“As America’s rural communities stagnate, what can we learn from one that hasn’t?” is the subtitle of Our Town by Larissa MacQuhar in the Nov 13, 2017 paper edition of the New Yorker. The online title is Where the Small-Town American Dream Lives On. It is a strange and fascinating analysis of America. (By the way in the same edition, you can also read The Patriot a critic of the collected nonfiction of Philip Roth, another enlightening explanation of what American-ness is.

The Chamber of Commerce in orange City, Iowa. Photograph by Brian Finke.

Towards the end of this 10-page article, the author writes: In his 1970 book, “Exit, Voice, and Loyalty,” the economist Albert O. Hirschman described different ways of expressing discontent. Your can exit – stop buying a product, leave town. Or you can use voice – complain to the manufacturer, stay and try to change the place you live in. The easier it is to exit, the less likely it is that a problem will be fixed. That’s why the centripetal pull of Orange City was not just a conservative force; it could be a powerfully dynamic one as well. After all, it wasn’t those who fled the town who could push it onward, politically or economically -it was the ones who loved it enough to stay, or to come back.

Americans, Hirschman wrote, have always preferred “the neatness of exit over the messiness and heartbreak of voice.” Discontented Europeans staged revolutions; Americans moved on. “the curious conformism of Americans, noted by observers ever since Tocqueville, may also be explained in this fashion,” he continued. “Why raise your voice in contradiction and get yourself into trouble as long as you can always remove yourself entirely from any given environment should it become too unpleasant?”

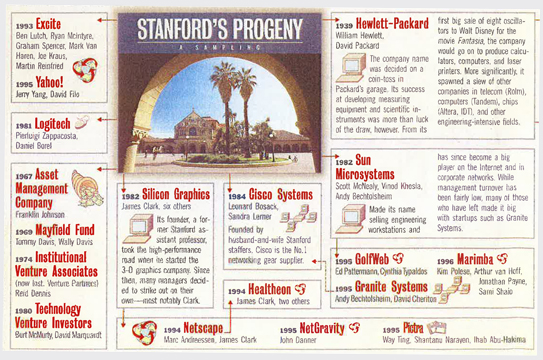

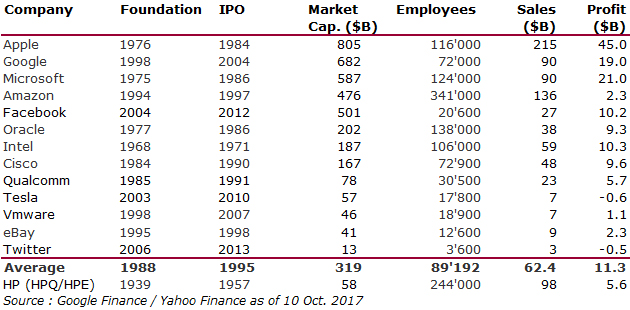

There are many other interesting descriptions of people leaving and those staying; and of their ambitions, their motivations. I am not sure how this relates to innovation and entrepreneurship, but I remember Robert Noyce, one of Silicon Valley’s fathers with born in a small town in Iowa… and moved first to MIT for his PhD and then West.