I very seldom read books twice, and had never done it with business books. This is the exception. I had blogged about this book here back in 2019. I remembered strong elements of good coaching but had not mentioned them. Here they finally come! Campbell does not talk much, does not give advice but asks questions… And he gives courage.

PRACTICE FREE-FORM LISTENING

In a coaching session with Bill, you could expect that he would listen intently. No checking his phone for texts or email, no glancing at his watch or out the window while his mind wandered. He was always right there. Today it is popular to talk about “being present” or “in the moment.” We’re pretty sure those words never passed the coach’s lips, yet he was one of their great practitioners. Al Gore says he learned from Bill how “important it is to pay careful attention to the person you are dealing with… give them your full, undivided attention, really listening carefully. Only then do you go into the issue. There’s an order to it.”

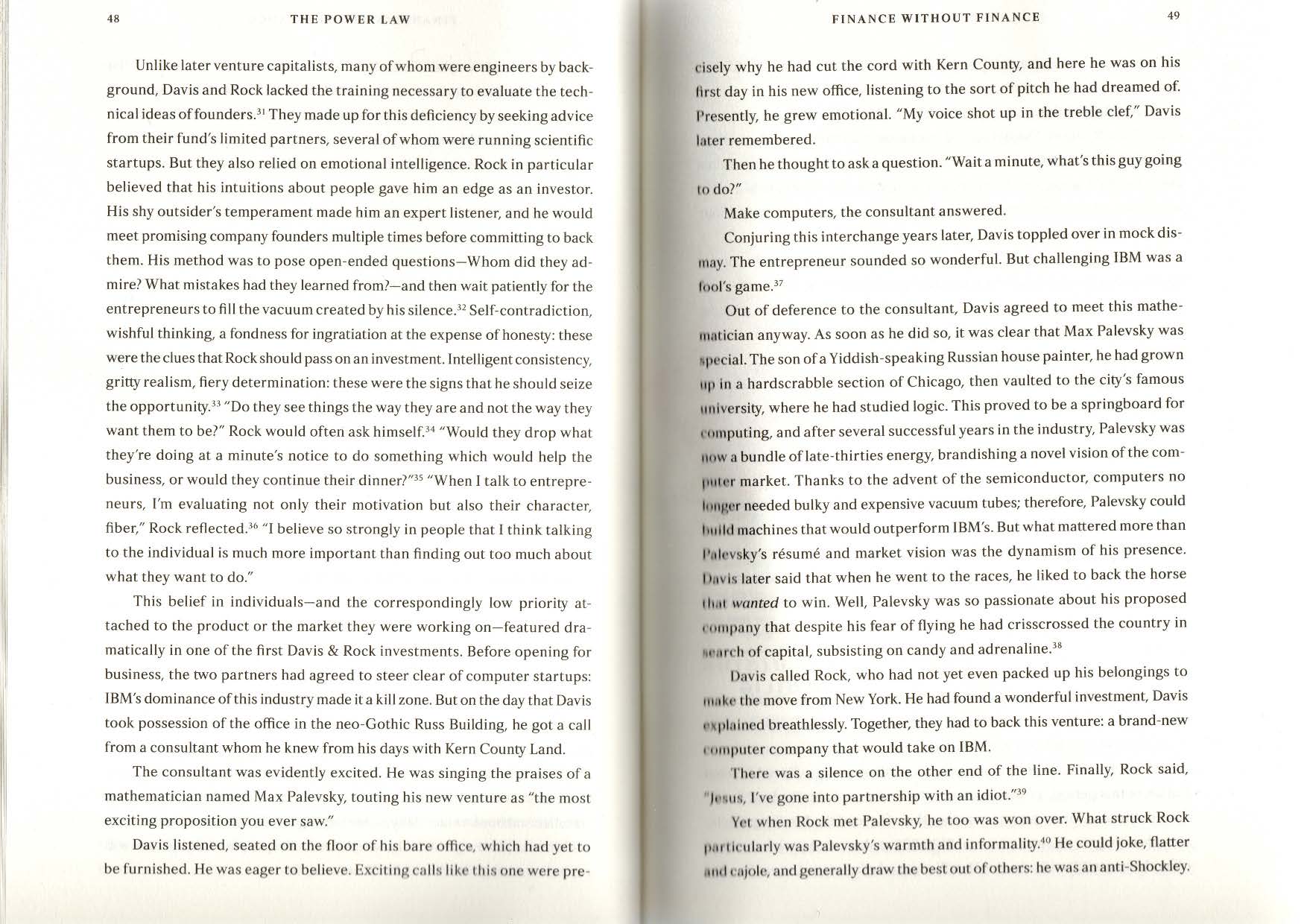

Alan Eustace called Bill’s approach “free-form listening” – academics might call it “active listening,” a term first coined in 1957 – and in practicing it Bill was following the advice of the great UCLA basketball coach John Wooden, who felt that poor listening was a trait shared by many leaders: “We’d all be a lot wiser if we listened more,” Wooden said, “not just hearing the words, but listening and not thinking about what we’re going to say.”

Bill’s listening was usually accompanied by a lot of questions, a Socratic approach. A 2016 Harvard Business Review article notes that this approach of asking questions is essential to being a great listener: “People perceive the best listeners to be those who periodically ask questions that promote discovery and insight.”

“Bill would never tell me what to do,” says Ben Horowitz. “lnstead he’d ask more and more questions, to get to what the real issue was.” Ben found an important lesson in Bill’s technique that he applies today when working with his fund’s CEOs. Often, when people ask for advice, all they are really asking for is approval. “CEOs always feel like they need to know the answer,” Ben says. “So when they ask me for advice, l’m always getting a prepared question. I never answer those.” Instead, like Bill, he asks more questions, trying to understand the multiple facets of a situation. This helps him get past the prepared question (and answer) and discover the heart of an issue.

[…]

When you listen to people, they feel valued. A 2003 study from Lund University in Sweden finds that “mundane, almost trivial” things like listening and chatting with employees are important aspects of successful leadership, because “people feel more respected, visible and less anonymous, and included in teamwork.” And a 2016 paper finds that this form of “respectful inquiry,” where the leader asks open questions and listens attentively to the response, is effective because it heightens the “follower’s” feelings of competence (feeling challenged and experiencing mastery), relatedness (feeling of belonging), and autonomy (feeling in control and having options). Those three factors are sort of the holy trinity of the self-determination theory of human motivation, originally developed by Edward L. Deci and Richard M. Ryan.

As Salar Kamangar, an early Google executive, puts it, “Bill was uplifting. No matter what we discussed, I felt heard, understood, and supported.” [Pages 89-91]

DON’T STICK IT IN THEIR EAR

And when he was finished asking questions and listening, and busting your butt, he usually would not tell you what to do. He believed that managers should not walk in with an idea and “stick it in their ear.” Don’t tell people what to do, tell them stories about why they are doing it. “I used to describe success and prescribe to everyone how we were going to do it,” says Dan Rosensweig. “Bill coached me to tell stories. When people understand the story they can connect to it and figure out what to do. You need to get people to buy in. It’s like a running back in football. You don’t tell him exactly what route to run. You tell him where the hole is and what’s the blocking scheme and let him figure it out.”

Jonathan often experienced this as a sort of test: Bill would tell a story and let Jonathan go off and think about it until their next session to see if Jonathan could process and understand the lesson it contained and its implications. Chad Hurley, YouTube cofounder, had the same experience. “It was like sitting with a friend at the Old Pro [the Palo Alto sports bar],” Chad says. “He would talk about things that had happened to him. He wasn’t trying to preach, just be present.”

Fortunately, Bill expected similar candor in return. Alan Gleicher, who worked with Bill as the head of sales and operations at Intuit, had a simple way of summing up how to be successful with him. “Don’t dance. If Bill asks a question and you don’t know the answer, don’t dance around it. Tell him you don’t know!” For Bill, honesty and integrity weren’t just about keeping your word and telling the truth; they were also about being forthright. This is critical for effective coaching; a good coach doesn’t hide the stuff that’s hard to talk about – in fact, a good coach will draw this out. He or she gets at the hard stuff.

Scholars would describe Bill’s approach – listening, providing honest feedback, demanding candor – as “relational transparency,” which is a core characteristic of “authentic leadership.” Wharton professor Adam Grant has another term for it: “disagreeable givers.” He notes in an email to us that “we often feel torn between supporting and challenging others. Social scientists reach the same conclusion for leadership as they do for parenting: it’s a false dichotomy. You want to be supportive and demanding, holding high standards and expectations but giving the encouragement necessary to reach them. Basically, it’s tough love. Disagreeable givers are gruff and tough on the surface, but underneath they have others’ best interests at heart. They give the critical feedback no one wants to hear but everyone needs to hear.”

Research on organizations shows what Bill seemed to know instinctively: that these leadership traits lead to better team performance. One study of a chain of retail stores found that when employees saw their managers as authentic (for example, agreeing that the manager “says exactly what he or she means”), the employees trusted the leaders more, and the stores had higher sales. [Pages 97-99]

BE THE EVANGELIST FOR COURAGE

Bill’s perspective was that it’s a manager’s job to push the team to be more courageous. Courage is hard. People are naturally afraid of taking risks for fear of failure. lt’s the manager’s job to push them past their reticence. Shona Brown, a longtime Google executive, calls it being an “evangelist for courage.” As a coach, Bill was a never-ending evangelist for courage. As Bill Gurley notes, he “blew confidence into people.” He believed you could do things, even when you yourself weren’t so sure, always pushing you to go beyond your self-imposed limits. Danny Shader, founder and CEO of PayNearMe, who worked with Bill at GO: “The thing I got the most out of meetings with Bill is courage. I always came away thinking, I can do this. He believed you could do stuff that you didn’t believe you could do.”

[…]

Conveying boldness was not blind cheerleading on Bill’s part. He had the mind-set that most people have value, and he had the experience and a good enough eye for talent that he generally knew what he was talking about. He had such credibility that if he said that you could do something, you believed him, not because he was a cheerleader but because he was a coach and experienced executive. He built his message on your capabilities and progress. This is a key aspect of delivering encouragement as a coach: it needs to be credible.

And if you believed him, you started to believe in your self, which of course helped you achieve whatever daunting task lay before you. “He gave me permission to go forth,” Alphabet CFO Ruth Porat says. “To have confidence in my judgment.” [Pages 100-102]

These are the elements that formed the foundation of Bill’s success as an executive coach – and that those who benefited from his coaching took with them when they became coaches to their own colleagues and direct reports, too. He started by building trust, which only deepened over time. He was highly selective in choosing his coachees; he would only coach the coachable, the humble, hungry lifelong learners. He listened intently, without distraction. He usually didn’t tell you what to do; rather, he shared stories and let you draw conclusions. He gave, and demanded, complete candor. And he was an evangelist for courage, by showing inordinate confidence and setting aspirations high. [Page 105]