I am surprised not to have published this before. It was one of my first work before I even wrote my book. It became its chapter 4. Venture capital is about 50 years old and it has changed a lot in parallel to innovation and high-tech. I hope you will enjoy these very visual slides!

Author Archives: Hervé Lebret

Smasher, another Silicon Valley mystery

Smasher is the second Silicon Valley thriller from Keith Raffel that I read. After reading dot.dead, I found this one more complex, and certainly as interesting. A mixture of a traditional thriller where the hero’s wife is smashed by a car, together with a good start-up story where the leader in the field is trying to smash the hero’s company and an academic story of intense competition between researchers in the physics field of [smashed] particles. Hence the title Smasher.

I already mentioned novels about start-ups or Silicon Valley (dot.dead, but also The Ultimate Cure). I have never mentioned though Po Bronson (I loved The First 20 Million Is Always the Hardest) or Michael Wolff (Burn Rate). I have not read (yet) Kaplan’s Start-up. On the academic side, there is Small World by the great David Lodge which I have not read (either…) There are of course many essays on the start-up or academic worlds (I mentioned many in my past posts in the must read category) but there are clearly not so many novels based on these worlds,

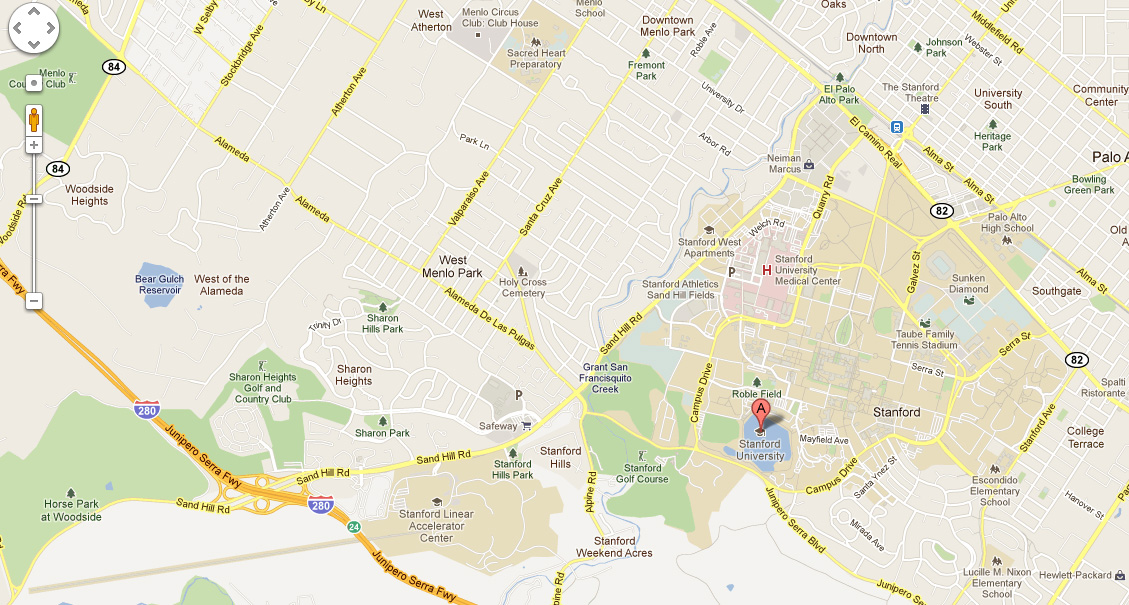

Raffel loves to take inspiration from real individuals in Silicon Valley. I had played at recognizing a few in dot.dead. Here it is less obvious; the academic smasher is a mixture of Feynman and Gell-Man. The start-up smasher looks more like Larry Ellison with his dark suits and love for Japanese architecture. But there is a little from Steve Jobs as well. The other characters existed in the first novel. I will not talk about the story and only shortly about the particle physics. I will say more about the start-up and broader Silicon Valley context. Smasher talks of Quarks and quirks, of Murray Gell-Man who got the Nobel prize for their discovery and of SLAC, the Stanford Linear Accelerator (a small CERN). You may identify SLAC both on the map and picture below.

There is indeed a link between particle physics and the start-up world. Raffel reminds us that the World Wide Web was invented at Cern thanks to Tim Berners-Lee. Slac had other spin-offs, but this is another story. Slac was also a home for the Homebrew Computer Club (see [1] and extract from page 214 below)

Smasher is also about women and science. “Stanford was on a campaign to recruit female undergraduates, Ph.D. candidates, and faculty to the natural sciences. My mother’s late aunt had been the first woman in the physics department back in the 1960s. In an effort to honor her and to appeal to what was still the second sex in the realm of natural sciences, the university was naming its particle physics lab after her. I’d lived in Palo Alto all my life and couldn’t recall a building, library, school or academic chair at Stanford labeled with a name except in return for a donation of dollars, euros, yens, dinars, or other convertible currency. So maybe Stanford was really serious about recruiting women.” And the invited professor for the ceremony adds: “We all follow in the footsteps of our predecessors. When I was a girl in France, I wanted to be Marie Curie. After two years as a graduate student at Stanford, after two years of hearing about her legacy, I wanted to be your great aunt.” (Page 12)

What may not be realistic is that this French professor smokes Gauloises (page 213). I know I left France a long time ago but I doubt professors still smoke them! It is pure work of fiction of course but Raffel adds in his acknowledgments that he found inspiration in Rosalind Franklin‘s life. A sad story which shows the complexity of being a woman in science or high-tech…

A funny (sorry for the jump for sadness to humor) quote and apparently true [2] on the academic world is “Clark Kerr once said his job as president of the University of California was to provide football for the alumni, sex for the students, and offices for the faculty. [The physics and Nobel prize professor] sanctum was twice the size of the [professor of English literature]’s but only a third the size of the business school professor [who is on the board of the hero’s start-up].” (Page 34)

It is also about VCs and term sheets. “VCs, bah. When you had no need for their money, investment offers would cascade over you like a tropical waterfall. When you could use a capital infusion – like now – the money flowed like water in a wadi, a riverbed in Sahara. In other words, it did not.” (Page 20)

“I drove west of Sand Hill Road. This was familiar territory, the Vatican of venture capitalism. In the bubble days of the late 1990s, office space on Sand Hill was the most expensive in the world. Here’s where the founders of Google, eBay, Amazon and Cisco had come, hat in hand, seeking the dollars required to turn the base metal of their dreams into stock market gold.” (Page 41)

Raffel has a few notes on Silicon Valley culture:

– “The value of Silicon Valley company wasn’t in inventory or patents. It was in the brain of its employees.” (page 33)

– “I had learned in the Valley that no more than two people could keep a business secret and that only worked if one of them was dead.” (Page 45 )

– “Under an NDA? I asked. Non-disclosure agreements didn’t usually do much good in the Valley, which was built on loosey-goosey dissemination of intellectual capital, but having one couldn’t hurt. We had a raft of patent applications pending on the technology, but if they stole what we had, we would be defunct by the time we won any lawsuit.” (Page 94)

– “Ron Qi, the inventor [of the technology incorporated in our product] and now head of engineering looked down as if examining the polish on his shoes. The other three around the table, Samantha Maxwell, our Korean-born MIT-educated marketing genius; Ori Mohr, the ex-Israeli paratrooper and kick-ass head of operations, and Bharat Gupta, the CFO, all moved their eyes back to me.” … “I saw Ron, who’d been brought up in the more deferential milieu of Taiwan…” (Page 44) [Immigrants again]

– “I asked the engineers how the tweaking of the product was going, the sales rep what I could do to help them close their big deals, and the bean counters how much work was left to close the books for the latest quarter. What I heard from them was unfiltered by the vice presidents who reported to me. (The business professor) had told me that I could ask any employee anything but I could only tell my direct reports what to do. Managing the others was – who’d’ve thunk of it? – the jobs of their managers. As I popped into offices or cubicles, I was following the footsteps of the Founding Fathers of Silicon Valley, Bill Hewlett and Dave Packard, who advocated MWBA – management by walking around.” (Page 102)

– “Thirty minutes later, I walked into a building named after Robert Noyce, one of the “traitorous eight” whose departure from Shockley Semiconductor loomed as large in Valley history as the exodus from Egypt did in the Bible. One of the founders of both Fairchild Semiconductor and Intel, Noyce was the co-inventor of the microprocessor, the electronic brain that ran everything from cell phones to server farms.” (Page 194)

A few more things on the academic world:

“It seems that the only way for a Stanford professor to win prestige is to start a successful company.

– Americans may not be interested in how the universe is made. I can tell you though, in Silicon Valley, they definitely want to know how money is made.

A researcher at CERN wanted to share information with others physicists. He invented a language to send it around and we ended up with the World Wide Web.

– Of course you would know our wonderful Sir Tim. […] The computer nerds at SLAC in the early 1970s hosted meetings of what they called the Homebrew Computer Club [1]. Steve Jobs and Steve Wozniak came.” … “And from that came Apple Computer and the whole PC industry. So you’re saying Silicon Valley wouldn’t be much without the physicists?” (Page 214)

as well as

“I caught sight of a new photo over the desk. His head flanked by two earnest student types. He followed my eyes. “Another sign of my vanity.” Sergey Brin and Larry page developed their search algorithm as Stanford grad students and, of course, started their company to exploit it. Stanford got shares in the venture in return for their ownership of intellectual property.

– And how many millions did that piece of Google add to the university coffers?

– Three hundred and thirty six” (Page 218)

Smasher is certainly not about literature, but it is (really) entertaining; nor does it belong to the category of the mystery masterpieces. Raffel does not have the genius (or experience) of James Ellroy, or even George Pelecanos and Henning Mankell but he is a real pleasure to read, I appreciate his talent, imagination and his interesting description of SV culture, history and dynamics.

[1] Homebrew Computer Club: “One influential event was the publication of Bill Gates’s Open Letter to Hobbyists, which lambasted the early hackers of the time for pirating commercial software programs.” http://en.wikipedia.org/wiki/Homebrew_Computer_Club. Another site is Memoir of a Homebrew Computer Club Member

[2] Another legacy was his wit—after writing a serious book “The Uses of the University”, Kerr surprised an audience with this riposte–“The three purposes of the University?–To provide sex for the students, sports for the alumni, and parking for the faculty.” From http://content.cdlib.org/view?docId=kt687004sg&chunk.id=d0e21648&brand=calisphere&doc.view=entire_text

What’s an entrepreneur in France?

I was shocked, or I should say, I smiled yesterday when I used Google Translate to obtain an English equivalent of “l’entrepreneur doit être au centre des écosystèmes innovants”; I got “the contractor must be the focus of innovative ecosystems.” It is not a pure accident.

Let me remind you one of my favorite quotes from Paul Graham “I read occasionally about attempts to set up “technology parks” in other places, as if the active ingredient of Silicon Valley were the office space. An article about Sophia Antipolis bragged that companies there included Cisco, Compaq, IBM, NCR, and Nortel. Don’t the French realize these aren’t startups?”

Contractor, concrete, office space… When I was a kid, an entrepreneur was building houses. Google just kept that old meaning. Or is it that old? I will come back on this topic when I will comment (on the French part of my blog) a book I am currently reading “le paléoanthropologue dans l’entreprise ; s’adapter et innover pour survivre” by Pascal Picq. What stroke me there is a description of the Lamarckian style of French companies vs. the Darwinian flavor of the Anglo-Saxon ones… The book may explain many of the cultural differences of these two worlds.

The end of a Silicon Valley adventure

I read this morning about Magma’s acquisition by Synopsys for $507M. In many cases, such an acquisition would look like a success. Here I am not sure…

EDA is an industry I appreciate because it is the perfect description of start-up dynamics. I will not describe it here but if you want to learn more you can read my previous contributions on the topic. I was also lucky to meet the CEOs of both companies, Aart de Geus and Rajeev Madhavan, two legends of the EDA industry, not to say of Silicon Valley (SV). Let me quote myself with a few paragraphs from my book in 2007.

“The only recent success story is Magma Design Automation. Its founder, Rajeev Madhavan, studied in his native country, India, then in Canada. He had founded two successful start-ups, LogicVision (sold to Synopsys) and Ambit (acquired by Cadence). He could have been satisfied enough but Magma became his new adventure.”

I should add that Andy Bechtolsheim, another SV legend, was a business angel in Magma, with investment amounts similar to a VC.

“It is still premature to bet on Magma’s future and its capability of becoming a giant. Some clouds have appeared on the horizon. Litigations are not a rule in Silicon Valley but they do happen. … In early 2005, Synopsys and Magma faced each other concerning the activities of one of Magma’s founders while at Synopsys and the ownership of some patents. The issue was finally resolved in 2007. But in 2005, Magma’s share price dropped by more than 50% from one day to the next and it only recovered two years later.”

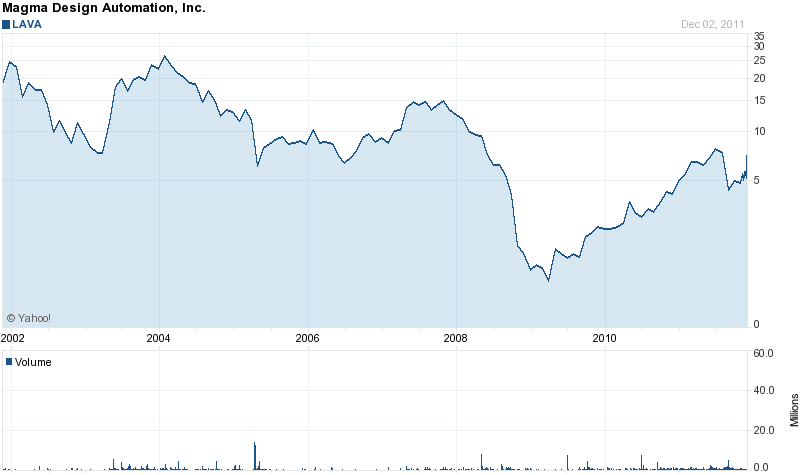

Magma’s stock suffered again in the following years as the curve below shows it:

“Costello bitterly complains about a disappearing culture in Silicon Valley. The region has become greedy and individuals forget to give back to the community. There is too much litigation. Out of the ambitious start-ups of the nineties, only Magma has passed the main obstacles. But Magma has not proved yet that it can become a giant. Or will it disappear like Quickturn or Avant! ? No other new start-up seems to have the potential of threatening the established players. In the unstable, dynamic, innovative world of Silicon Valley, this is not a good sign.”

Now EDA is left with three big players, Synopsys, Cadence and Mentor. No start-up seems to be threatening them and the market is not really growing anymore. This is indeed not a good sign.

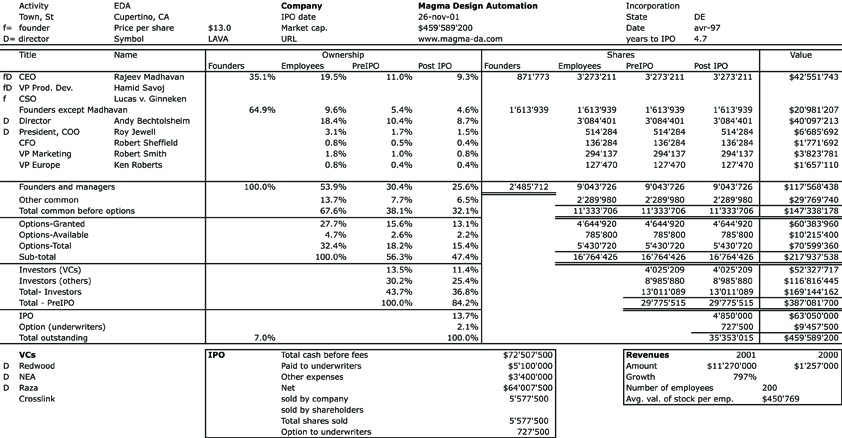

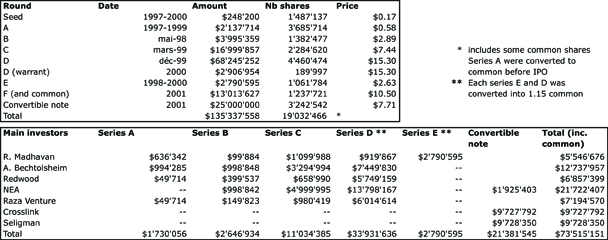

PS: Just as a reminder and because I now do this often, here is Magma’s data at IPO. Just note it is not very different from the price it is bought for in 2011…

Mind the Gap: the seed funding of university innovation

I recently read Mind the Gap: The University Gap Funding Report published by innovosource.

Disclaimer: I usually do not mention my activities at EPFL on this blog and this report deals exactly with the type of funds I manage there: the Innogrants. I was indeed interviewed for this report as one of the active members of the Gap Funding community and the Innogrants are one of the examples mentioned.

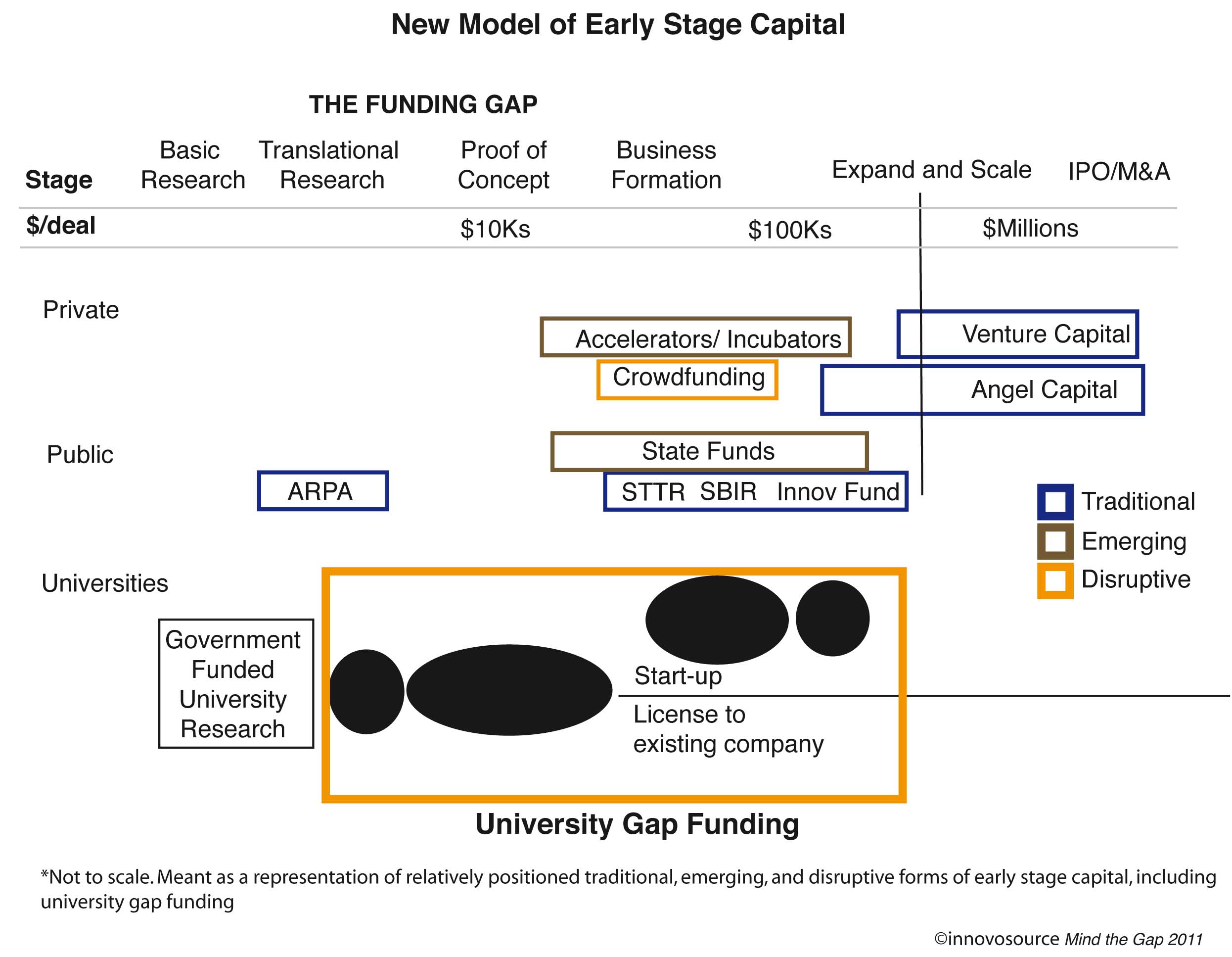

Mind The Gap is a great report because it describes a concept which was born a little before 2005, the seed funding, I should even say the pre-seed funding, by universities of their innovations, including start-ups. The next figure illustrates not only gap funding but all the existing tools enabling academic innovation.

Let me just briefly quote it (but you should know the report is not free, so I cannot summarize it in too much detail. The author allowed me however to give you a 25% discount code: USHAPE). In any case, it is extremely rich in data and information.

“This “gap” extends from where the government funding of basic research ends to where existing companies or investors are willing to accept the risk to commercialize the technology.” [page 9]. The author reminds us that “Failure is commonplace in these sorts of pursuits, but ask where you would find yourself (or where you are going) without GPS and the internet, and most recently a little iPhone “assistant” named Siri that originated from the DARPA funded CALO (Cognitive Agent that Learns and Organizes) program through a university consortium.” [page 20]

As a side element, there are also the emerging accelerators, “Popularized in recent years with the likes of Y Combinator and TechStars, accelerators combine access to talent and support services with “stage-appropriate” capital in return for a stake in the company or other repayment structures.” [page 22] but this is another subject!

There are already some “famous” gap funding tools: “another study by the Kauffman Foundation [1] investigated two well-known proof of concept centers at MIT (Desphande Center) and UC-San Diego (von Lebig Center) and reported general process and impacts.” [page 26]

[1] C. and Audretsch, D. Gulbranson, “Proof of Concept Centers: Accelerating the Commercialization of Univeristy Innovation,” Kauffman Foundation, 2008.

I do not want to quote much more this 100-page deep and very interesting analysis. My final comment is that a critical element is the leverage gap funding enables. You will find a full analysis on pages 88-90. In his Report Summary, the author depicts the value of gap funding through:

High commercialization rates

– 76-81% of funded projects commercialized on average

Attraction of early stage capital

– $2.8B leveraged from public and private investment sources

Business formation and job creation

– 395 new start-up companies

– 188 technology licenses to existing companies

– 7,761 new jobs, at cost of $13,600 gap fund dollars per job

Building a community of innovation

– Thousands of faculty and students engaged in the process

– Incorporate networks of technical and business professionals in the evaluation, mentorships, and leadership of these technologies

Organizational returns

– $75M returned to the organizations through repayments, royalties, and equity sales

– Maximize resource allocation and downstream savings, by permitting early failures through exploratory and evaluation tactics

– Empower universities to continue to take risks that support the type of breakthroughs that define our present, and the type of innovation that will carry us into the future

Let me finish with what I contributed to the report, i.e. a short description the EPFL innogrants:

When I met Jochen Mundinger in October 2006 it did not take me much time to make up my mind. I had previously seen many startup ideas and Jochenʼs Internet project looked to me original and powerful. Prior to any due diligence, I told him that if my analysis was positive, he would get a 12-month grant to work on his start-up. Because of this program, I am lucky enough to be able to make fast decisions and by January 2007, Jochen was working on his project. He did not wait until the end of his grant to found routeRank and by October 2007, with the support of business angels. Today, the service has grown and been recognized by the famous MIT TR35 award in 2010.

And then there was Andre Mercanzini, a Canadian citizen, who certainly has the drive and enthusiasm of many North-Americans. Andre obtained his PhD at EPFL following a few start-up experiences in the US. Andre has developed electrodes for Deep Brain Stimulation. The path was not as fast and easy as for Jochen. Though Aleva Neurotherapeutics was founded in mid-2008, Andreʼs prototypes needed further validation to attract venture capital (a major use of the grants). The Swiss ecosystem is rich with mentors and support so that Andre developed further his project to the point of raising $10M in his series A round in August 2011.

These are just two examples of EPFL innogrants. Initially backed by Swiss bank Lombard Odier, it has since received support from KPMG and Helbling, an engineering firm. The fact that similar initiatives were launched in Switzerland is another illustration that gap funding attracts and seduces. The Innogrants are a bet on young people. Since 2005, 48 projects have been funded out of more than 300 ideas and 24 companies created. We admit at EPFL that failure is part of the process and even if no start-up is ever launched, the grant is a learning experience. We also have the vision that Innogrants become role models and hope that more and more students will be less shy about expressing their dreams.

What’s a start-up?

Why should I ask such a question 4 years after publishing my book and isn’t this obvious? I do not think it is when I see how many times I need to clarify the difference between a start-up and any corporation. After all, any corporation being launched is a start-up, right? Not so. Thanks to my colleague Pascal :-), I just read another article by Steve Blank, Why Governments Don’t Get Startups, who gives the perfect definition:

“While large companies execute known business models, startups are temporary organizations designed to search for a scalable and repeatable business model.”

In my book, I had said it this way: “A start-up is a company which is born out of an idea and has the potential to become a large company” and I had also added “Apple, Cisco, Google, Intel, Microsoft, Oracle, Yahoo, YouTube. You certainly know these names. These companies did not exist forty years ago. They are technology giants today.”

Why do I like Blank’s definition? Because of his use of “temporary” as well as “search for a scalable and repeatable business model”. Apple, Cisco, Google, Intel, Microsoft, Oracle, Yahoo, YouTube clearly belong to the start-ups; I had not mentioned that non-existing business model.

Now Blank adds something:

“Scalable startups require risk capital to fund their search for a business model, and they attract investment from equally crazy financial investors – venture capitalists. They hire the best and the brightest. Their job is to search for a repeatable and scalable business model. When they find it, their focus on scale requires even more venture capital to fuel rapid expansion.”

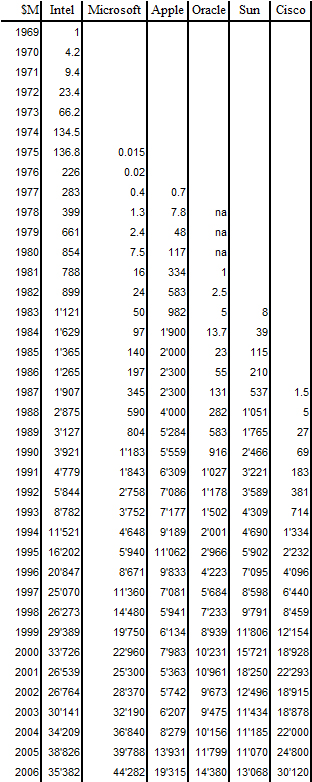

This is the typical Silicon Valley model of fast and usually non-organic growth. Gazelles have often yearly revenue growth of at least 50%, not to say 100%. Look again at the growth rates of Gazelles and Gorillas in my post on the topic or at the revenue growth below (table 8-8 from the book).

I see at least two opened debates:

– In Europe, the growth is often slower, at least less than 100%! Is slow growth compatible with a start-up definition?

– Blank sees two phases of VC funding, the first one to search and validate the business model, the second one to fuel rapid expansion. At least Oracle and Microsoft never had the second funding and their growth was more than 100% during their first 10 years!

The Lean Startup – Eric Ries

After reading Clayton Christensen, Geoffrey Moore and Steve Blank, I was expecting a lot from The Lean Startup by Eric Ries. I was disappointed. It could be that I did not read it well or too fast, but I was expecting much more. But instead of saying what I did not like, let me begin with the good points.

Just like the previous three authors, Ries shows that innovation may be totally counterintuitive: “My cofounders and I are determined to make new mistakes. We do everything wrong. We build a minimum viable product, an early product that is terrible, full of bugs and crash-your-computer-yes-really stability problems. Then we ship it to customers before it’s ready. And we charge money for it. After securing initial customers, we change the product constantly. […] We really had customers, often talked to them and did not do what they said.” [page 4]

On page 8, Eric Ries explains that the lean startup method helps entrepreneurs “under conditions of extreme uncertainty” with a “new kind of management” by “testing each element of their vision”, and “learn whether to pivot or persevere” using a “feedback loop”.

This is he Build-Measure-Learn process. He goes on by explaining why start-ups fail:

1- The first problem is the allure of a good plan. “Planning and forecasting are only accurate when based on a long, stable operating history and a relatively static environment. Startups have neither.”

2- The second problem is the “Just-do-it”. “This school believes that chaos is the answer. This does not work either. A startup must be managed”.

The main and most convincing lesson from Ries is that because start-ups face a lot of uncertainty, they should test, experiment, learn from the right or wrong hypotheses as early and as often as possible. They should use actionable metrics, split-test experiments, innovation accounting. He is also a big fan of Toyota lean manufacturing.

I loved his borrowing of Komisar’s Analogs and Antilogs. For the iPod, the Sony Walkman was an Analog (“people listen to music in a public place using earphones”) and Napster was an Antilog (“although people were willing to download music, they were not willing to pay for it”). [Page 83]

Ries further develops the MVP, Minimum Viable Product: “it is not the smallest product imaginable, but the fastest way to get through the Build-Measure-Learn feedback loop.” Apple’s original iPhone, Google’s first search engine, or even Dropbox Video Demo were such MVPs. More on Techcrunch [page 97]. He adds that MVP does not go without risks, including legal issues, competition, branding and morale of the team. He has a good point about intellectual property [page 110]: “In my opinion, […the] current patent law inhibits innovation and should be remedied as a matter of public policy.”

So why did I feel some frustration? There is probably the feeling Ries gives that his method is a science. [Page 3]: “Startup success can be engineered by following the right process, which means it can be learned, which means it can be taught.” [Page 148]: “Because of the scientific methodology that underlies the Lean Startup, there is often a misconception that it offers a rigid clinical formula for making pivot or persevere decisions. There is no way to remove the human element – vision, intuition, judgment – from the practice of entrepreneurship, nor that would be desirable”. I was probably expecting more recipes, as the ones Blnak gives in The Four Steps to the Epiphany.

So? Art or science? Ries explains on page 161 that pivot requires courage. “First, Vanity Metrics can allow to form false conclusions. […] Second, an unclear hypothesis makes it impossible to experience complete failure, […] Third, many entrepreneurs are afraid. Acknowledging failure can lead to dangerously low morale.” A few pages before (page 154), he writes that “failure is a prerequisite to learning”. Ries describes a systematic method, I am not sure it is a science, not even a process. Indeed, in his concluding chapter, as if he wanted to mitigate his previous arguments, he tends to agree: “the real goal of innovation: to learn that which is currently unknown” [page 275]. “Throughout our celebration of the Lean Startup movement, a note of caution is essential. We cannot afford to have our success breed a new pseudoscience around pivots, MVPs, and the like” [page 279]. This in no way diminishes the traditional entrepreneurial virtues; the primacy of vision, the willingness to take bold risks, and the courage required in the face of overwhelming odds” [page 278].

Let me mention here a video from Komisar. Together with Moore and Blank, he is among the ones who advise reading Ries’ book. I am less convinced than them about the necessity to read this book. I have now more questions than answers, but this may be a good sign! I have been more frustrated than enlightened by the anecdotes he gives or his use of the Toyota strategy. In na interview given to the Stanford Venture Technology program, Komisar talks about how to teach entrepreneurship. Listen to him!

To be fair, Eric Ries is helping a lot the entrepreneurship movement. I just discovered a new set of videos he is a part of, thanks to SpinkleLab.

Fred Destin had also a great post on his blog about the Lean Startup and you should probably read it too to build your own opinion. Lean is hard and (generally) good for you. Fred summaries Lean this way and he is right: “In the real world, most companies do too much development and spend too much money too early (usually to hit some pre-defined plan that is nothing more than a fantasy and / or is not where they need to go to succeed) and find themselves with an impossible task of raising money at uprounds around Series B. So founders get screwed and everyone ends up with a bad taste in their mouth. That’s fundamentally why early stage capital efficiency should matter to you, and why you should at least understand lean concepts.”

Let me finish with a recent interview given by Steve Blank in Finland:

I have devoted the last decade of my life and my “fourth career” to trying to prove that methods for improving entrepreneurial success can be taught. Entrepreneurship itself is more of a genetic phenomenon. Either you have the passion and drive to start something, or you don’t. I believe entrepreneurs are artists, and I’d like to quote George Bernard Shaw to illustrate:

“Some men see things as they are and ask why.

Others dream things that never were and ask why not.”

Over the last decade we assumed that once we found repeatable methodologies (Agile and Customer Development, Business Model Design) to build early stage ventures, entrepreneurship would become a “science,” and anyone could do it. I’m beginning to suspect this assumption may be wrong. It’s not that the tools are wrong. Where I think we have gone wrong is the belief that anyone can use these tools equally well.

When page-layout programs came out with the Macintosh in 1984, everyone thought it was going to be the end of graphic artists and designers. “Now everyone can do design,” was the mantra. Users quickly learned how hard it was do design well and again hired professionals. The same thing happened with the first bit-mapped word processors. We didn’t get more or better authors. Instead we ended up with poorly written documents that looked like ransom notes. Today’s equivalent is Apple’s “Garageband”. Not everyone who uses composition tools can actually write music that anyone wants to listen to.

It may be we can increase the number of founders and entrepreneurial employees, with better tools, more money, and greater education. But it’s more likely that until we truly understand how to teach creativity, their numbers are limited. Not everyone is an artist, after all.”

The Missed Deals of Venture Capitalists

Venture Capitalists are always proud to mention which companies they successfully backed. It is because of their success stories that Sequoia and Kleiner Perkins are so famous in this industry. But the deals the VCs decline are much less famous. In my book, I had mentioned some examples by some pioneers of venture capital:

| Investor | Missed deal |

| Arthur Rock | Rolm then Compaq |

| Bill Draper | Apple |

| Burt McMurtry | Tandem |

| Tom Perkins | Apple |

| Don Valentine | Sun Microsystems |

A few VCs use the humour to tell their biggest mistakes. A colleague of mine (thanks Amin 🙂 ) recently mentioned to me that Bessemer has a full list on their anti-portfolio: A123, Apollo, Apple, Check Point, eBay, Federal Express, Google, Ikanos, Intel, Intuit, Lotus and Compaq,

PayPal, Stratacom.

The most striking miss is probably Google: “[One of Bessemer’s partner] Cowan’s college friend rented her garage to Sergey and Larry for their first year. In 1999 and 2000 she tried to introduce Cowan to “these two really smart Stanford students writing a search engine”. Students? A new search engine? In the most important moment ever for Bessemer’s anti-portfolio, Cowan asked her, “How can I get out of this house without going anywhere near your garage?”

But then what about OVP’s ironic style in their Missed Deals including

Starbucks.

“A guy walks into your office in the late 1980’s and says he wants to open a chain of retail shops selling a commodity product you can get anywhere for 25 cents, but he will charge 2 dollars. Of course, you listen politely, and then fall off your chair laughing when he leaves. Howard Shultz didn’t see this as humorous. And we didn’t make 500 times our money.

To get even (wasn’t our not making money enough?) years later, Howard opened his own venture capital firm right down the street. “

Amazon.

“The Internet boom was just beginning. Amazon had sales of $4M a year. We had a handshake on a term sheet with the CEO to put $2M into Amazon for 20% of the company (a $10M post money value). At the eleventh hour, some guy named John Doerr flew up and offered $8M going in for 20% of the company (a $40M post money value). Handshake? What handshake?

To get even, we buy all our books at Barnes & Noble. We don’t think Amazon has noticed.”

Just a few lessons about the difficulty in reading the future. If you have other links, please comment.

America and entrepreneurship

Nearly 3 years after my unusual post about Obama, here is a post slightly related. Before digging into the topic, I have to admit I have a huge respect for the American president. Even after watching George Clooney’s The Ides of March and the disappointment expressed by many people, I am intrigued and fascinated by his track record. I should add for the anecdote that I was in Washington in October 2009 when he was award the Nobel Peace Prize and in Silicon Valley in September 2011 when he pronounced his recent speech to the Congress. I also quite liked the Titan Dinner.

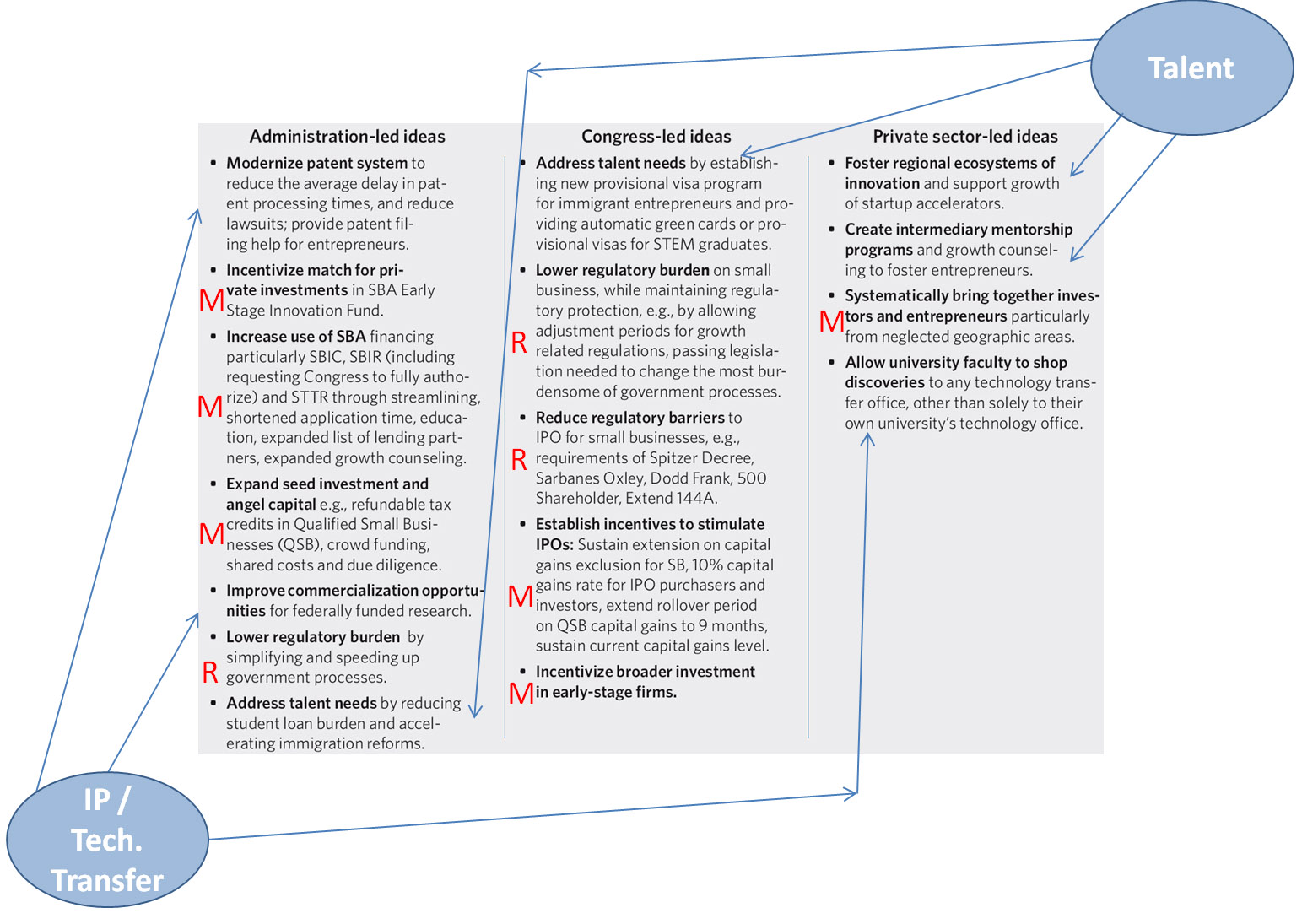

The White House recently published TAKING ACTION, BUILDING CONFIDENCE and the second initiative is about entrepreneurship. It is worth reading these dense 6 pages and among other things, it is striking to notice that the USA, “the most entrepreneurial nation on earth” [page 17] is extremely worried about an “increasingly unfavorable environment” and a “fallen optimism”. For these reasons, the report suggests 12 initiatives to “help spur renewed entrepreneurship”. (They are listed at the bottow on this post)

Here is my simplistic vision of the proposals:

– a few are about lowering the barriers, i.e. “changing the Rules”, what I tagged with an “R” below.

– a few more are about enabling more money and investment towards start-ups, tagged with an “M”.

These are classical measures, important and necessary.

What I found very interesting are the other ones:

– three are about Intellectual Property and Technology Transfer, a sign that the patent system might be in trouble

– even more interesting, the last three are about the People, the Talent. They mention the Immigrants and the Mentors.

These are great advice, that we should also look at very seriously in Europe!

Click on the picture to enlarge

Win the Global Battle for Talent

Some of the most iconic American companies were started by immigrant entrepreneurs or the children of immigrant entrepreneurs. Today, however, many of the foreign students completing a STEM degree at a U.S. graduate school return to their home countries and begin competing against American workers. A significant majority of the Jobs Council calls upon Congress to pass reforms aimed directly at allowing the most promising foreign-born entrepreneurs to remain in or relocate to the U.S.

Reduce Regulatory Barriers and Provide Financial Incentives for Firms to Go Public

Lowering the barriers to and cost of IPOs is critical to accessing financing at the later stages of a high growth firms’ expansion. A significant majority of the Jobs Council recommends amending Sarbanes-Oxley and “rightsizing” the effects of the Spitzer Decree and the Fair Disclosure Act to lessen the burdens on high growth entrepreneurial companies.

Enhance Access to Capital for Early Stage Startups as well as Later Stage Growth Companies

The challenging economic environment and skittish investment climate has resulted in investors generally becoming more risk-adverse, and this in turn has deprived many high-growth entrepreneurial companies of the capital they need to expand. The Jobs Council recommends enhancing the economic incentives for investors, so they are more willing to risk their capital in entrepreneurial companies.

Make it Easier for Entrepreneurs to Get Patent-Related Answers Faster

There are concerns among many entrepreneurs that, as written, the recently passed Patent Reform Act advantages large companies, and disadvantages young entrepreneurial companies. The Jobs Council recommends taking specific steps to ensure the ideas from young companies are handled appropriately.

Streamline SBA Financing Access, so More High -Growth Companies Get the Capital they Need to Grow

The SBA has provided early funding for a range of iconic American companies. The Jobs Council recommends that the Administration streamline and shorten application processing with published turnaround times, increase the number of full time employees who perform a training or compliance function, expand the overall list of lending partners, and push Congress to fully authorize SBIR and STTR funding for the long term, rather than for short term re-authorizations.

Expand Seed/Angel Capital

The Jobs Council recommends that the Administration clarify that experienced and active seed and angel investors should not be subject to the regulations that were designed to protect inexperienced investors. We also propose that smaller investors be allowed to use “crowd funding” platforms to invest small amounts in early stage companies.

Make Small Business Administration Funding Easier to Access

The SBA has provided early funding for a range of iconic American companies, including Apple, Costco, and Staples. The Jobs Council recommends that the Administration streamline and shorten application processing with published turnaround times, increase the number of full time employees who perform a training or compliance function, expand the overall list of lending partners, and push Congress to fully authorize SBIR and STTR funding for the long term, rather than for short term re-authorizations.

Enhance Commercialization of Federally Funded Research

The government continues to play a crucial role in investing in the basic research that enables America to be the launchpad for new industries. The Jobs Council recommends that the Administration do more to build bridges between researchers and entrepreneurs, so more breakthrough ideas can move out of the labs and into the commercialization phase.

Address Talent Needs by Reducing Student Loan Burden and Accelerating Immigration Reforms

A large number of recent graduates who aspire to work for a start-up or form a new company decide against it because of the pressing burden to repay their student loans. The Jobs Council recommends that the Administration promote Income-Based Repayment Student Loan Programs for the owners or employees of new, entrepreneurial companies. Additionally, we recommend that the Administration speed up the process for making visa decisions so that talented, foreign-born entrepreneurs can form or join startups in the United States.

Foster Regional Ecosystems of Innovation and Support Growth of Startup Accelerators

There is a significant opportunity to build stronger entrepreneurial ecosystems in regions across the country – and customize each to capitalize on their unique advantages. To that end, the Jobs Council recommends that the private sector support the growth of startup accelerators in at least 30 cities. Private entities should also invest in at least 50 new incubators nationwide, and big corporations should link with startups to advise entrepreneurial companies during their nascent stages.

Expand Programs to Mentor Entrepreneurs

Research consistently shows that a key element of successful enterprises is active mentorship relationships. Yet, if young companies do not have the benefit of being part of an accelerator, they often struggle to find effective mentors to coach them through the challenging, early stages of starting a company. Therefore, the Jobs Council recommends leveraging existing private sector networks to create, expand and strengthen mentorship programs at all levels.

Allow University Faculty to Shop Discoveries to Any Technology Transfer Office

America’s universities have produced many of the great breakthroughs that have led to new industries and jobs. But too often, research that could find market success lingers in university labs. The Jobs Council recommends allowing research that is funded with federal dollars to be presented to any university technology transfer office (not just the one where the research has taken place).

10 lessons from the Dropbox story

Forbes recently published Dropbox: The Inside Story Of Tech’s Hottest Startup or is it its legend already? (I should thank my colleague Mehdi for mentioning the link to me, 🙂 )

It looks so similar to many of Silicon Vallley success stories that we should sometimes be a little skeptical about such beautiful stories. In any case, it is worth reading and here are my 10 lessons from it:

1- YOUNG GEEK – Drew Houston, the “typical” American start-up founder, began playing with computers at age 5 and began to work with start-ups at age 14. Steve Jobs knew this kid who had reverse-engineered Apple’s file system. He was 24 when Dropbox was launched.

2- ROLE MODEL – “No one is born a CEO, but no one tells you that” is what Houston learnt but when he saw one of his friends starting his own company he thought “If he could do it, I knew I could”.

3- COFOUNDER – In 2007, Paul Graham selected him in his Y Combinator program but insisted he has a cofounder. This would be MIT dropout, Arash Ferdowsi.

4- FRIENDLY ANGEL – Months later, they are supported by Pejman Nozad (famous with Saeed Amidi for their family rug business turned into office space [Logitech, Google] turned into investing [PayPal]).

5- VENTURE CAPITAL – Soon, Nozad introduced them to Michael Moritz (Sequoia’s legendary investor in Yahoo and Google) who invests $1.2M.

6 – MIGRANTS – Both Ferdowsi and Nozad have roots in Iran. They chatted in Farsi when they first met.

7- TALENT & PASSION – “I was betting they have the intellect and stamina to beat everyone else” claims Moritz. “Houston and Ferdowsi moved offices again and often just slept at work.”

8- LEAN & SPEED – Ycombinator funded Dropbox in June 2007, Sequoia in Sept. 2007, followed a year later by $6M from Accel and Sequoia. 9 employees in 2008 (with 200’000 users) and 14 people in 2010 with 2M users.

9- CUSTOMERS – In 2011, Dropbox should make $240M in revenues, from only 4% of its 50-million user base. 70 people and profitable.

10- RESOURCES – Being profitable did not prevent Dropbox to raise another $250M from Index, Greylock, Benchmark and existing investors. At a $4B valuation.