A month ago, I published data about French startups. I had been surprised to discover that access to data about private companies was finally possible for free in my dear country. So I looked at some (famous) French unicorns with an interest in the shareholder structure and how much money they had raised overall, as well as in their seed and A rounds. You will find the detailed information in a pdf in the bottom of the post.

But before moving on to this analysis, I want to mention an excellent article on seed fundraising, which gives advice and quite rich information. It is in French though and is entitled La levée de fonds seed ou amorçage. So here are the results:

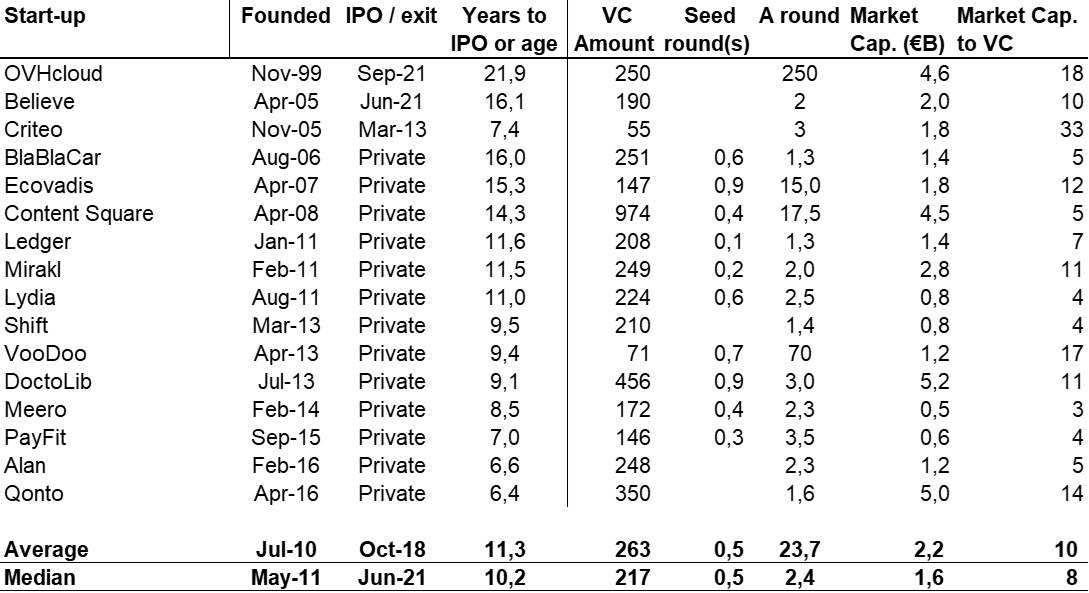

In this first table, I just had a look at their age and fund raising. To give simple rule of thumbs, about the ones which are still private, they are about 5 to 15 years old, they have raised about €200M, with seed rounds of €0.5M and A round of €2-3M. The market capitalization should be (by definition) above one billion euros, but apparently this is not always the case (let us say that the value of a private company is a very volatile metric!) and the ratio of this value to amount raised seems also to be 5 to 15…

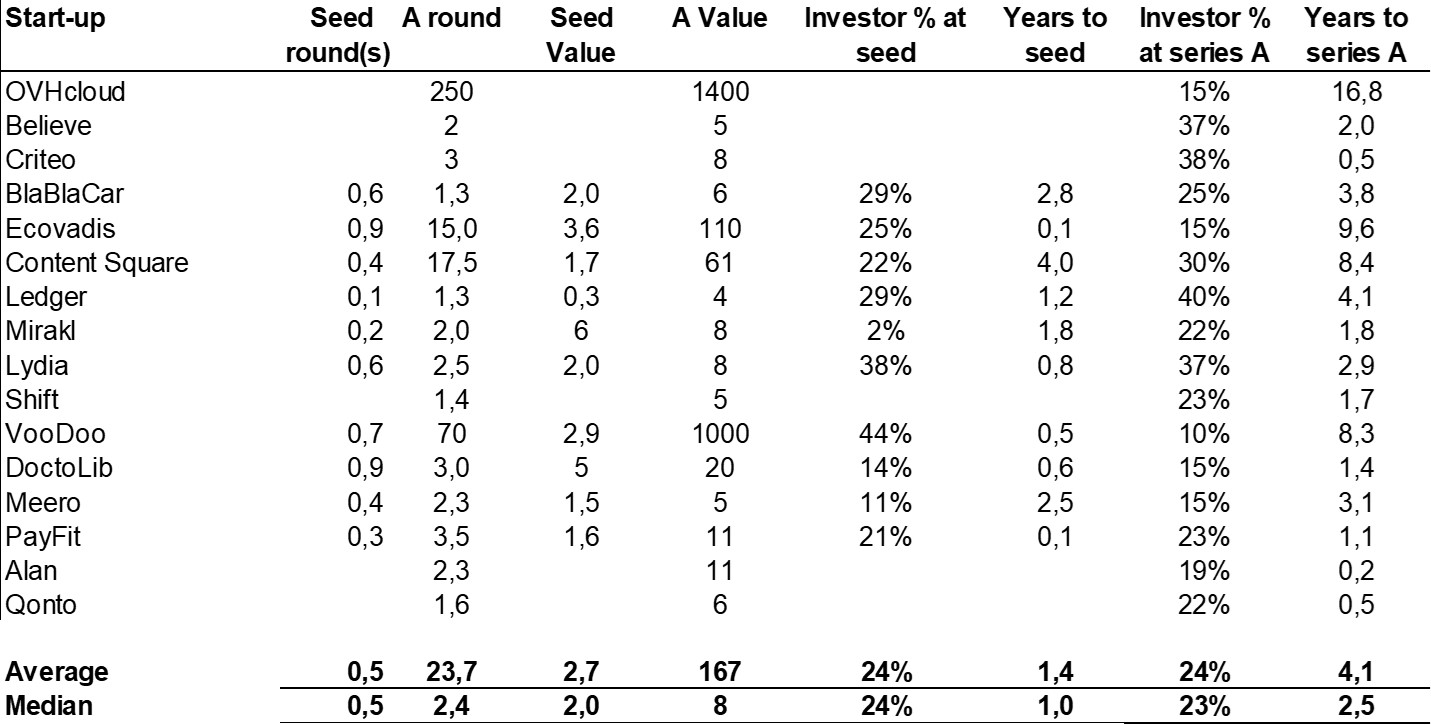

I then looked at how much dilution the seed and A rounds correspond to as well as the age of the companies for these rounds. Again, not taking outliers into account, both the seed and A rounds seem to induce a 25% dilution, therefore, with rounds of €0.5M and €2-3M respectively, the value at seed is about €2M and at A round is €8-12M. Finally the startups are less than 1-2 years old at seed and less than 4 years old at A round.

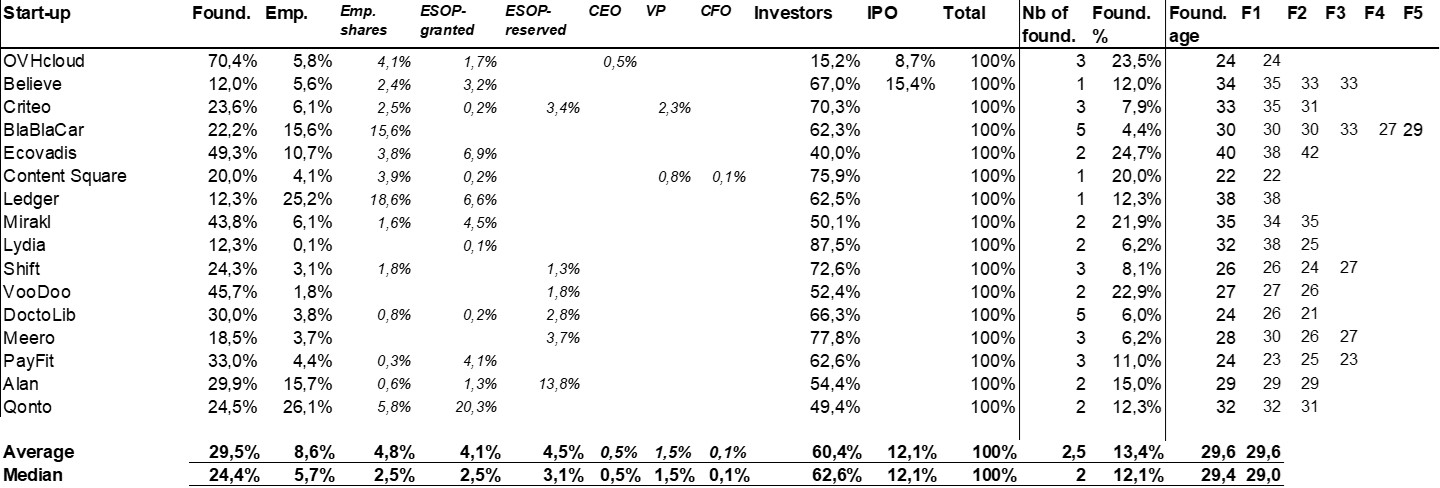

The last table is about the shareholding or equity structure as well as some data about the founders. The founders keep 25-30% of their startups, investors have 60-65% whereas employees have 5-10%.

There are about two founders per startup, they are surprisingly often below 30 with a median and average age of 29 and sadly with not a single woman.

Equity List – French Unicorns