I have been very surprised by the bankruptcy of Silicon Valley Bank (SVB). Silicon Valley finance was (and I think still is) about venture capital and not banking, about equity and not loans/debts. So how is it possible that a bank fail by serving startups?

When I was in venture capital, and this is 20 years ago, startups would marginally borrow money. Banks indeed did not trust these fragile entities and they were statistically right. Of course startups could borrow money if they had sound collaterals like equipment and this is when Silicon Valley Bank and its peers were used by startups: for leasing for example (office space, equipment that could be reused).

Apparently things have changed as I recently learned. Some venture capitalists managed to convince SVB to go further. Money was cheap and if “powerful” VCs were financing a startup, then SVB thought the startup was solid.

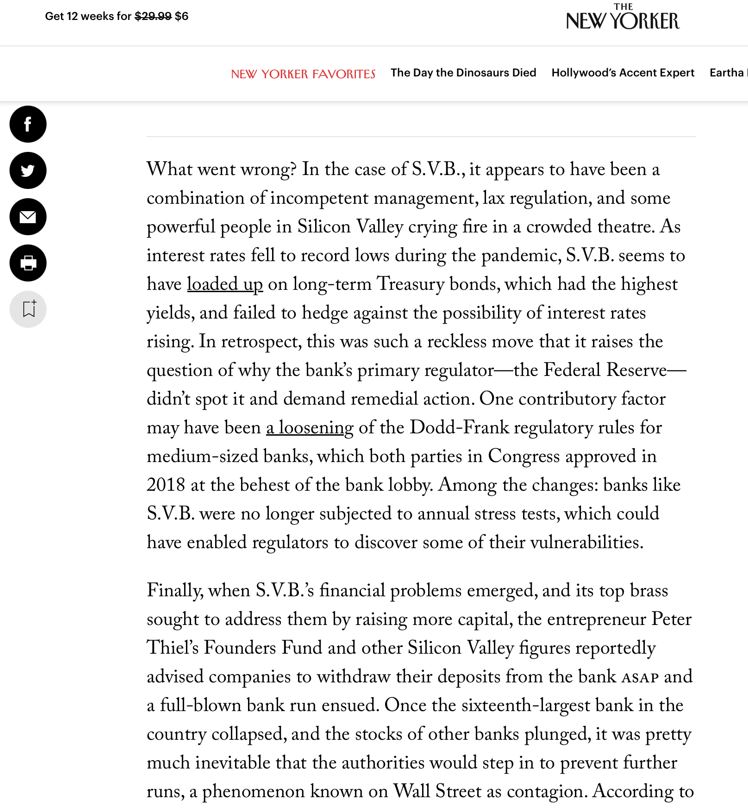

As the article by the New Yorker below says, it appears to have been a combination of incompetent management, lax regulation, and some powerful people in Silicon Valley crying fire in a crowded theatre.

You may read additional material from the New Yorker with

– The Old Policy Issues Behind the New Banking Turmoil (March 13)

– Why Barney Frank Went to Work for Signature Bank (March 15)

Another interesting article is In Their Own Words: What Silicon Valley Bank Meant To The Valley

There is also this interview about Peter Thiel’s role in SVB collapse

Some quotes include :

“Silicon Valley has an image problem but remains hugely popular.”

“The issue is not that VCS are powerful but more not as smart as they think they are”.

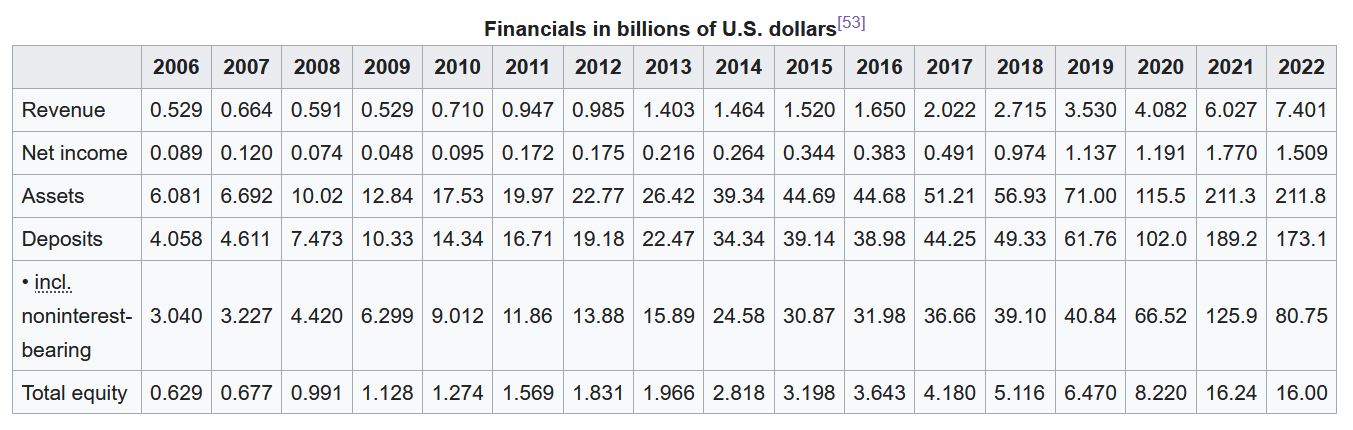

Finally, there is no doubt that the money had become very easy, in too big quantity as indicated by the wikipedia page about SVB. The end of megarounds and the recent new startup crisis have played their part.

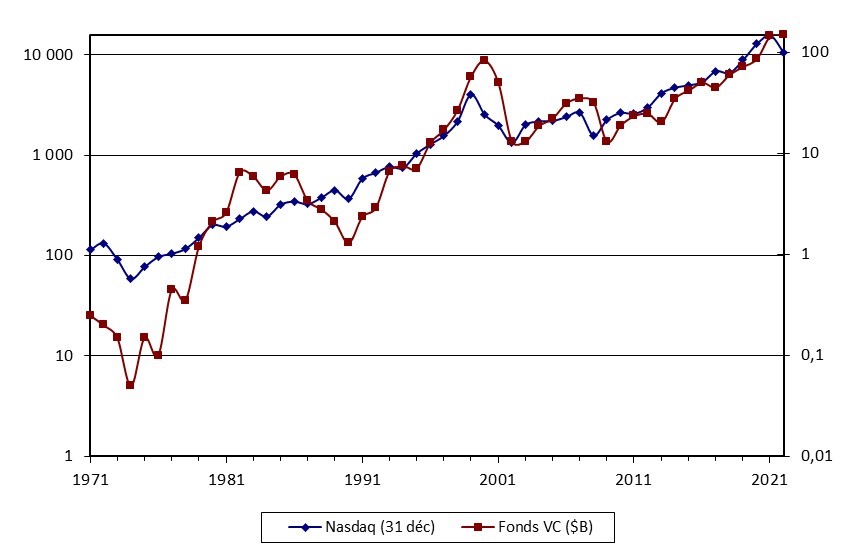

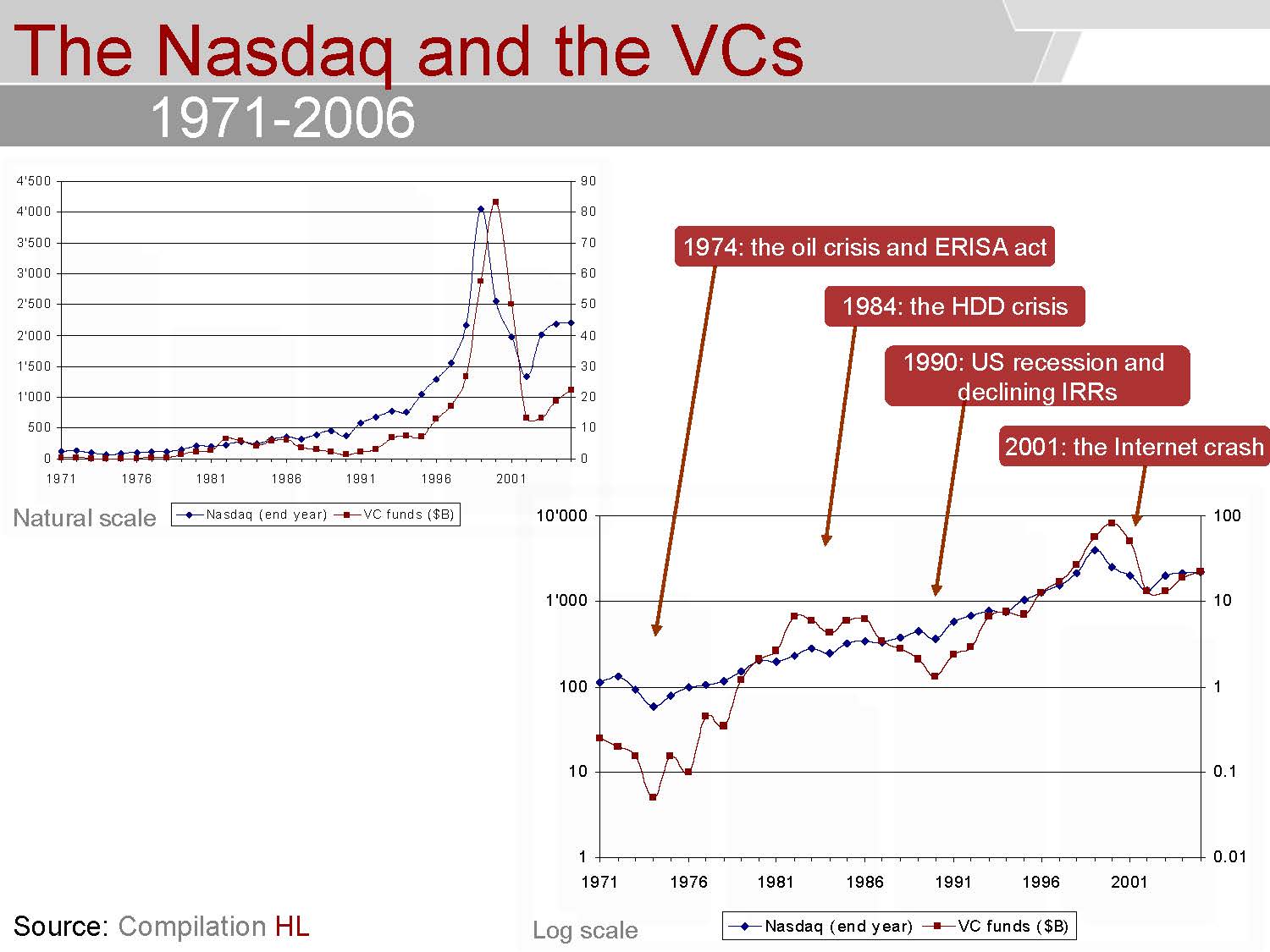

This probably needs to be looked at over the long term. When I wrote my book, I had a look at the correlations between the Nasdaq Index, VC fund raising and the economic crisis. Here is what it gave:

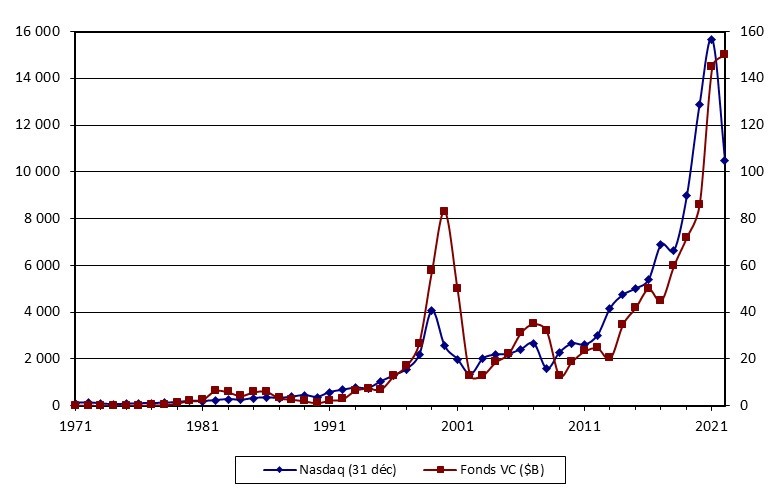

and here is what it looks like in 2022 with, among other things, the 2008 crisis

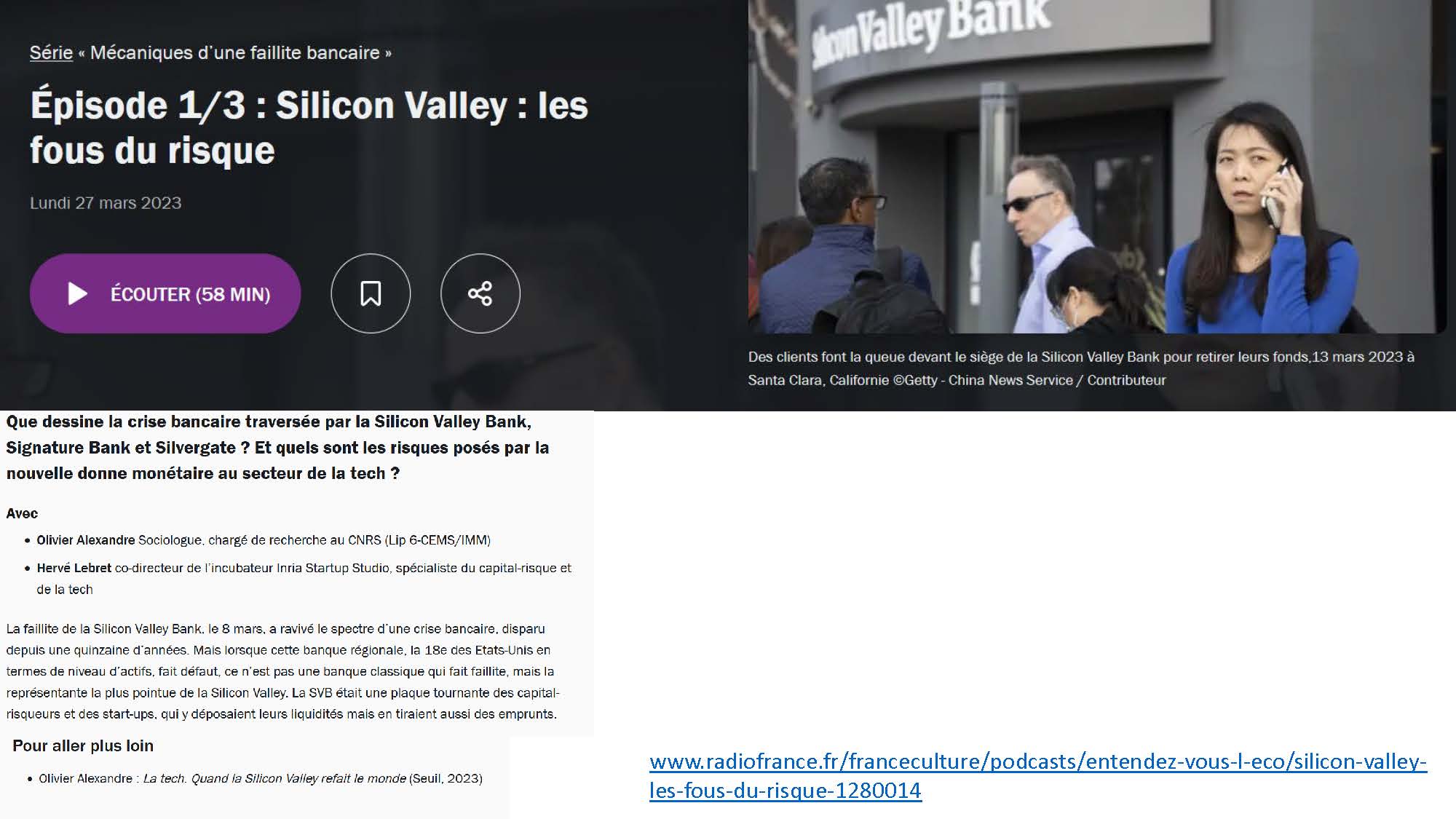

I post this article because I was invited to debate about Silicon Valley, Venture Capital and how can technology startups my impact the banking system on France Culture in Entendez-vous l’éco ? (in French). I now have to read the new book of the other guest, Olivier Alexandre, La tech. Quand la Silicon Valley refait le monde (Seuil, 2023) (Tech. When Silicon Valley changes the world) which seems very interesting. Probably a futrure post.