I had the pleasure to be part of the group who contributed to the Beylat-Tambourin report, Innovation: High Stakes for France, which subtitle is also important: Dynamizing the Growth of Innovative Companies. It was a long process, we started working in September and the final document was presented to the Ministers on 5 April. You can download the report in pdf format or here, should the previous one not work..

The report is in French but as I saw the Wall Street journal mentioning it, I thought I would do a post in English too. However, if you read French, go to the sister blog post: L’innovation en France: le rapport Beylat Tambourin. My French is much better!

What should be noted before discussing the content is that 25 members of the mission come from different worlds (see end of article), which could have made it difficult to find agreement. This was not the case. There were debates, but this report summarizes the proposals without forgetting important points, or dilute the point, I think. I read (only) one satirical article in the media, but I’m not sure that the author had read the report (see end of the article as well)…

Click on the image to download the report in pdf format

I translate (again my apologies for my far from perfect English) here a quote from the introduction: “With the acceleration and the complexity of the issues, public policies sometimes seem poor, often messy. […] They have often been compared to a system of research transfer, itself too weak, and indeed not focusing enough on the creation of high-growth companies with an ability to create jobs. […] But there is no single model of innovation. […] However, invariants exist: research excellence; low barriers between public and private sectors; an entrepreneurial culture; cultural diversity, the ability to attract talent at an international level; a migration policy; and a successful combination of start-ups, large corporations, public research, higher education and investors.” [Pages 1-2]

The difficult definition of innovation

Here’s a great paragraph that I want to quote again: “There is no definition – uncontested and incontestable-of innovation but it is possible to bring out some characteristics of innovation:

– Innovation is a long, unpredictable and hard to control process.

– Innovation is not limited to the invention and innovation is not only technological.

– At the end of this process, are created products, services or new processes that demonstrate that they meet the needs (market or non-market) and create value for all stakeholders.

Another point worth noting: an innovation cannot be decreed, cannot be planned, but it is seen through the commercial (or societal) success it meets. This explains why it often comes at the margins of existing businesses and through interactions with many different actors: “The Internet is the product of a unique combination of military strategy, scientific cooperation and protest innovation” in the famous sentence by Manuel Castells.” [Page 5] ” Accordingly, a vision where the expenditure on R&D is the main concern should be changed in favor of a systemic vision for results, in terms of growth and competitiveness.” [Page 6] In other words, innovation is not the invention and certainly not R&D.

Here are the 19 recommendations, divided into four groups:

I. Developing a culture of innovation and entrepreneurship.

II. Increase the economic impact of public research by the transfer.

III. Support the growth of innovative companies.

IV. Develop instruments of public policy for innovation.

For the first group (Culture):

1. Revise teaching methods in primary and secondary schools to develop innovative initiatives.

2. Implement a large-scale program for entrepreneurship learning in higher education.

3. Promote the dissemination from large groups through spin-offs.

4. Develop a policy for attractiveness of talent around innovation.

For the second group (transfer):

5. Implement the operational monitoring of 15 measures for rebuilding the transfer of public research (see http://www.enseignementsup-recherche.gouv.fr/cid66110/une-nouvelle-politique-de-transfert-pour-la-recherche.html – in French)

6. Promote the mobility of researchers between the public and private sectors.

7. Develop a coherent program for the transfer through the creation of businesses.

8. Focus SATT on maturation [SATT are the new French structures for academic technology transfer].

9. Establish a consistent policy of public-private research partnerships, bringing together different policies (scattered today).

For the third group (growth):

10. Address the lack of equity financing for innovative companies (venture capital and later-stage growth equity) by mobilizing a small part of the French savings and improving the possible exit strategies for investors in these segments.

11. Launch “early stage” sector initiatives.

12. Implement the policy instruments of protection (IP, standardization) serving innovative companies.

13. Harmonize the different labels of innovative companies for better readability and link them to the growth of companies, consistently aligning all support tools available.

14. Encourage large groups and large public institutions to be involved in the emergence and growth of innovative enterprises, integrating new dimensions in their obligation for environmental and social responsibility.

Finally for the last group (public policy):

15. Recognize the role of metropolitan innovation ecosystems as the support for regional strategies as well as for the national innovation strategy.

16. Organize the transfer system to make it more readable and more efficient.

17. Provide the means to develop, pilot and evaluate a comprehensive and coherent strategy of French innovation.

18. Appoint a single operator for the operational consolidation of public finance policies of innovation: the BPI (the Investment Public Bank in its innovation component).

19. Making innovation a real political issue, organizing a broad public debate.

[Again sorry for the imperfect translation. I hope you got the points…]

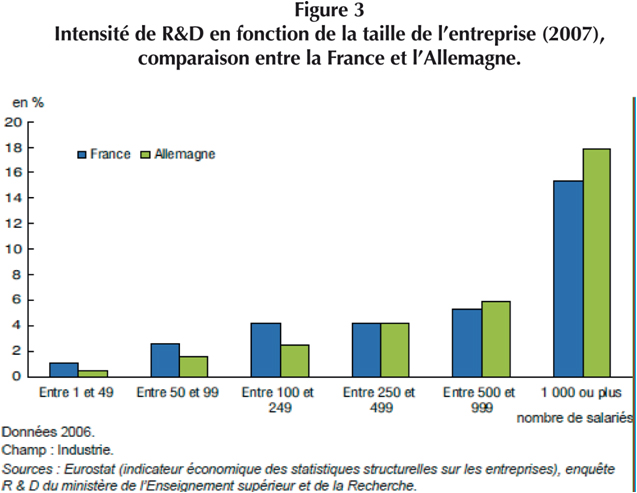

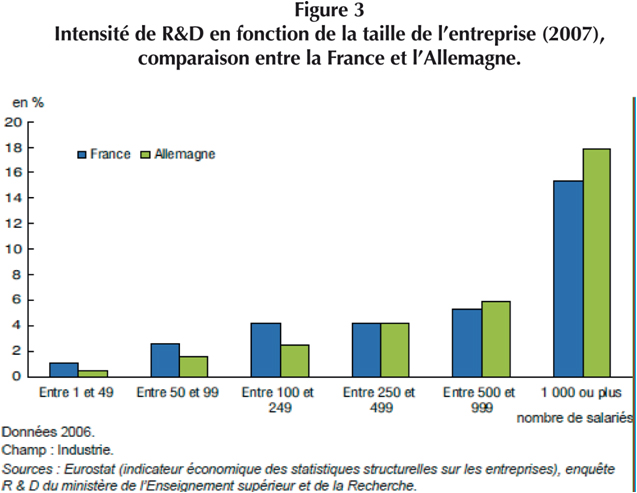

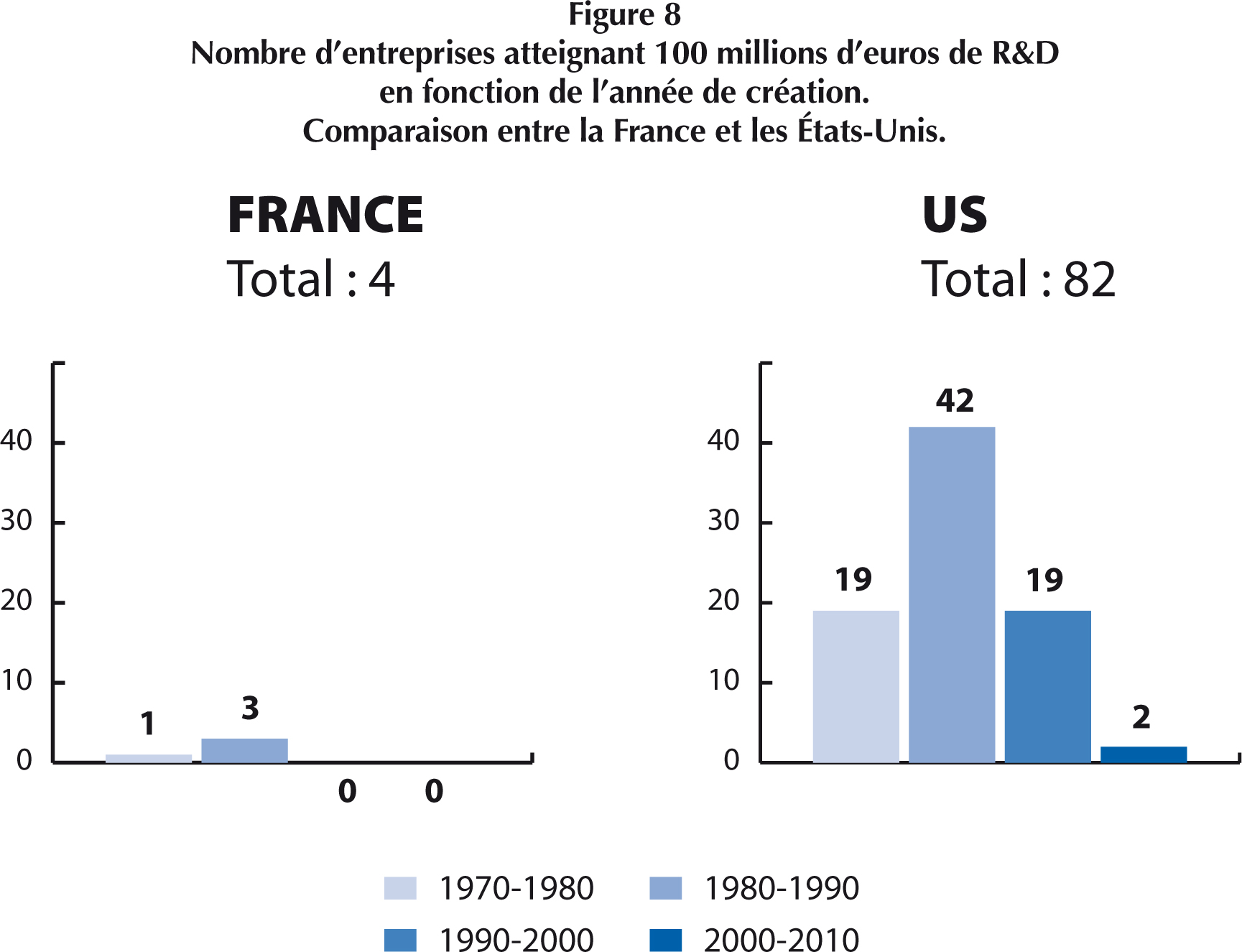

As explained in the Wall Street Journal in Nineteen Ways to Make France More Innovative, “In the short-term, the government should move away from considering R&D spend as a metric of innovation recommended the authors, and look at jobs created. France outspent Germany on R&D in many areas, said Mr. Beylat and Mr. Tambourin, but the effect wasn’t felt in the economy.”

Another comment concerns the sub-title of the report: Dynamizing the Growth of Innovative Companies. This is a very important subtitle, but do not get me wrong, it is not about start-ups only here, but the message is that innovative companies should be a source of growth, whether large groups, SMEs or start-ups. It may not be a cultural revolution, or is it?

To push the envelope a little further, here is a short excerpt: “France is between the American dream of Silicon Valley, where disruptive innovations are supported by start-ups, the German dream of a well-established industrial Mittelstand, efficient in incremental innovation, and a French tradition of industrial planning in sovereign sectors. This oscillation blurs the representation that France has made of innovation because it mixes breakthrough innovation, incremental innovation and “strategic industrial policy.” We must cut short a myth: if innovation often requires an excellent R&D, it is not limited to R&D. It is not its natural extension. Innovation is above all the process that leads to the marketing of products or services, meeting a need, made by individuals engaged in an entrepreneurial approach. Innovation is thus at the crossroads of several areas, first and foremost research, entrepreneurship, industry and education. There is therefore no conceptual optimization or normative expected pattern.” [Page 6]

And on the cultural aspects: “Innovation is primarily a matter of individuals, state of mind and ambition for the company and for themselves. The dissemination of the culture of innovation and entrepreneurship is vital. These cultures are closely linked: vision, risk-taking, acceptance and learning from failure, capacity for initiative, project culture and commitment to completion are the main components. Finally, the ability to create companies with high growth potential (spin-offs and start-ups), some of which will become world leaders, sometimes in a few years, characterizes an effective innovation system.” [Page 7]

And finally I add a quote from President Obama, which perfectly symbolizes the problem: “We insist on personal responsibility and we celebrate individual initiative. We’re not entitled to success. We have to earn it. We honor the strivers, the dreamers, the risk-takers, the entrepreneurs who have always-been the driving forces behind our free enterprise system – the greatest engine of growth and prosperity the world has ever known.”

The report was presented to ministers on April 5, and to the French Prime Minister on April 8, for the appointment of Anne Lauvergeon as President of Innovation 2030. Genevieve Fioraso [the French minister for research and higher education] noted, however, in her introduction to the submission of this report, that President Obama was able to speak for about an hour on this one chapter of innovation. Where else would this be possible?

Finally, and this is a personal note, this report should be used more as a base for innovation than as a toolbox or a set of recipes. This is the big picture that matters and not the extraction of recommendations that would suit one or the other. “The issues of competitiveness show that innovation must be at the heart of public policy, as illustrated by our recommendations. While this is a technical issue that is inherently complex (because of all the dimensions that make up), where the “right” decisions are sometimes against-intuitive (eg, linear view of innovation seductive but wrong), it seems essential that innovation becomes a real political issue to ensure its adoption by policy makers and citizens.” [Page 121]

Finally I would like to add more quotes on innovative ecosystems. As it begins to be long, I’ll do it in a future article …

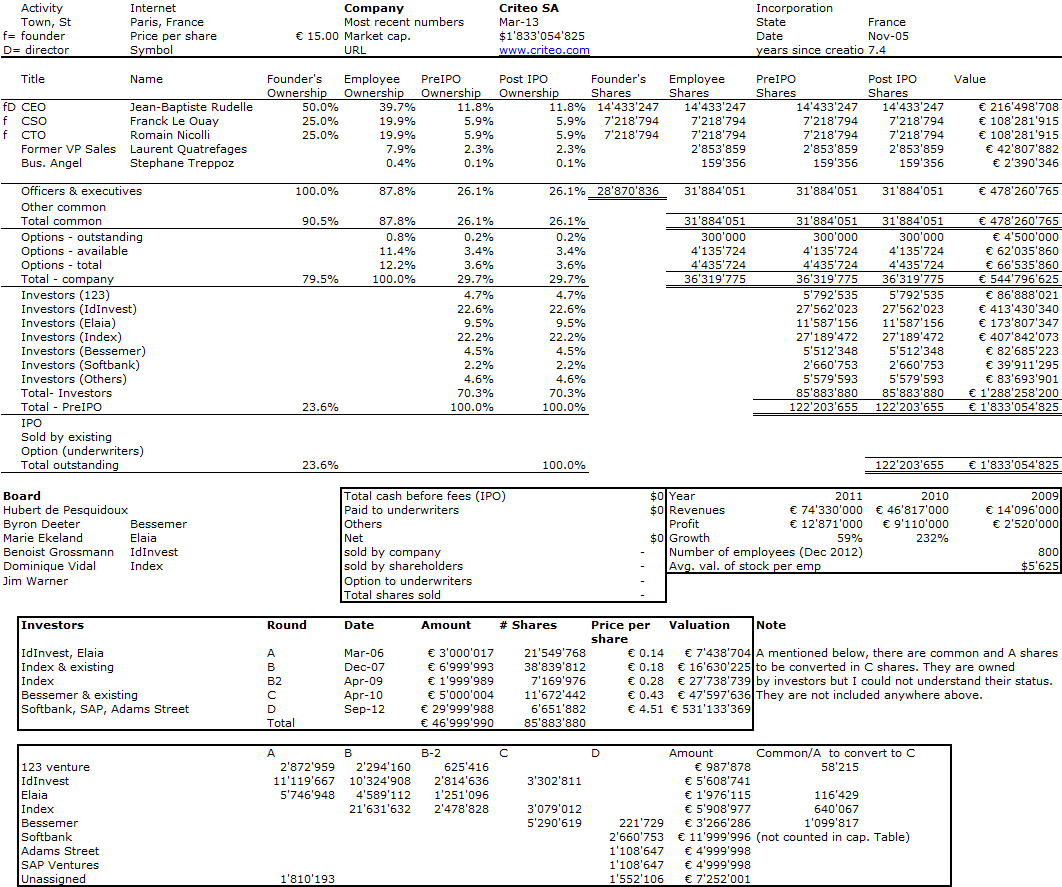

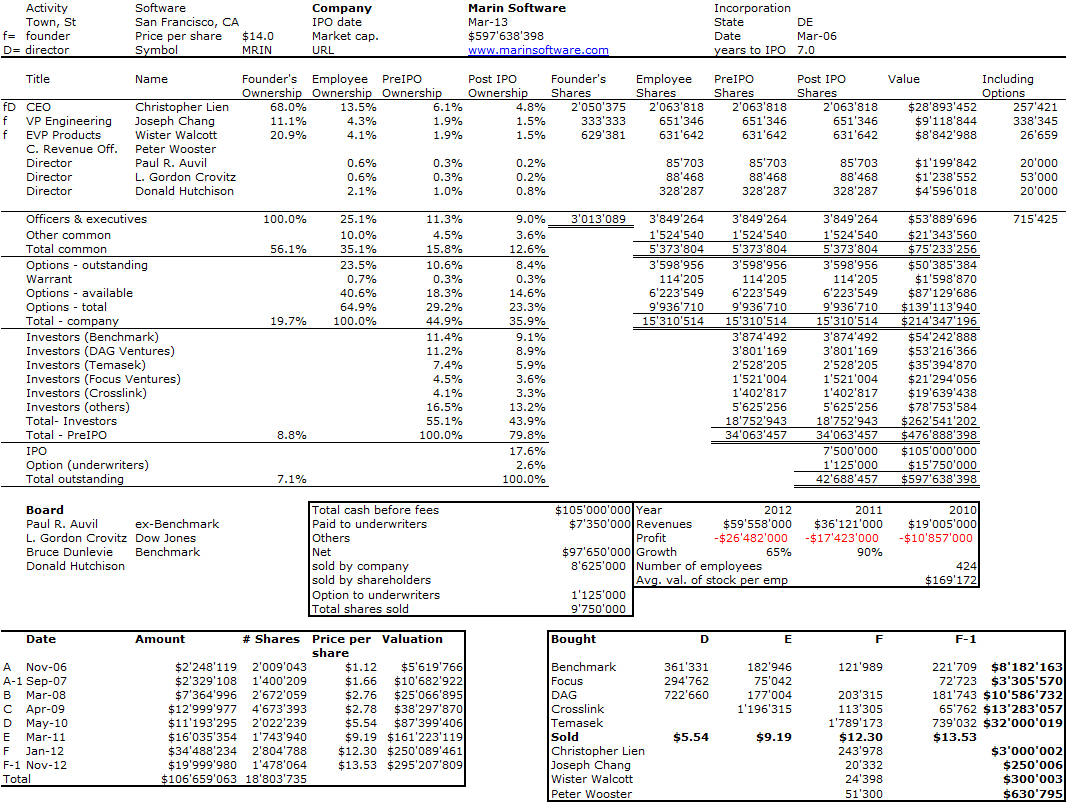

Facts and Figures

They show the challenges of innovation, particularly in France. I’ll let you judge for yourself.

R&D Intensity (compares France and Germany in their R&D efforts relatively to firm size)

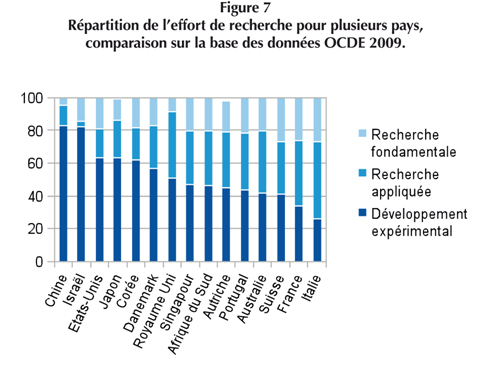

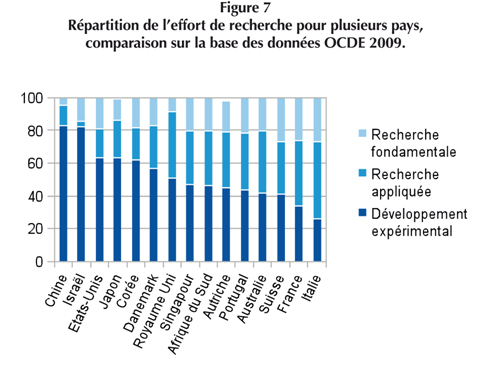

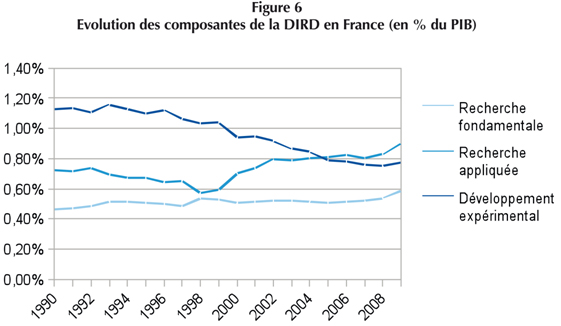

An interesting typology of research using fundamental and applied research as well as experimental development

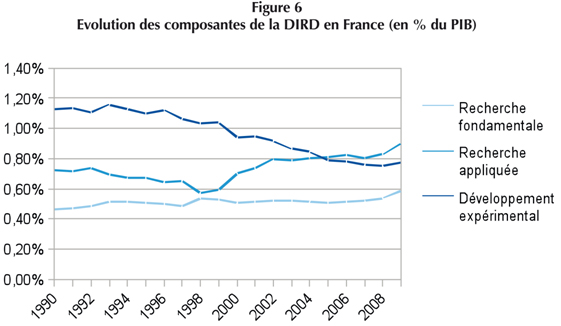

… and its evolution in France

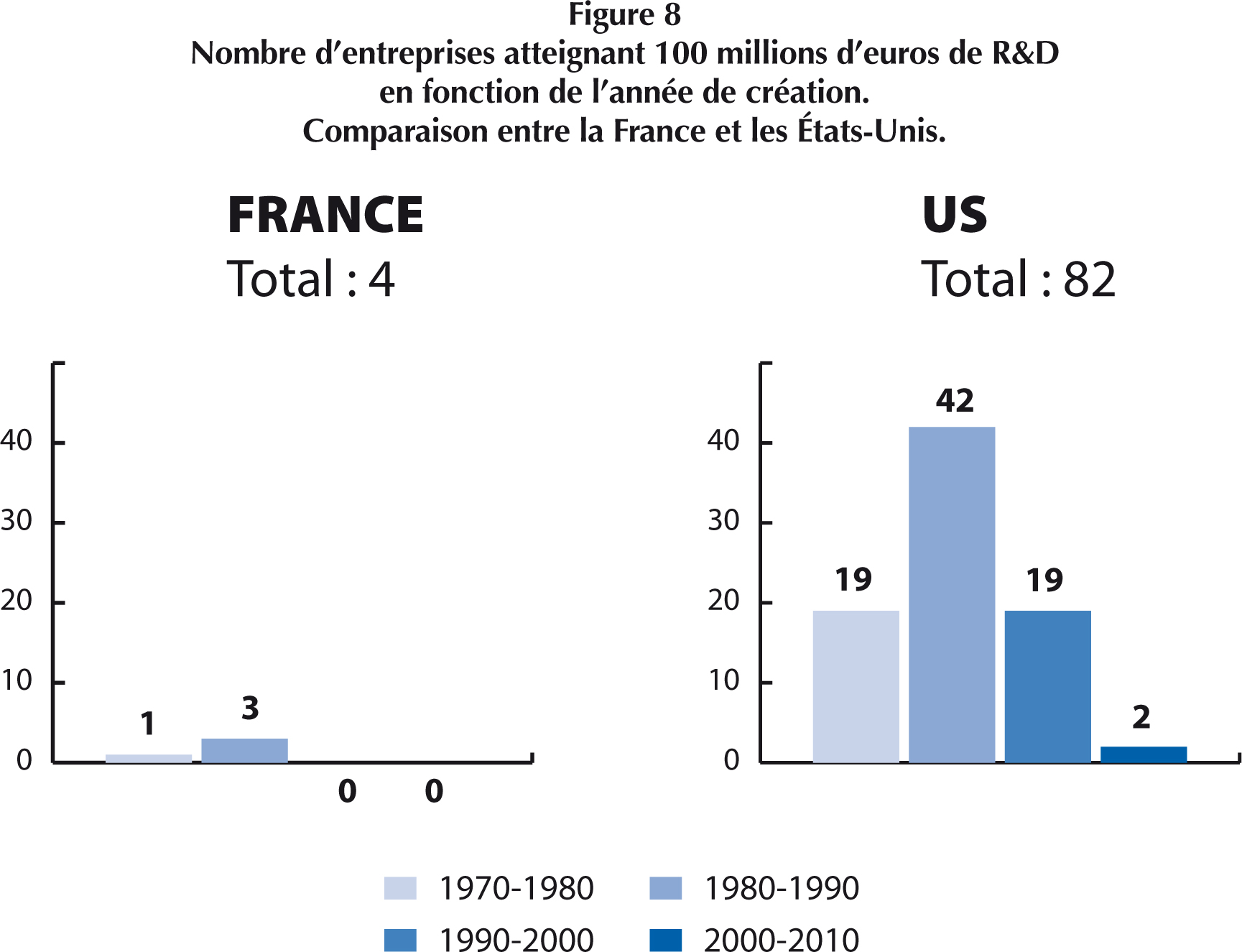

A real issue: company growth – number of companies reaching €100M in R&D relatively to company year of foundation

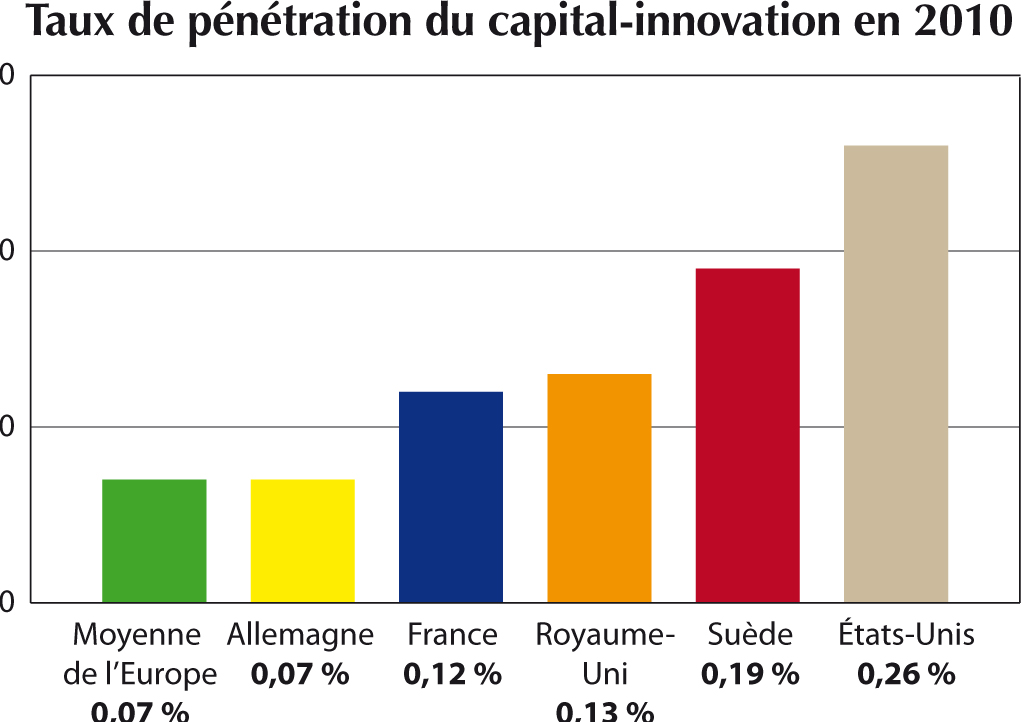

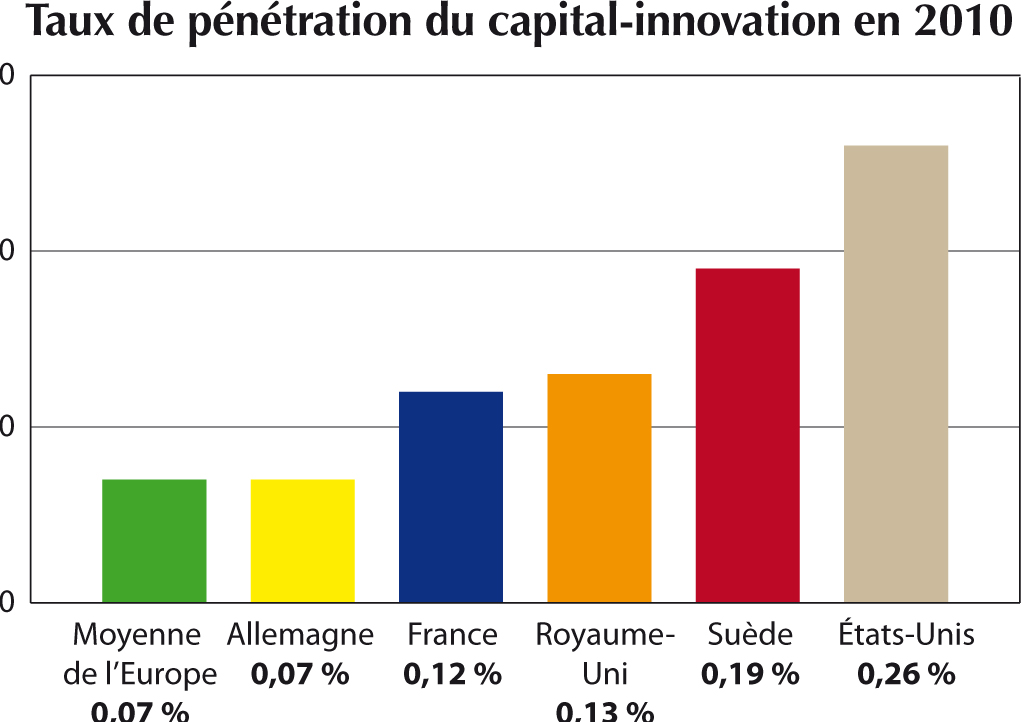

The complexity of the financing situation – as a % of GDP

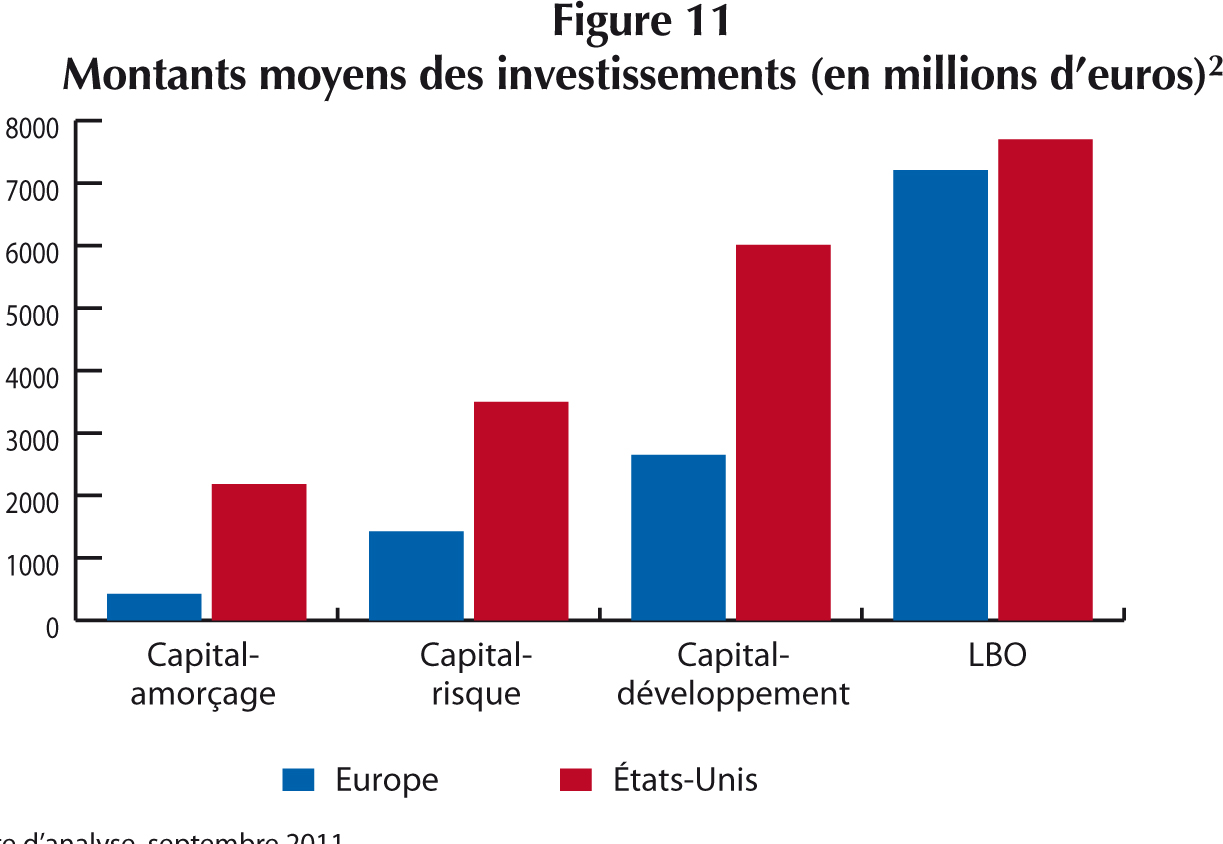

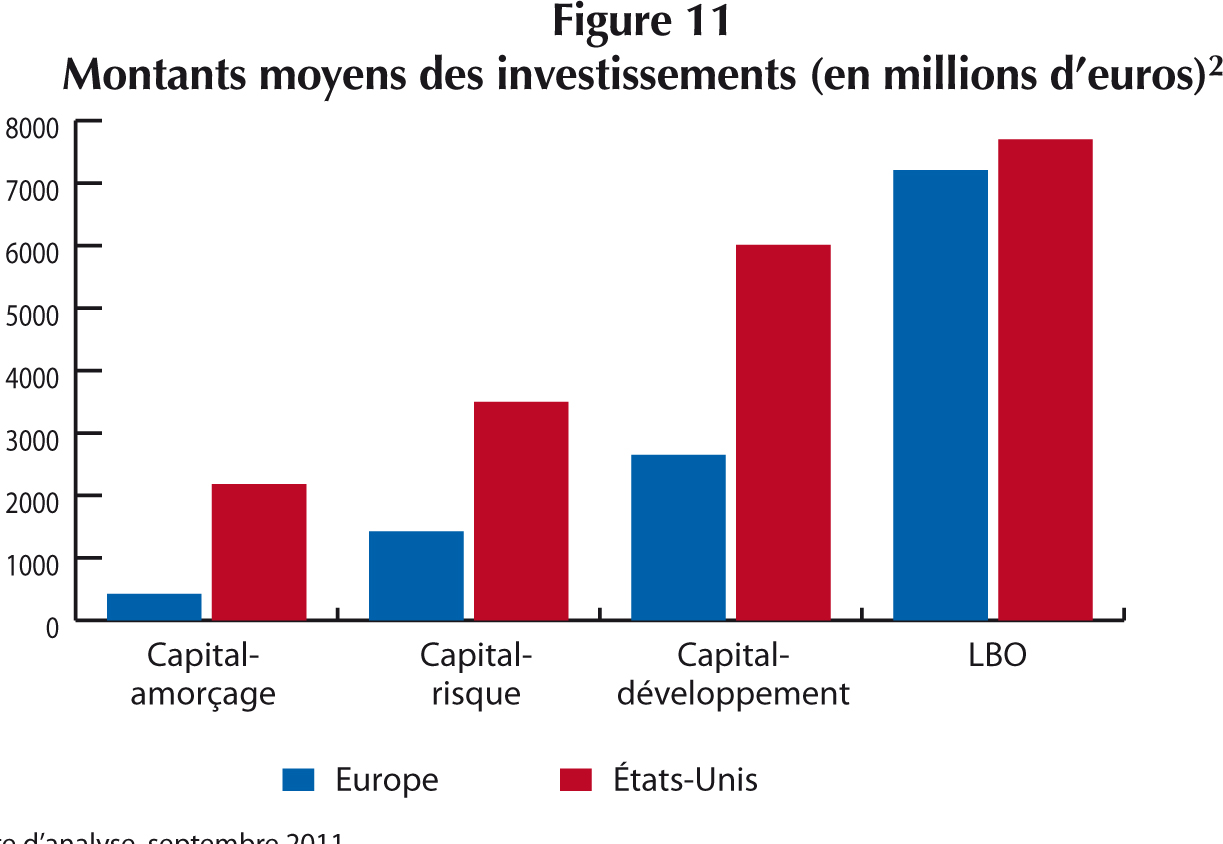

The complexity of the financing situation – seed, early, late & LBO

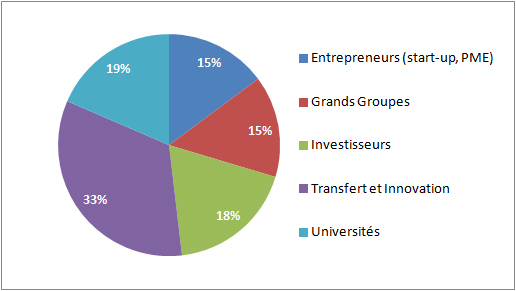

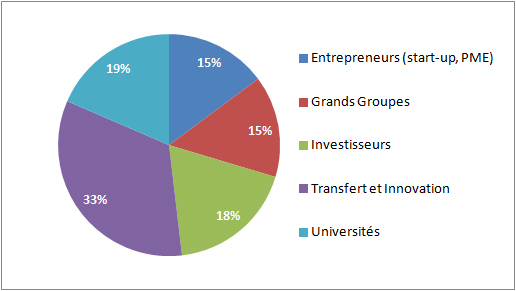

As mentioned above this is the origin of 27 members (two presidents, 25 experts).

A few references from the Press:

– Nineteen Ways to Make France More Innovative (Wall Street Journal)

– Une mission sur l’innovation après le rapport Gallois (les Echos)

– Cinq pistes pour favoriser l’innovation en France (L’Expansion)

– Le gouvernement va-t-il enfin mener une politique volontariste d’innovation ? (ZDnet)

– Un rapport sur l’innovation qui sent la naphtaline (The satirical article by L’Informaticien)