I just read Biotech IPOs Start to Show Some Modest Signs of Life from Xconomy. It’s an interesting article because it focuses on Biotech, a field that many people consider as very different from other high-tech start-ups such as Internet, Software or IT in general. The general idea is that it takes much longer to succeed in biotech. You should read the article if biotech is of interest for you and I will not comment it more than mentioning that the good news is that there have been recent biotech filings and IPOs, the less good news being that the market capitalizations are not huge.

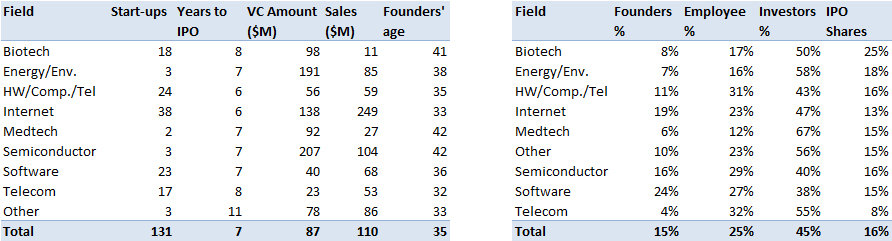

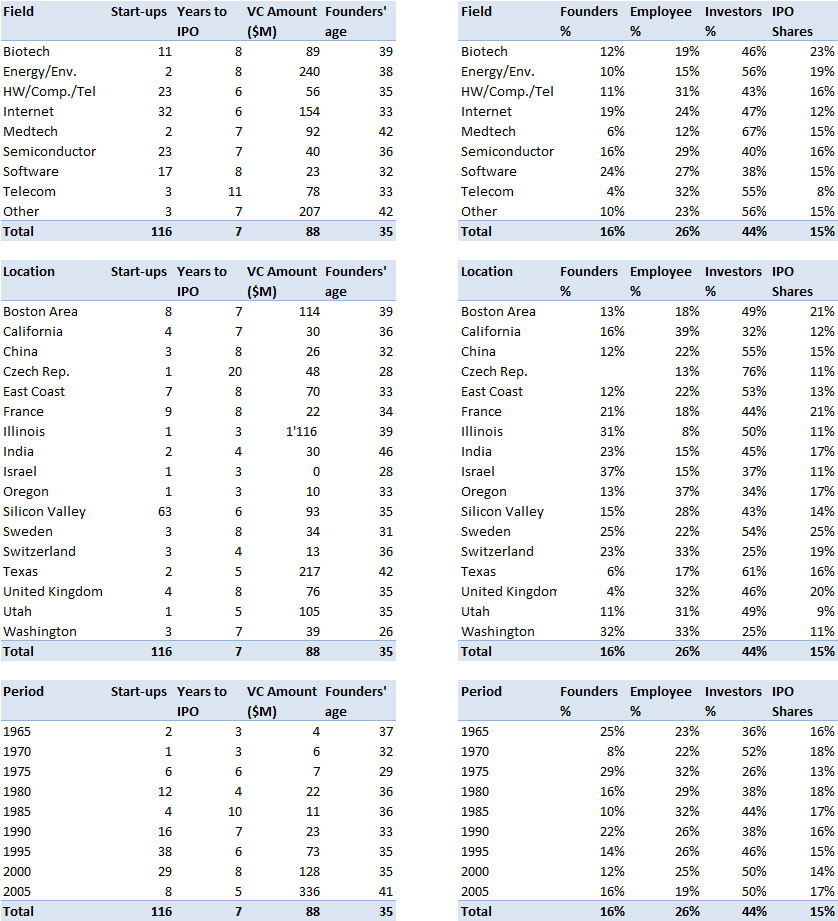

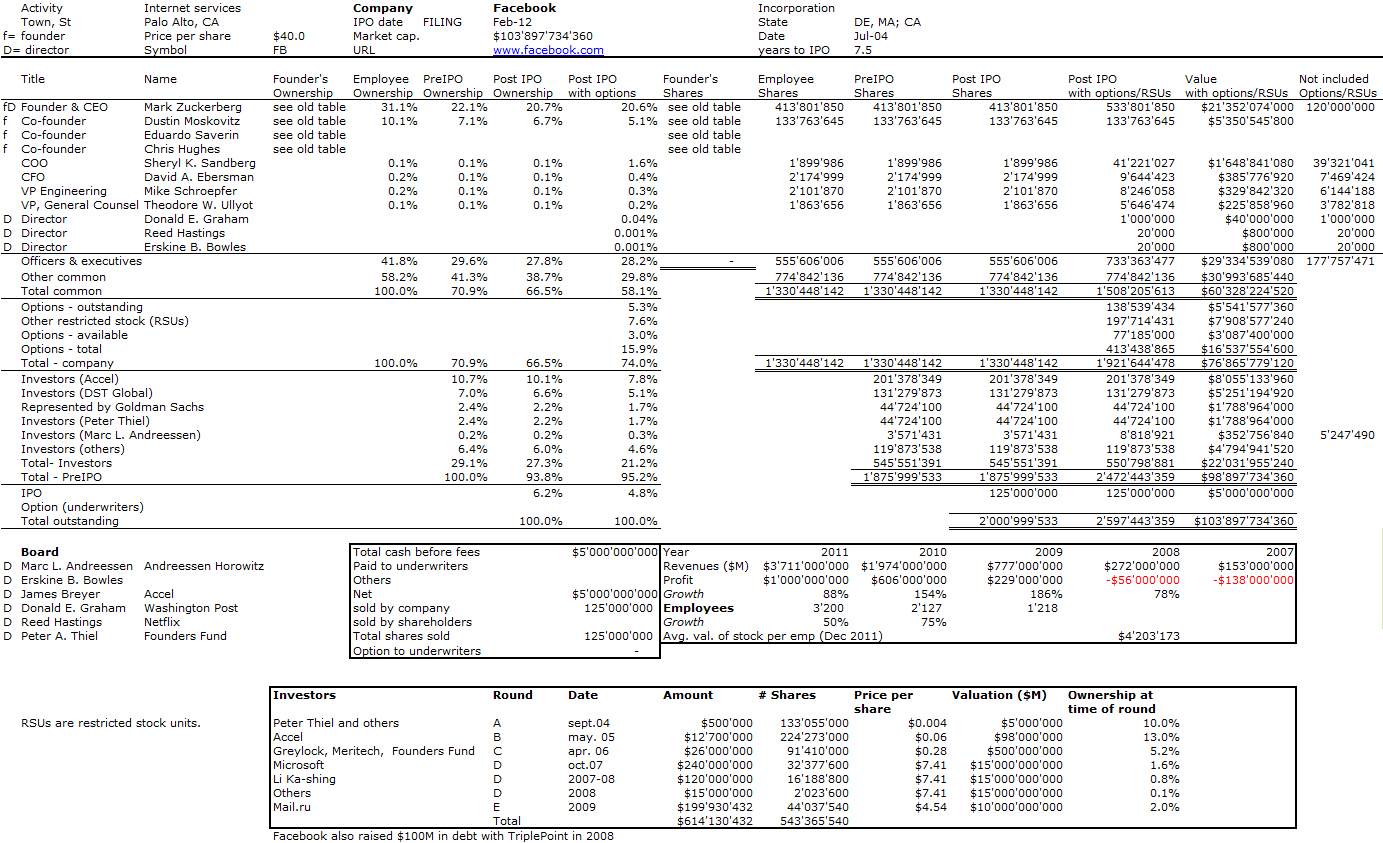

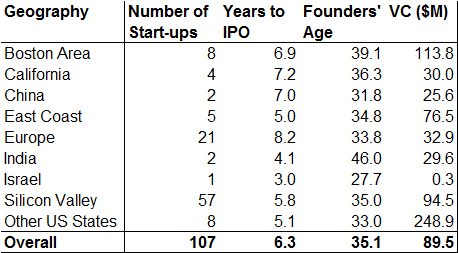

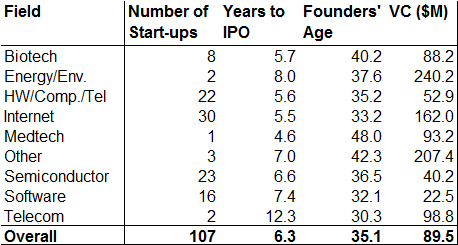

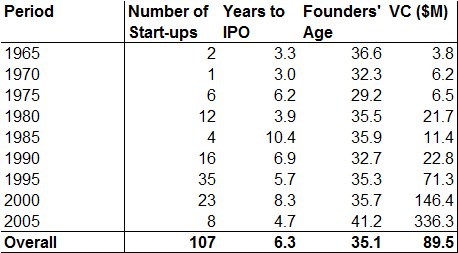

What I am more interested in is updating my regular analysis of start-up data (I have now 131 start-ups; see my latest analysis in March 2012 for example with 116 companies) and see how biotech behaves. Here is the synthesis (if you are interested the detailed list is provided at the end).

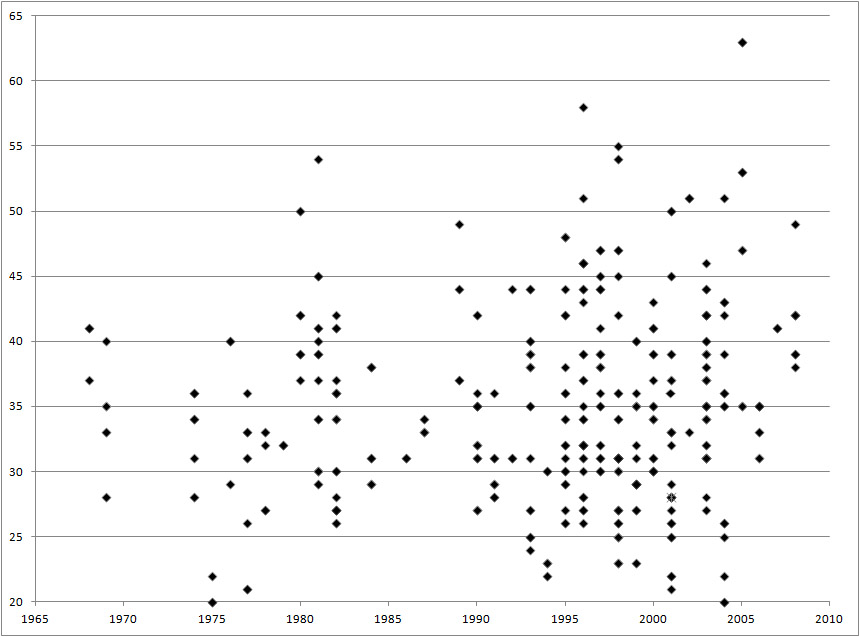

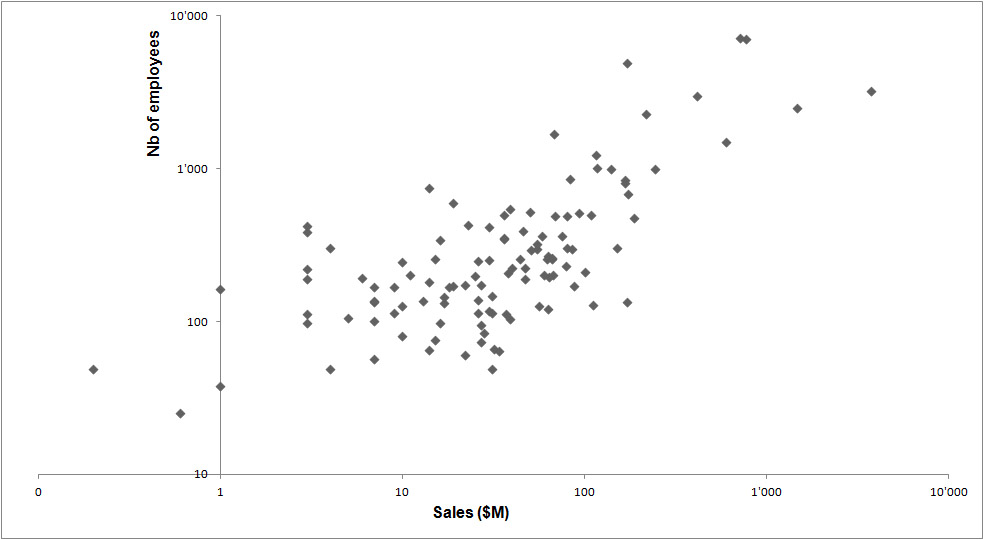

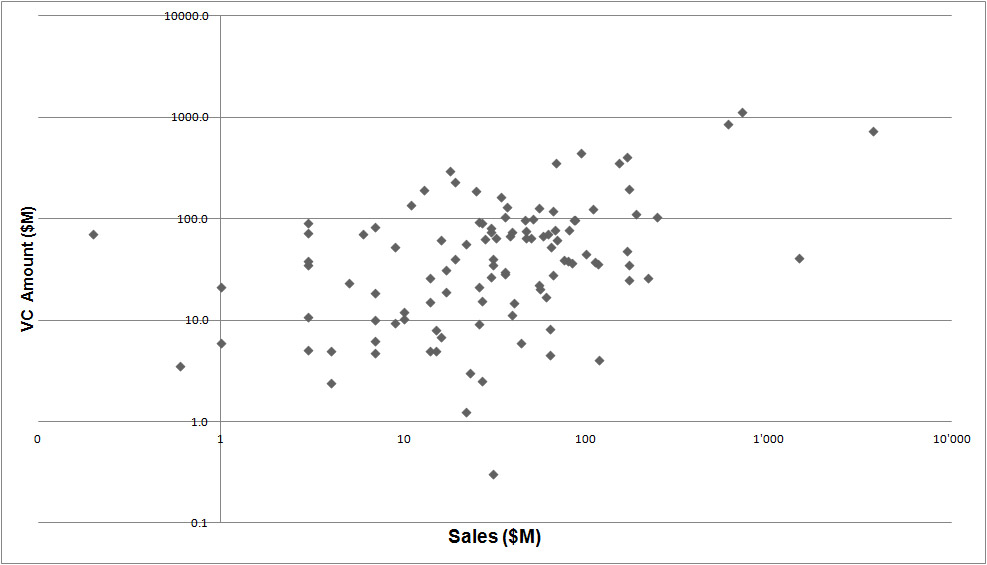

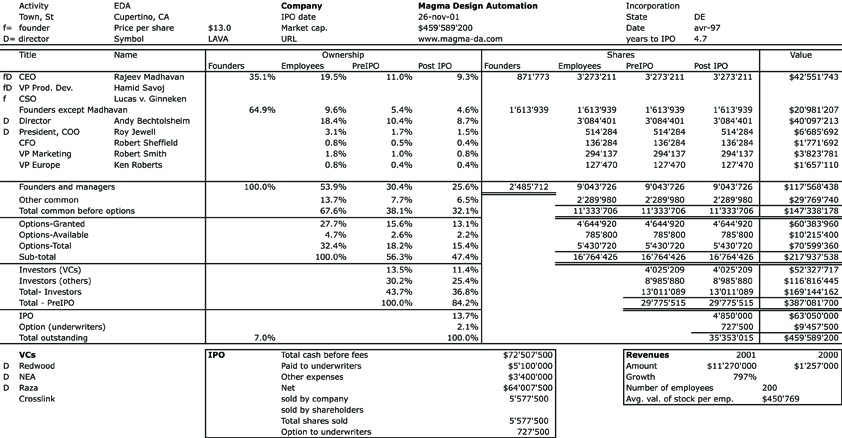

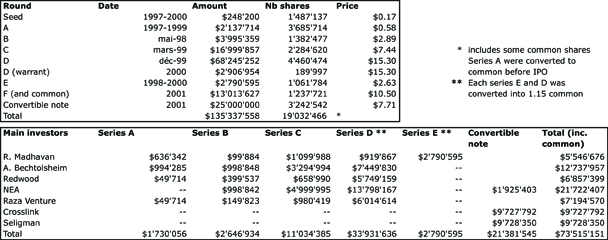

So what do I see as specific to biotech start-ups? First it does not take them longer to go public. 8 years vs. an average of 7 years. The difference is not in the exit time. They raise $98M on average, but this does not look so special either. But, and here is the but, their sales are only $11M when they go public. So, it takes them much longer to reach revenues. But it does not prevent them from going public (or even be acquired when they begin to have good results in clinical trials).

Another specific element is about founders. The founders’ average age is 41 (similar to medtech and semiconductor) whereas it is 35 on average. Why is that? because many founders are established, recognized university professors. Often times, they do not work full-time in the start-up but have a role of chief scientist. Indeed, the ownership of founders in the start-up is smaller than average (8% vs. 15%).

I should also add that the founders/employee shares ownership is much smaller too (25% vs. 40%) and the reasons are manyfold:

– founders have fewer shares as I just mentioned

– investors have more equity (50% vs. 45%)

– IPO shares are higher (25% vs. 16%). This comes from the fact (I think) that in order to raise the same amount of money, it is more dilutive for a company with less revenue…

– I did not mention another statistical element, which is they have fewer employees. The detailed table below imples about 100 employees (and you may see many of them have even less than 50 or 20 employees). This induces a smaller amount of stock options… (On average my 130 companies have 500 employees when they go public).

I thought this data was of some interest. Please react or comment!

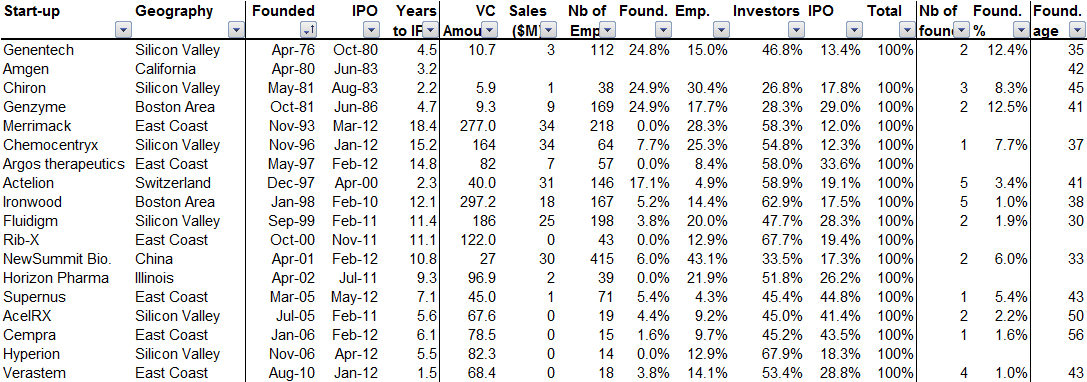

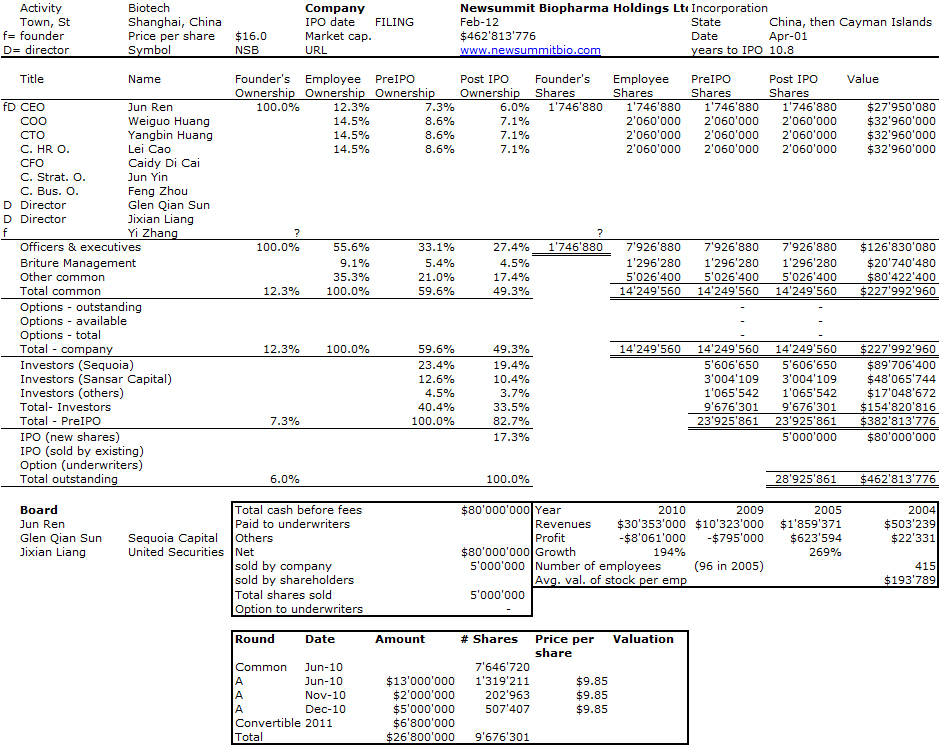

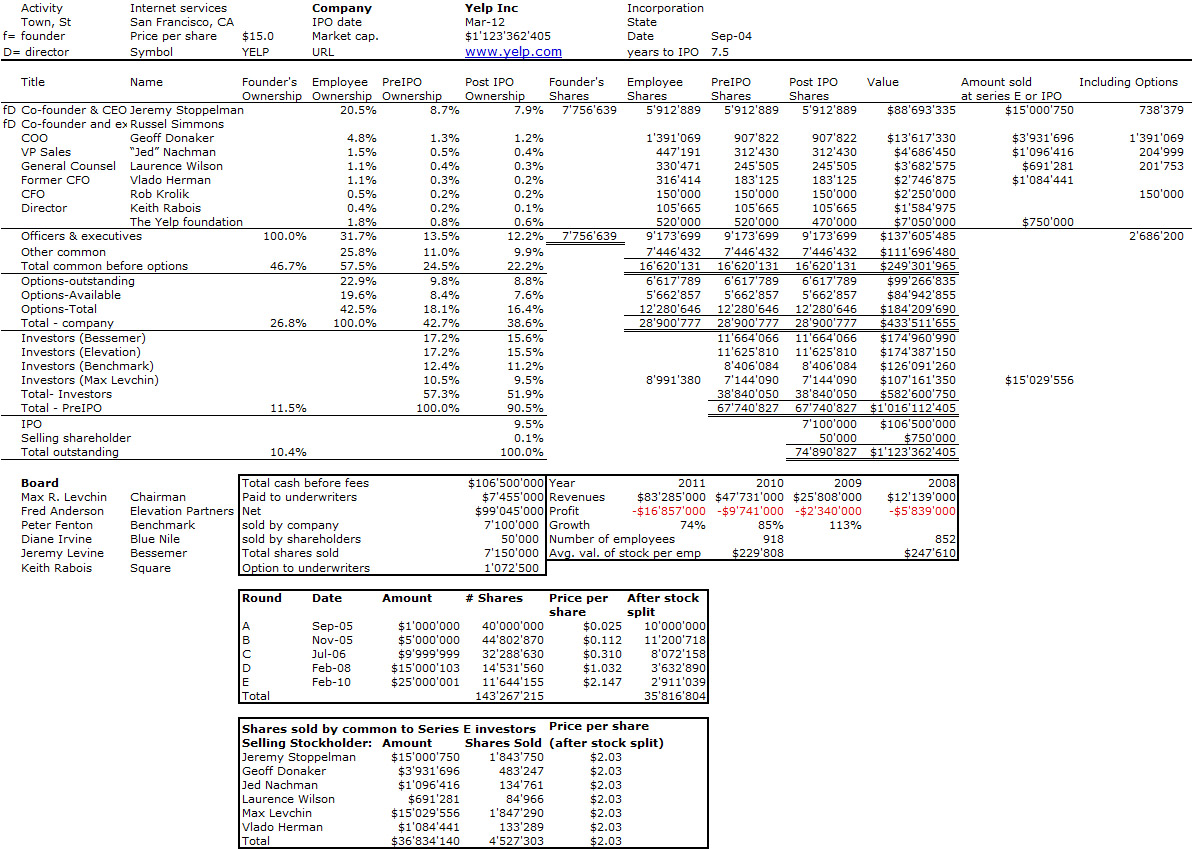

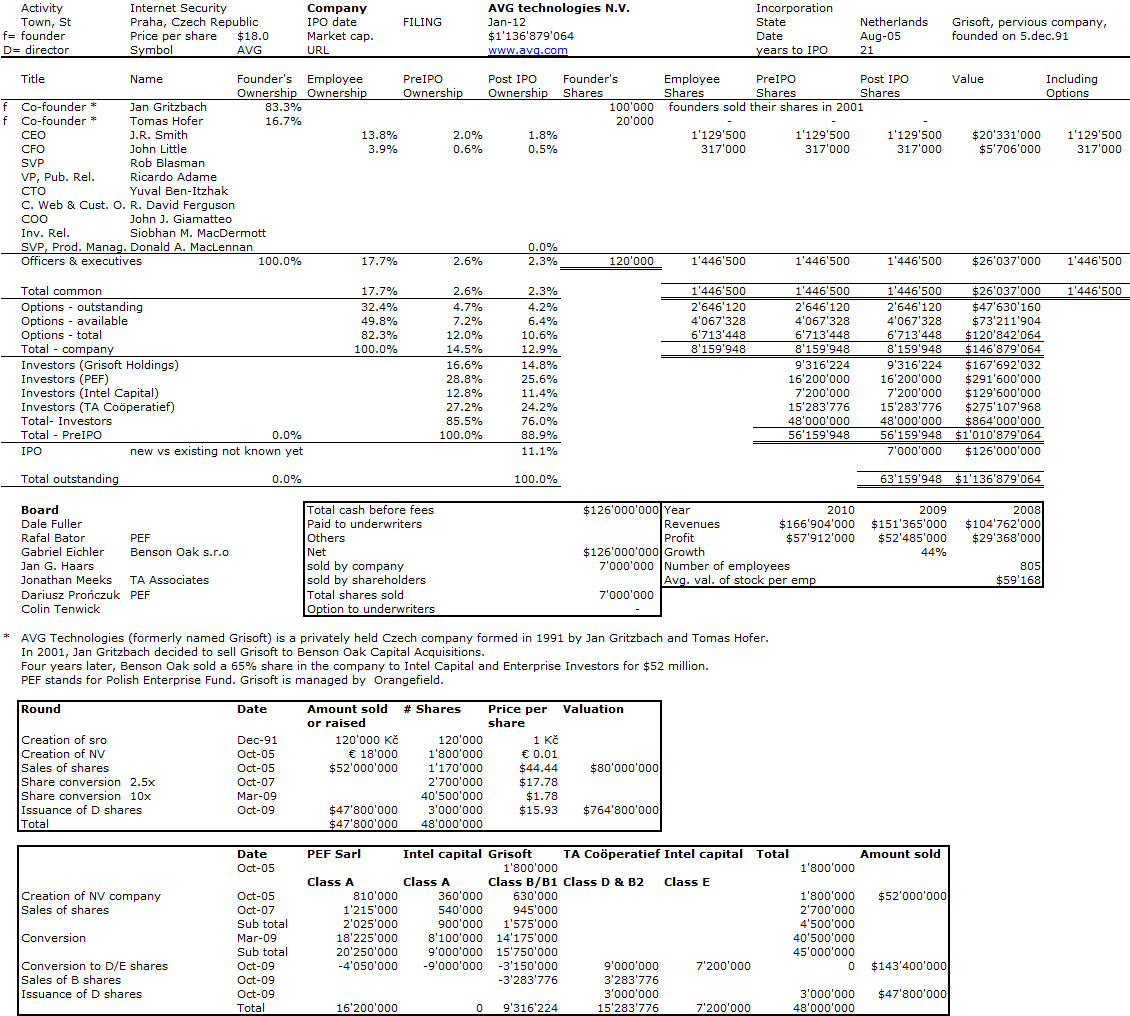

Appendix: detailed data (notice that I am missing the Amgen data)