Two articles caught my attention relatively to the Facebook acquisition of Instagram:

– By The Numbers: Facebook’s $1 Billion Acquisition Of Instagram may mean that we are in a new speculative bubble. There were 37 $1B acquistions since 1992 of venture backed companies and already 3 in 2012…

Instagram co-founders Kevin Systrom, chief executive (right), and Mike Krieger at the company offices in San Francisco. Photo: New York Times / Redux / eyevine

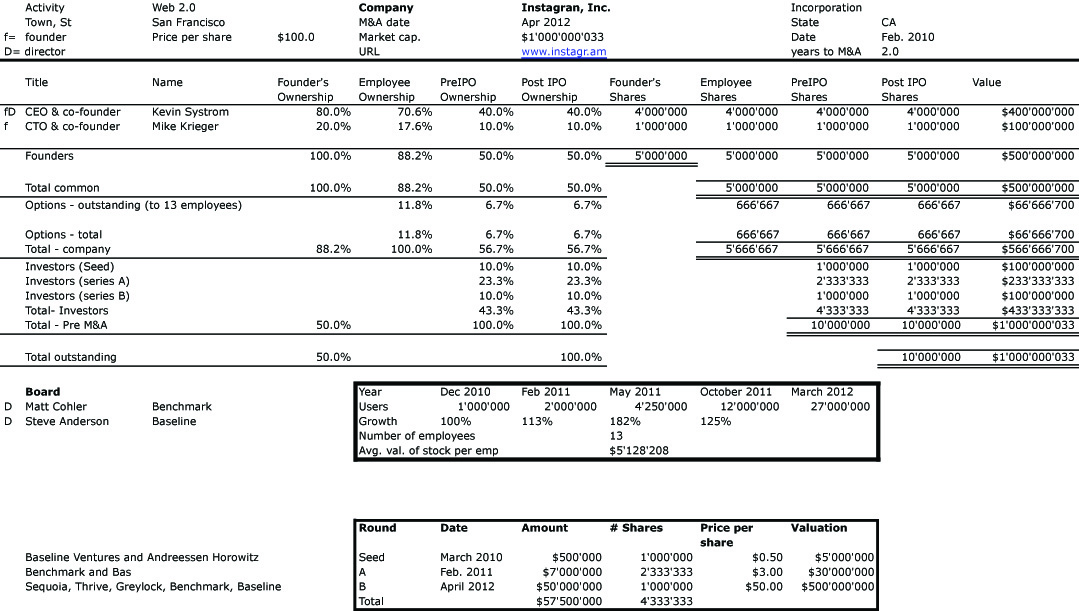

– Who’s getting rich from Facebook’s $1bn Instagram deal? shows that it makes 10+ happy people! And using these data, here is my cap. table. I have to admit that the numbers are also speculative but based on the previous article, they kind of make sense.

More info on http://articles.businessinsider.com/2012-04-18/tech/31359622_1_instagram-acquisition-facebook-stock-facebook-s-ipo

“Last week, Instagram was acquired by Facebook for $1 billion, or so we thought.

Today we’re learning, it was really worth much more. The New York Times reports it was a 70/30 split — 70% of the $1 billion deal was Facebook stock, 30% was cash. Instagram got $700 million of Facebook shares at $30 a share, which means Facebook is internally valuing itself at $75 billion. That’s a low-balled valuation. Everyone expects Facebook’s IPO valuation to be near $100 billion.

That means the shares will be worth $933 million. ($700 million at $30 a share = 23 million shares. 23 million shares at $40 a share = $933 million.)”

That’s obviously unless WS screws up their IPO by under-evaluating shares, in which case they could end-up with much less than 1B

I’ve been browsing on-line greater than 3 hours nowadays, but I never discovered any fascinating article like yours. It’s beautiful value sufficient for me. Personally, if all website owners and bloggers made just right content as you probably did, the net will likely be much more useful than ever before.