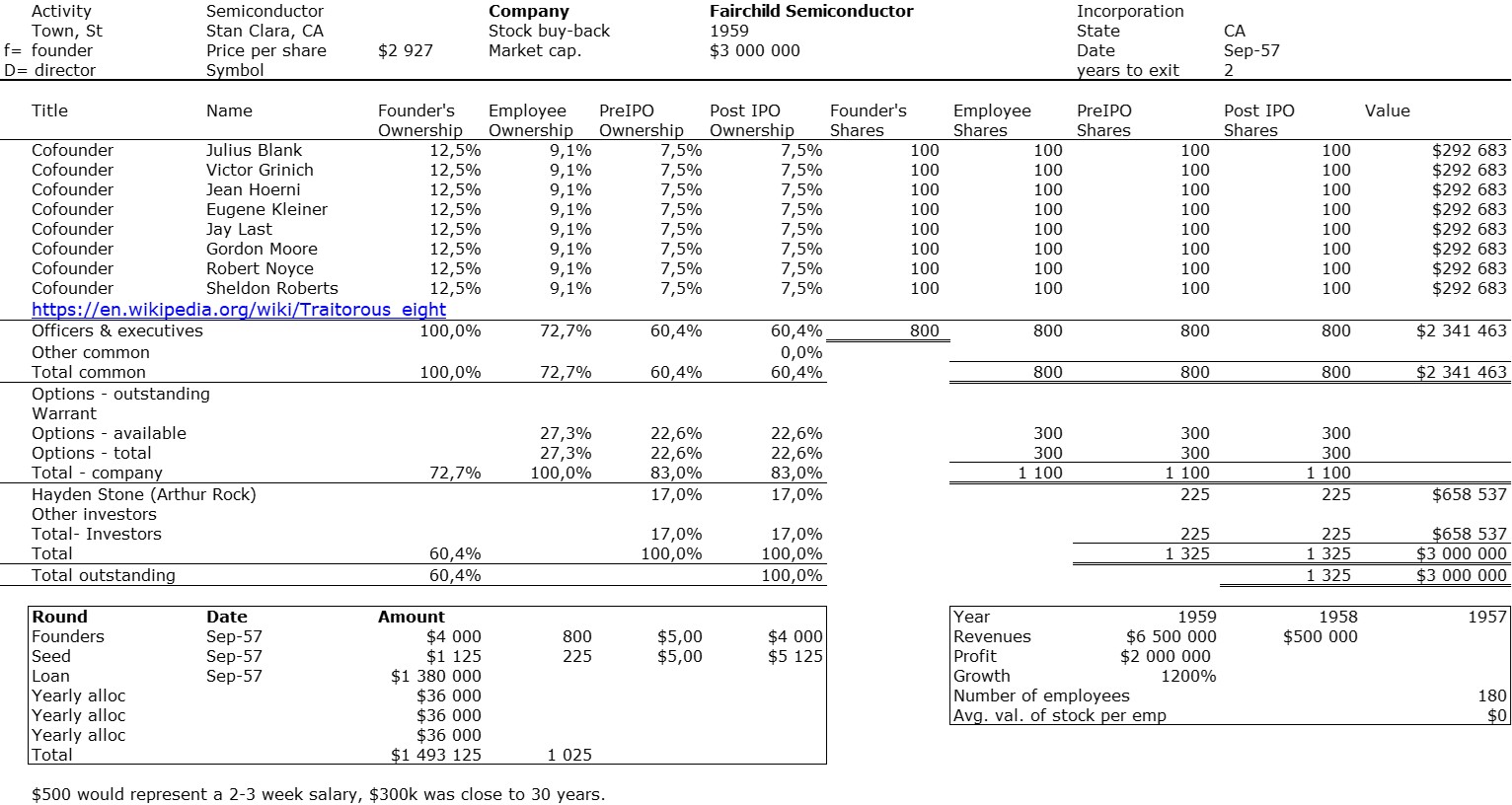

Each of the 8 founders put $500 for 100 shares ($500 was two to three weeks of salary), Hayden Stone (through Rock and Coyle) 225 shares at the same price per share and 300 reserved for future managers. Fairchild put $1.4M as a loan to be compared to the initial $5,125, with an option to buy all the stock for $3M. It happened making the founders rich but not as rich as if there had not been that option. Fairchild had made a profit of $2M at the time of acquisition and price to earnings were easily 20x to 30x. SO I had to do my usual cap. table from foundation to exit. Here it is:

What VCs such as Rock looked for

I just scanned pages 48-49 and this is very similar to what you could find in slideshare slides in the previous post.

“Some winning venture capitalists claim to look almost exclusively at the backgrounds and personalities of the founders; others focus mostly on the technology involved and the market opportunity the venture addresses” from The New Venturers, Wilson (1984)

“They look for outstanding people without worrying too much about the details of product and marketing strategy. The right people have integrity, motivation, market orientation, technical capability, accounting capability and leadership. The most important is motivation.

Rock’s style was supportive of entrepreneurs with an implacable will.” from Wilson (1984)

In 7 years, the Davis & Rock $3.4M fund would return $77M or a 22.6x multiple… [Page 50].

If you do not fully understand what I talk about read Mallaby! And of course watch Something Ventured.