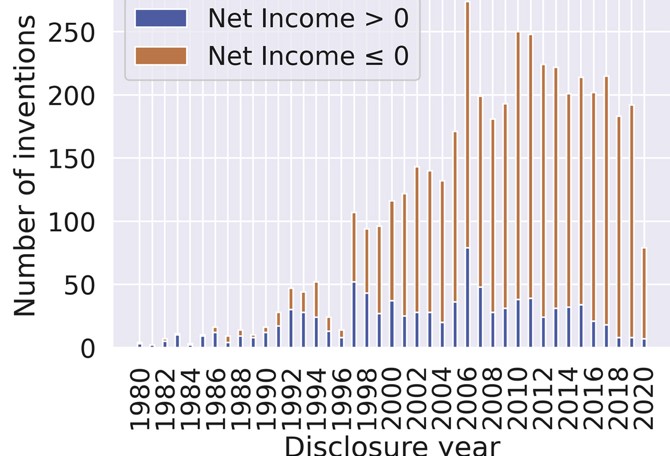

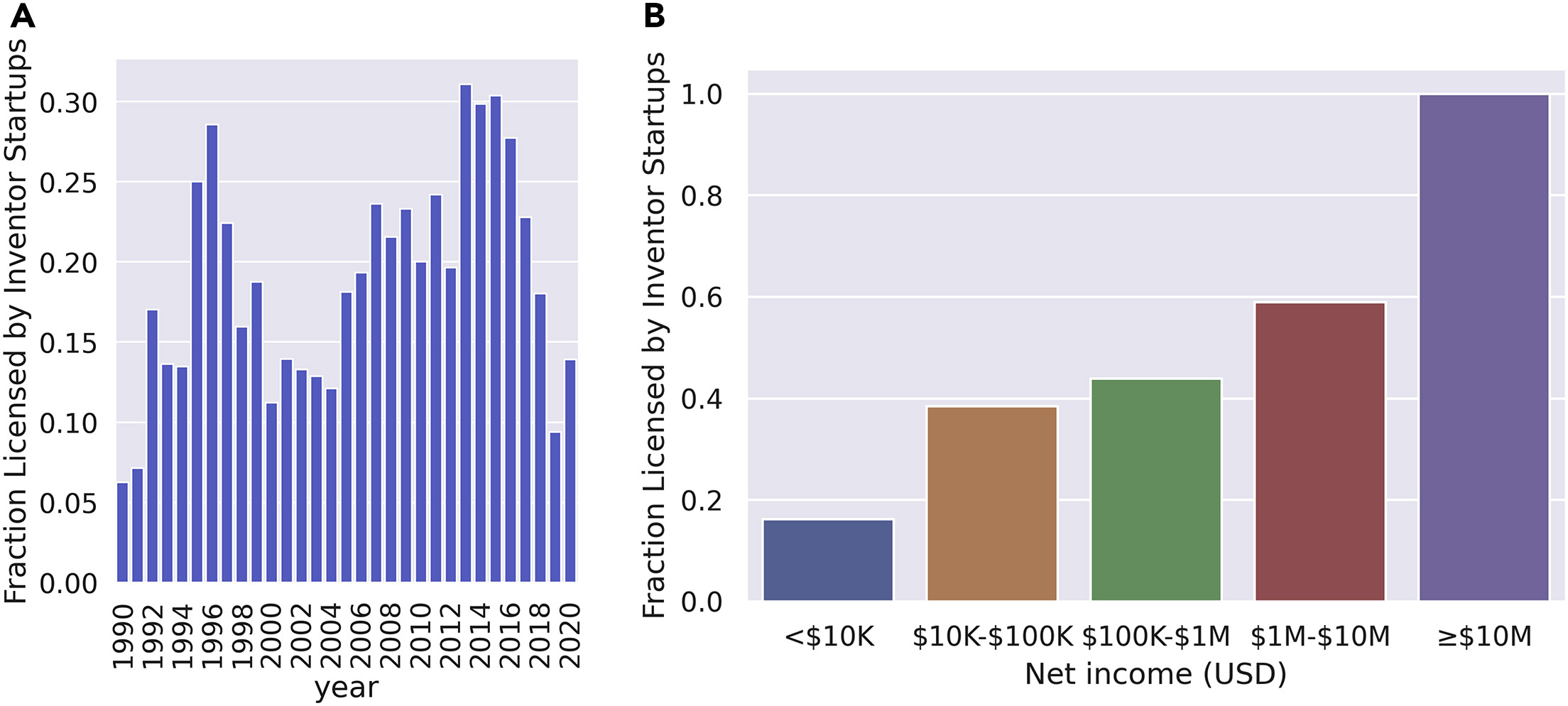

In recent weeks or months, I have been discovering with amazement or embarrassment that many people in Silicon Valley have apparently turned their backs to support Trump’s policies in the United States. It’s quite impressive, even if it’s not as impressive as we think. I already addressed the topic in July 2024, at a time when I believed Kamala Harris would be elected president. It was titled Politics and Silicon Valley. And I indeed discovered that former Democrat “sympathizers” were turning to Republicans such as Mark Zuckerberg, Sam Altman, or Marc Andreessen. Worse, it seems that even Sundar Pichai (CEO of Google) or Tim Cook (CEO of Apple) were going in the same direction. After all, in Europe, we are never shocked that a boss is right-wing and the least favored are left-wing. Again, you can reread my post on the subject. In reality, Silicon Valley is so Democrat in its voting that it was perhaps difficult to position oneself otherwise, and today, people position themselves more openly. Votes are also evolving as illustrated here.

So I asked myself the question: who is opposing Trump today in tech and Silicon Valley?

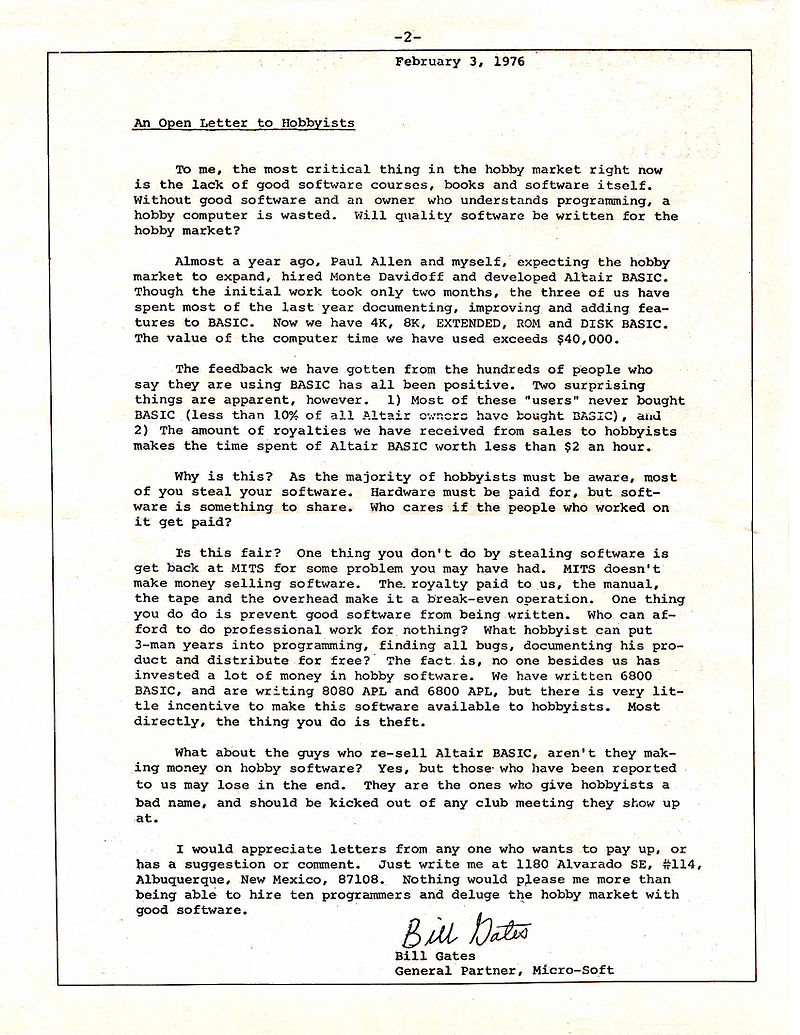

I was pleasantly surprised to find that there were figures like Bill Gates and Michael Moritz:

– Bill Gates is a moderate and not active politically. But I quote him from Bill Gates says he’s surprised about his fellow billionaires’ rightward political shift: ‘I always thought of Silicon Valley as being left of center’ : “The fact that now there is a significant right-of-center group is a surprise to me.” while “incredible things happened because of sharing information on the internet,” social media has had major downfalls. “You see ills that I have to say I did not predict,” While Gates is by no means an open Trump supporter, he said he’d do his best to work with the president. “I will engage this administration just like I did the first Trump administration as best I can,” Gates told the NYT.

– Michael Moritz is less well known, but given that he funded Google, Yahoo!, PayPal, Apple, Cisco, and YouTube, we can appreciate what he has to say in Trump’s tech backers are ‘making a big mistake,’ Trump’s tech financiers and supporters were “making the same mistake as all powerful people who back authoritarians.” He wrote that wealthy financiers believe “they will be able to control Trump,” or else are committing “another cardinal error: deluding themselves that he will not do what he says or promises.” “That has not been the modus operandi of authoritarians over the centuries,”

Paul Graham, whom I respect, wrote an article on wokeness that deserves careful reading, but it’s not really an opposition to Trump; rather, it seeks to explain a movement. Please read The Origins of Wokeness. For example I’m not going to claim Trump’s second victory in 2024 was a referendum on wokeness; I think he won, as presidential candidates always do, because he was more charismatic; but voters’ disgust with wokeness must have helped. And “Trump and wokeness are cousins”.

Steve Blank is rather silent but I discovered that in 2020, that he resigned from a Department of Defense advisory board, protesting the Trump administration’s decision to oust most of his fellow board members and replace some of them with political loyalists with no defense or business experience. See here.

Who else? I’ve searched a bit in vain. My “heroes” are rather silent, but they always have been, so what can I conclude? Hopefully, some will wake up and dare to oppose them, whatever the cost…

PS: I found a little more, for example, Larry Page: “I intend to tell the president that we are with him and that we will help him in any way we can. If you can reform the tax code, reduce regulations and negotiate better trade agreements, the US technology industry will be stronger and more competitive than ever3, he would be quoted as saying by Andoidsis.

Roger McNamme is another investor: Well, everything about Trump seems like a payback, right? All these executives are giving a million dollars each. These are rounding spreads. This is money they find between the cushions of their living room couch. But, you know, this is essentially a precautionary payment. And in Musk’s case, the investment he made in Trump, which was a quarter of a billion dollars, or the investment he made in Twitter, which was about $44 billion, has paid off, obviously, many, many times over. I think Trump and Musk will eventually part ways. I don’t know Trump at all, but he doesn’t seem like the kind of guy who would support someone who competes on the same level as Musk. But we’ll see how it goes. See here.

And of course, yes, there is Reid Hoffman, the founder of Linkedin, “one of the tech bosses most fiercely opposed to Donald Trump and Elon Musk“. See here or there or again là.

PS2: April 15, 2025. On the day Harvard University rejects Donald Trump’s requests, I just read a few marvelous pages from the Magic Mountain by Thomas Mann. Here they are:

There came a day when Herr Settembrini directly confronted his pupil, and so betrayed his own pedagogic uneasiness. “But in God’s name, my good engineer, he is just a stupid old man. What do you see in him? Can he do anything for you? It is beyond all reason. It would be clear enough — though not necessarily praiseworthy—if you were simply taking him into the bargain, if in seeking out his company you were seeking out that of his current sweetheart. But it is impossible not to notice that you pay almost more attention to him than to her. I implore you, help me understand this.”

Hans Castorp laughed. “By all means,” he said. “Agreed! The fact is, as we know—permit me to say—fine!” And he tried to ape Peeperkorn’s cultured gestures as well. “Yes, yes,” he said, and laughed again. “You find that stupid, Herr Settembrini, and certainly it is vague, which in your eyes is worse than stupid. Ah, stupidity. There are so many different kinds of stupidity, and cleverness is one of the worst. Hello! Why, I think I’ve just coined a phrase, a bon mot. How do you like it?”

“Very much. I cannot wait for your first collection of aphorisms. Perhaps there is still time, however, to ask you to take into account certain observations we have occasionally made concerning the misanthropic nature of paradoxes.”

“It shall be done, Herr Settembrini. Absolutely—shall be done. No, in this bon mot of mine, you do not see me in hot pursuit of paradoxes. I was merely trying to point out the great difficulty one has in defining ‘stupidity’ and ‘cleverness.’ It is so hard to keep them separate, they are so intertwined. I know very well how you hate any sort of mystical guazzabuglio and are a man who believes in values and judgments—value judgments—and I quite agree with you. But the issue of ‘stupidity’ and ‘cleverness’ is at times a complete mystery, and it must be permissible to concern oneself with mysteries, always presuming it is an honest attempt to get to the bottom of them, if possible. Let me ask you this question: Can you deny that he has us all in his pocket? I’m putting it crudely, and yet, as nearly as I can tell, you cannot deny it. He puts us in his pocket, and somehow or other he has the right to make fun of us all. But why? And how? And where does it come from? It is certainly not a matter of his cleverness. One can hardly speak of cleverness in this case, I admit. He is much more a man of fuzziness and feelings, feelings are his cup of tea, so to speak—if you’ll forgive me the colloquial phrase. What I am saying is this: it is not by way of cleverness that he puts us in his pocket, not through intellectual prowess. You wouldn’t stand for that. And it really is out of the question. But surely it is not physical prowess, either! It cannot be because of his broad captain’s shoulders, or any raw brute force, or because he could lay any one of us flat with his fist—it would never occur to him that he could, and if it did, why, a few civilized words would calm him down. And so it’s not physical, either. And yet the physical dimension does play a role, without a doubt—not in the sense of brute strength, but in another, more mystical sense—the moment anything physical plays a role, things always get mystical. And the physical merges into the intellectual, and vice versa, and cannot be differentiated, and stupidity and cleverness cannot be differentiated. But the effect is there, the dynamic effect, and we find ourselves stuck in his pocket. And for that we have only one word at hand, and that word is ‘personality.’ We use the word in another, perfectly reasonable sense, too: we are all personalities—moral and legal and all those other sorts of personalities. But that is not what I mean. I’m talking about a mystery that extends beyond stupidity and cleverness, and that is what we need to concern ourselves with—partly to get to the bottom of it, if possible, and partly, to the extent that it is not possible, to edify ourselves. And if you are for values, then, in the end, personality is a positive value, too, I should think—a more positive value than stupidity or cleverness, positive in the highest degree, absolutely positive, like life itself—in short, a value for life and in that sense suitable for our earnest consideration. And that’s how I thought I should respond to what you said about stupidity.”

Herr Settembrini let silence reign. Then he said, “You deny that you are in hot pursuit of paradoxes. By now you should know that I have an equal dislike of seeing you in hot pursuit of mysteries. By turning personality into an enigma, you run the danger of idol-worship. You are venerating a mask. You see something mystical where there is only mystification, one of those hollow counterfeits with which the demon of corporeal physiognomy enjoys taunting us on occasion. You have never spent any time in theatrical circles, have you? So you do not know those thespian faces that can embody the features of a Julius Caesar, a Goethe, and a Beethoven all in one, but whose owners, the moment they open their mouths, prove to be the most miserable ninnies under the sun.”

“Fine, a freak of nature,” Hans Castorp said. “And yet not just a freak, not just something to taunt us. For people to be actors, they must have talent, and talent is something that goes beyond stupidity and cleverness, it is itself a value for life. Mynheer Peeperkorn has talent, too, no matter what you may say, and he uses it to put us in his pocket. Set Herr Naphta in the corner of a room and have him deliver a lecture on Gregory the Great and the City of God, something well worth listening to — and in the other corner have Peeperkorn stand there with his strange mouth and a brow raised in great creases and say nothing except, ‘By all means! Permit me to say—settled!’ And you will see people gather around Peeperkorn, down to the last man, and Naphta will be left sitting there alone with his cleverness and his City of God, although he can express himself so clearly that it makes your blood and spit run cold, to use one of Behrens’s phrases.”

“You should be ashamed of yourself, worshiping success like that,” Herr Settembrini chided him. “Mundus vult decipi. I do not demand that people flock around Herr Naphta. He is a dreadful obstructionist. But I would be inclined to stand at his side in the imaginary scene you have just painted with such reprehensible relish. Go ahead and despise distinctions, precision, logic, the coherence of the human word. Go ahead and despise it in favor of some sort of hocus-pocus of insinuation and emotional charlatanry—and the Devil will definitely have you in his—”