I regularly follow the publications of Serge Kinkingnéhun, whose strong statements are such as “I apply the properties of the cockroach to startups to make them invulnerable” so I read with delight his recent book La stratégie du cafard (The Cockroach’s strategy), which subtitle is also strong: “Cockroach perhaps, but I create profitable startups”

So why such a love for cockroaches (rather than unicorns)? The author refers to an article by Catarina Fake dating from September 2015: The Age of the Cockroach from which I take a brief extract: A Plague is coming to kill off the Unicorns. Inflated and unsustainable valuations, a shaky stock market, a weak China, and the aftermath of excessive enthusiasm are all pointing to the inevitable. Who will survive? As always, the less glamorous, but very hardy Cockroaches.

He could have cited Paul Graham who wrote on his blog in 2008: Fortunately the way to make a startup recession-proof is to do exactly what you should do anyway: run it as cheaply as possible. For years I’ve been telling founders that the surest route to success is to be the cockroaches of the corporate world. The immediate cause of death in a startup is always running out of money. So the cheaper your company is to operate, the harder it is to kill. And fortunately it has gotten very cheap to run a startup. A recession will if anything make it cheaper still. And related to the topict, the founder of AirBnB was proud to be treated as such by the founder of YCombinator: Surprisingly, Paul [graham] said, “If you can convince people to pay $40 for a $4 box of cereal, maybe you can get strangers to stay in other strangers’ homes.” He also liked that we were resilient, calling us “cockroaches.” In the midst of an investment nuclear winter, he believed only the cockroaches would survive, and apparently, we were one of them. More here.

Serge Kinkingnéhun dedicates his book to all entrepreneurs who want to remain free! adding Live Free or Die. Does he want to indicate that being a cockroach is a way of being happy because it is invulnerable? The author pertinently recalls a certain number of fundamentals of entrepreneurship. Its chapter 2 is entitled A startup is first and foremost a business [Page 20]. However, this is not exactly what Steve Blank explains here. Whether a startup is a business or a business in the making, there is a consensus on the necessary survival of the organization and that its main fuel is money, the use of which must be optimal.

Serge Kinkingnéhun gives a multitude of excellent advice such as the answer to the title of chapter three When to start your startup? [Page 103]: as late as possible, that is to say when cash flow requires the creation of a bank account. He explains How to sell without a product or service (Page 27]. He also explains How to find non-dilutive financing [Page 129] And he has numerous examples such as KFC, Free by Xavier Niel, MailChimp, CoolMiniOrNot (CMON) for what is the crowdfunding strategy of the latter.

I must not give the impression of an excessive fascination with cockroaches. Indeed ! The book remains very focused on a particular and very French situation; namely that the state through subsidies (multiple grants) and favorable taxation (the Research Tax Credit for example) allows businesses to survive. I’m not sure it promotes growth, even slow growth. Furthermore, the examples given are always fascinating but not necessarily exemplary. Cmon, Mailchimp, Free seem to have been possible because the founders had (had) an entrepreneurial activity which facilitated the launch of the new one. The world of food and/or mass distribution shows a very large proportion of unlisted companies as indicated on Wikipedia, companies which in their own way undoubtedly started like Serge Kinkingnéhun’s cockroaches without ever external funding but bank loans.

In reality, entrepreneurs are often cockroaches. In high-tech, there was more than just MailChimp. There was GoDaddy, Navision, or even more famous Oracle or Microsoft, companies which were able to grow their revenues without using (or very little) fundraising. There is no doubt that this is the strongest way to grow. I am not convinced that all of the world’s technology could have reached this stage without the particular model of venture capital, the limits of which the author clearly shows. Investors are impatient, sometimes incompetent. It is therefore better to know who you are dealing with and how.

But I remain cautious about the fact that inventiveness and frugality would be exclusive alternatives as promising as what venture capital has brought to the world of technology over the past fifty years. VC has a history and a reason for existing. It has excesses too. But I still think its existence stems from a need to find a way to launch a business before customer revenue is a possibility. Intel, Apple, Google were undoubtedly born from this constraint. Inventiveness and creativity have also been part of their history. I am therefore not convinced that we can systematically create quickly profitable startups (at least in high-tech).

(And on another sidenote which would deserve an article, I just like unicorns as little as I like cockcroaches, as they are the result of a deviation from the world of startup financing, by the arrival of exuberant actors who have forgotten or did not know the rules of financing of startups, based in fact on inventiveness and frugality… but that’s another subject. You can for example read How Venture Capitalists Are Deforming Capitalism)

Another important nuance: I am not an entrepreneur and Serge Kinkingnéhun is. There is probably neither a single typology of entrepreneurs as the author indicates. What is important is that the actions are in harmony with the personality, ambitions and intentions of the actors.

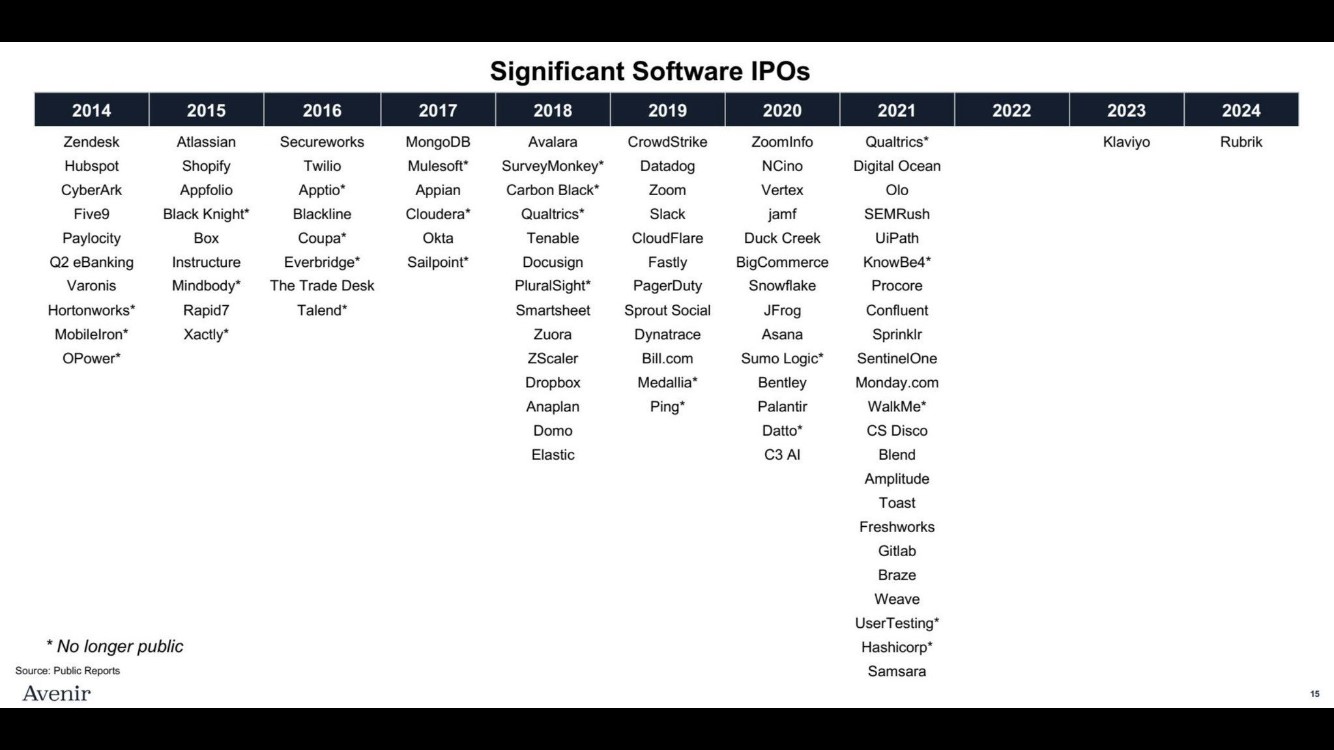

PS: In an article on LinkedIn, the excellent and funny Michael Jackson mentions the scarcity of IPOs in software in recent years.

The reasons for such scarcity have to do with startup funding and exit modes on markets such as Nasdaq. It would be interesting to check how many of them were cockroaches. I do not have the answer. More broadly, I noted that of the more than 900 startups whose capitalization table I recreated, only 6 had not raised funds from private investors.