Why should I ask such a question 4 years after publishing my book and isn’t this obvious? I do not think it is when I see how many times I need to clarify the difference between a start-up and any corporation. After all, any corporation being launched is a start-up, right? Not so. Thanks to my colleague Pascal :-), I just read another article by Steve Blank, Why Governments Don’t Get Startups, who gives the perfect definition:

“While large companies execute known business models, startups are temporary organizations designed to search for a scalable and repeatable business model.”

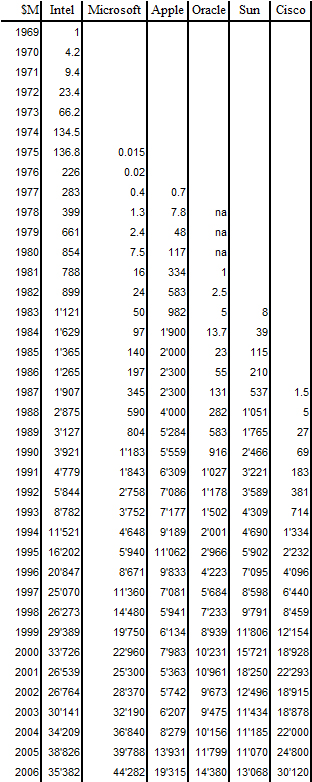

In my book, I had said it this way: “A start-up is a company which is born out of an idea and has the potential to become a large company” and I had also added “Apple, Cisco, Google, Intel, Microsoft, Oracle, Yahoo, YouTube. You certainly know these names. These companies did not exist forty years ago. They are technology giants today.”

Why do I like Blank’s definition? Because of his use of “temporary” as well as “search for a scalable and repeatable business model”. Apple, Cisco, Google, Intel, Microsoft, Oracle, Yahoo, YouTube clearly belong to the start-ups; I had not mentioned that non-existing business model.

Now Blank adds something:

“Scalable startups require risk capital to fund their search for a business model, and they attract investment from equally crazy financial investors – venture capitalists. They hire the best and the brightest. Their job is to search for a repeatable and scalable business model. When they find it, their focus on scale requires even more venture capital to fuel rapid expansion.”

This is the typical Silicon Valley model of fast and usually non-organic growth. Gazelles have often yearly revenue growth of at least 50%, not to say 100%. Look again at the growth rates of Gazelles and Gorillas in my post on the topic or at the revenue growth below (table 8-8 from the book).

I see at least two opened debates:

– In Europe, the growth is often slower, at least less than 100%! Is slow growth compatible with a start-up definition?

– Blank sees two phases of VC funding, the first one to search and validate the business model, the second one to fuel rapid expansion. At least Oracle and Microsoft never had the second funding and their growth was more than 100% during their first 10 years!