The business of biotech is very unique as my previous posts illustrated. Companies go public without any revenue or product; they are often times very small firms in part because they are science-based mostly with a lot of collaborations with universities. Finally, an interesting feature is the biotech is a licensing business. Start-ups seldom produce and sell drugs but license their intellectual property (IP) to large pharmaceuticals companies. They also themselves license IP from universities, where the early inventions are made and protected through patent applications.

One of the best-guarded secrets is the terms of such licenses. I have already published articles about the licensing conditions by universities to start-ups. See for example:

– June 2010: University licensing to start-ups – https://www.startup-book.com/2010/06/15/university-licensing-to-start-ups-part-2/

– November 2013: How much Equity Universities take in Start-ups from IP Licensing? – https://www.startup-book.com/2013/11/05/how-much-equity-universities-take-in-start-ups-from-ip-licensing/

– June 2015: Should universities get rich with their spin-offs? – https://www.startup-book.com/2015/06/09/should-universities-get-rich-with-their-spin-offs/

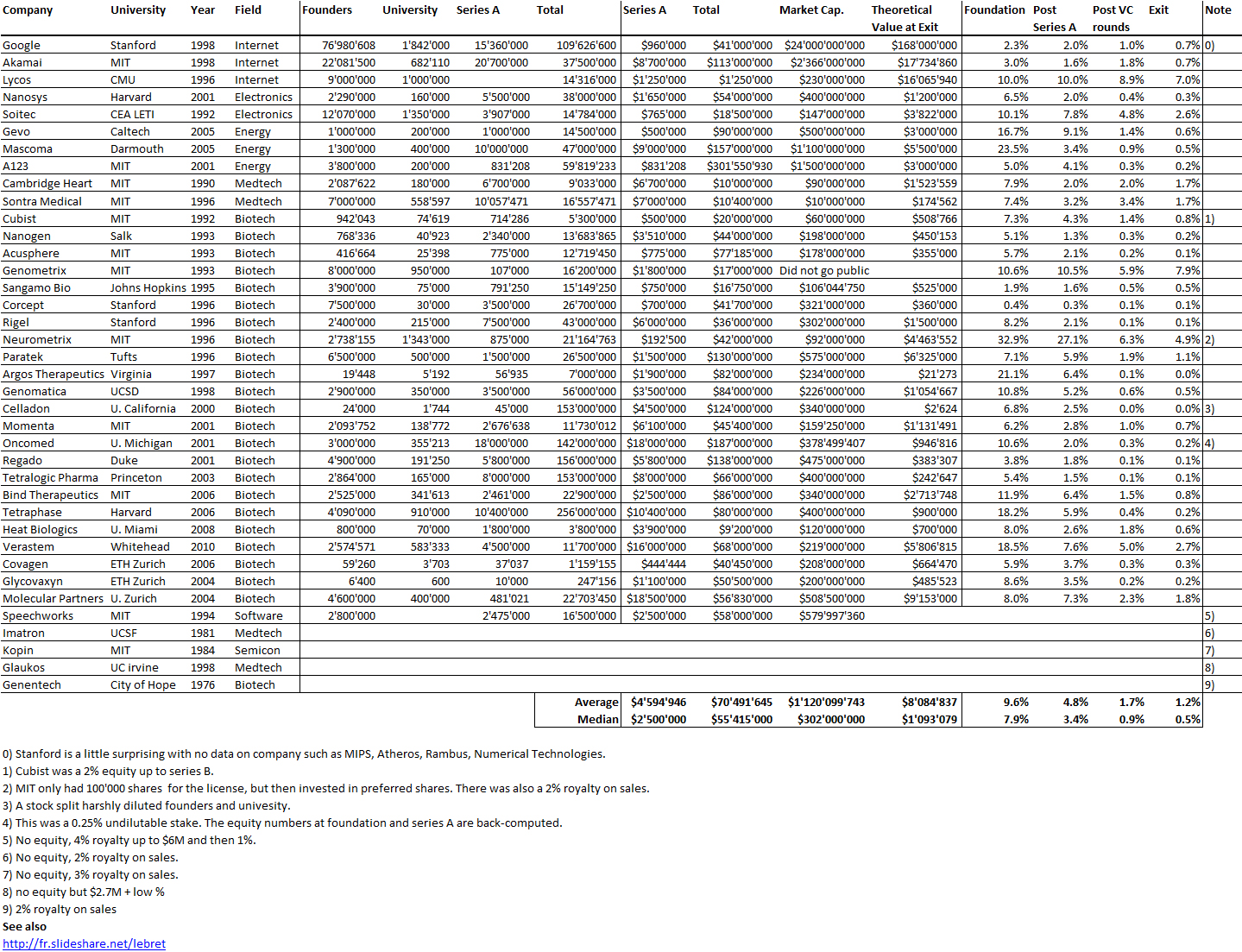

So I’d like to revisit the topic for biotech companies. In terms of equity, there is not much difference; you can read again the table below. But there is an additional term that I’ve seen less often in other fields. Royalties on sale are very much accepted because Genentech (part 3) and Amgen (part 1) defined the industry rules.

Again let me quote my previous articles:“[…] negotiated an agreement between Genentech and City of Hope that gave Genentech exclusive ownership of any and all patents based on the work and paid the medical center a 2 percent royalty on sales of products arising from the research.” [Page 57]

“For an upfront licensing fee of $500,000, Lilly got what it wanted: exclusive worldwide rights to manufacture and market human insulin using Genentech’s technology. Genentech was to receive 6 percent royalties and City of Hope 2 percent royalties on product sales.” [Page 94] Perkins believed that the 8 percent royalty rate was unusually high, at a time when royalties on pharmaceutical products were along the lines of 3 or 4 percent. “It was kind of exorbitant royalty, but we agreed anyway – Lilly was anxious to be first (with human insulin). […]The big company – small company template that Genentech and Lilly promulgated in molecular biology would become a prominent organizational form in a coming biotechnology industry.[Page 97]

“Memorial Sloan-Kettering had filed a weak patent, not knowing what it actually had. Therefore, said my general counsel, Amgen was legally free to process on its own, without paying a royalty to MSKCC. That didn’t seem ethical to me; without Sloan-Kettering, we wouldn’t have stumbled across filgrastim (Neupogen’s generic name). We negotiated a license with a modest royalty.” [Pages 143-44]

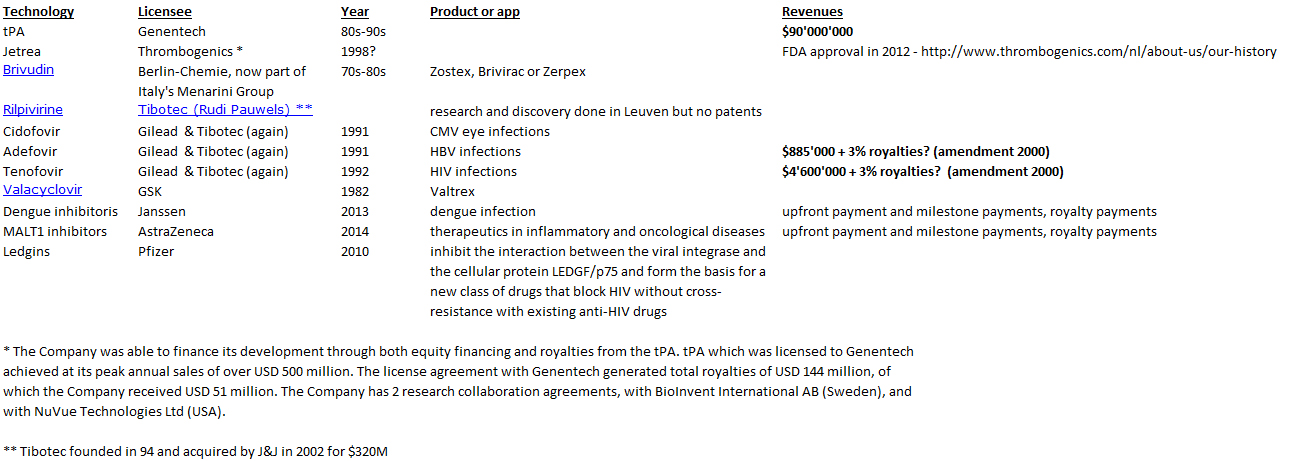

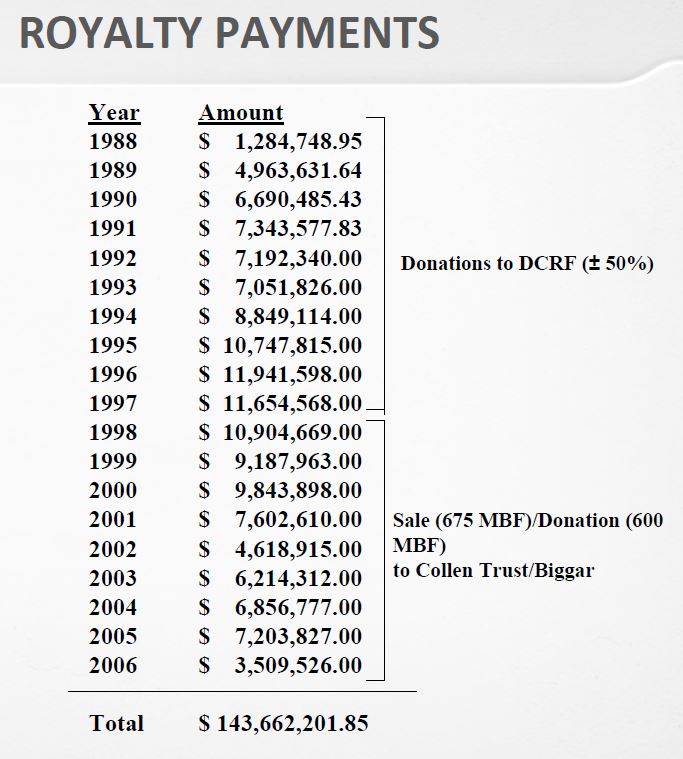

Another interesting source of information is KUL (Katholieke Universiteit Leuven) in Belgium and its spin-offs Thormbogenetics and Tibotec. KUL has a long history of licensing with its R&D arm (LRD) founded in 1972. Here are examples of licenses.

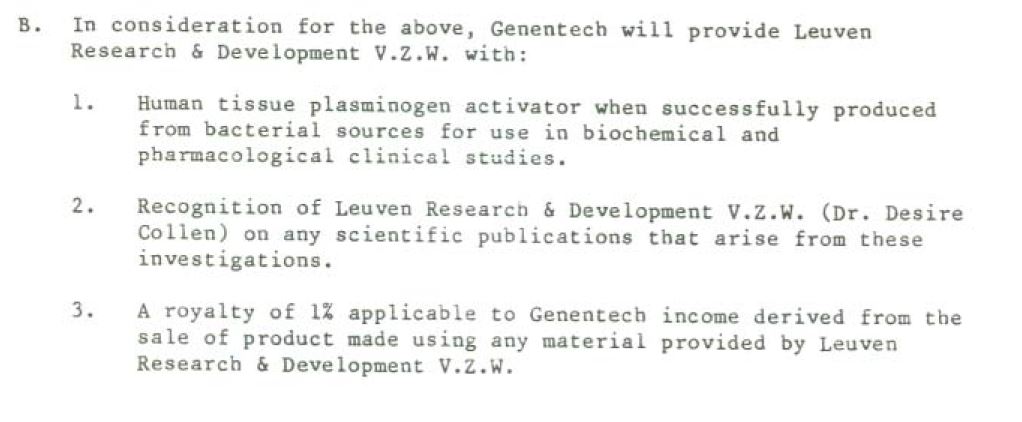

One particular example is the Genentech-Thromobogenetics-KUL relationships with license terms as follows:

All this comes from http://www.seii.org/seii/documents_seii/archives/colloques/2012-10-12_5_TG%20NV%20from%20lab%20to%20company-COLLEN.pdf

So what is a fair deal? I do not know. If you check the footnotes in the table above, you can see again a 2-4 % royalty range. So let me finish with a text I found many years ago:

– A raw idea is worth virtually nothing, due to an astronomical risk factor

– A patent pending with a strong business plan may be worth 1 %

– An issued patent may be worth 2 %

– A patent with a prototype, such as a pharmaceutical with pre-clinical testing may be worth 2-3 %

– A pharmaceutical with clinical trials may be worth 3-4 %

– A proven drug with FDA approval may be worth 5-7 %

– A drug with market share, such as one pharma. distributing through another, may be worth 8-10%

Ref: Royalty Rates for Licensing Intellectual Property by Russell Parr

Thanks for these thoughts. An immediate thought to the question posed at the end of the article: “So, what is a fair deal?” – Well, we all know – at least, when it comes to really UNfair deals… or the attempts by one party to pull off an unfair deal … but that is not your question, I understand. In my view, there is actually no one answer to this question. Or only a high-level, qualitative one; i.e. I strongly disagree with putting “generic numbers” as quantitative guidelines the way Russell Parr “responded” to your question in the cited ref. A fair deal is a deal in which the parties feel that they haven’t overcompromised (and you ALWAYS have to live with a compromise when licensing); and on terms and conditions that hand back a fair (sic) value in return for rights granted. As such terms are almost ever a mixed bag of financial + intangible “value”, with esp. the value of the latter being a matter of perception, there simply is no generic “fair” price tag on royalties.

Well I tend to agree with you, although this means you consider there is a balance in the negotiation. If yes, I am fine. But when people have much less experience and knowledge (if they are very young entrepreneurs), there may be a critical need for education, i.e. some quantitative guidelines available somewhere, and this is a challenge, I try to diminish by giving some more information and data points here.