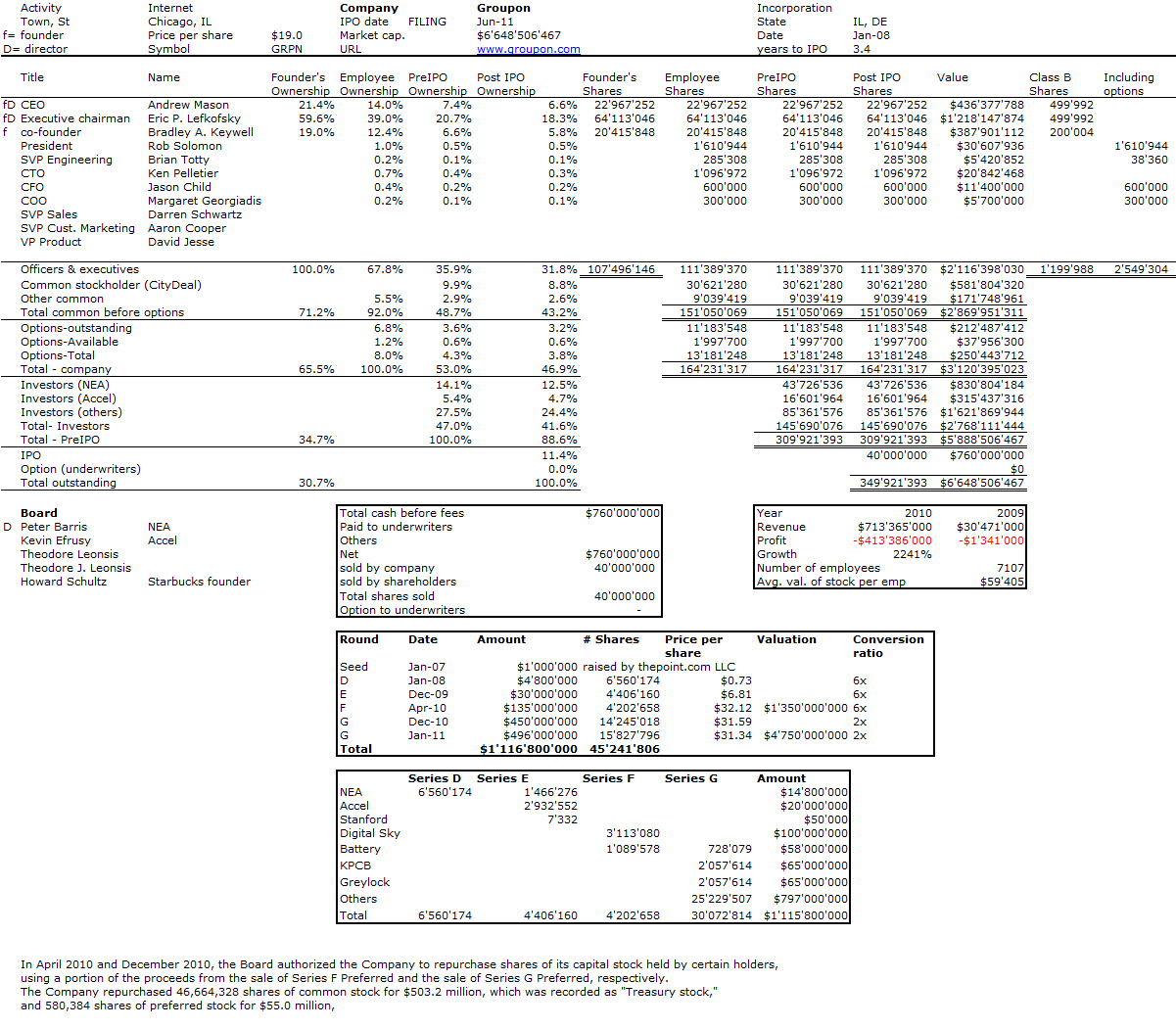

The latest IPO filing is 3 year-old Groupon. After raising more than $1B from its (famous) investors, the start-up hopes to sell $750M worth of shares at its IPO. I quickly build the capitalization table which follows (hoping there are not too many mistakes). I will update it when the IPO nears including the shares sold by existing stockholders, if any.

Worth noticing is the crazy valuation some “savvy” investors such as KP, Greylock or Battery paid for their shares. The other winners, besides the Groupon founders, should be the German start-up CityDeal launched by the Sawmer brothers (from the European Founders Fund).

I assumed a price per share of $19M but this is just to accomodate the $750M the company wants to raise with a consistent number of shares. I made no assumption on existing vs. new shares. Some analysts claim Groupon value would be more in the $20B range (i.e. a price per share of $60.)

Final comment for today: Groupon declined to be acquired by Google for about $6B last December. We’ll see soon if they were right to do so…

A short addition following a tweet from my friend Rémi. Are we in a new gtech bubble. Rémi mentions a recent Techcrunch article which begins with:

“Whether you’re on Team Andreessen, who held that we weren’t in a tech bubble at the AllThingsD conference, or the now revised Team Arrington (“All signs point to a real bubble, probably starting later this year when a lot more companies start to go public.”), there’s no denying post Groupon S-1 drop that we’re in a bubble of people talking about whether or not we’re in a tech bubble.

Hence Venture Crapital…” more at http://techcrunch.com/2011/06/03/venture-crapital-lets-you-play-the-tech-bubble-as-a-video-game