I have regularly been puzzled with the (real) impact of venture capital on startups, their growth or even their success. A few days ago, I received an email from a friend with a very interesting table.

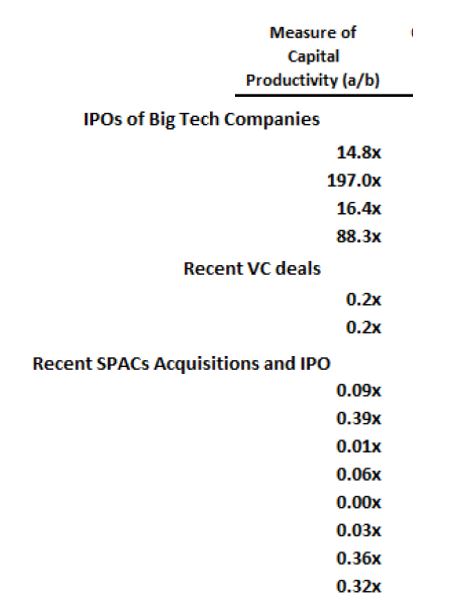

The measure of capital productivity is given by the ratio a/b where a is the startup revenue at the time of IPO and b is the amount of venture capital raised by the startup before going public. The 4 big tech companies are Apple, Microsoft, Amazon and Google, 4 companies founded before 2000. The ratio a/b is greater than 10. The recent VC or IPO deals give ratios below 1 and closer to 0.1.

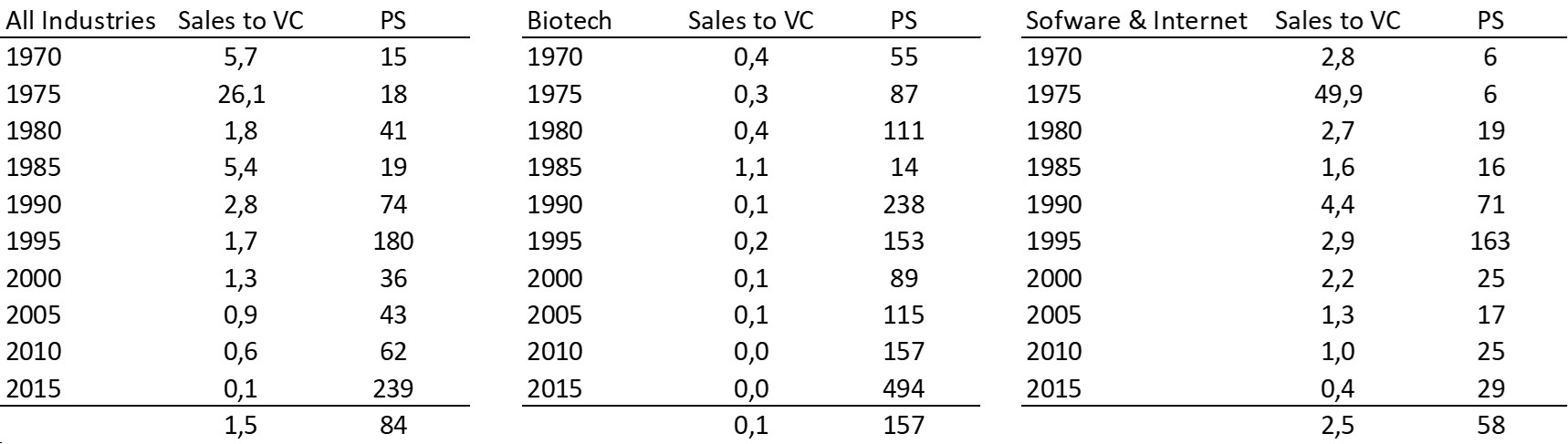

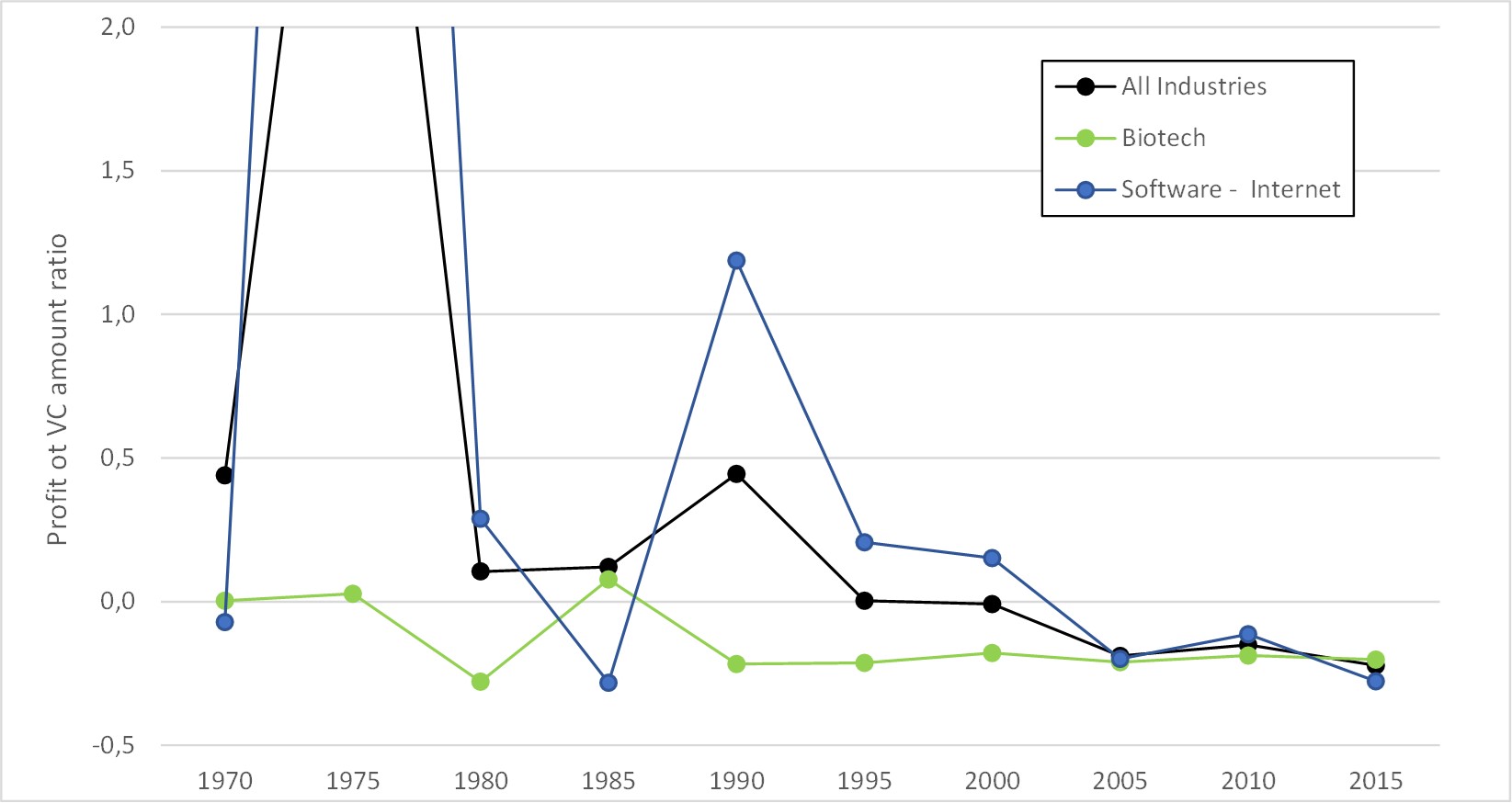

So it was easy for me to look at my usual cap. tables (check here if you do not know what I talk about). I have now 880 companies and I sorted this a/b ratio over time. Here is the result:

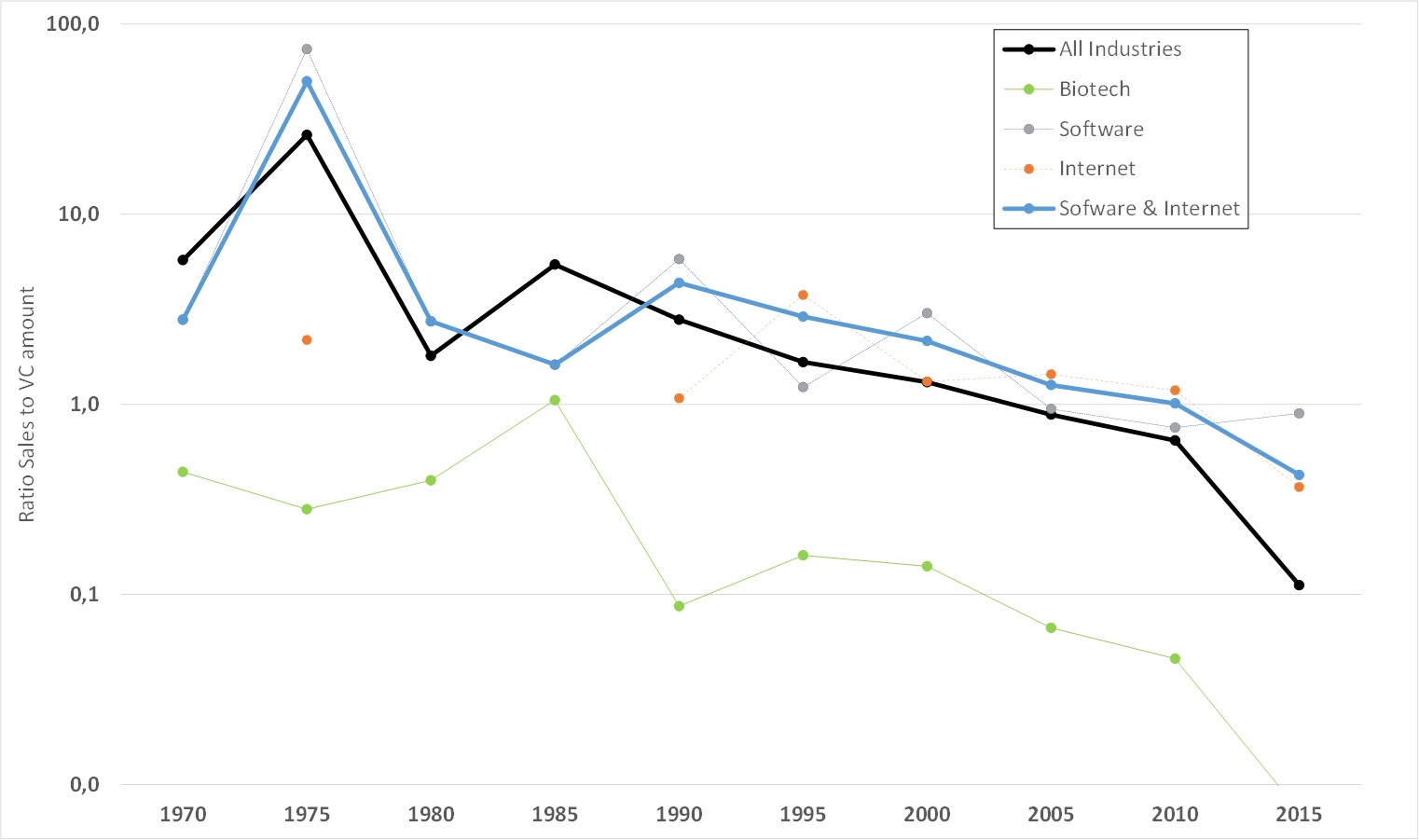

I have 272 biotech startups and 361 in the Software and Internet fields (the others are hardware, semiconductor, energy, medtech companies mostly). I have the a/b ratio (which I call Sales to VC) by period of 5 years (the years of foundations of the startups). I also pu the PS ratio (the famous Market Capitalization to Sales or “Price to Sales” ratio). Indeed the ratio is “collapsing” from above 5 before the 90s to below 1 after 2000.

I have also separated biotech which is known to have startups going public with low revenue and the group of Software and Internet. The curves which follow are probably better illustrations. Quite striking!

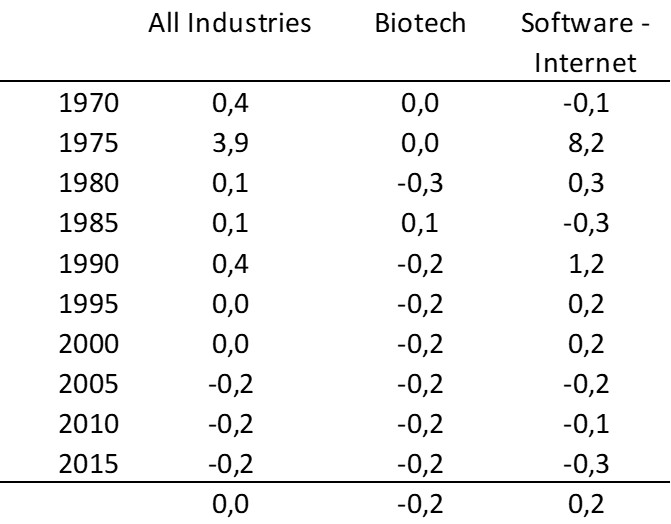

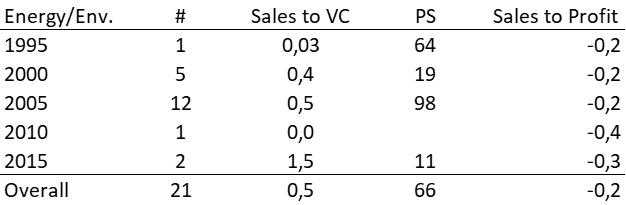

I also looked at the profits (or losses) of the startups and computed the Profit to VC amount ratio. Here it is:

Biotech is different as companies were rarely profitable when going public and the ratio is quite stable since 1990. But overall, companies were profitable at IPO before 2000 (and sometimes highly profitable, so that I could not find a good axis scale for my figure). They are losing money since 2005 and apparently losing more and more.

All this is no real surprise. Mallaby in his recent book The Power Law has described the new trends in venture capital. Funds like Softbank Vision or Tiger Global are pouring tons of money in startups which try to capture market dominance, whatever the cost. So the capital productivity is decreasing at IPO with the hope of huge gains in the future. A very, very risky bet…

PS (dated April 22, 2022) : I was asked a question about startups in the energy / greentech field. This is indeed interesting. Couple of comments before providing an answer from my data. Greentech has never been a stable or profitable segment. Kleiner Perkins or Khosla Ventures, early entrants in the field, seem to have suffered a lot. In addition I have only 21 companies in my DB. You are right, it is stable but from the low range, with low sales to VC ratios and negative profits…

La question était : On a different note you have data only on Energy/green tech? what would you expect to see? I was wondering if for capex intensive businesses the trend is more weak as they already needed to raise a lot of capital.