I could have tweeted only (and not blogged) about the picture below. Its author whom I met today authorized me to put it online. It is good to remember the fundamentals, the basics of entrepreneurship. It does not mean entrepreneurs do not need support, but not too much except if they are too fragile. In the past I had heard many similar things (incubators – incinerators?), and Wikipedia explains that incubators have various functions such as a device used to care for premature babies in a neonatal intensive-care unit, a device for maintaining the eggs of birds or reptiles to allow them to hatch. Once they are out of incubators, at least they are ready for accelerators…

Category Archives: Silicon Valley and Europe

Silicon Valley 2018 : The Libertarians Have Replaced the Hippies

While Trump and Harari were in Davos, I visited Silicon Valley for the nth time. Even more than during my last trips in 2014 and 2016, I could feel the gap that has been created between the Silicon Valley that I discovered and loved in the late 80s and the one that exists today (and that I still love).

As one of my interlocutors mentioned, the Hippie generation – which Leslie Berlin describes in her Troublemakers and which until Brin and Page tried to democratize technology – has been replaced by the Libertarian self-interest of social networking that even Reid Hoffman will have a hard time to balance (see It’s time to change the culture of Silicon Valley). The skyscrapers climb in San Francisco, the poor had to leave or live in tents all over the bay, the venture capital funds do not perform as one might think, the unicorns might disappear one after the other, it takes 3 hours to drive from Berkeley to Palo Alto at 6am, one finds more founders than entrepreneurs according to Leslie Hook, and even Steve Blank is looking at a little less at startups and focuses more on innovation of government organizations.

This is a bit the “Querelle des Anciens et Modernes” and I am not sure Steve Jobs would pass the baton to this new generation when he said in 2005 [death] clears out the old to make way for the new. Some think that Silicon Valley is reaching its limits, but AnnaLee Saxenian said the same thing … in 1979. Will we live old enough to have the answer?

Where the Small-Town American Dream Lives On

“As America’s rural communities stagnate, what can we learn from one that hasn’t?” is the subtitle of Our Town by Larissa MacQuhar in the Nov 13, 2017 paper edition of the New Yorker. The online title is Where the Small-Town American Dream Lives On. It is a strange and fascinating analysis of America. (By the way in the same edition, you can also read The Patriot a critic of the collected nonfiction of Philip Roth, another enlightening explanation of what American-ness is.

The Chamber of Commerce in orange City, Iowa. Photograph by Brian Finke.

Towards the end of this 10-page article, the author writes: In his 1970 book, “Exit, Voice, and Loyalty,” the economist Albert O. Hirschman described different ways of expressing discontent. Your can exit – stop buying a product, leave town. Or you can use voice – complain to the manufacturer, stay and try to change the place you live in. The easier it is to exit, the less likely it is that a problem will be fixed. That’s why the centripetal pull of Orange City was not just a conservative force; it could be a powerfully dynamic one as well. After all, it wasn’t those who fled the town who could push it onward, politically or economically -it was the ones who loved it enough to stay, or to come back.

Americans, Hirschman wrote, have always preferred “the neatness of exit over the messiness and heartbreak of voice.” Discontented Europeans staged revolutions; Americans moved on. “the curious conformism of Americans, noted by observers ever since Tocqueville, may also be explained in this fashion,” he continued. “Why raise your voice in contradiction and get yourself into trouble as long as you can always remove yourself entirely from any given environment should it become too unpleasant?”

There are many other interesting descriptions of people leaving and those staying; and of their ambitions, their motivations. I am not sure how this relates to innovation and entrepreneurship, but I remember Robert Noyce, one of Silicon Valley’s fathers with born in a small town in Iowa… and moved first to MIT for his PhD and then West.

Silicon Valley, 20 years ago

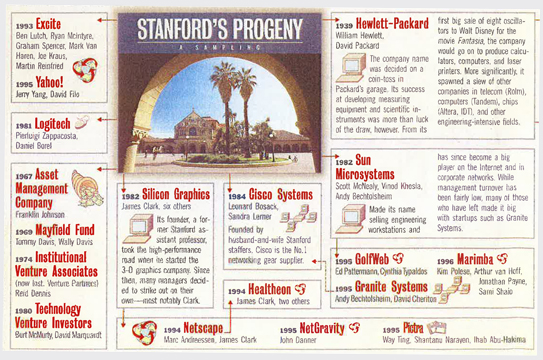

Twenty years ago, I entered the VC and startup world. What an anniversary! It was fun and exciting. I would have forgotten it if I did not have a lunch two days ago with people from Logitech. When we talked about Logitech offices in Silicon Valley, I told them I had a document from Businessweek which showed that Logitech was considered as Stanford’s Progeny.

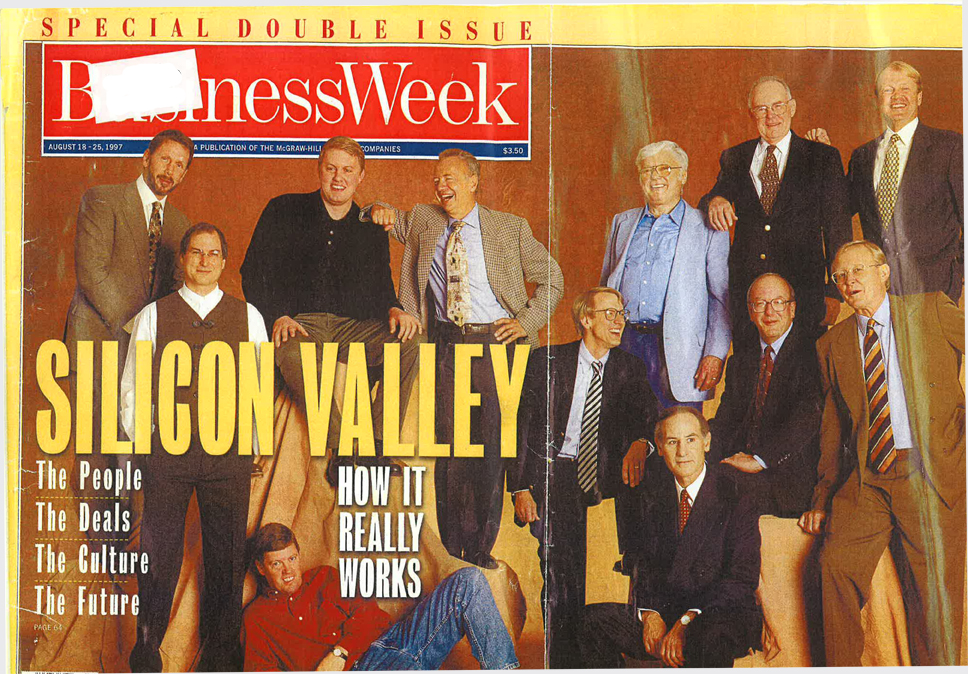

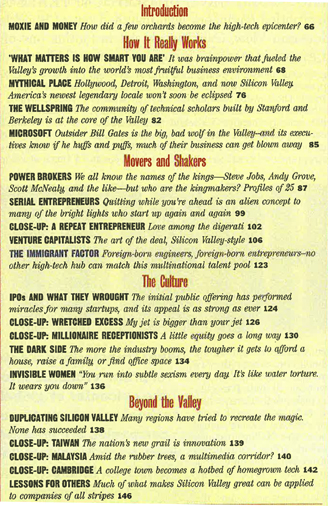

I had to find that document and it was fascinating to go through this 50+ page special issue of Businessweek dated August 18, 1997 and entitled: Silicon Valley, The People, the Deals, the Culture, The Future – How it really works. So let me go through it again.

First the cover. This is a nice little quizz. How many people do you recognize? The answer is at the end of the post.

Second, the table of content. It could be the same today. So things have not changed so much. For example, the migrant factor; the craziness of the area, because of cost, stress; and the invisibility of women, this “subtle sexism every day”.

Third, the recurrent question of why the efforts to duplicate Silicon Valley have all failed…

There are the classical arguments: local governments offer tax incentives or small investments but have no hand in inventing or commercializing technology. And there is an interesting piece: Even private efforts to clone the Valley have fallen flat. Terman, the father of Silicon Valley, was hired in the 1960s to recreate the magic in New Jersey and Texas. He focused on establishing strong research institutions, like Stanford, that could provide a petri dish for bright ideas. But Terman was hired by large organizations, including Bell Labs and Texas Instruments Inc., and few company men were willing to chance a startup. ‘He failed, in part, because he overestimated the importance of academia and in part because he was hired by large companies with no entrepreneurial traditions.’

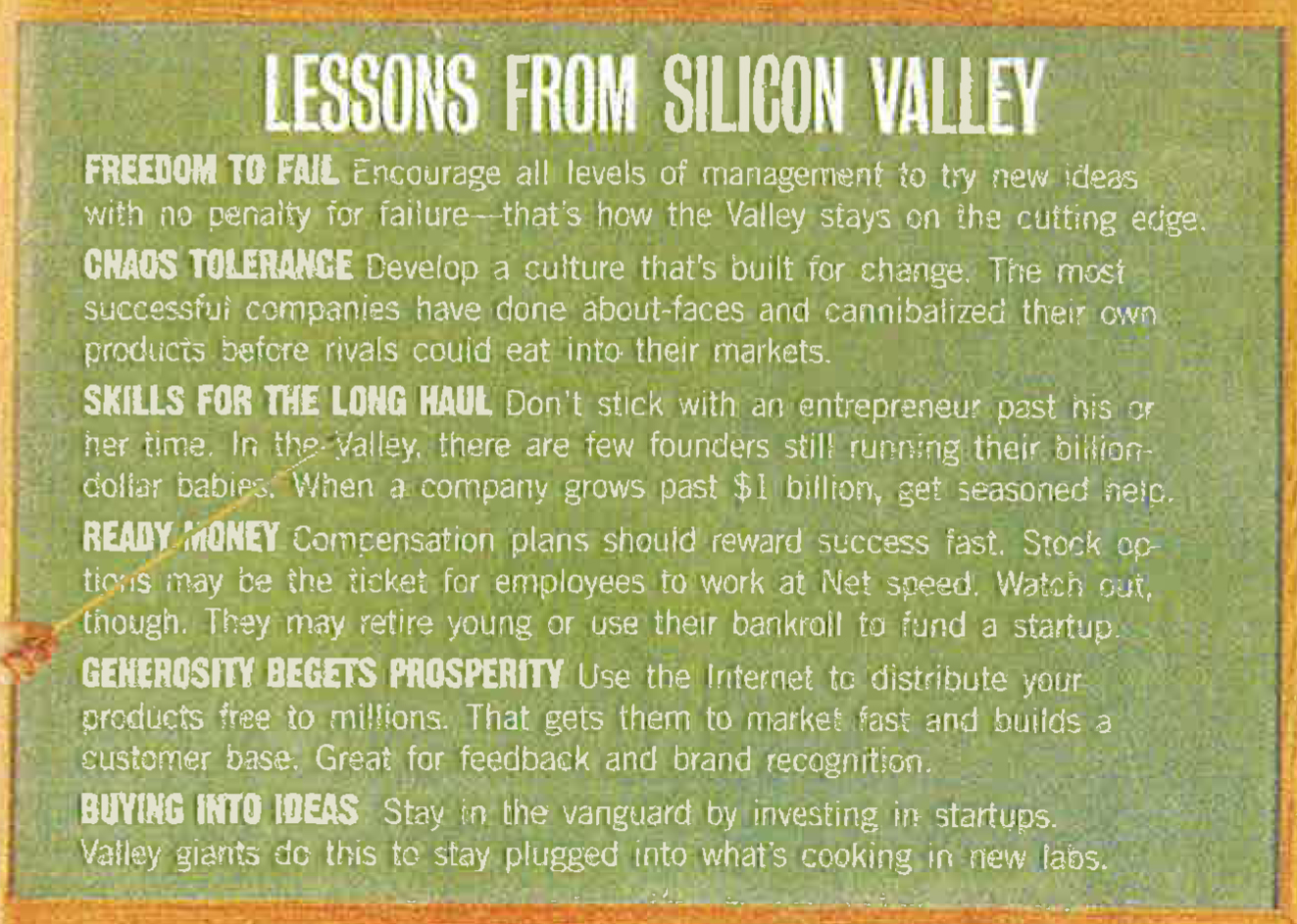

Finally, what are the lessons learnt? Well known and still valid today…

If you want the pdf, just ask me. This would be a private gift. Whereas putting the full document onlien would be copyrigth infrigement…

Answer to the quizz: A dozen of the Valley’s brightest stars: (top row, left to right) Larry Ellison, Oracle; Marc Andreessen, Netscape; Andy Grove, Intel; Al Shugart, Seagate Technology; Gordon Moore, Intel; John Chambers, Cisco Systems (bottom row, left to right) Steve Jobs, Apple Computer, Pixar; Scott McNealy, Sun Microsystems; John Doerr, Kleiner Perkins Caufield & Byers; Larry Sonsini, Wilson Sonsini Goodrich & Rosati; Lew Platt, Hewlett-Packard; Jim Clark, Netscape.

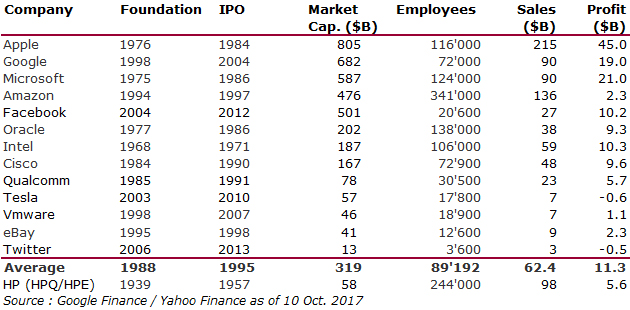

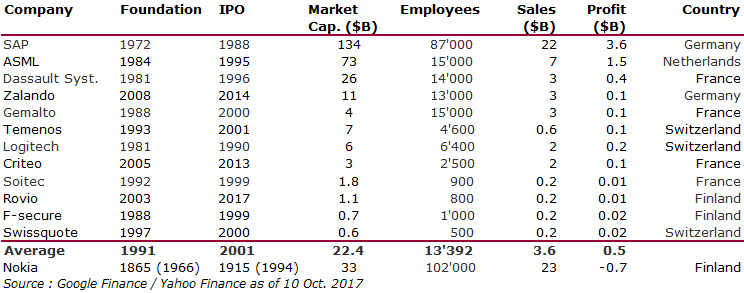

The top US and European (former) start-ups in 2017

Since I published my book in 2007, I have regularly been doing the exercise of comparing the largest US (former) start-ups and their European counterparts. You can look at my data in 2016 in The top US and European (former) start-ups in 2016. Here are my update lists:

Things have not changed that much. Yahoo is out. Rovio is in…

Is Switzerland a Startup Nation?

This is the question I was asked to answer at the EPFL Forum today. Well it was even “Is Switzerland the Startup Nation?” I did not answer the question but tried to provide food for thought and I invite you to look at the slides below.

Now that you may have read them, I will add two points I did not mention in my talk:

First Swiss newspaper Le Temps analyzed the issue: Are we, too, a start-up nation from the point of view of the Israelis? ‘I have a message for Switzerland, Dov Moran announces: you do not have enemies and so you do not have to spend 20% of your GDP on your protection. If you’re less entrepreneurial than us, it’s not that bad.’

Then again Orson Welles about creativity and war… “In Italy, for thirty years under the Borgias, they had warfare, terror, murder and bloodshed, but they produced Michelangelo, Leonardo da Vinci and the Renaissance. In Switzerland, they had brotherly love, they had five hundred years of democracy and peace – and what did that produce? The cuckoo clock.” in The Third Man, said by Holly Martins to Harry Lime…

Just food for thought.

A new toxic pattern in Silicon Valley – Sexism and even worse?

Silicon Valley is talking these days a lot about sexism and harrassment. If you have nmot heard botu it yet, you may just want to read:

– Women in Tech Speak Frankly on Culture of Harassment from the New York Times, dated June 30, 2017.

– Uber’s Opportunistic Ouster in the New Yorker, dated July 10.

I have already mentioned here some dark features of Silicon Valley. For example:

– Is Silicon Valley crazy (again)? in January 2016,

– Something rotten in the Silicon Valley kingdom? in January 2014,

– Silicon Valley and (a)politics – Change the World in NOvember 2013,

There is no doubt Silicon Valley is not a paradise. But i had never seen it as a sexist place. At least not more sexist thn the rest of the planet. And yes, there has been terrible stories, such as rapes on the Stanford campus, but my recollection of the area is more of an asexual place, mostly of introvertite people, like you could see on HBO’s Silicon Valley (right from its 1st episode). Just read (again?) the funny and sad comment: “That’s weird, they always travel in groups of 5, these programmers. There is always a tall skinny white guy, a short skinny asian guy, a fat guy with a ponny tail, some guy with crazy facial hair, and then an east indian guy. It’s as if they trade guys until they have the right group.

– You clearly have a great understanding of humanity.”

But if there is something ot be said about all this, is that hwoever complex a society is and it is never easy to explain human interactions without being simplistic, what some and maybe too many individuals are doing in Silicon Valley is unacceptable and should be fought so that it happens less and less often…

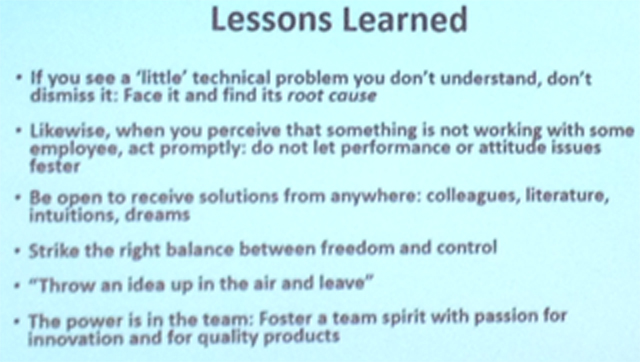

When the Inventor of the Microprocessor and Founder of Synaptics Talks

I had never mentioned here Federico Faggin, another European who became a serial entrepreneur in Silicon Valley. He was at EPFL today where he delivered an amazing speech about creativity and courage, the two elements inventors, innovators and entrepreneurs critically need. If you do not know him, just rush to his wikipedia page: “an Italian physicist, inventor and entrepreneur, widely known for designing the first commercial microprocessor. […] He was co-founder, with Ralph Ungermann, and CEO of Zilog, the first company solely dedicated to microprocessors. He was also co-founder and CEO of Cygnet Technologies and of Synaptics.”

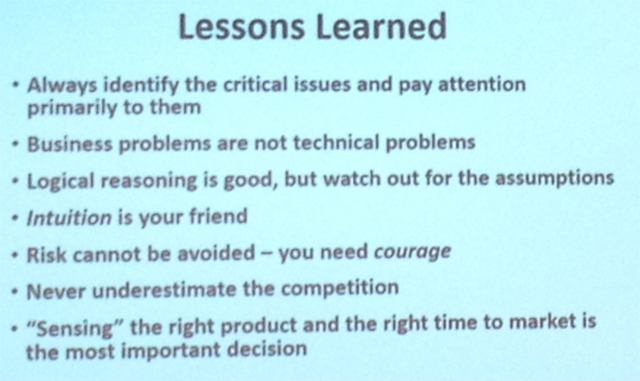

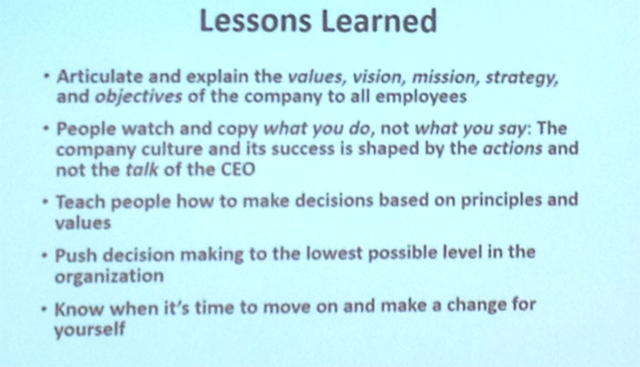

I hope his talk will be put online, in which case I will give the reference later. In the mean time, here are just 3 pictures (taken by a colleague, thanks!) about his lessons learned.

– If you see a ‘little’ technical problem you don’t understand, don’t dismiss it: Face it and find its root cause

– Likewise, when you perceive that something is not working with an employee, act promptly: do not let performance or attitude issues fester

– Be open to receive solutions from anywhere: colleagues, literature, intuitions, dreams

– Strike the right balance between freedom and control

– ‘Throw an idea up in the air and leave’

– The power is in in the team: Foster a team spirit with passion for innovation and for quality products

– Always identify the critical issues and pay attention primarily to them

– Business problems are not technical problems

– Logical reasoning is good but watch out for the assumptions

– Intuition is your friend

– Risk cannot be avoided – you need courage

– Never underestimate the competition

– ‘Sensing’ the right product and the right time to market is the most important decision

– Articulate and explain the values, vision, mission, strategy and objectives of the company to all employees

– People watch and copy what you do, not what you say: The company culture is shaped by the actions and not the talk of the CEO

– Teach people how to make decisions based on principles and values

– Push decision making to the lowest possible level in the organization

– Know when it’s time to move on and make a change for yourself

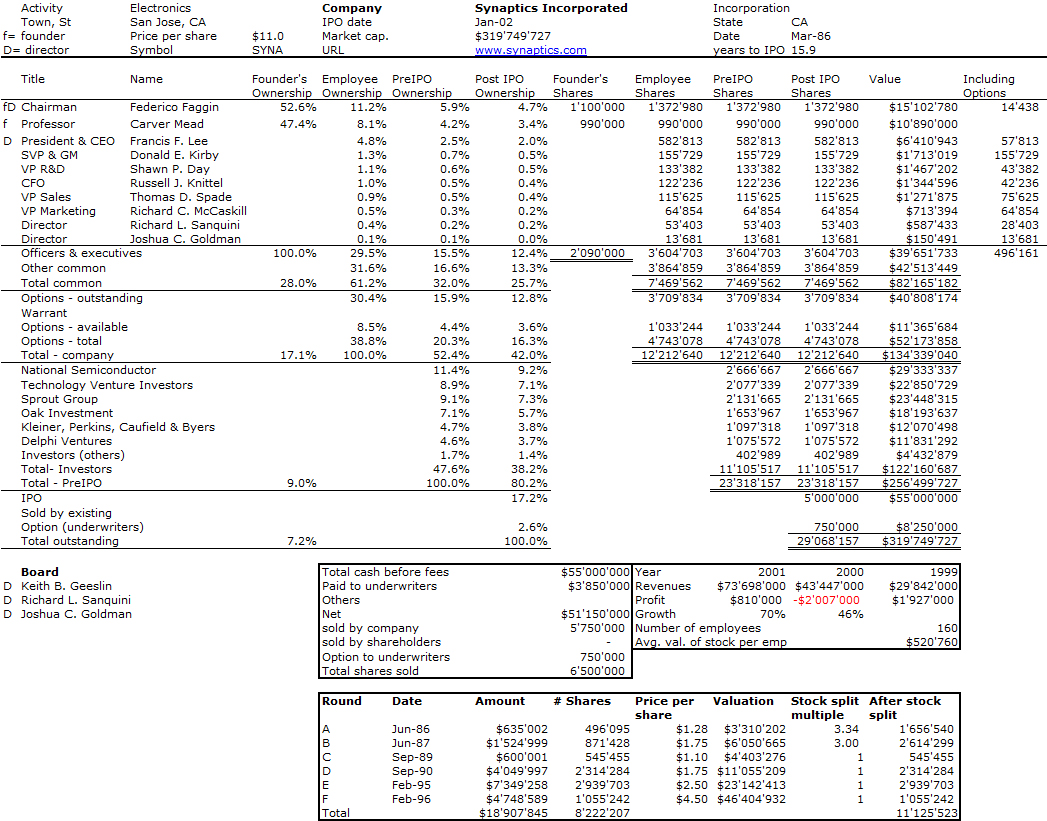

As a conclusion to this post, here is my usual cap. table when I have data about founders. Here is Synaptics.

The University-based Startup Porsche Principle. Or is it the Tesla Principle?

Or should it be called the Tesla Index?

In the book The Rainforest that I am currently reading, the authors write about Role Models that “a common phenomenon of university-based startup companies in the United States is what is sometimes jokingly called the Porsche principle. This principle holds that one of the greatest motivators for professors or graduate students on campus to start new companies is when one of their colleagues drives up in a new Porsche after selling their startup. Confidence is contagious”. [Page 210]

It reminds me a famous quote by Tom Perkins: “The difference is in psychology: everybody in Silicon Valley knows somebody that is doing very well in high-tech small companies, start-ups; so they say to themselves “I am smarter than Joe. If he could make millions, I can make a billion”. So they do and they think they will succeed and by thinking they can succeed, they have a good shot at succeeding. That psychology does not exist so much elsewhere.”

I’ve seen it in Europe too, but to be honest, today, at EPFL and probably elsewhere, I would call it the Tesla principle… or Tesla Index. I biked quickly on campus today and here is what I found, although I know of at least 4-5 Teslas close-by… Could this become the equivalent for Innovation to the Impact Factor in Research?!!!Don’t take all this too seriously. Launching a start-up is not motivated by money. It is mostly about passion…

And two more on June 13, 2017…

and June 15, 2017

EPFL’s Tesla Index on June 15, 2017 is larger than 3…

The State of the European Tech

The recently published The State of the European Tech, co-sponsored by Atomico and Slush is an extremley interesting analysis of the European tech start-up and VC scene. it is a rather long 118-slide document but most (not all) pages provide food for thought.

Here are a couple of comments, in the page order:

– The introduction is too optimistic (slides 5-7). I doubt their title: the future is being invented in Europe. But it has always been Atomico’s founder vision: see Europe and Start-ups : should we worry? Or is there hope? The future will tell us… One interesting point though: London, Berlin and Paris are the 3 hubs main European hubs and Paris was probably underestimated (in the past).

– The entrepreneurial mindset is continuously improving (slides 15-16). Repeat entrepreneurs are more numerous (slide 18). And they mention their importance not so much as future successful entrepreneurs (you may know my doubts – check Serial entrepreneurs: are they better?) but because of the experience and network they bring.

– I love slide 21 with EPFL #4 world wide in Computer Science (though I hate these rankings!). Switzerland is clearly on the map together with the UK. I am honestly less convinced about the impact of business schools in tech (slide 22). Talent exists in Europe but may not be available for tech (slide 23).

– Again the three top hubs are obvious: together London, Paris and Berlin outnumber Silicon Valley. But the ranking from #4 to #20 is mostly linked to city size, not so much any unique positioning. Tech is creating jobs faster than other industries (slide 26). Never too late! But again Europe is fragmented with 153 identified tech hubs (slide 34)

– Migrants (slides 27-29). Again the UK is #1. France and Germany follow. And Switzerland is well-ranked (except for non-Europeans).

– Local entrepreneurs want to stay home (slide 37): 60% prefer home to another place in Euope (17%) or Silicon Valley (12%), even if 25% of founders incorporated outside of their home country (slide 38). Clearly Europe exists! Even if slide 39 shows more local migrations inside Europe, with the exception of London and Berlin again and the links between hubs are weak (slide 41)

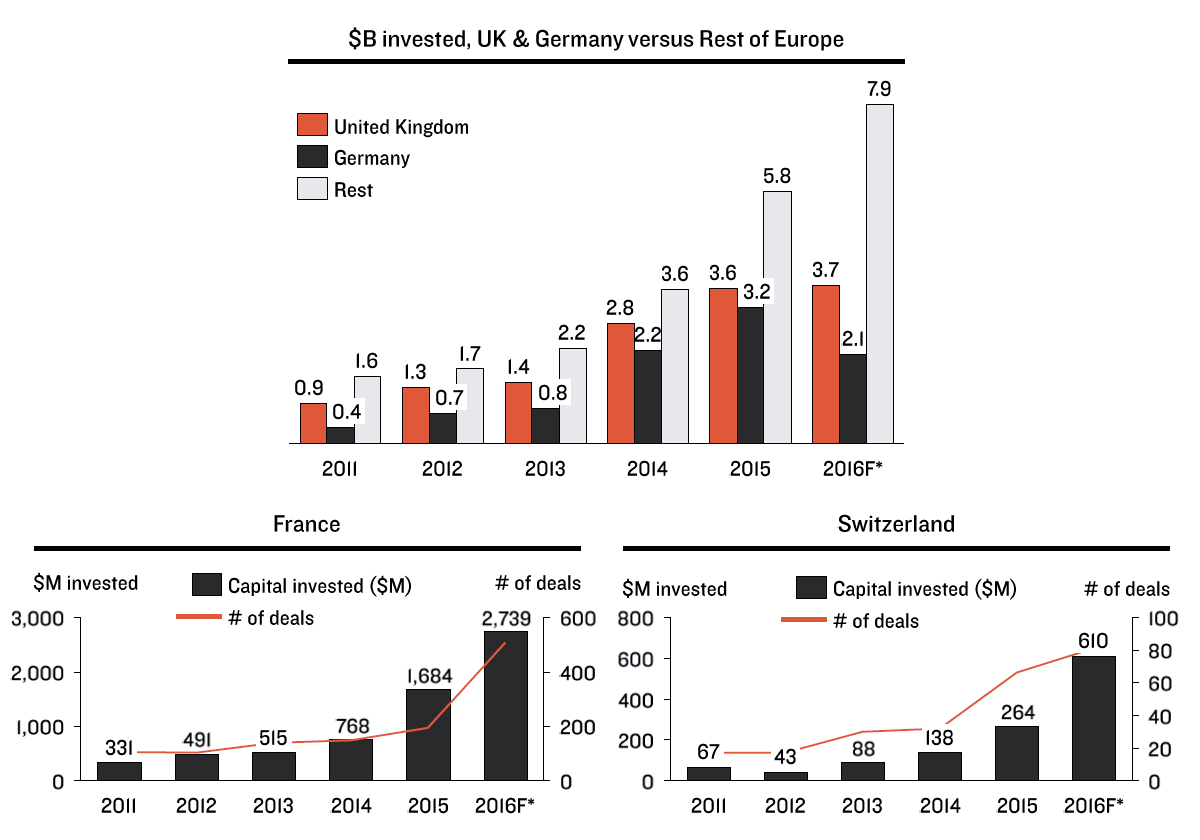

– The slides about venture capital are the most surprising. Slide 46 shows that the European investments have jumped from less than $5B before 2013 to $13B in 2015-16. (In comparison the US is about $30B). And the growth is consistent from early eseed ($0-2M) to early stage ($2-5M) and later stage ($10-50+M). I assemble here their data about the UK, Germany, France and Switzerland (slides 50-52). A new generation of investors is confirmed, those who were entrepreneurs 1st (slide 60). The early such actors were Atomico, Liautaud/Balderton, Niel/Kima. But many emerge. A new generation of funds also emerge (slide 64), and yes, US funds invest in Europe (slide 65)

– Their section about deep tech is less convincing (to me). Probably I did not fully understand what they meant by that and why it would be so special. Slides 78-9 about US tech giants coming to Europe and about their acquisitions in Europe is worth checking though.

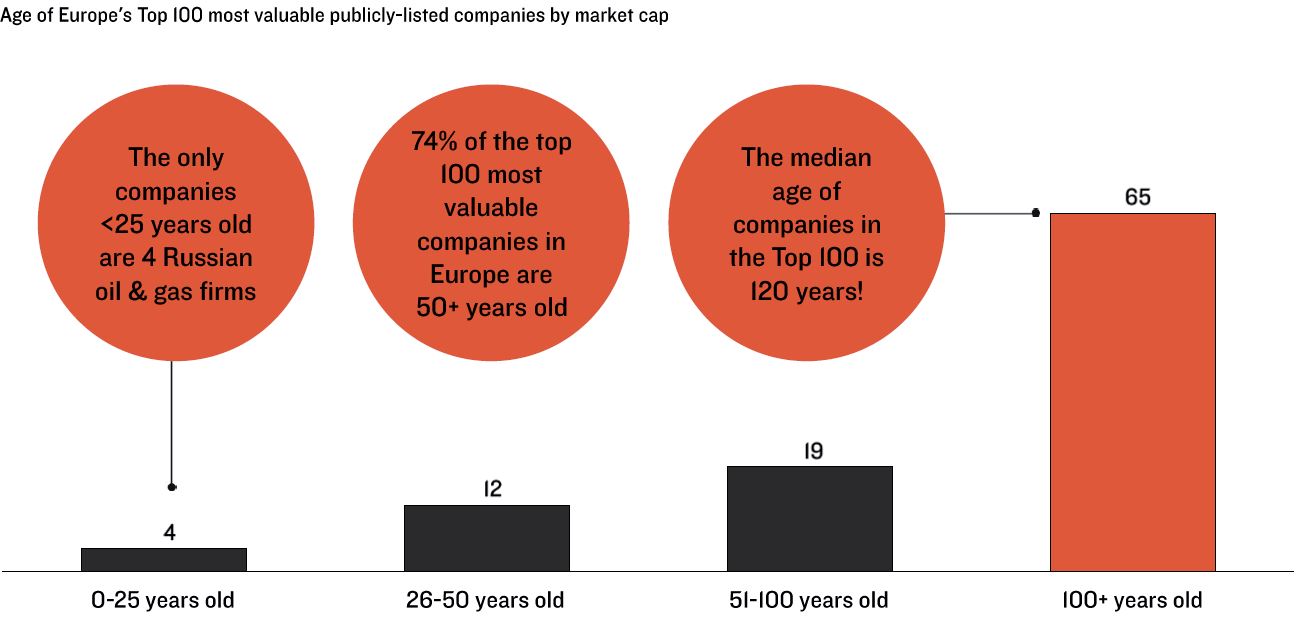

– I was not convinced either about the growing awareness of European corporations of the importance of tech. Their investments and acquisitions are still small compared to their US counterparts (slides 84-86). But slide 83 is the confirmation of a scary situation. This is another illustration of the Darwinian and Lamarckian innovation. Look at next figure.

– The section about scale-ups and exits (slides 89-101) could have been called unicorns & IPOs. I see bubbles and low value creations. Not good enough and not enough tech…

– Finally the lside about perceived risks is worth spending some time. they classify them as Business issues (40%); Economic issues (30%); European issues (22%); International issues (8%). But somehow their classification is subjective. For example if you combine risk aversion (4%), fear (2%), ambition (2%), that is 8%. And talent (4%), innovation (3%) and education (2%) would be another 9%. These elements which I consider as cultural could be considered as quite high…

All these notes were taken while reading so don’t see them as a deep analysis and you should build your own views about this really interesting analysis.