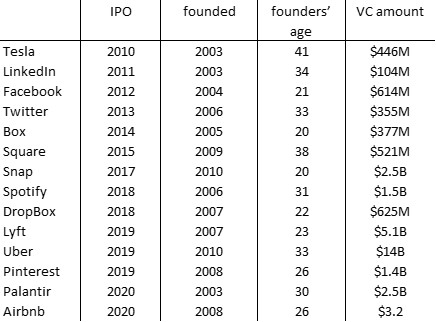

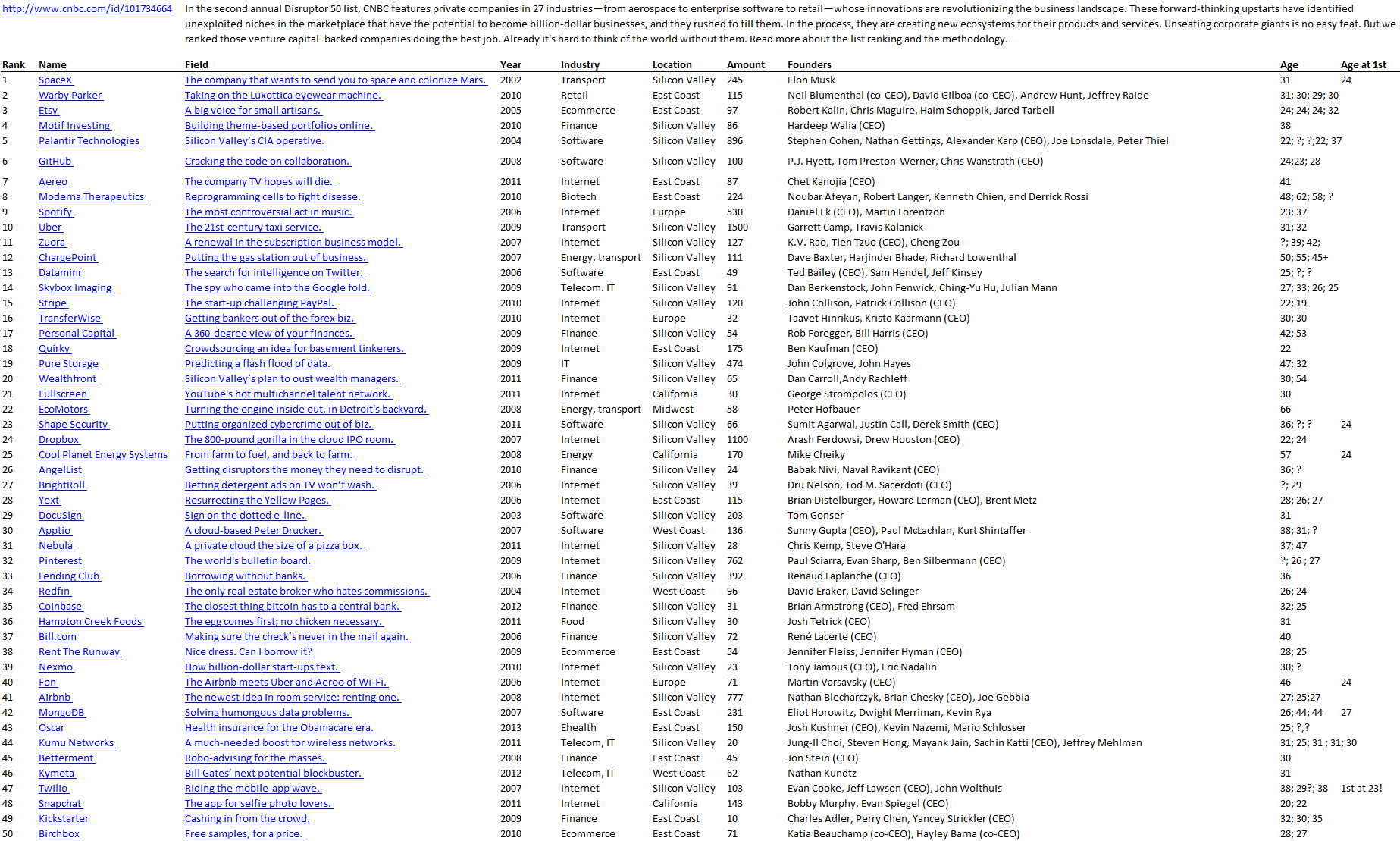

A couple of colleagues informed me about Welcome To The Unicorn Club: Learning From Billion-Dollar Startups by Aileen Lee. I understand why. The article is closely connected to some of my main interests: high-growth start-ups and dynamics of entrepreneurs. Aileen Lee has analyzed start-ups in the Software and Internet fields which have reached a billion-dollar value while being less than 10 years old. She calls them Unicorns, whereas Super-Unicorns are companies which reached a $100B value!

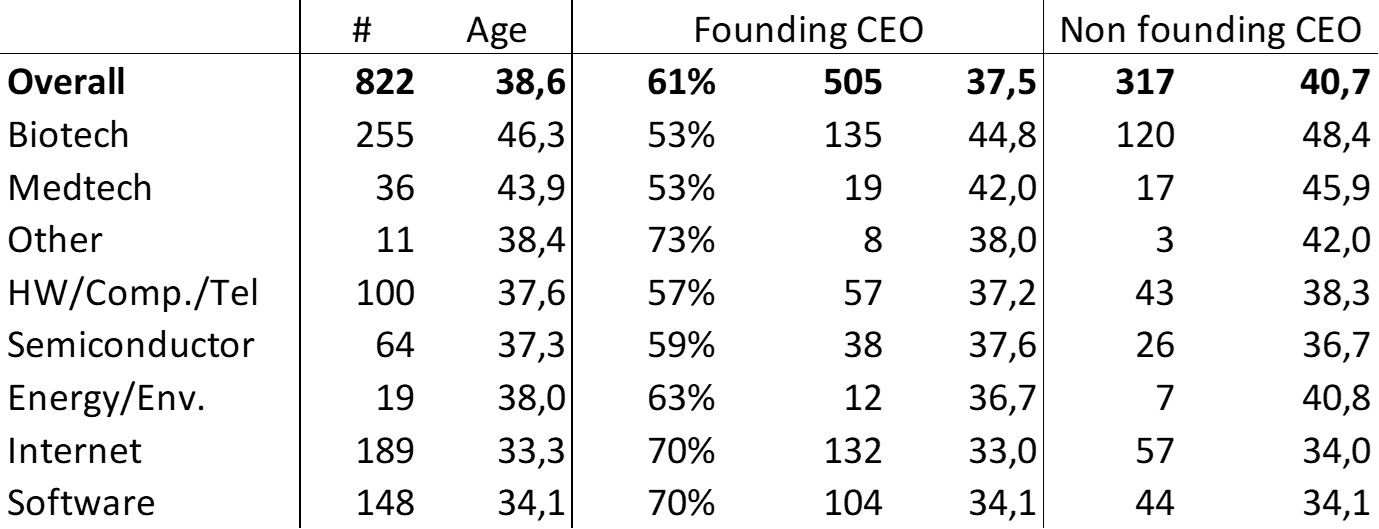

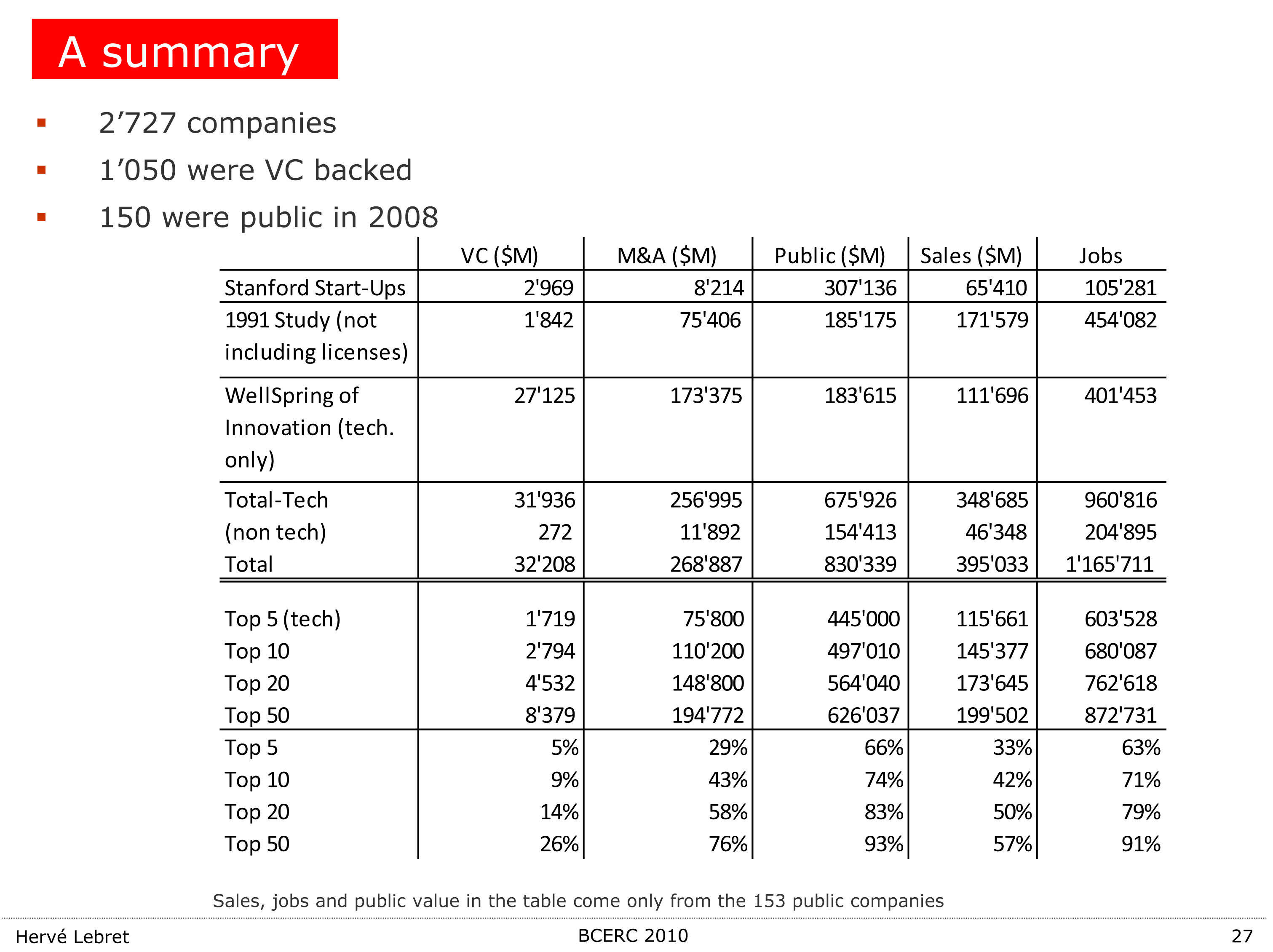

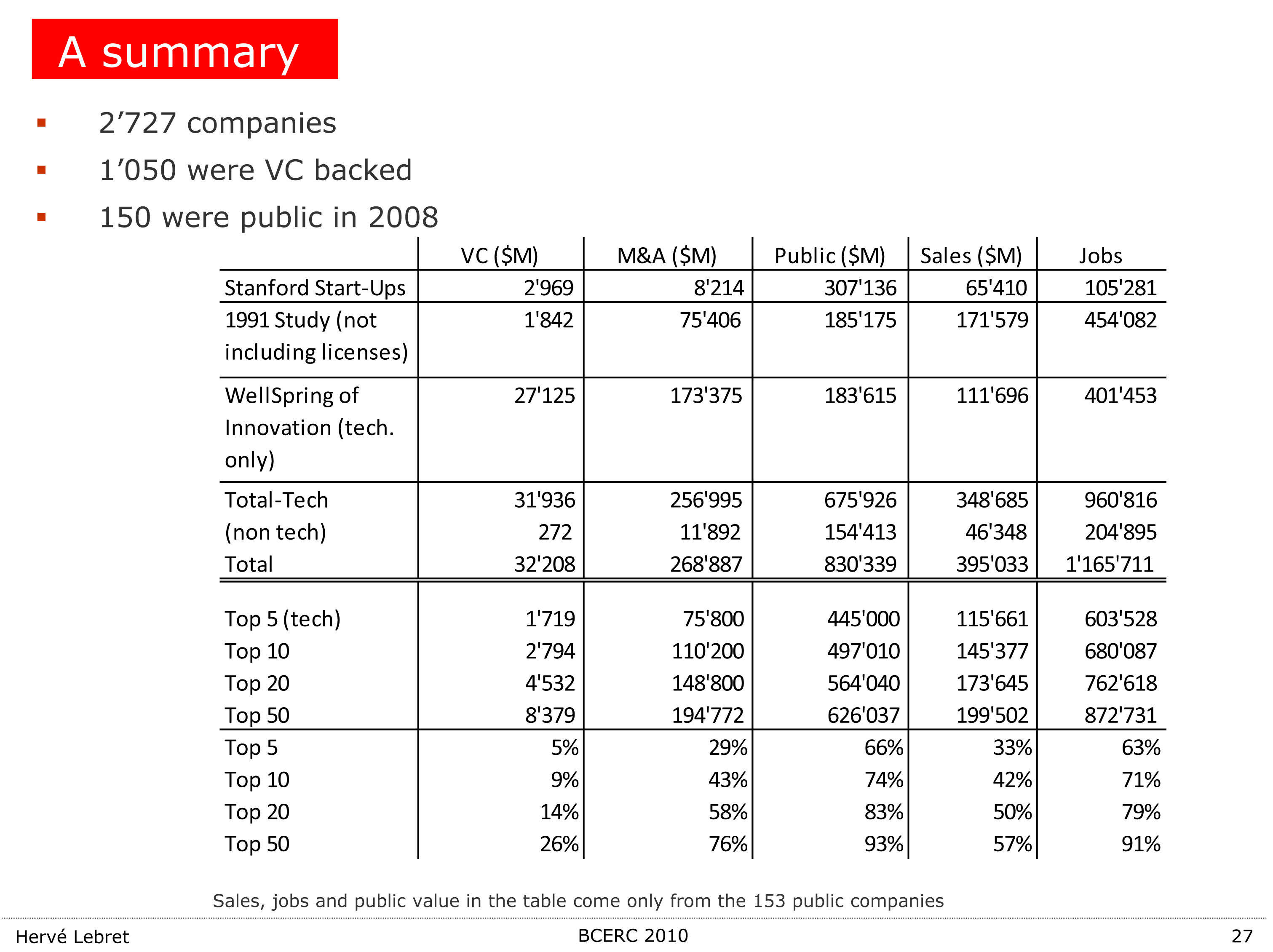

All this reminds me of my analysis of 2700 Stanford-related start-ups (you can check Serial entrepreneurs: are they better? as well as High growth and profits) and to a lesser extent about the link between age and value creation: Is there an ideal age to create?

Aileen Lee has interesting results:

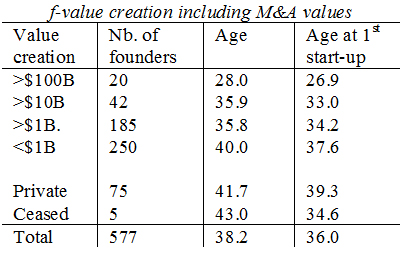

– out of 10,000+ founded companies per year, there are 4 unicorns per year (39 in the last decade – that is .07% of total) and about 1-3 super-unicorns per decade,

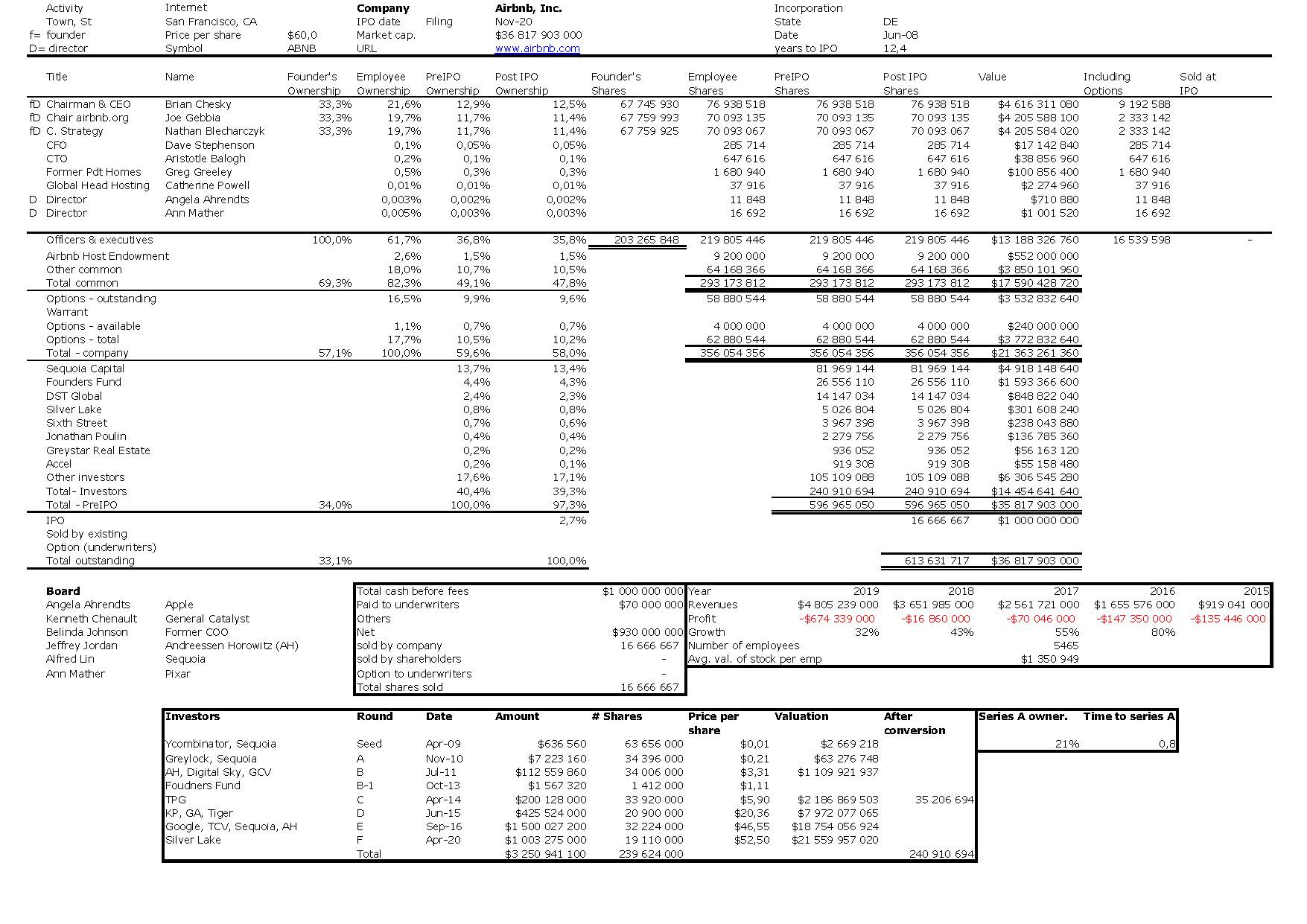

– they have raised more than $100M from investors (more than $300M for consumer-related). They may have been lean in their early days, but they grow fat!

– it takes 7+ years for an exit,

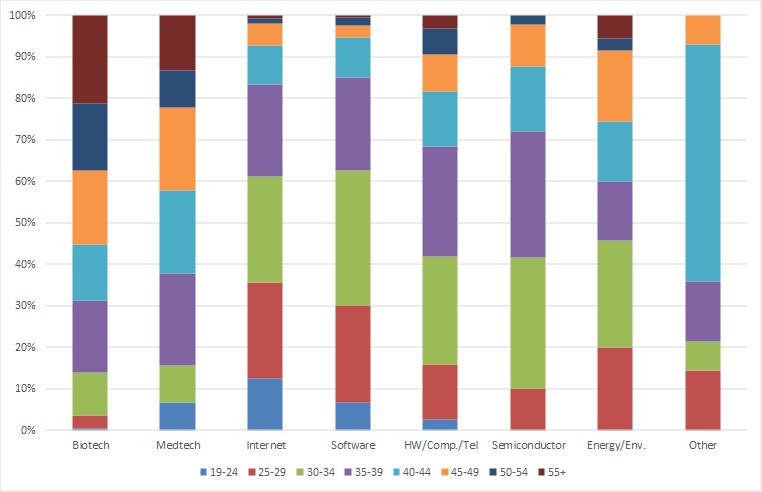

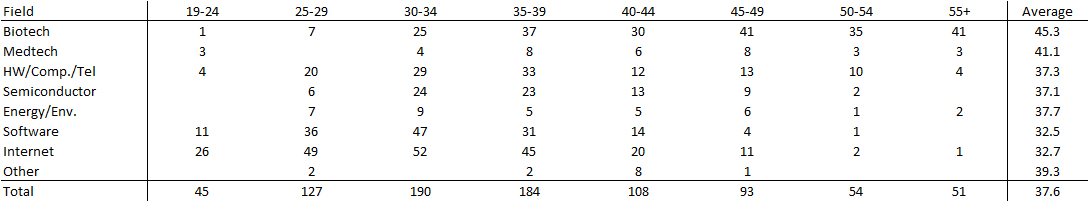

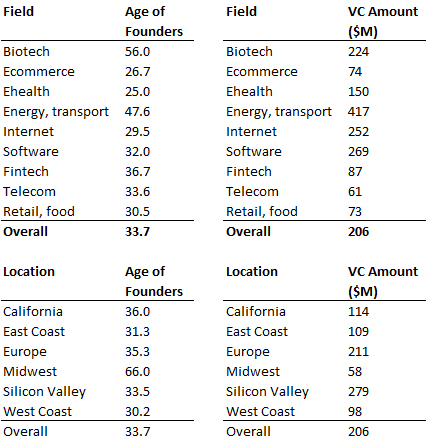

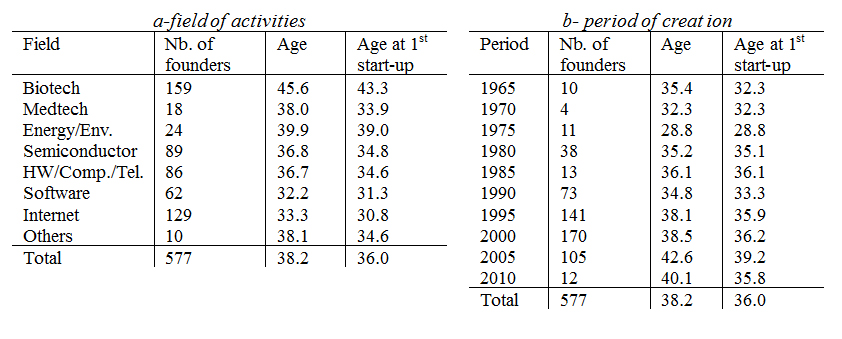

– founders have an average age of 34,

– they have 3 co-founders on average with a long experience together, often back from school,

– 75% of the founding CEO lead the company to an exit,

– many come from elite universities (1/3 from Stanford),

– pivot is an outlier.

I found this article interesting, important, and I even felt empathy and let me tell you why. We have a tendency to underestimate the importance of hyper-growth and hyper-fast. Growth is extremely important for start-ups; reaching $100M in value is a success. Looking at the small group which reaches $1B and then $100B is interesting. You need money for this (VC), you do not need that much experience but you need trust from co-founders. The founders of super-licorns seem to be the explorer of unknown territories. You need passion and resources.

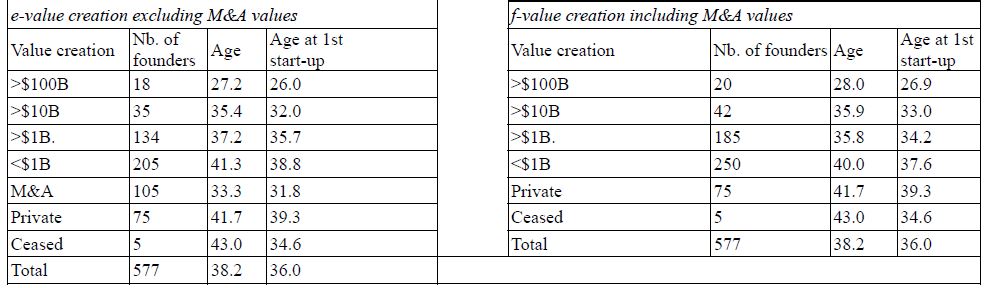

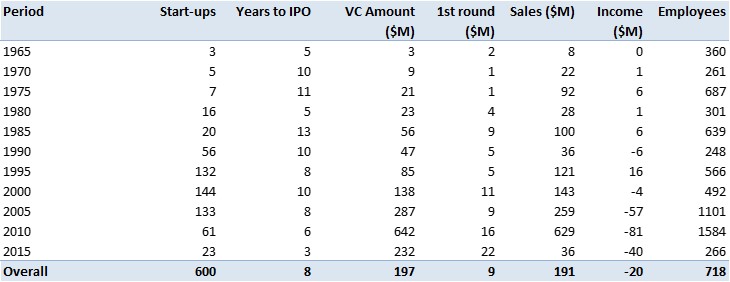

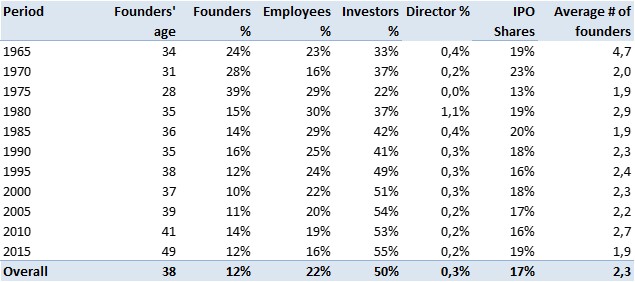

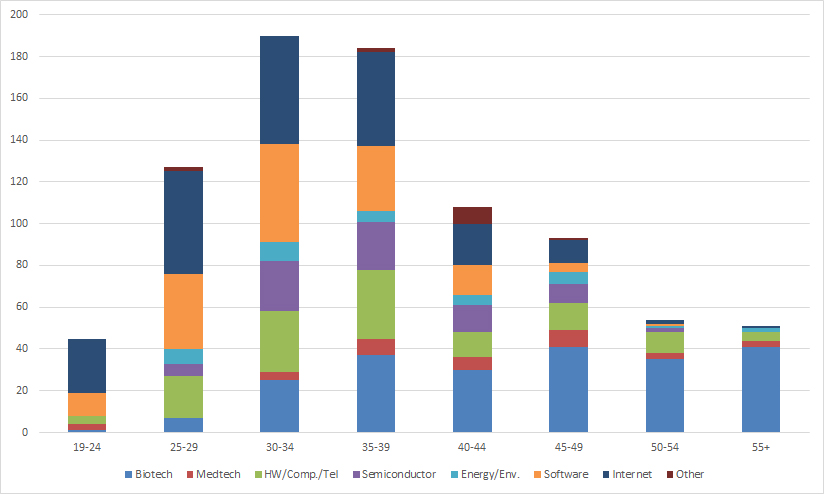

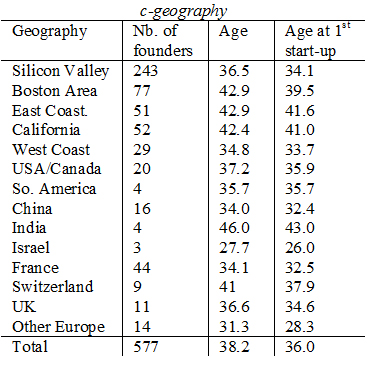

On Unicorns, I have done a similar analysis in “Is there an ideal age to create?” I also have an average age of 34 for 1st start-up experience of all founders, and regarding Super-Unicorns which I call Black Swans (highly unpredictable outcome according to Taleb), I have identified 10 Super-Unicorns (see below) and there are 1-4 such companies per decade since the 60s. The average age of their founders is 28 and even 27 if I count the 1st experience.

[My Black Swans – Ancestor: HP (1939); 60s: Intel (1968); 70s: Microsoft (1975), Oracle (1976), Genentech (1976), Apple (1977); 80s: Cisco (1984); 90s: Amazon (1994), Google (1998); 00s: Facebook (2004).

Age of founders: HP: Hewlett and Packard (27) – Intel: Noyce (41) and Moore (39) (but they had founded fairchild 11 years earlier). Andy Grove was 32 – Microsoft: Gates (20) and Allen (22) – Oracle: Ellison (33) – Genentech: Swanson (29) and Boyer (40) – Apple: Jobs (21) and Wozniak (26) – Cisco: Lerner and Bosack (29) – Amazon: Bezos (30) – Google: Brin and Page (25) – Facebook: Zuckerberg (20) – Cofounder was 22.]

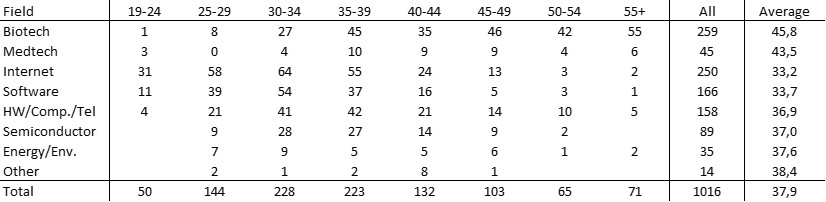

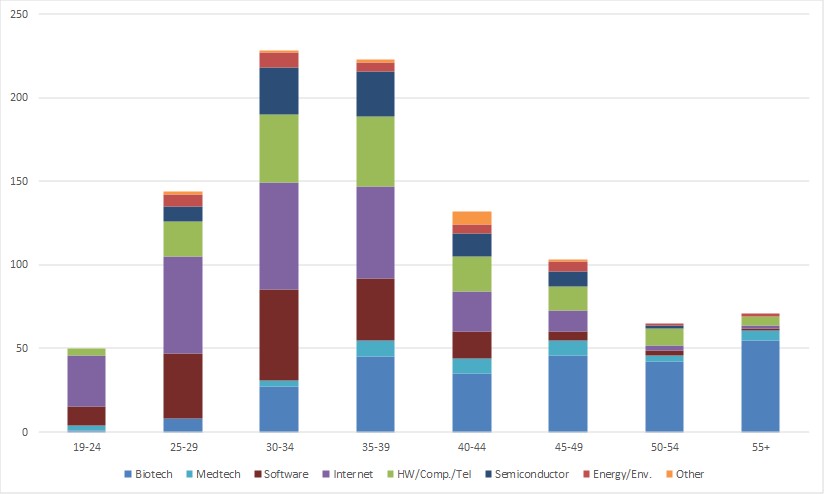

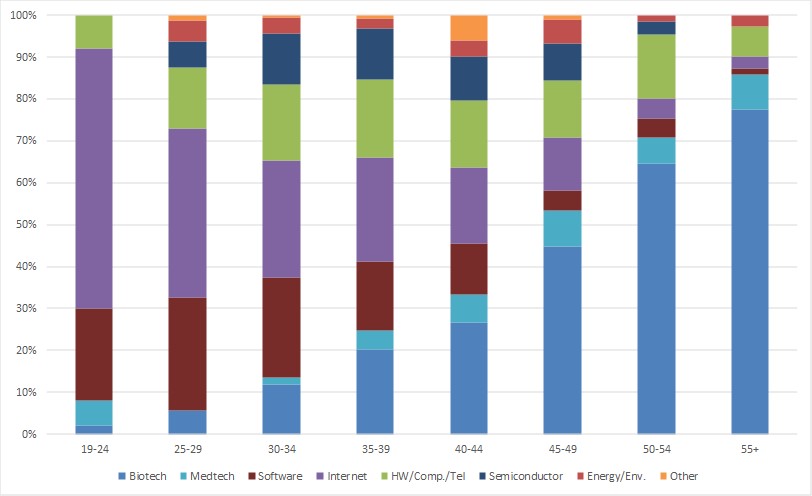

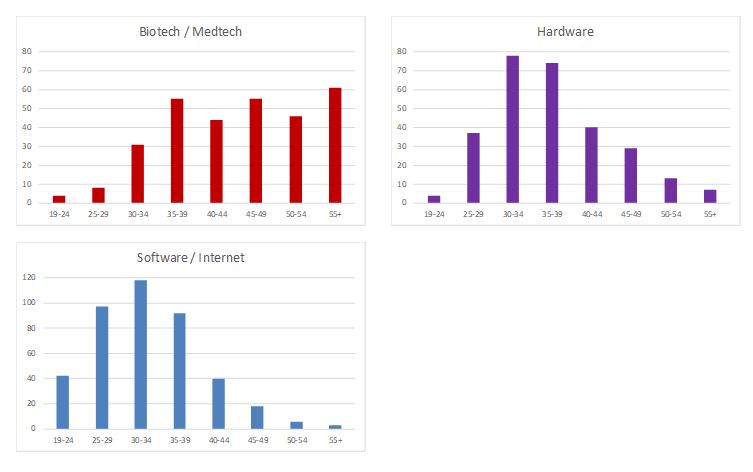

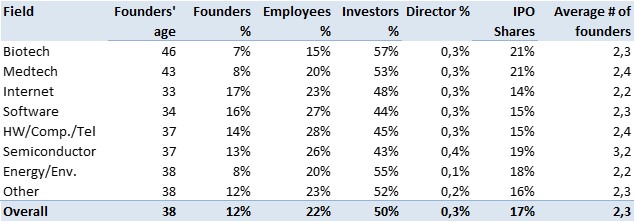

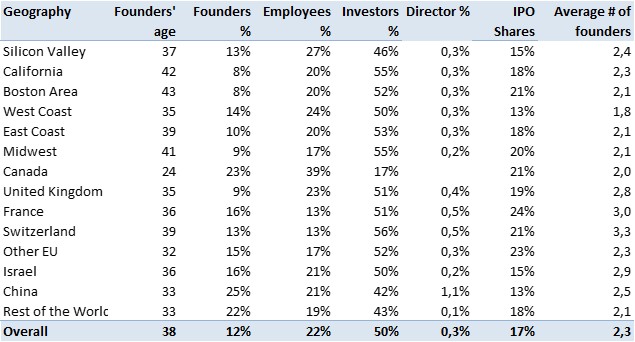

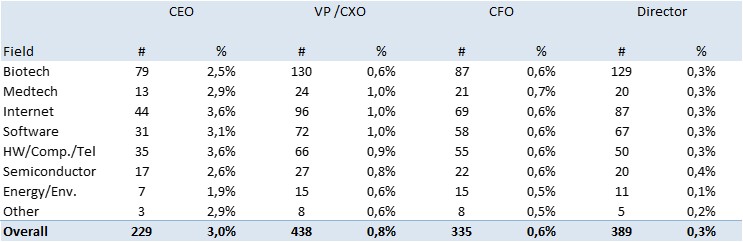

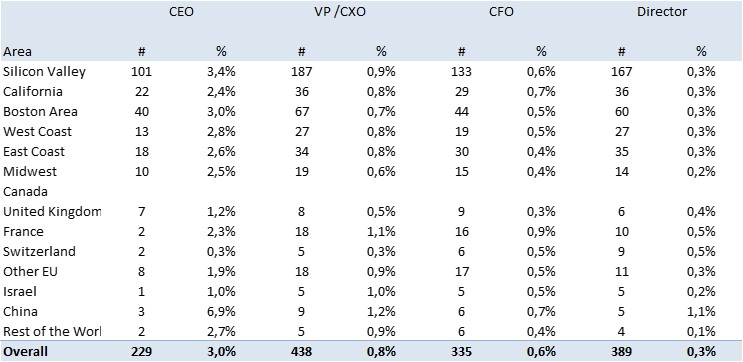

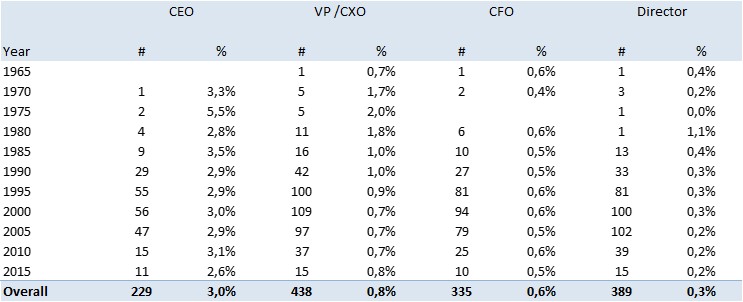

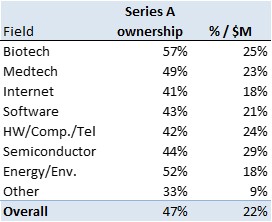

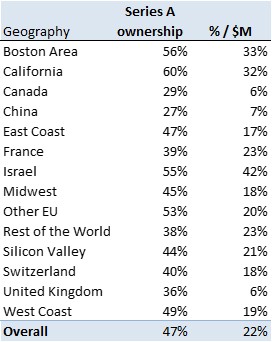

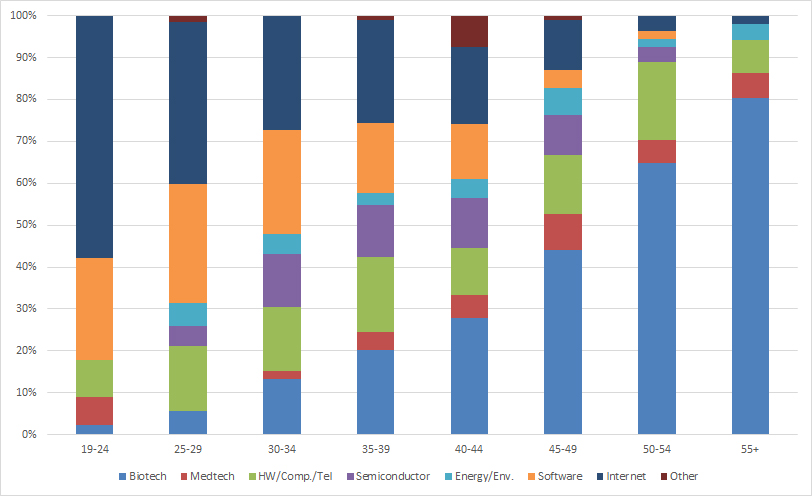

Now more data and statistics based on the Stanford-related companies. You can have a look first at my past slides and then I look at the Unicorn statistics.

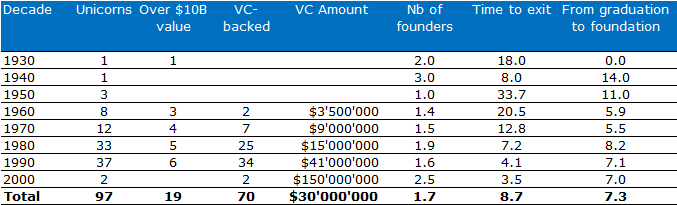

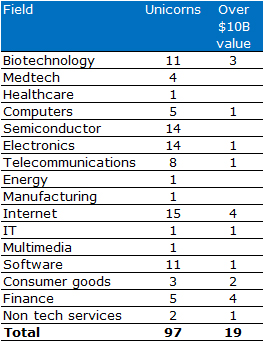

Basic analysis of Stanford-related unicorns

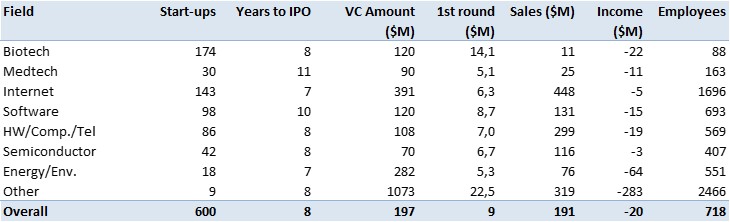

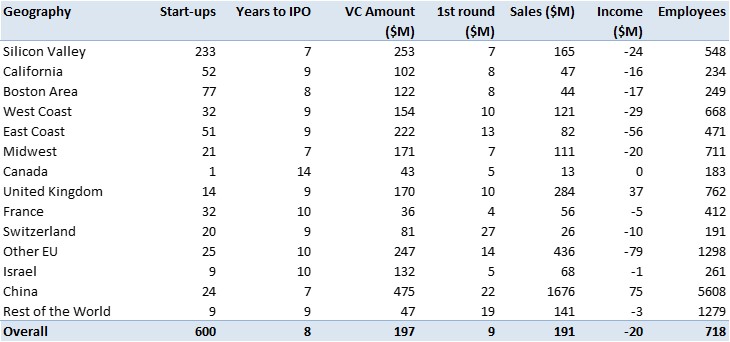

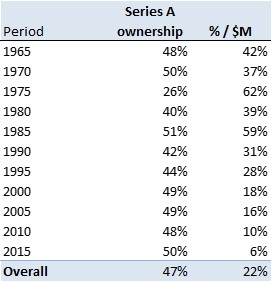

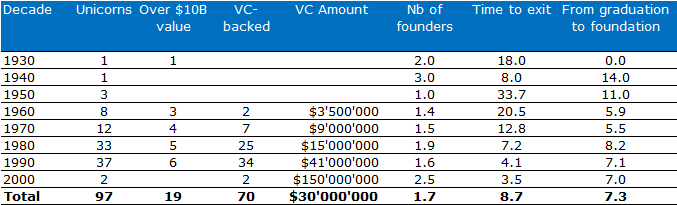

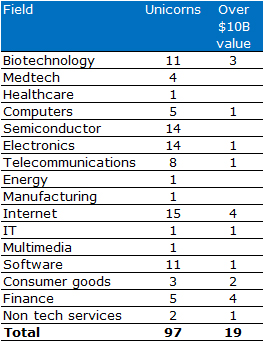

There are 3 super-unicorns in that group (HP, Cisco & Google). Out of 2700, there are 97 unicorns, which is a huge 3%! It probably means my sample is not exhaustive! Indeed Prof. Eesley estimates that 39’900 active companies can trace their roots to Stanford. This means now .2%. Now these are real exits whereas Lee includes private companies with no exit but a value provided by their investors. Whatever the ratio, unicorns are rare. Mine are less fat than Lee’s: they raise $30M with VCs.

I have less than 2 Stanford-related founders per company (but I do not count the ones with no Stanford link. It confirms Lee’s comment that many founders have roots back to school. It takes 8 years for an exit (fewer in recent years though) and 7 years for a graduate to decide about founding a company.

Unicorns and high-value creation is an interesting not to say important topic. Billion-dollar companies are not just a rare event, they tell us something about the impact of high-tech innovation & entrepreneurship. They are possible and desirable!