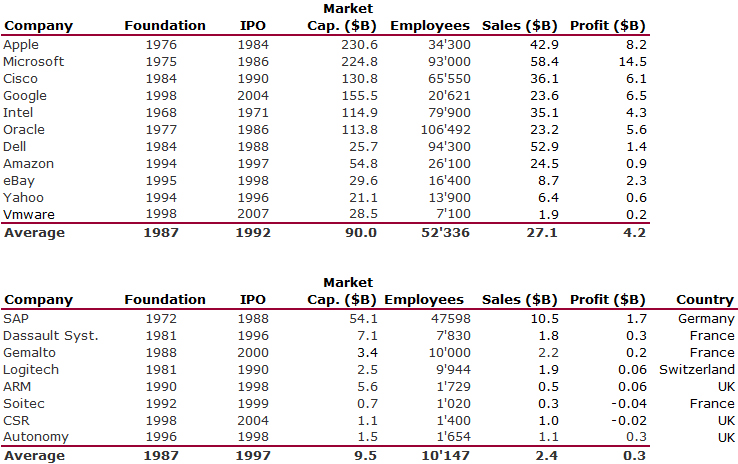

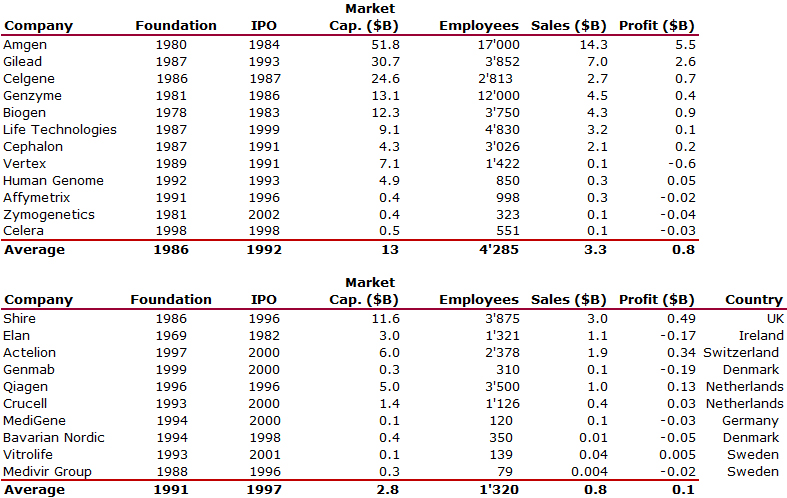

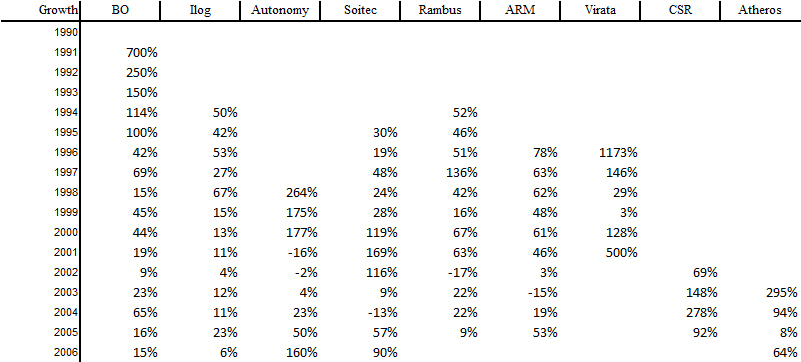

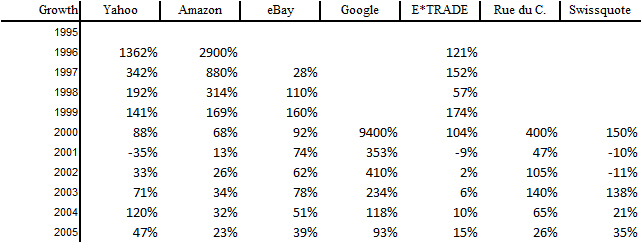

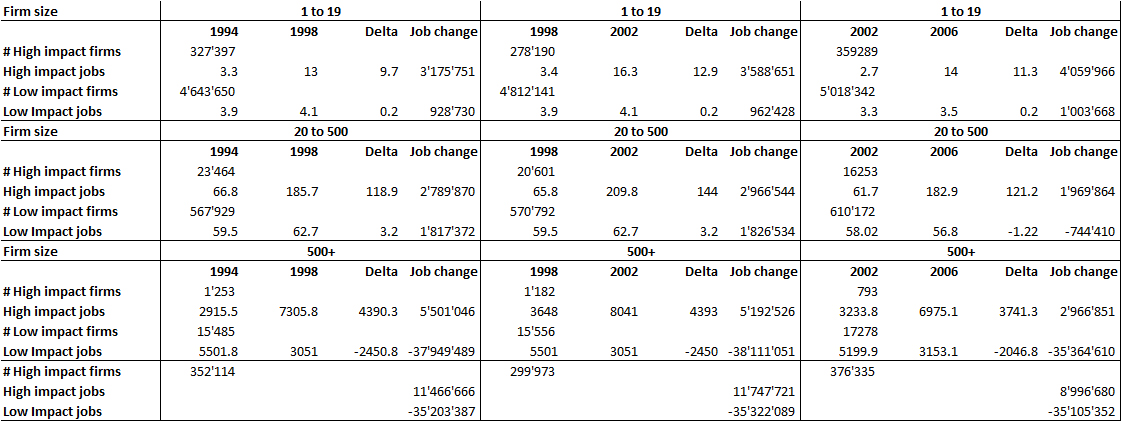

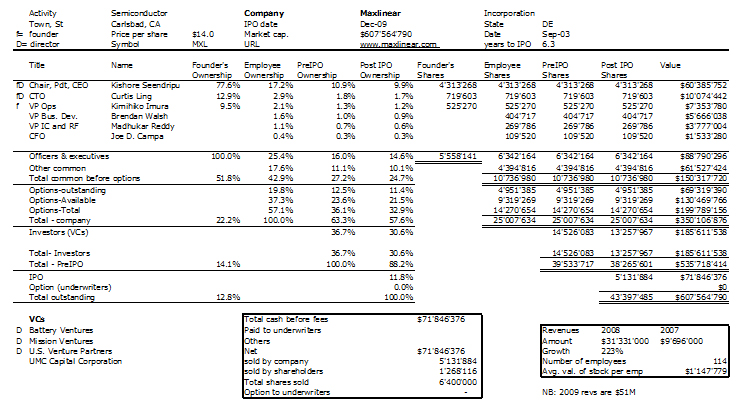

Before I talk about the topic I announce in this post, let me mention briefly my coming back in the research world! I published a paper at the BCERC Babson Conference on Stanford high-tech start-ups. You may wish to go through the slides below.

I promise to come back to growth and profits and indeed there is a link to my own paper so be a little patient. But I need to mention one other thing before! The two keynote speakers were great.

First Ernesto Bertarelli, former CEO of Sereno and winner (and loser) of the America’s Cup with Alinghi gave a great 20-minute talk on entrepreneurship. Let me just quote him:

– in entrepreneurship, you need passion, fire and love, these are critical,

– you need a team, you can not win alone so you need to accept to hire better people than yourself and you need to accept change,

– you need vision, i.e. you need to visualize your plan and objectives,

– entrepreneurship = business, i.e. it is about taking chances, about asking yourself why should I not do it,

– if you’re sure to win, it’s boring; the risk of failing is OK and he was honest enough to show his two victories and then his defeat with Alinghi.

In summary, it is not so much a process it is about values.

Second Nicolas Hayek, founder and chairman of the Swatch Group, gave his views about entrepreneurship and business. He said basically the same things. Entrepreneurs are creative people and the pity (with our current crisis) is that we train managers who are not risk-takers, who are not creative people (or only for creative finance!). In fact, we kill creativity with our kids when they are 6-years old and business schools / MBA programs do not change this.

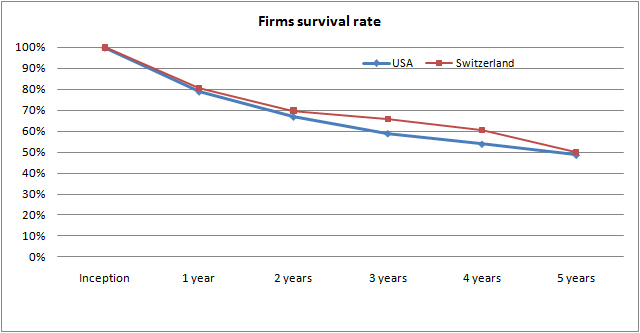

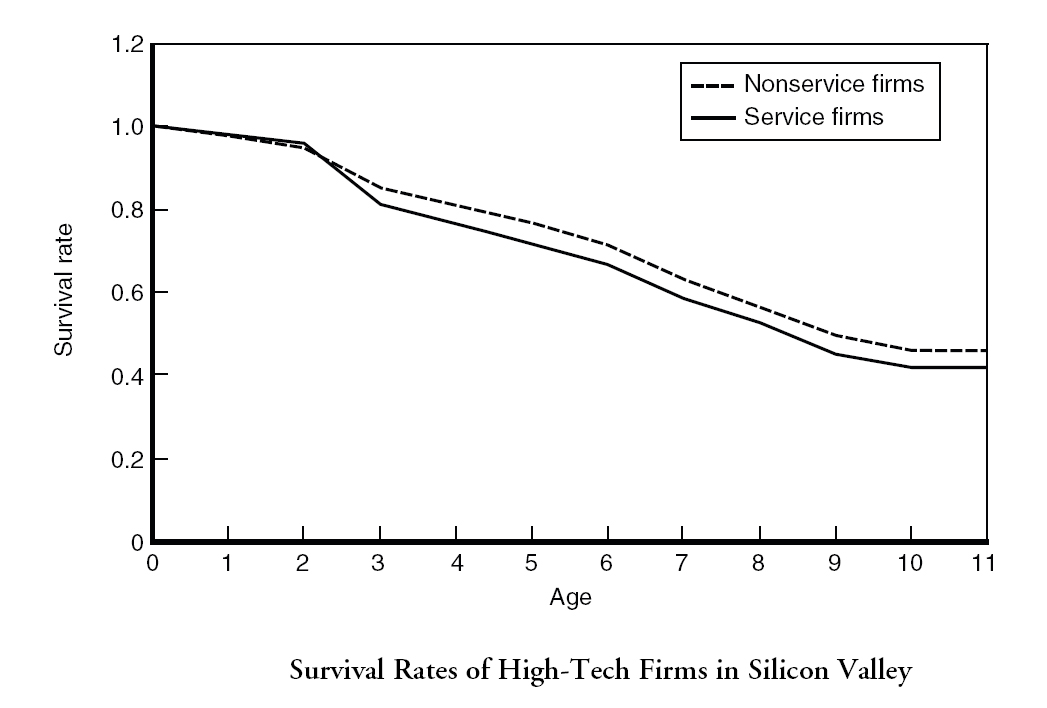

So now that I have mentioned typical keywords of entrepreneurship, (this above is not new at all, but the speakers were great and convincing), I can elaborate on the title of my post . At the Babson conference, there was a paper entitled “MUCH ADO ABOUT NEARLY NOTHING? AN EXPLORATORY STUDY ON THE MYTH OF HIGH GROWTH TECHNOLOGY START-UP ENTREPRENEURSHIP”

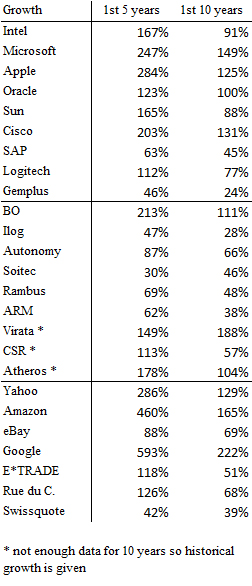

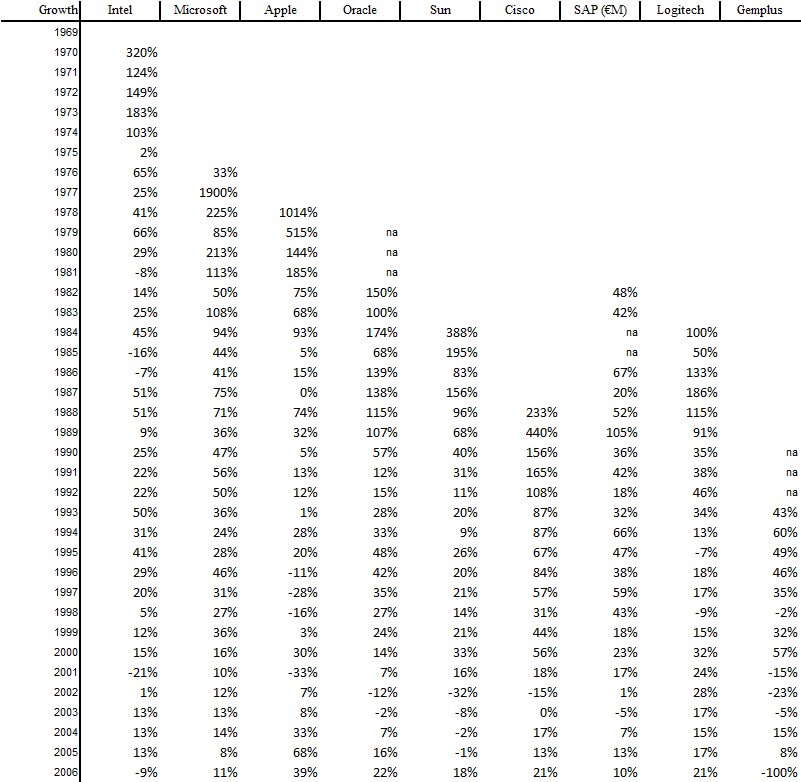

As you may imagine, I was shocked. I was discovering a totally new field of research exemplified by Per Davidsson. High growth would not be as important as profits. Said this way, I do not think anyone would disagree. If you are interested, you should read “Davidsson, P., Steffens, P. & Fitzsimmons, J. 2008. Growing profitable or growing from profits: Putting the horse in front of the cart? Journal of Business Venturing” (pdf manuscript here) if you have the restricted access.

The reason why I was shocked is that my experience with high-tech start-ups is that profits come later than sooner as you need to develop a product that no customer would pay for its development. So first you lose money, usually through funding by investors. Then you grow and generate profits.

Indeed Davidsson is not saying the contrary: in his paper, he states that “For external investors, our results imply that high growth in a low-profitability situation is a warning signal rather than an unambiguous sign of positive development. However, we must caution that our results do not necessarily apply to the much more select group of high-potential firms that VCs invest in. First-mover-advantage (FMA) reasoning suggests radical innovators who create entirely new markets play under different rules to the average SMEs. This said, the lack of proof that size leads to eventual profitability is something that has concerned the very researchers who coined the FMA concept: (Lieberman and Montgomery, 1998:1122). Similarly, in the specific context of disruptive innovation, Christensen and Raynor (2003) have argued forcefully for patience for growth but impatience for profit, a notion directly in line with our ‘profits first’ arguments and findings for SMEs more generally. In combination with our results, this provides sound reason for external investors to put more emphasis on establishing profitability through VRIO resources within their portfolio of firms, and having more patience for the growth that can eventually realize the full value of opportunities developed and pursued by these firms.”

So you could think I feel better. Not at all! The paper “Much ado about nearly nothing” by Malin Brännback, Niklas Kiviluoto and Ralf Östermark, from Åbo Akademi University, Finland and Alan Carsrud, Ryerson University, Canada seems to indicate similar results in high-tech to what Davidsson is stating for SMEs. More specifically, another paper, “Growth and Profitability in Small Privately Held Biotech Firms: Preliminary Findings” by Carsrud and his colleagues states that “A high profitability-low growth biotech firm is more probably to make the transition to high profitability-high growth than a firm that starts off with low profitability and high growth.” Well maybe there is no contradiction between my views and theirs. It might be that start-ups are about outliers and probabilities then are, yes, very low to succeed from low profitability. I am still convinced high value creation comes from there and still, I doubt you can focus on profits first, on growth second in high-tech start-ups. It is however an interesting topic which if true, entrepreneurs, investors, policy makers and researchers should know better about!

Any reaction?