I just read about Sebastian Quintero’s data analyses on start-ups on his web site Towards Data Science. Thanks Martin H. 🙂 I was really fascinated about his original way of looking at them, their failure rate, the valuation prediction, their runway between rounds, and his Capital Concentration Index or Investor Cluster Score. You should read them.

Of course, it rang strong bells with all the data analyses I have done in the recent past 8see end of the post if you wish)

So as an appetizer to Quintero‘s work, here are a couple of figures taken from his site…

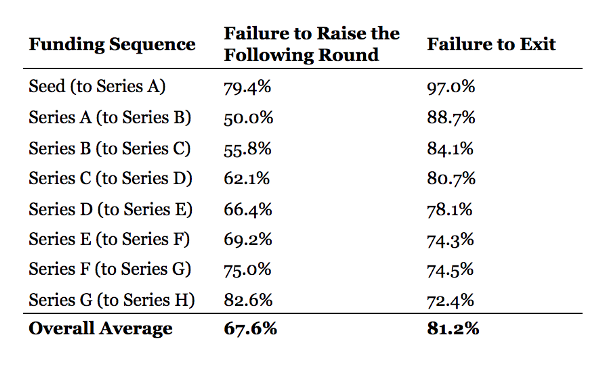

Dissecting startup failure rates by stage

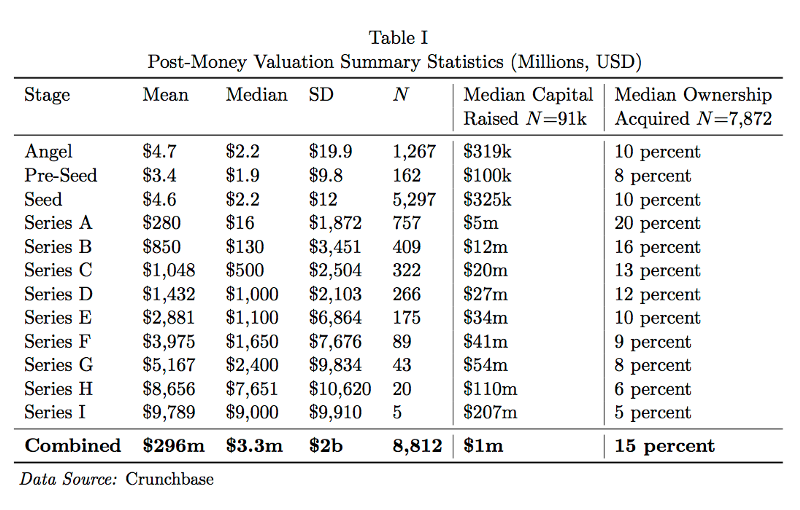

Predicting a Startup Valuation with Data Science

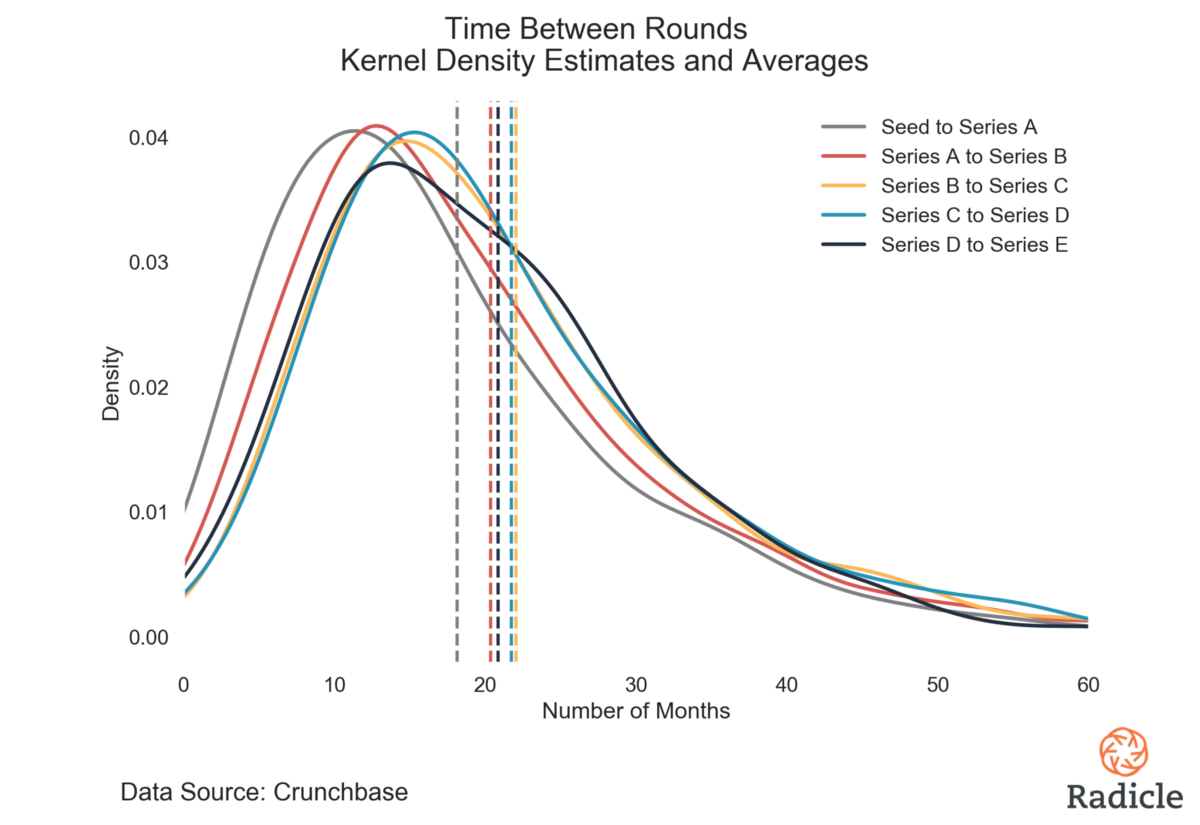

How much runway should you target between financing rounds?

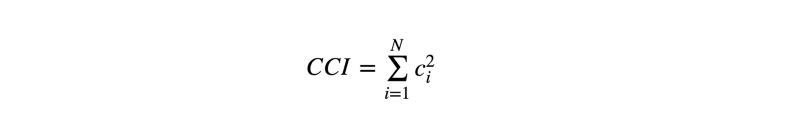

Introducing the Capital Concentration Index™

Where c is the percentage capital share held by the i-th startup, and N is the total number of startups in the defined set. In general, the CCI approaches zero when a sector consists of a large number of startups with relatively equal levels of capital, and reaches a maximum of 10,000 when a sector’s total invested capital is consolidated in a single company. The CCI increases both as the number of startups in the sector decreases and as the disparity in capital traction between those startups increases.

As of my own analysis, here are a couple of links…

My papers on arxiv:

– Are Biotechnology Startups Different? https://arxiv.org/abs/1805.12108

– Equity in Startups https://arxiv.org/abs/1711.00661

– Startups and Stanford University https://arxiv.org/abs/1711.00644

or on SSRN

– Age and Experience of High-tech Entrepreneurs http://dx.doi.org/10.2139/ssrn.2416888

– Serial Entrepreneurs: Are They Better? – A View from Stanford University Alumni http://dx.doi.org/10.2139/ssrn.2416888

– Start-Ups at EPFL. An Analysis of EPFL’s Spin-Offs and Its Entrepreneurial Ecosystems Over 30 Years https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3317131