I was lucky to present some ideas around entrepreneurship at a Startup event of Institut Pasteur. I did not reinvent the wheel but used quotes of people I have a lot of respect for. Here they are again:

A culture of entrepreneurship – Startup me up – Nov2020Category Archives: Silicon Valley and Europe

Joe Biden

Twelve years ago, I had a post entitled Obama. Such an important day at the time.

Today maybe as important…

This was posted on Nov 5, 2008…

The Microchip revolution (part III) : the maturity

You will find part I here and part II there. If the 60s were the early days which ended with the oil crisis in 73, the maturity came in the 80s with a second crisis coming from Japanese competition.

There was still a lot of uncertainty as the authors show in the chapters dedicated to Cypress, IDT, Micron. For example:

Another example about the uncertainty around which technology was superior for memory products at the time is that in 1986, when I was a founder of a semiconductor startup company with a business plan predicated on making bipolar RAM products. This was Synergy Semiconductor. We were funded by two premier Sand Hill Road venture capital firms, Sequoia Capital and Mayfield Funds. Even these supposedly smart VC partners couldn’t predict the superiority of the MOS technology in the memory chip business. Rodgers and Cypress made the correct bet on CMOS. It is also interesting that Sequoia Capital invested in Synergy with bipolar technology and Cypress with CMOS technology, thereby covering their bets. (Synergy never went public, struggled for 10 years and was eventually bought by Micrel.)

Intel didn’t believe that they needed CMOS for their memory or processor products for years. They knew that CMOS was a more complex process, and therefore more expensive, and they were not yet dealing with the high-power limitations of their process. Intel did not switch to CMOS for memory products until 1986. [Page 260]

Entrepreneurship is the ability to face these uncertainties and also to act by taking risks:

I already knew that [Rodgers] was a special guy, very smart, in great shape, from running every day and probably a risk taker, but this was nuts [diving in a dangerous place in Hawaii]. What if the timing was wrong and he gets sucked into the tube? How will I get help, it is a 15-minute walk over lava. But he did it. And then he jumped it. He did it twice! This event defines Rodgers. He is self-assured, even egotistical, but able to back up his decisions with actions and willing to take risks even if the parameters are not totally known. Shortly after the lava leaping escapade, he quit AMD and started Cypress Semiconductors. [Page 252]

While he was still at AMD, [Rodgers] got a call from a venture capitalist who was doing reference checks on an executive and inventor while at Fairchild and who also trying to raise money to start a new business. This got Rodgers thinking: “If this guy can raise money and start a new business, why can’t I do it?” And he began exploring the possibility of doing just that. [Page 253]

This reminds one of my favorite quotes ever, from Tom Perkins the famous P in KPCB (Kleiner, Perkins, Caufield and Byers): The difference is in psychology: everybody in Silicon Valley knows somebody that is doing very well in high-tech small companies, start-ups; so they say to themselves “I am smarter than Joe. If he could make millions, I can make a billion”. So they do and they think they will succeed and by thinking they can succeed, they have a good shot at succeeding. That psychology does not exist so much elsewhere.

The Microchip revolution (part II) : the very early days

If you missed Part I, it’s here. All the culture of Silicon Valley was born in these early years. Here are a few examples.

In the early days of the semiconductor, it was mainly about high-quality research: With an absentee boss, Sherman Fairchild, on the East Coast, the group could focus mainly on doing pure research, with no boss to bug them. Their main direction came from intense competition between each other. No VC or corporation would finance anything like this now! [Page 14] The authors are right. Only Google maybe is doing it with or without VC or boss approval and peer pressure is similar.

They finally make and ship their first product in 1958, 100 transistors to IBM. [Page 17]

Jack Kilby was awarded the Nobel prize in physics in 2000 for the invention of the integrated circuit. Unfortunately Bob Noyce had died 10 years earlier and Jean Hoerni passed away 3 years earlier. The Nobel prize is never awarded posthumously. The scientific community informally agreed that both Kilby and Noyce had invented the chip and that they both deserved credit. [Page 21]

Chapter 2 is about a non-startup, Hughes Research Labs, based in Los Angeles.

We did not have stock options; few of us even knew what they were. [Page 48]

Having dynamic leaders who gave free rein to ambitious young engineers and scientists meant that the engineers and researchers were stimulated by competition among themselves rather than by management layers above, which helped create an explosion of papers and patents. However, in both cases [at Fairchild and Hughes RL], the transfer of technologies from R&D to production was not easy. Although they were distinctly different organizations, both were very large corporate structures. But in the case of HRL, having R&D and production in the same physical location meant that discussions between the two groups were quite frequent.

Another difficulty was the lack of stock option program at HRL. This definitely caused significant personal turnover, especially among the non-attached young scientists who were hearing about the new utopic world, and its lucrative stock option packages, up in Silicon Valley. [Page 67]

Chapter 3: Intersil, a lost opportunity.

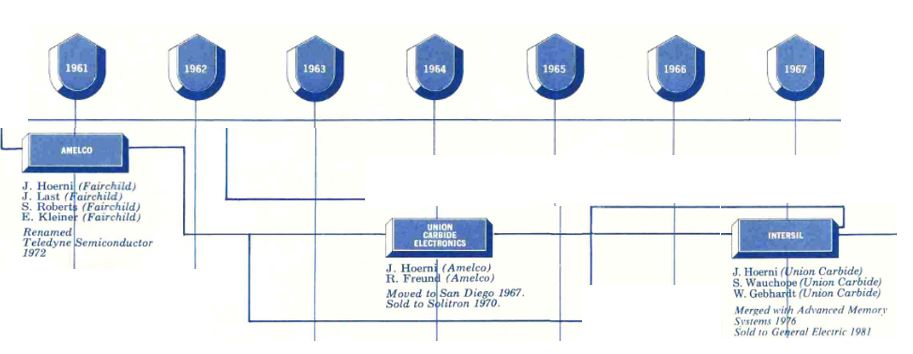

Another genealogy of Silicon Valley and extracted, the impact of Jean Hoerni.

Intersil was founded by Jean Hoerni, one of the eight traitors. The early days are best described as a mix of genius and chaos. The two most versatile personalities were Jean Hoerni and Don Rodgers, the VP Sales and also ex-Fairchild. Hoerni with 2 PhDs in physics was a shy genius quite the introvert but given to unpredictable mood swings. Rodgers was an extrovert. He came from the rough and tumble, hard-drinking, hard-living Fairchild sales team of the 1960s. One of the early frustrations was the ineffectiveness of the marketing department. [Page 71]

Hoerni’s contentious and rebellious personality often appealed to the young managers and engineers who were also looking for the next opportunity and also rejected conformism and authority, in part to the traumatism of the Vietnam war.

When I [Luc Bauer] started working with Hoerni, he strongly advised me not to be blindly loyal to any company, but only to my own ambition and goals. He said that if your employer doesn’t help you reach them, then you better change companies or start your own because life is too short. [Page 74]

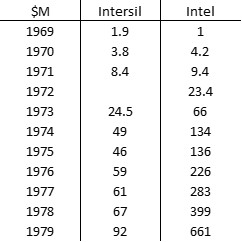

But Bauer talks about a missed opportunity and the reason follows: just have a look at the revenue growth of Intersil (founded in 67, IPO 72) and Intel (founded in 68, IPO 71):

Joe Rizzi, one of Intersil founders summarized his seven years at Intersil with two words: Lost opportunity. He said that all, or most of the seven product categories could have become sizeable businesses on their own, given enough care and focus to nurture their growth.

At the time, uncertainty in the market pushed to diversity of products. Intel’s narrow product focus was a risky gamble. [Page 102]. Intersil had $572M in sales in 2014 and was acquired by Renesas in 2017. Intel is now a $71.9B business…

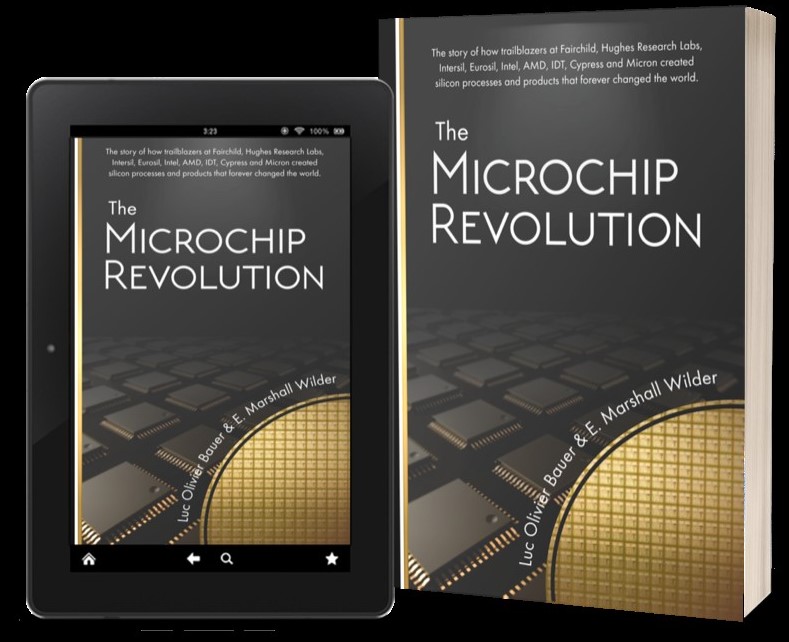

The Microchip Revolution by Bauer and Wilder (part I)

I felt a but of nostalgia when I received the following email : “The idea of doing a book on semiconductor startup had been teasing me for a while, I finally found a longtime buddy who has been okay with doing this book over the past 2 years. We were greatly assisted in this mission by the Computer History Museum (CHM) in Mountain View, CA. The book focuses on the period from the late 1950s to the late 1990s, about the development history of MOS and CMOS industrial processes mainly but not only from the point of view of managers, but also workers in fab and fab managers that we were at the time. We describe the development of 9 companies that we knew well and that had developed original technologies: Fairchild, Hughes, Intersil, Eurosil, Intel, AMD, IDT, Cypress, and Micron. The title is The Microchip Revolution – A Brief History.” [1]

I met Luc Bauer in the early 2000s when investing in a startup he was a business angel in and a mentor. I remember how he lectured me saying that Kleiner Perkins was much more professional than we were! Luc is a gentleman which does not mean he cannot be tough when he is frustrated; when people have been working hard in Silicon valley like he did, they can be really tough! But we stayed in touch and I was so happy to begin reading his book a few days ago.

This is a poster about the Silicon Valley Genealogy of semiconductor startups from the mid 50s to the mid 80s. This is what Luc is writing about through 9 companies which I am pretty sure are on this poster. By the way, Luc is there too.

His book begins with Fairchild and the Traitorous Eight and it makes sense as it is at the beginning of the genealogy. By the way the book is dedicated to one of the eight traitors, Jean Hoerni, A Swiss national and one of the rare people I have heard about with 2 PhDs. Luc has the same double culture and double education (BS, EPFL Lausanne and MS, PhD Caltech)

So here are a few excerpts: “A good part of our motivation [for writing the book] was to relive the intensity in our lives when we started in this industry: the endless and stressful hours of looking for yield crash factors, the great excitement and shouts of joy when you see a brand new integrated circuit product coming alive and functioning perfectly when the “hot out of the furnace” processed wafer is put for the first time on the electrical test prober. Another great motivator for us was to propagate an important story to younger generations, that working in high technology fields is hard and exhausting, but also a source of joy and pride as it is easy to see the impact of your hard work on the company you work for and possibly on the workd you live in.”

Let me put this again below, in bold this time:

Another great motivator for us was to propagate an important story to younger generations, that working in high technology fields is hard and exhausting, but also a source of joy and pride as it is easy to see the impact of your hard work on the company you work for and possibly on the workd you live in.

More to come I am sure!

[1] The real email was in French: “L’idée de faire un livre sur le démarrage des semi-conducteurs me taquinait depuis un moment, j’ai finalement trouvé un copain de longue date qui a été d’accord de faire ce livre avec mois ces 2 dernières années. On été beaucoup aidé dans cette mission par le Computer History Museum (CHM) de Mountain View, CA. Le livre se concentre sur la période entre la fin des années 50 jusqu’à la fin des années 90, sur l’histoire de développement des processus industriels MOS et CMOS principalement mais pas seulement du point de vue des chefs, mais aussi des travailleurs de fab et managers de fab que nous étions à ce moment. On décrit le développement de 9 compagnies que nous connaissions bien et qui avaient développé des technologies originales: Fairchild, Hughes, Intersil, Eurosil, Intel, AMD, IDT, Cypress, et Micron. Le titre est The Microchip Revolution – A Brief History.”

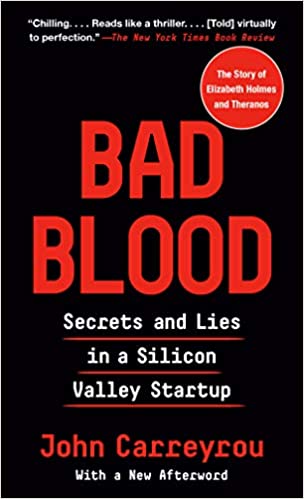

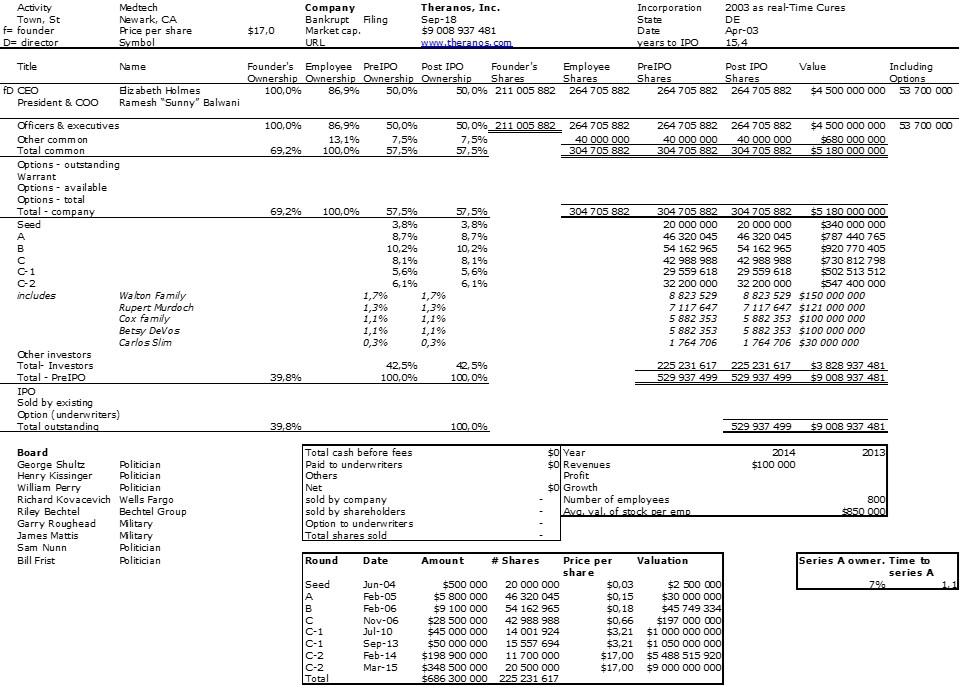

Theranos, the (not so)-Silicon Valley biggest scandal ever

Bad Blood by John Carreyrou is a thriller and an amazing document about Silicon-Valley based Theranos, a medtech startup that is probably the biggest scandal ever about a technology startup, and its cofounder Elizabeth Holmes. But it is not so much about Silicon Valley, as I will discuss below, but about where extremes of hubris, lack of ethics, can drive human nature.

This is a thriller, a page-turner, but this is reality, unfortunately. In the end Carreyrou is not really puzzled about Holmes: Was she manipulated, did she lose control, but he has his answers (pages 372-73): Holmes knew exactly what she was doing and she was firmly in control. When one former employee interviewed for a job at Theranos in the summer of 2011, he asked Holmes about the role of the company’s board. She took offense at the question. “The board is just a placeholder,” he recalls her saying: “I make all the decisions here.” … A sociopath is often described as someone with little or no conscience. I’ll leave it to the psychologists to decide whether Holmes fits the clinical profile, but there’s no question that her moral compass was badly askew.

This is a thriller because Carreyrou introduces many individuals who suffered from the company’s total lack of ethis and secretive methods. Theranos did not hesitate to threaten these and used the most expensive lawyers who know how to intimidate. Homes knew how to seduce, to convince: She is also part of this terrible mentality that had been killing us for the last 20 years : if you are not (totally) with me, then you are my ennemy and I will crush you. A must-read!

Now Theranos was based in Silicon Valley but is not an illustration of what Silicon Valley is. People do not have to love Silicon VAlley, but using Theranos as a a reason why is a mistake: Silicon Valley, at least the one I know or I knew and appreciate is a place where trust and honesty are paramount values. This would take to long to explain but here is another quote of why Theranos is really an outlier (not the only one, but they are not so many:

Actually the most striking thing about Theranos's cap table was the lack of SV firms.

— Paul Graham (@paulg) July 29, 2020

Ah yes, the cap. table. My favorite exercise! Difficult to do here because there is very little information. Here is what I was able to build.

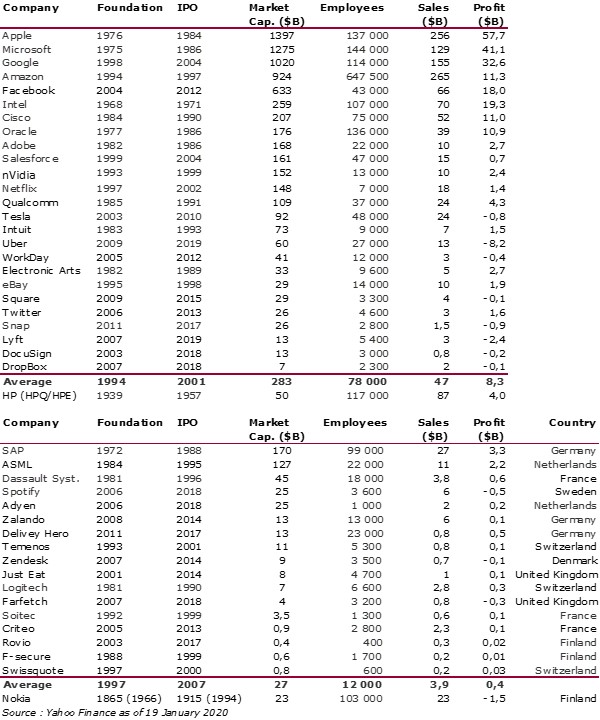

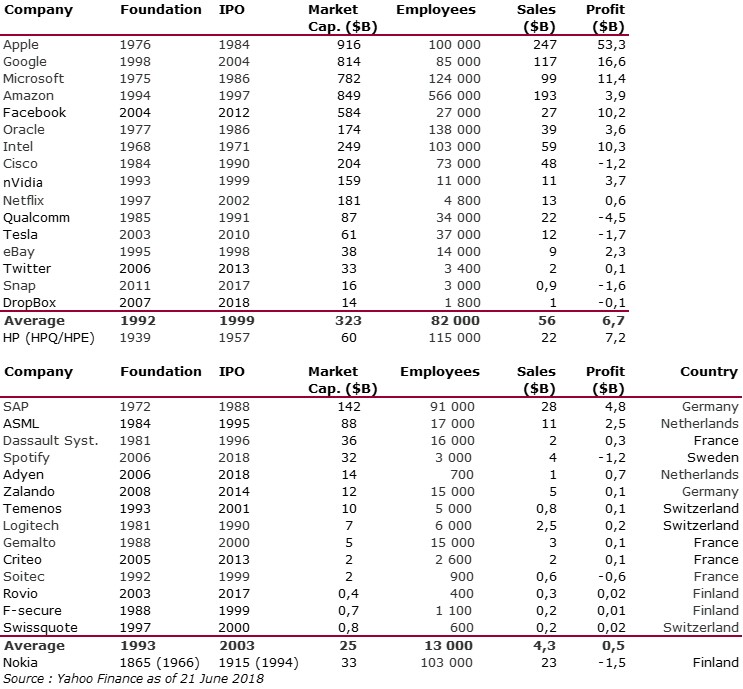

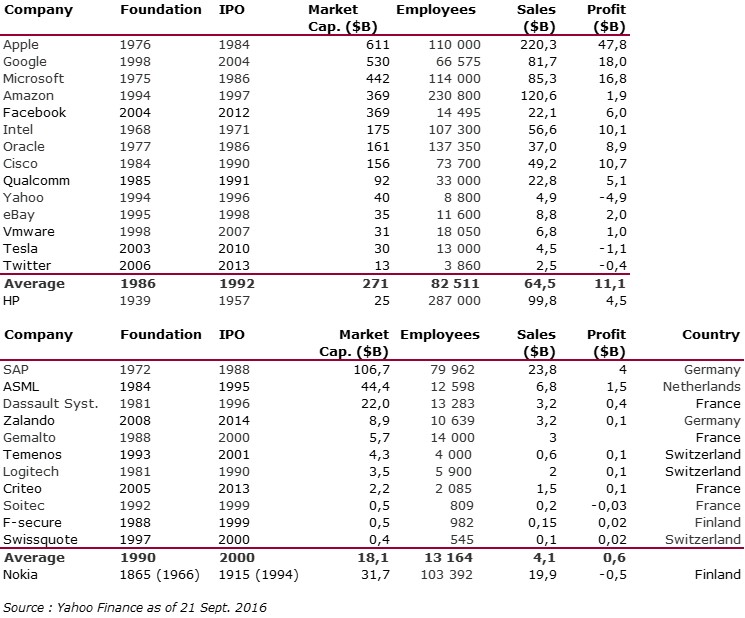

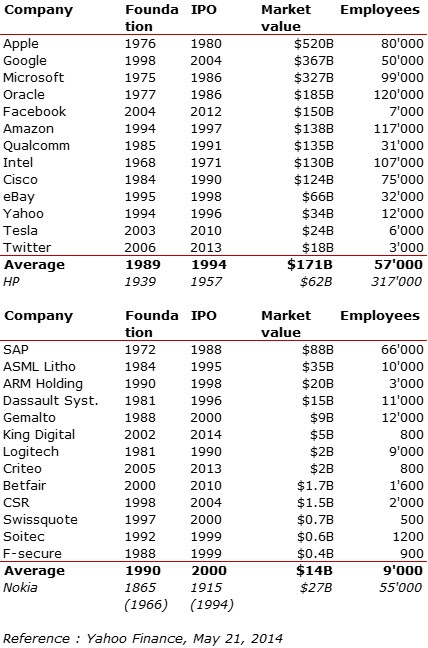

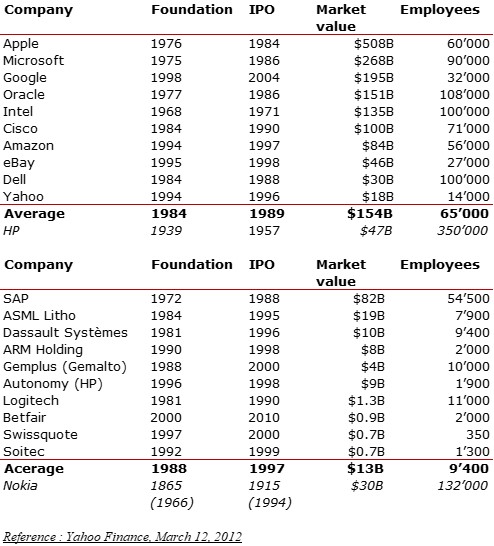

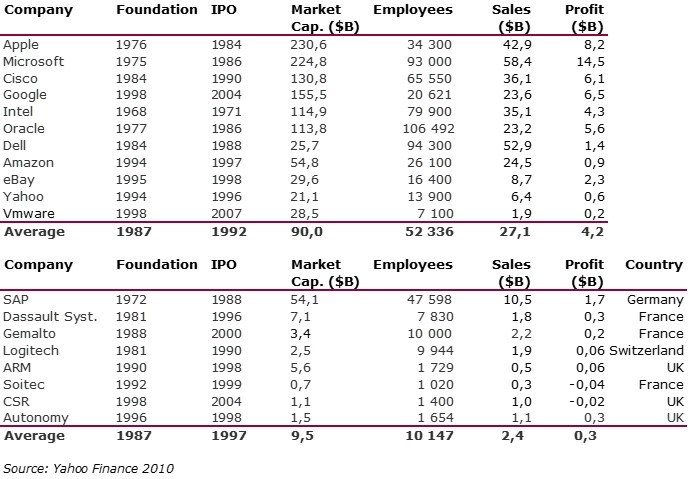

The largest technology companies in Europe and the USA in the last 10 years

It’s just after reading on Twitter that Google had just become a trillion dollar company (In honor of Google becoming a $1T company today), and also after reading Nicolas Colin’s concerns about European technology companies (Will Fragmentation Doom Europe to Another Lost Decade?) that I remembered I used to compare US and European tech former startups.

In honor of Google becoming a $1T company today, presenting its pre-IPO financials…lmao😳

Just insane pic.twitter.com/kXqwiRkUdo — Andrew Reed (@andrew__reed)January, 18 2020

So here are my past tables and also a short synthesis in the end. The full data in pdf in the end too.

USA vs. Europe in 2020

USA vs. Europe in 2018

USA vs. Europe in 2016

USA vs. Europe in 2014

USA vs. Europe in 2012

USA vs. Europe in 2010

USA vs. Europe: the Synthesis over the decade

If you prefer to download it all and a little more: Top US Europe (in pdf)

A letter to and about America

While looking at old files, I found a letter, written by a family member in october 1993. At the time, I was living in California. I read it again, loved it so much for personal reasons but also found it so farseeing that I decided to share it here. Hopefully some of you will like it. If you read French, go to the French page, if not forgive my awkward translation…

Tell me, my good friends, what is America? The roughness of the confines, this impossible frontier where humans find themselves by violence stripped of lies, where the truth is revealed? The old southern lands, so carnal, so indolent, so cruel? The devastating wind gusts and hurricanes in the business that are moving people across the country? The Blacks, the Yellows, the Darks, the Goldens and the Indians who open casinos in their reservations, just to take some power from the Whites? The Indians are a faded dream, like Route 66, like the Rocky Mountain train. In Europe, paradoxically, we experience America in a visual mode more than in writing or thinking. Everyone does not read Tocqueville, but then, who is Tocqueville’s successor? There remains the image. Fake images where violence and melodrama reigned, between popcorn and ice cream, the tanned men of westerns, statues of dust and wind, the dazzling comedians of the musicals, Miles Davies, head down, dark glasses, emaciated face, pushing on his trumpet in a corner, excited suffragettes and delusional sodomites. The true and the false mix, merge. The memory stutters. De Niro continues to return to his companions, the steelmakers, on a rainy night, climbing a muddy street lined with small pavilions, in the blue-gray, monstrous and motley decor of foundries; Kennedy collapses again in the back of his big convertible car, under the bewildered look of Jackie; and I still go around Long Island and Brooklyn to approach the arrogant challenge of the Manhattan Towers. Or I fly high mountains, deserts, lakes, endless plains, where the eye hangs, staking the immensity, pressed and tight clusters of skyscrapers, mounds of the day, monuments of glass and concrete in the silence of nights, built to the glory of which unknown dead god.

I watch sometimes CBS Evening News, I see people worry about everything and anything, to the obsession. Haunted by cancer, cellulite, poisoned milk, fast weight loss, tobacco smoke, the nimble hands of men and the eyes of others. I wonder: what has become of proud America? Or did it ever exist only in presidents’ speeches on the state of the Union? What is America? Thoreau and the transcendentalists, Charles Ives, the musician insurer, who has captured better than anyone else the roar of the choral society, the feast and the provincial slowness, the immensity of the lands and the simplicity of the beings? Or Blacks who are perhaps the most American of Americans since they have really lost their roots (Africa is not a place, but a myth and rhythms while emigrants still have families, which in Sicily, which in Korea, which in Mexico, which in Ireland)? Or this “melting pot” that does not mix, but that unites because in the manner of the feudal society, the membership is aimed at people, the sworn faith, requests the individual to the noblest of itself? (Perhaps we should not laugh too much at the Bibles deposited in the hotel rooms, which symbolize the direct and intimate relationship that Protestants establish between man and his creator. Transposed, we perceive the direct relationship, transcendent of all the administrative, legal, institutional mediations that unite the American man to America: God is America. Like God, would it be inaccessible to our intellect?) We find everything, apparently in America. Would it be the store of the creator, La Samaritaine of eternity? Is America out of time? Alice in the land of rubble wanders among abandoned silos, deserted factories, discarded jerrycans, worn tires, rusted bodies, to discover in the spreading fields the unexpected, the surprising, the eternally new. America, pioneering and tired.

I say this to myself, but maybe I’m wrong. The ambiguous attitude that we Old Europeans have towards America is rather a parent-child relationship that combines ambition, hope, expectation and disappointment, surprise and misunderstanding, rapture and exasperation, tenderness and anger. Recognition, ignorance. A new being has come out of us, which prolongs us but which is not ourselves and whose destiny escapes us. America, America, the dream of the emigrant, but also in some way our dream to all of us. The new Jerusalem or the new Babylon. Something strikes, if one tries to fly over the centuries. The other side. The other side of the hills, the other side of the mountains. We are people of little witnesses, of limited horizons. Who have often quarreled, fought, gorged from valley to valley, from castle to castle, from village to village, from country to country. Less to take, if not rapine, less to enlarge than to establish a place, a domain, a territory as part of oneself, from which the other will be excluded, tolerated at best, always in an extraneous situation. And suddenly, these Lilliputians are leaving. Do you realize, my friends, what such a departure represents? It is not exactly a question of travel, of the traveler’s curiosity – there has always been Herodotus, Marco Polo. No more the trade or the wandering that follows the path of exchange. Demographics, economics, politics of the powers, religion can nourish the motivations and satisfy the historian. Still, there needs to be a higher determination that guides choices. How to name it? The call of the unknown, the will to force the destiny, the ability to face the mystery? We are lacking beings, says the philosopher. Beings of desire. To miss is to have the desire of something else, which can not be defined since one has a negative idea of it. An incredible audacity: to deny the present to open oneself to the mystery. Standing, eyes open on the horizon. To confront the immensity of the ocean and its fury, to approach lands as vast as the sea, to sink deep in immense forests, shadow cathedrals swarming with a strange life, to follow the trace of the sun in the mirages of gold of the desert, to discover bizarre, incomprehensible, wild manners, and peoples more numerous than grains of sand on the beach. But above all to be in front of the excess in the excess without yielding. And to stay, or to come back, with in the head, the distant little world, so far away, left so long ago, whose tiny outlines slowly become numb in the sleep of remembrance. What was at the heart of this obstinate will? Perhaps the secret trace of a very long memory. After all, each of us goes down more or less from distant invaders. Celts, Franks, Germans, Goths, who were our ancestors? And have we kept in the recesses of our desires the imprint of these ancient migrations?

Asia, Africa, America, all these continents were not equally offered to the coming settlers. Asia, Africa, worlds too full already or natures too difficult, too hostile. There remained America, and particularly North America, with a cowardly occupation whose Atlantic coast, at the 40th parallel, was not altogether so exotic for Europeans. The spirit of enterprise of Protestants did the rest. One could build a New England and imagine that one would reproduce while purging it in a sort of Virgilian dream the old mother Europe. What is America then? Viewed retrospectively, it can appear as the development of a simple historical conjuncture, as the fruit of chance and necessity. Or would one say such was the fate inscribed, almost from all eternity, on this piece of continent? Why do I think that, thinking of America, I have the feeling of an infinitely old reality and an unfinished promise? In this sense, if America stems from a destiny, this destiny is always to come, always remains an opening on the unexpected.

This for example, which is about understanding. We Frenchmen have the religion of a well-conducted text, according to the order of the reasons: we like a well-conducted reflection and what is more amiable than to go from the idea to its consequences; we are legislators of writing. American pragmatism tends to advance general ideas that are supported by the analysis of facts. [I put this in bold, it was not in the letter.] This does not free them from prejudices, but gives them a powerful mobility and protects them against the excess of systems. But I believe that in the intellectual crisis that we are going through, we will not be able to find the way if we do not find a satisfactory understanding of the multiple and multiplicity, which is blocked, or at least thwarted, by the need for a unitary interpretation, a deeply rooted need as it comes from Christian theology and its Hebrew antecedents. Because America is essentially multiple, because the unitary is at home only the means to associate and coordinate these multiplicities in the faith in America and the faith in the individual, perhaps the novel thoughts will come from across the Atlantic. And as usual, we will systematize them. For the pleasure of order. Eternal youth of America? But what is America?

Forgive me for writing to you so late. (I hope this overloaded letter will come to you.) Thank you for giving me some news. So few people do it. But I am a bad letter-writer. I run after the money that runs after clever evils and I miss the time.

I kiss you,

Georges, October 2, 1993.

Le bonheur, une idée neuve dans les entreprises ? (selon France Culture)

(Sorry I was too fast, this should have been posted on the French version… where it is also now. For non French-speaking readers, this post is about new management techniques that were born in Silicon Valley…)

J’étais invité ce matin à débattre des méthodes de travail et de management (y compris “l’utilisation du bonheur”) importées de la Silicon Valley. Je mets plus bas (après les tweets) les notes que j’avais prise pour préparer cette émission

[EN DIRECT] Travail : les nouvelles conditions

Le bonheur, une idée neuve dans les entreprises ?Quelles sont les valeurs portées par le nouveau management ?#management #SiliconValleyhttps://t.co/Kjf7kbTDpZ pic.twitter.com/ngNAvfdYMS

— Culturesmonde (@CulturesMonde_) June 12, 2019

Fabien Blanchot : « Le management ne disparaît pas. En revanche il peut y avoir débat sur l’existence ou non de managers. Même si on supprime les coachs, on fait perdurer des accompagnateurs. #management #manager https://t.co/Kjf7kcbeOz» pic.twitter.com/evCm0B47ah

— Culturesmonde (@CulturesMonde_) June 12, 2019

.@hlebret : « C’est une recherche d’efficacité qui n’est pas manipulatoire, qui a souvent été discutée avec les employés eux-mêmes. »#management #bonheurhttps://t.co/Kjf7kcbeOz pic.twitter.com/fmbbg93rc8

— Culturesmonde (@CulturesMonde_) June 12, 2019

Fabien Blanchot : « Dans l’économie de la connaissance, il faut faire vibrer les cerveaux et les cœurs. On est nécessairement dans un mode de management qui doit tenir compte des aspirations de ces cerveaux et de ces cœurs. » https://t.co/Kjf7kcbeOz pic.twitter.com/o6yGZBHldl

— Culturesmonde (@CulturesMonde_) June 12, 2019

.@jbaptistemalet : « Beaucoup d’employés qui entrent dans un entrepôt Amazon ont des paillettes dans les yeux. Ils déchantent car ils réalisent rapidement qu’il s’agit d’un vernis. »#Amazon #entrepot #managementhttps://t.co/Kjf7kcbeOz pic.twitter.com/iyPwyCTQ6t

— Culturesmonde (@CulturesMonde_) June 12, 2019

.@hlebret « On ne peut malheureusement pas comparer la situation d’un employé dans un entrepôt d’Amazon et celle d’un jeune développeur qui arrive à Google avec un doctorat de Stanford. »#management #Google #Amazonhttps://t.co/Kjf7kcbeOz pic.twitter.com/re8pHUi6ga

— Culturesmonde (@CulturesMonde_) June 12, 2019

Voici les notes que je m’étais préparées.

On ne peut pas mettre dans les même paquet tous les GAFAM. Tout d’abord Amazon et Microsoft qui par coïncidence ne sont pas basées dans la Silicon Valley, mais à Seattle ne sont pas connues pour un management original. Ni Bill Gates, ni son successeur Steve Ballmer, ni Jeff Bezos ne sont connus pour des styles de management innovants. Par contre Google, Apple et Facebook ont sans doute des similarités:

– ce sont des méritocraties et le travail est la valeur “suprême”, plus que le profit, au risque de tous les excès: recherche de performance, concurrence et risque de burn-out. On ne tient pas toujours très longtemps chez GAF

– on y recherche les meilleurs talents (sur toute la planète et sans exclusive, au fond le sexisme et le racisme n’y existent pas a priori)

– le travail en (petites) équipes est privilégié.

Du coup le management a innové pour permettre cette performance et reconnaître les talents (par le fameuses stock options mais aussi une multitude de services pour rendre les gens toujours plus efficaces)

J’aimerais vous mentionner 3 ouvrages (sur lesquels j’avais bloggé pour 2 d’entres eux)

– Work Rules décrit le “people management” chez Google (ils ne parlent “plus” de ressources humaines). L’auteur Lazlo Bock qui fut le patron de cette activité a quasiment théorisé tout cela. Vous trouverez mes 5 posts sur ce livre par le lien: https://www.startup-book.com/fr/?s=bock. C’est un livre en tout point remarquable parce qu’il montre la complexité des choses.

– I’m feeling Lucky décrit de l’intérieur ces manières hétérodoxes de “foncer”. Un pro du marketing montre comment Google a tout chamboulé par conviction / intuition plus que par expérience. https://www.startup-book.com/fr/2012/12/13/im-feeling-lucky-beaucoup-plus-quun-autre-livre-sur-google/

– Enfin un livre hommage sur Bill Campbell vient de sortir écrit par l’ancien CEO de Google Eric Schmidt. https://www.trilliondollarcoach.com. Comme je viens de commencer ce livre, je peux en parler plus difficilement mais il serait dommage d’oublier cette personnalité qui fut le “coach” de Steve Jobs, Eric Schmidt et Sheryl Sandberg, trois personnes majeures pour justement les GAF! Or ce Bill Campbell, décédé il y a 3 ans, fut une personne essentielle à cette culture du travail et de la performance. Ses valeurs sont décrites dans https://www.slideshare.net/ericschmidt/trillion-dollar-coach-book-bill-campbell. Bill Campbell revient de temps en temps sur mon blog pour des anecdotes assez étonnantes. (https://www.startup-book.com/fr/?s=campbell). Par exemple, chez Google on a souvent pensé que les managers étaient inutiles. L’autonomie d’individus brillants devait suffire… mais ce n’est pas si simple! – voir https://www.startup-book.com/fr/2015/09/01/google-dans-le-null-plex-partie-3-une-culture/.

A nouveau excellence des individus et travail en équipe, reconnaissance des talents à qui on donne autonomie, responsabilité(s) avec peu de hiérarchie semble être le leitmotiv… Tout cela on pas pour rendre les gens heureux, mais pour leur permettre d’être plus efficace parce qu’ils sont “heureux” au travail. “People First”. L’objectif c’est de fidéliser, de rendre plus productif, mais c’est aussi une mise en pratique de la confiance en les autres.

Alors comme je l’avais lu chez Bernard Stiegler, à toute pharmacopée sa toxicité. Les excès dans des valeurs conduisent à des abus. Trop de travail, de concurrence, de pression conduit au burnout. J’ai l’impression que la politique et même le sexisme y jouent moins de rôle qu’on pense, même s’il y en a comme partout. Quant au racisme, il me semble limité (et on est aux USA!) Le sexisme est un vrai sujet, mais je vois plus des nerds qui ont peur ou ne connaissent pas les femmes que des “old boy clubs of white men” qui dirigeraient les choses comme je l’ai lu (même si cet élément existe j’en suis sûr). La polémique sur la congélation des ovocytes chez Facebook peut être lue de manière contradictoire j’imagine. J’ai aussi abordé le sujet dans le passé, https://www.startup-book.com/fr/?s=femmes ou https://www.startup-book.com/tag/women-and-high-tech/. L’autre sujet de diversité, est plus clair: il y a tellement de nationalités dans les GAFAs et les startup en général que le racisme est dur à imaginer. Indiens, chinois surtout sont présents et jusqu’au somment (les CEO de Google et Microsoft aujourd’hui). Seule la minorité “African-American” est sans doute sous représentée et on peut imaginer que tout cela est corrélé avec le problème de l’accès à l’éducation (qui existe moins en Asie)

Voilà, c’est déjà beaucoup pour ne pas dire trop… je trouve que commencer par Bill Campbell est une manière simple et efficace d’entrer dans le sujet. Et maintenant que j’y pense tout cela est d’autant plus facilement que vous verrez que mes lectures récentes sont liées au “sens du travail” (Lochmann, Crawford, Patricot) https://www.startup-book.com/fr/?s=travail

Steve Jobs in Paris in 1984

My friends at INRIA just mentioned to me a short but great interview of Steve Jobs by French Television in 1984, when he was asked if France could have similar start-ups to Silicon Valley. Here is his answer:

Even if you hear more the French translation, you can hear his voice too:

– Research level is good but concrete applications seem to be a problem, and this is an important step for innovation

– This is coming from a lack of companies ready to try

– The risk is seldom taken by large corporations, but by small ones

– You need many small firm with talented students and venture capital

– You also need champions you take as models, that enable saying “innovation is this”

– There is a more subtle problem, a cultural one: in Europe, failure is serious. If you fail in Europe right after university, it follows you for ever. In the USA, we keep failing all the time.

– What you also need is a solid software industry, because software is the new oil. You need hundreds of small firms and then you can dominate an industry.

– You need talented students, a good understanding of technology and encougare young people to create small firms.

– It’s all about private initiative. Big companies should not interfere, neither the government should. We should let entrepreneurs own it.

Thirty-five years later, is the situation different? And if he was still alive, would he say the same things? I let you judge …