As you noticed recently if you read this blog, IPO filings are piling up. The latest one (I heard of) is Apache Design Solutions and it is very interesting for me because the company belongs the the field of Electronic Design Automation (EDA) which I covered as a full chapter of my book and I follow from time to time the EDA domain on this blog.

EDA is an interestign market because it has reach maturity so you can look at its dynamics over 30 years. I will come back on it at the end of the post. But first, Apache. John Cooley on his DeepChip web site has the best possible description of the company: A brief history of Apache and its IPO.

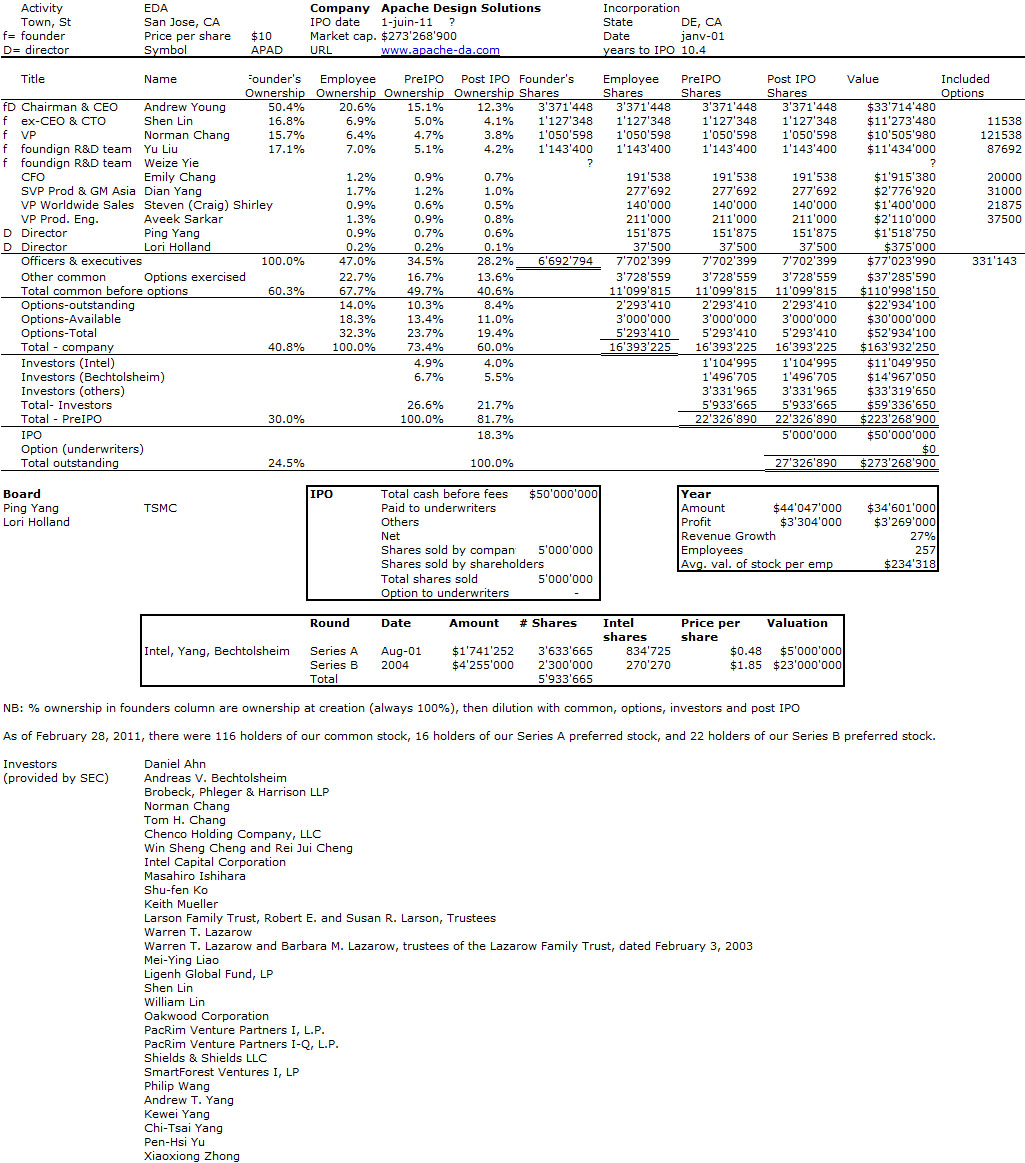

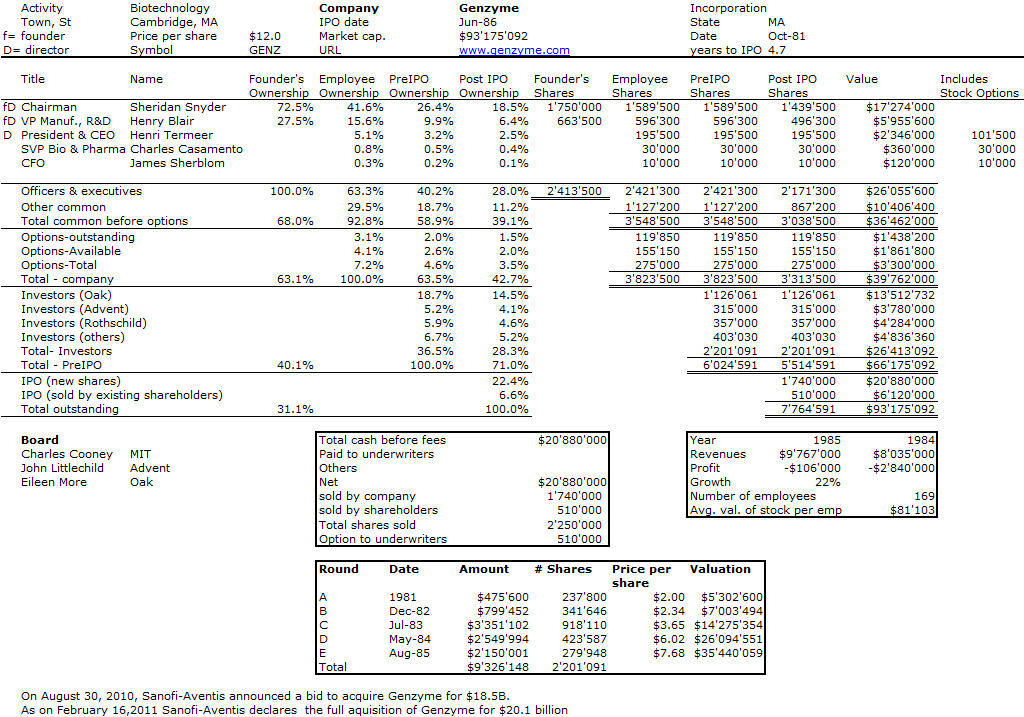

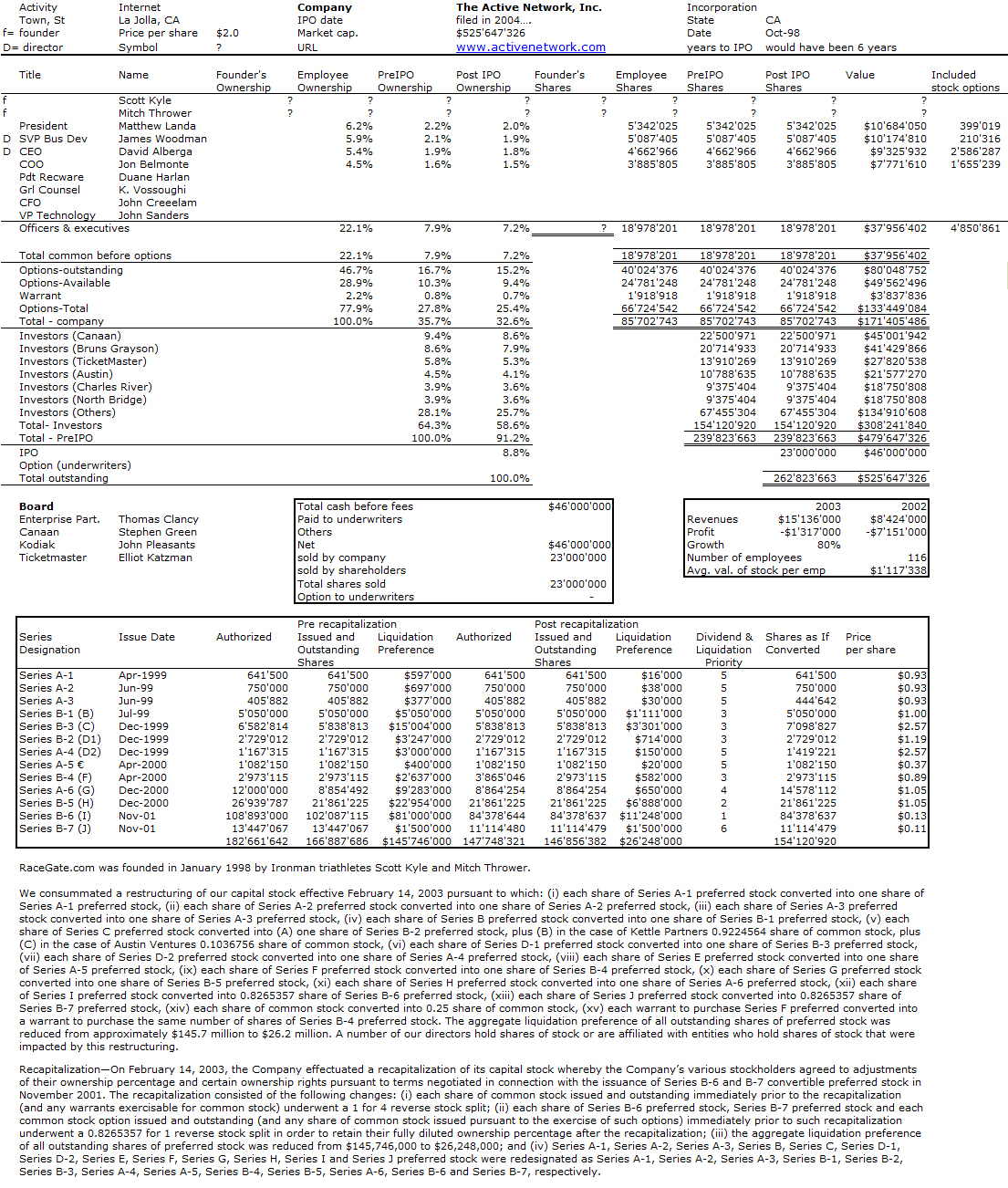

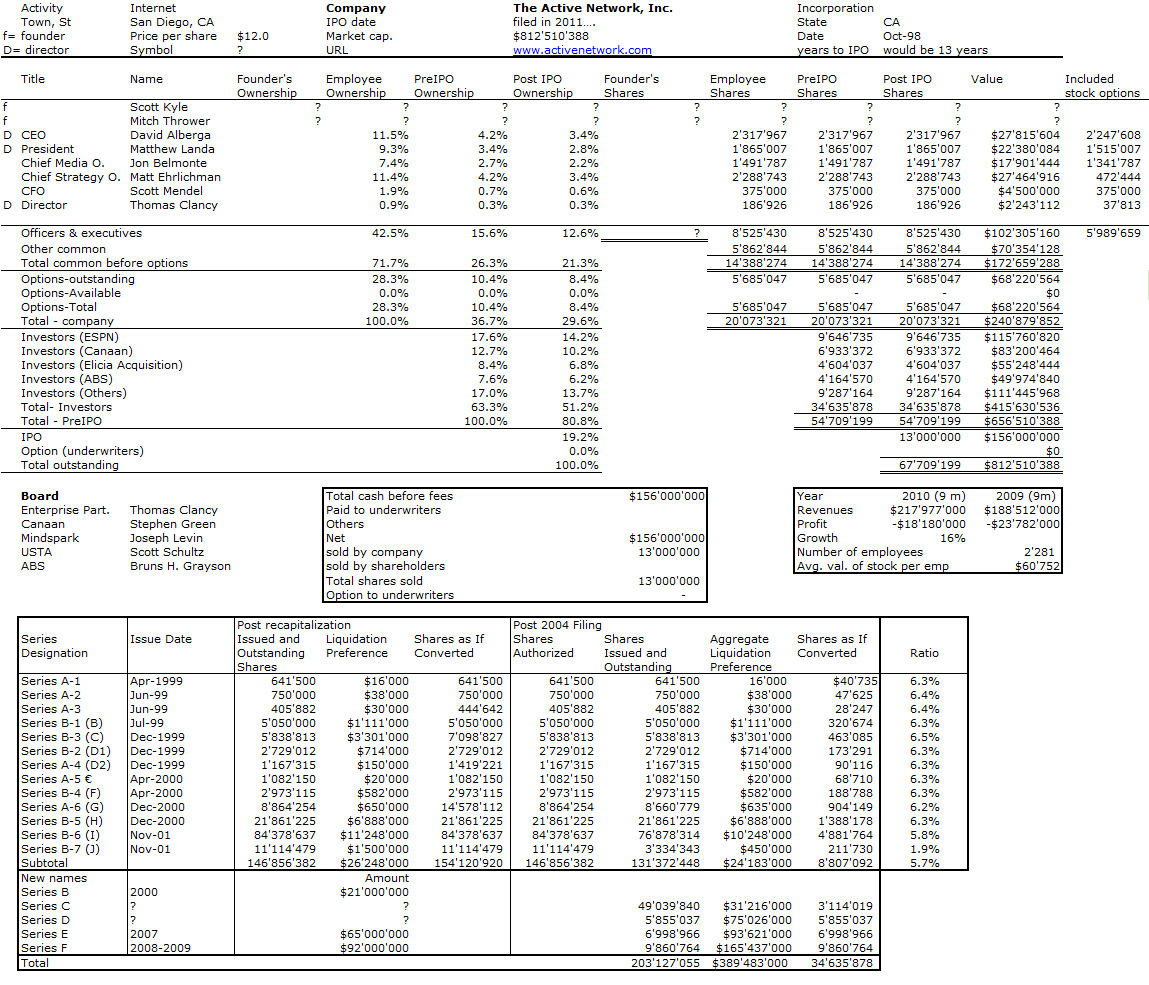

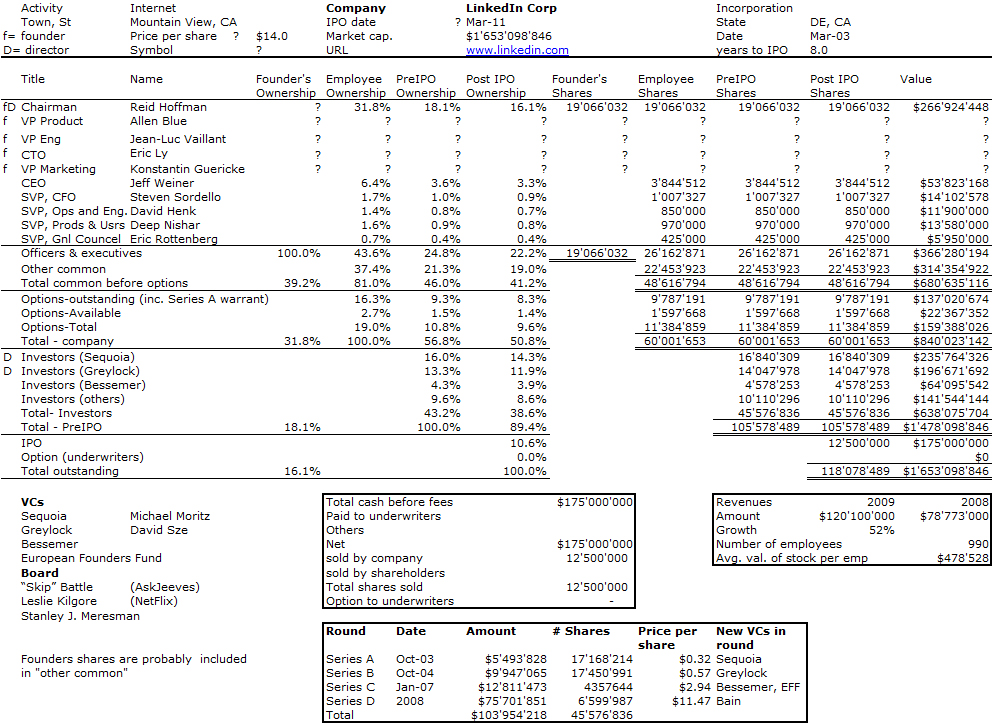

So here is my usual cap. table. It took Apache 10 years to file despite the fact that the company has been profitable for many years. Not very famous investors (though Intel and Bechtolsheim are not bad!), solid revenues and profits. It shows how much the tech sector has suffered. Such companies would have been public easily ten years ago. In fact,a s Cooley notices, tehre has not been any EDA IPO since 2001.

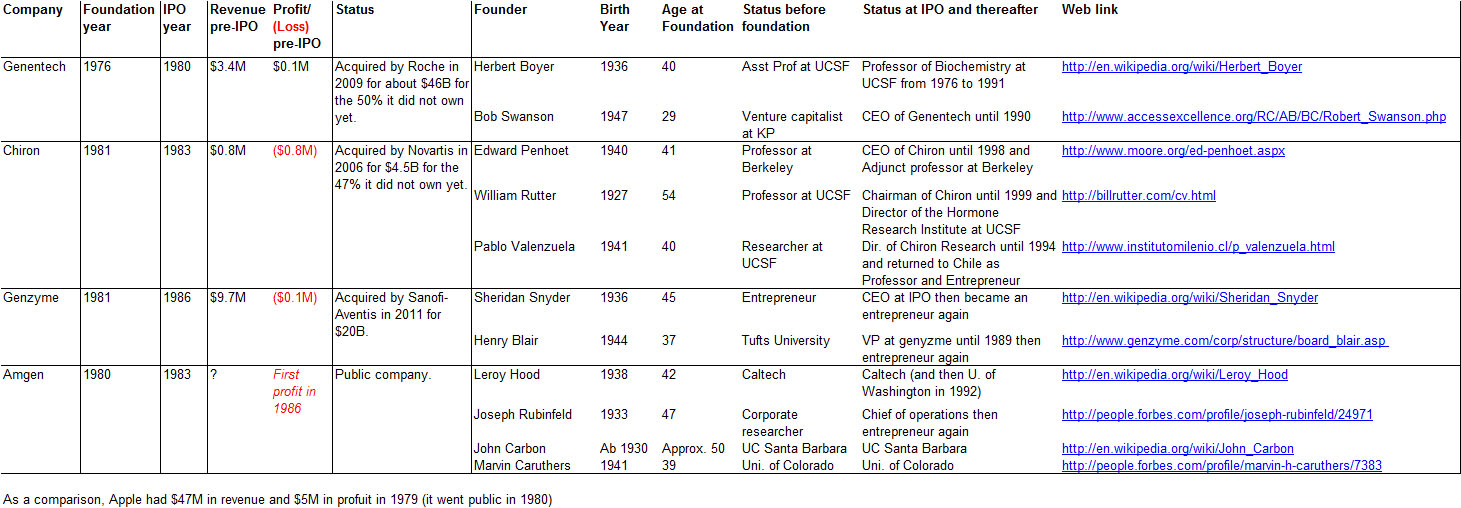

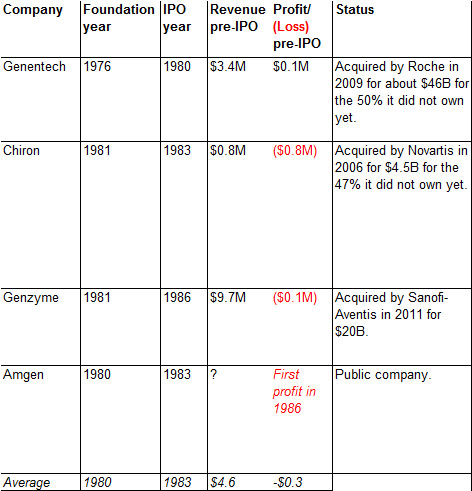

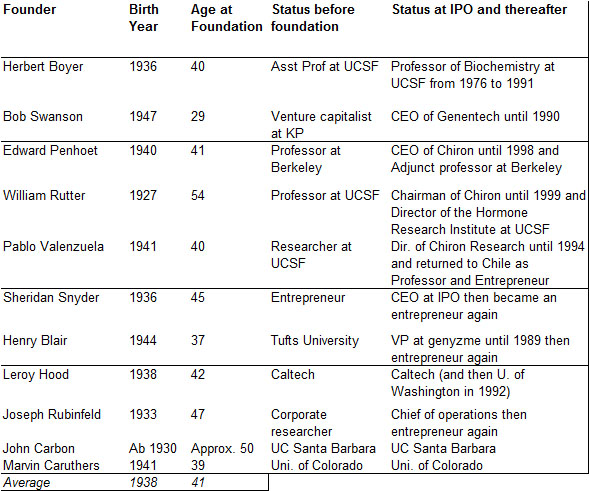

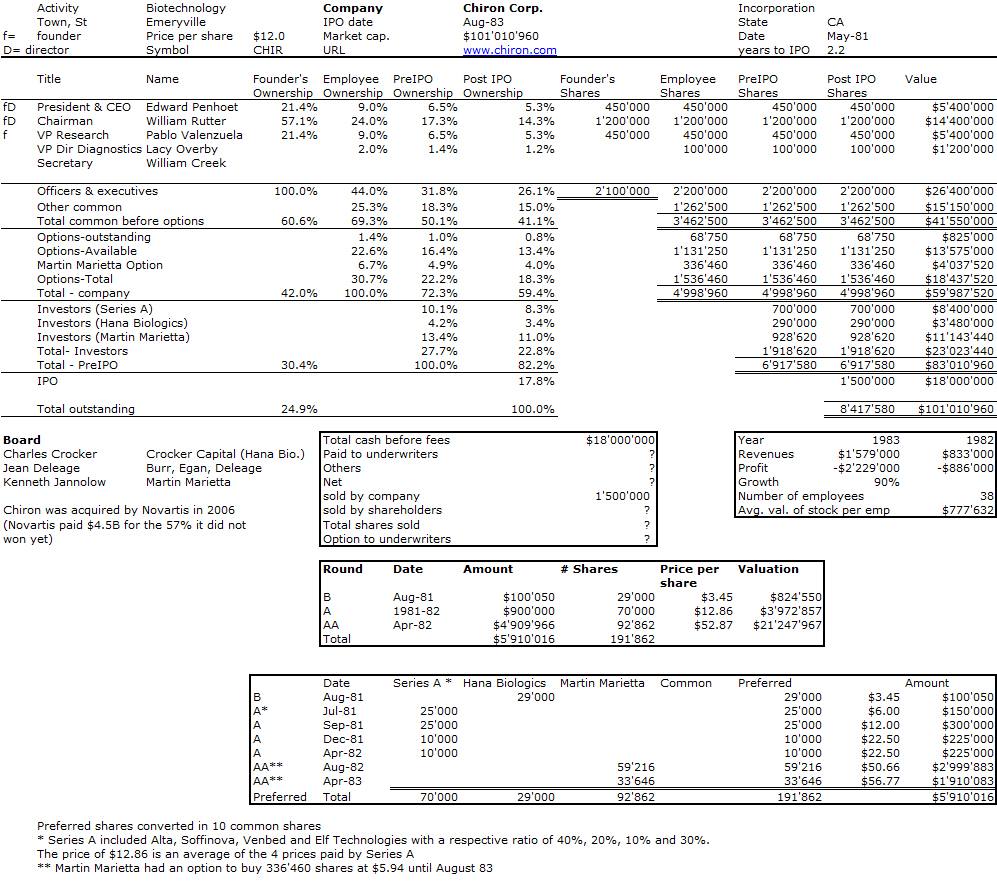

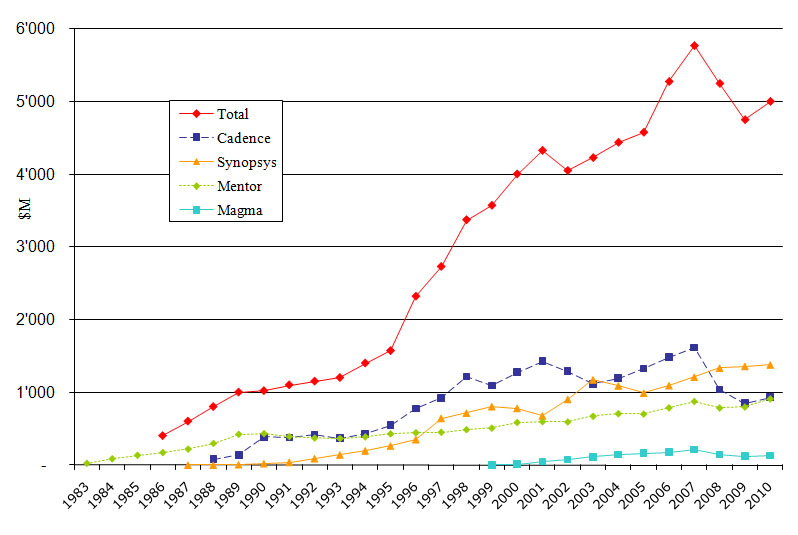

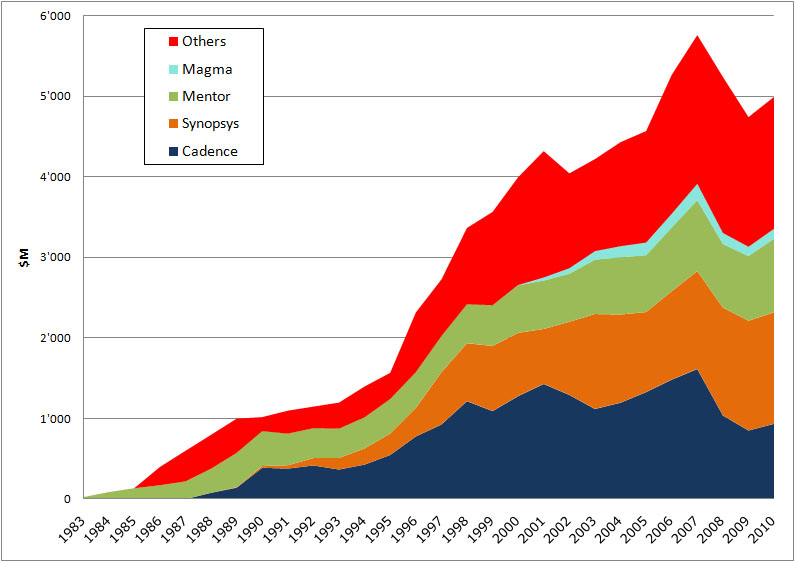

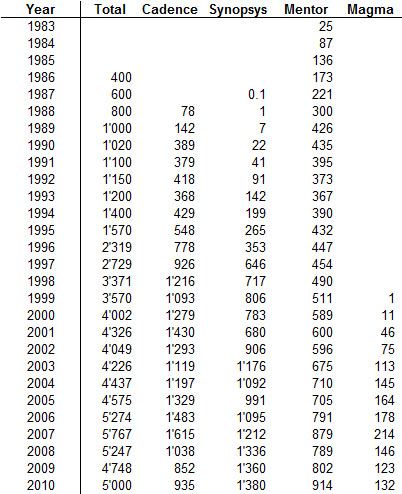

So what about the EDA market? The last EDA IPO in 2001 was… Magma. I will just let you look at the market data and judge about the market.

Figure 1 – EDA Market and Players 1983, – 2010.

Figure 2 – EDA Market and Players, 1983 – 2010.

Table 1 – EDA Market and Players, 1983 – 2010 (Revenues in $M).

NB: the 2010 figures for Total and Magam are assumptions (as they are not known yet).